-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex Services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

Premium Current Account designed to meet your

Business Banking Needs

-

Best-in-class Netbanking and Mobile Banking Platform

-

Bank from anywhere, across any branch, without extra charge

-

Suite of payment and collection solutions to optimize cash flows

-

Doorstep Banking Service- Free document & cheque pickup

-

Best-in-class Netbanking and Mobile Banking Platform

-

Bank from anywhere, across any branch, without extra charge

-

Suite of payment and collection solutions to optimize cash flows

-

Doorstep Banking Service- Free document & cheque pickup

Strengthen and grow your business with an IDFC FIRST Bank Current Account.

Taking the right decisions is crucial for the success of your business. Choosing IDFC FIRST Bank’s Current Account is one of them. With Nil charges on 40 + commonly used Current Account services we believe that our Current Account offering gives you the flexibility towards attaining the business growth you’ve always dreamed of.Read More

With an IDFC FIRST Bank Platinum Current Account, you gain access to multiple features and benefits. Take advantage of an integrated Internet and Mobile Banking Platform with attractive features, such as Trade Forex Solutions, GPS-enabled Doorstep Banking, Payment and Receivable Solutions, and much more, all at your behest. We are also transparent about our Current Account fees & charges. No surprises.

So, go ahead and open Platinum Current Account online to secure your business growth with IDFC FIRST Bank.Read Less

Empower Your Enterprise with the Ultimate Current Account Solution

Anywhere Banking: Enjoy commonly used current account services without fees.

Cash Management Solutions: Benefit from a suite of payment and collection solutions to optimize your cash flows

All-in-one app: A single app with 100+ features that meet both personal and business financial needs

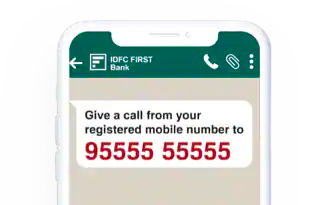

WhatsApp Banking: Access your accounts anywhere, anytime. Just send a 'hi' to 95555 55555 to get started

Debit Card: Free VISA Signature Business Debit card with exclusive benefits

Beyond Banking Services: We offer 100+ Beyond Banking offerings to suit your enterprise's needs, including ERP, HRMS, Payroll, Taxation, Legal, Cloud Services, CoWorking Spaces, etc.

Platinum Current Account

Exclusively tailored benefits for strong businesses that are set to grow

- Zero charges on 40+ commonly used Current Account services*

- Auto Sweep FD Facility of 6.30%– BRAVO exclusively for Platinum customers

- Free Cash deposit limit of 15 times of current month AMB

- Free VISA Signature Business Debit card with lounge access

- Complimentary insurance with the debit card

- Free NEFT, RTGS, IMPS transactions*

- Daily ATM limit of ₹2 Lakh & Purchase limit of ₹4 Lakhs

- Preferential Trade & Forex pricing

- Leverage our Payment and Collection solutions to optimize your business

- Get complimentary General Insurance Cover with your Current Account

*on maintenance of average monthly balance of ₹2,00,000

Offer Details

Flat Rs 100 Off | Min purchase: Rs. 699 | Max discount: Rs. 100

Valid on every Thursday

How to claim this offer?

- Visit Swiggy Instamart app/website

- Select items of your choice and add them to the cart

- Apply coupon code on the payment page

- Click on “Make Payment”

- Pay using IDFC FIRST Bank Card to avail discount

Offer Details

15% off up to Rs. 125 / Flat Rs. 50 off on non-Participating Restaurants | Min purchase: Rs. 499

Valid on every Saturday & Sunday

How to claim this offer?

- Visit Zomato app/website

- Select items of your choice and add them to the cart

- Apply IDFCFEAST coupon code on the payment page

- Click on “Make Payment”

- Pay using IDFC FIRST Bank Credit Card to avail discount

Offer Details

Complimentary One-year e-subscription of Hindustan Times worth Rs 999 on FIRST Select, FIRST Family, FIRST Wealth, FIRST Private and FIRST WOW Credit Cards Valid till 31st January 2023

How to claim this offer?

- Visit https://subscriptionbenefits.thriwe.com/ and complete the registration process

- Enter your IDFC FIRST Bank Credit card details to complete the Rupee 1 transaction for verification

- The promo code along with the process to claim code will be sent to your email address & mobile number

- For any issues, queries or assistance please contact Thriwe (Visa Offers Partner) at below numbers

Call at : 1800 208 7899 (India), 800035703553 (UAE) Whatsapp on : +91-9717176899

Mon-Fri, 9 AM to 7 PM IST

Offer Details

Get Flat 150 off on Rs 700 | Once per user | Per month

Valid till 31st March 2023

How to claim this offer?

- Visit Domino’s app/Mobile website

- Select items of your choice and place your order in the cart

- Apply DOMIDFC150 coupon code on the payment page

- Click on “Make Payment”

- Pay using IDFC FIRST Bank Credit Card to avail discount

Offer Details

Cuisines: Pizza, Fast Food & Beverages. Offer detail: 15% off on food bill*Not Valid on Buffet & Alcoholic Beverages. Locations: Bangalore, Hyderabad & Secunderabad.

Offer Details

Cuisines: Chinese, Thai, Asian & Beverages & Finger Food. Offer detail: 15% off on Food & Soft Beverages in M Café by Marriot *Not Valid on Buffet & Alcoholic Beverages. Locations: Bangalore.

Offer Details

Cuisines: Desserts & Beverages. Offer detail: 15% off on food bill*Not Valid on Buffet & Alcoholic Beverages. Locations: Multiple locations.

Offer Details

Cuisines: Seafood, North Indian, Chinese, Mangalorean, Kerala, South Indian, Desserts & Beverages. Offer detail: 15% off on food bill*Not Valid on Buffet & Alcoholic Beverages. Locations: Mumbai.

Offer Details

Cuisines: North Indian, Continental, Seafood & Asian. Offer detail: 15% off on food bill*Not Valid on Buffet & Alcoholic Beverages. Locations: Pune.

Offer Details

Get 10% Cashback up to Rs 3000 Valid till 31st March 2023

Valid till 31st March 2023

How to claim this offer?

- Shop for an Oppo phone at authorized stores. Please click here to see the list of authorized stores.

- Request the staff at billing counter to apply applicable EMI offer on IDFC FIRST Bank Credit Cards

- Use IDFC FIRST Bank credit card as mode of payment to avail of the benefit

Offer Details

Dom Flights : 12% instant discount up to INR 1200 |International Flights: 10% instant discount up to Rs 7500 |Domestic Hotels : 20% instant discount up to Rs 4800 | Bus : 15% instant discount up to Rs 500

Valid on every Friday

How to claim this offer?

- Visit Yatra website (https://www.yatra.com/) or Mobile application on any Friday during the offer period to do hotel booking/ book flight or Bus ticket.

- Apply the coupon code YTIDFC at checkout

- Use your IDFC FIRST Bank Credit card to make the payment.

Offer Details

Flat Rs 50 off on a Minimum Order Value of Rs 499

Valid till 31st March 2023

How to claim this offer?

- Visit Dunzo Mobile App during the offer period

- Select items of your choice and place your order in the cart

- Apply IDFC50 coupon code on the payment page

- Click on “Make Payment”

- Pay using IDFC FIRST Bank Credit Card to avail discount

Offer Details

10% Cashback up to Rs 3000 on EMI Txns

Valid till 31st March 2023

How to claim this offer?

- Shop for Electronics at Vijay Sales for at least Rs 15,000. Find the nearest Vijay sales store at https://www.vijaysales.com/store-locator

- Request the Vijay sales staff at billing counter to apply applicable EMI offer on IDFC FIRST Bank Credit Cards

- Use IDFC FIRST Bank Credit Card as mode of payment to avail of the benefit

Offer Details

10% Disc up to Rs 2000 on Non EMI Txns | 10% Disc up to Rs 3000 on EMI Txns | Minm Txn Value Rs 15,000

Valid on every Saturday & Sunday

How to claim this offer?

- Shop for Electronics at Croma Stores for at least Rs 15,000. Find the nearest Croma store at https://www.croma.com/store?location=default

- Request the Croma sales staff at billing counter to apply applicable offer on IDFC FIRST Bank Card

- Use IDFC FIRST Bank Card as mode of payment to avail of the benefit

Pay Instantly with Reward Points

Pay instantly for any online transaction with your Credit Card Reward Points and for offline transactions too, at select merchants.

• Get gift cards or memberships of your favourite brands.

• Check out our unique Credit Card Reward Redemption Catalogue page for updates

Reward points that never expire!

Earn forever and Redeem anytime, anywhere with IDFC FIRST Bank credit cards

Lower Interest Rates

• Usually, other credit cards charge a standard and fixed interest rate as high as 42% p.a. , in case you carry forward your outstanding balance beyond the payment due date.

• IDFC FIRST Bank Credit Cards offer low and dynamic interest rates starting from 9% per annum. The interest rates stated are typically ‘yearly’ rates, also known as the annual percentage rate (APR). No Interest is charged if you repay your balance in full, each month by the due date. We recommend that you always pay Total Amount Due of your credit card to avoid any charges. Paying Minimum Amount Due each month is mandatory.

0% Interest on Cash Withdrawal

IDFC FIRST Bank Credit Cards offer ATM cash withdrawals at 0% interest until your due date.

• Usually, other credit cards charge interest from date of withdrawal with interest rates as high as 3.5% per month along with withdrawal fee of ₹500.

• With IDFC FIRST Bank offering India’s best credit card interest rates, you pay zero interest until your due date for payment and at a flat transaction fee of just ₹199/- only.

Stay safe with Insurance/RSA coverage

• Avail Emergency Roadside Assistance worth ₹1,399 with your credit card – in case of an unfortunate & unforeseen event like a breakdown or a road accident.

• Avail 24*7 Roadside Assistance (RSA) anywhere, anytime by calling our RSA partner, Global Assure on 1800 572 3860 (toll free)

• Avail 4 complimentary RSA services in a year

• This is available on all IDFC FIRST Bank Credit Cards

Pay Instantly with Reward Points

Pay instantly for any online transaction with your Credit Card Reward Points and for offline transactions too, at select merchants.

• Get gift cards or memberships of your favourite brands.

• Check out our unique Credit Card Reward Redemption Catalogue page for updates

Reward points that never expire!

Earn forever and Redeem anytime, anywhere with IDFC FIRST Bank credit cards

Lower Interest Rates

• Usually, other credit cards charge a standard and fixed interest rate as high as 42% p.a. , in case you carry forward your outstanding balance beyond the payment due date.

• IDFC FIRST Bank Credit Cards offer low and dynamic interest rates starting from 9% per annum. The interest rates stated are typically ‘yearly’ rates, also known as the annual percentage rate (APR). No Interest is charged if you repay your balance in full, each month by the due date. We recommend that you always pay Total Amount Due of your credit card to avoid any charges. Paying Minimum Amount Due each month is mandatory.

0% Interest on Cash Withdrawal

IDFC FIRST Bank Credit Cards offer ATM cash withdrawals at 0% interest until your due date.

• Usually, other credit cards charge interest from date of withdrawal with interest rates as high as 3.5% per month along with withdrawal fee of ₹500.

• With IDFC FIRST Bank offering India’s best credit card interest rates, you pay zero interest until your due date for payment and at a flat transaction fee of just ₹199/- only.

Stay safe with Insurance/RSA coverage

• Avail Emergency Roadside Assistance worth ₹1,399 with your credit card – in case of an unfortunate & unforeseen event like a breakdown or a road accident.

• Avail 24*7 Roadside Assistance (RSA) anywhere, anytime by calling our RSA partner, Global Assure on 1800 572 3860 (toll free)

• Avail 4 complimentary RSA services in a year

• This is available on all IDFC FIRST Bank Credit Cards

Exciting discounts on Movie Tickets

25% discount on movie tickets up to ₹100 (valid once per month)

Complimentary Lounge Access

Complimentary Domestic Airport Lounge access , once every quarter

Savings Calculation

Category |

Annual Spends in (₹) |

Savings (₹) |

Fuel |

60,000 |

2,100 |

HP Pay Savings |

900 |

|

Welcome Benefit-1 (Fuel Cashback) |

250 |

|

IDFC FASTag Recharge |

6,000 |

150 |

Grocery & Utility |

24,000 |

600 |

Other Spends |

18,000 |

60 |

Annual Fee Waiver |

|

199 |

Welcome Benefit-2 (EMI Cashback) |

20,000 |

1,000 |

Complimentary Roadside Assistance |

|

1,399 |

Offer discount - ZoomCar rentals |

1000 |

|

Total |

1,28,000 |

7658 |

Fuel worth in litres @ ₹105 |

|

72.9 |

Assuming monthly spends of ₹5000 on Fuel, ₹500 on IDFC FASTag, ₹2000 on Utility & Grocery, ₹1000 on other spends (excluding Insurance, EMI, Cash withdrawal),₹20,000 from other spends converted to EMI.

Savings Calculation

Category |

Annual Spends in (₹) |

Savings (₹) |

Fuel |

1,20,000 |

6,000 |

HP Pay Savings |

1,800 |

|

Welcome Benefit 1 – (Fuel Cashback) |

1,800 |

|

IDFC FASTag Recharge |

12,000 |

600 |

Grocery & Utility |

24,000 |

1,200 |

Other Spends |

24,000 |

120 |

Annual Fee Waiver |

- |

499 |

Welcome Benefit 2 - (EMI Cashback) |

20,000 |

1000 |

Complimentary Roadside Assistance |

- |

1,399 |

Offer Discount – Zoomcar Rentals |

- |

1,000 |

Movie Discount |

- |

1200 |

Complimentary Dom. Airport Lounge Access |

- |

3,600 |

Total |

2,00,000 |

20,218 |

Fuel worth (@ ₹105) |

|

192.5 litres |

Assuming monthly spends of ₹10,000 on Fuel, ₹1000 on IDFC FASTag, ₹2000 on Utility & Grocery, ₹2000 on other spends (excluding Insurance, EMI, Cash withdrawal),₹20,000 from other spends converted to EMI.

Eligibility

Anybody who meets any of the following requirements can apply:

- Self Employed Professionals

- Hindu Undivided Family (H.U.F.)

- Sole proprietorship

- Partnership

- OPC / Private / Public Limited Company.

- Limited Liability Partnership

Sole proprietorship

- 2 documents in the name of Entity

- Address proof in the name of entity

- Proprietor Document – (Photo, PAN copy and 1 OVD document copy)

- Nature of Industry proof (In case not indicative in Entity documents, please check for Invoice Copy, Bill of Entry, Freight Invoice, Agreement Copy)

Partnership

- Partnership Deeds

- Partnership Firm Declaration

- Entity PAN card copy

- Address Proof in the name of the Entity

- OVD copy of the Partners / Authorised Signatories / Beneficial Owners (Including Latest Photograph and PAN card copy)

- Click here to read the Schedule of Charges

FEES & CHARGES

Find out about our minimal and transparent fees & charges

FREQUENTLY ASKED QUESTIONS

What is a Current Account?

A Current Account is an account that is used by business enterprises or self-employed professionals to carry out business-related transactions. It allows businesses to carry out a higher number of transactions daily.

Who can apply for a Current Account?

Anyone who meets any of the following requirements can apply:

- Self Employed Professionals

- Hindu Undivided Family (H.U.F.)

- Sole Proprietorship

- Partnership

- OPC / Private & Public Limited Company

- Limited Liability Partnership

How do I open a Current Account?

You can open an IDFC FIRST Bank Current Account by visiting your nearest bank branch or click here to apply online.

What are the documents required for opening a Current Account?

The documents required to open a Current Account are based on your constitution type. Click here to view the list of documents.

Do IDFC FIRST Bank Current Accounts earn interest?

Yes. with BRAVO feature, you can enjoy interest on your Platinum Current Account. BRAVO feature allows you to set up an Auto Sweep into FD limit, with no penalty on premature FD breakage. Click here to know more about the ‘BRAVO’ feature for Current Account

What is the minimum Average Monthly Balance (AMB) required to be maintained in the IDFC FIRST Bank Platinum Current Account?

Minimum Average Monthly Balance (AMB) requirement for Platinum Current Account is ₹ 2,00,000.

What is an Average Monthly Balance?

The average monthly balance is calculated by taking the average of end of the day/ daily closing balances in your Current Account, in a given month. E.g., For a 31-day month, the average is calculated by adding the closing day balances for all the days in the month and dividing it by 31.

What are the benefits of having an IDFC FIRST Bank Current Account?

After opening a Current Account with IDFC FIRST Bank, you can avail of below benefits:

- State-of-the-art Mobile Banking App & Net Banking platform

- Bank from anywhere, across any branch, at ZERO charges

- Seamless POS, QR & Payment Gateway facility

- Doorstep Banking Service - Free document & cheque pickup

What are the fees and charges on IDFC FIRST Bank Current Account?

IDFC FIRST Bank has minimal and transparent fees & charges. Click here to view.

Are all services offered free of charge in the Platinum Variant?

All current account services (except cash deposit) are offered free of charge to the customer provided they maintain the required balance.

Name of the Product |

Criteria |

Platinum |

AMB: >=2,00,000 - CA services are FREE, AMB: 50K- 2 Lakh - Rs. 1000; AMB: < 50K - Rs. 1000 + Standard charges applicable |

What is the free cash deposit limit for Platinum Current Account?

Platinum Current Account offers free cash deposit limit of 15 times the current month AMB with no restriction on maximum amount.

Can I deposit or withdraw cash in any IDFC FIRST Bank branch?

Yes, every Branch is a Home Branch with IDFC FIRST Bank which means you can get banking service like cash deposits or withdrawals at any IDFC FIRST Bank branch in the country. These services are provided without any additional charges.

What are the digital modes through which I can access IDFC FIRST Bank Current Account?

Current Account can be accessed through the following digital modes:

- Internet Banking & Mobile Banking

- 24x7 Banker on Call 1800-10-888

- Alerts through Email and SMS

- WhatsApp Banking

What all Beyond Banking offer will I get with my Current Account?

IDFC FIRST Bank Beyond Banking offers premium banking services with 100+ partners. You can benefit from 150+ offers across ERP &Accounting, HRMS Solutions, Legal, Logistics, Travel & more.

Click here to view the Beyond Banking offers.

What is the digital Payment & Collection solutions available for my Current Account?

Below are some of the digital payment and collection solutions available with IDFC FIRST Bank Current Account:

| Payment Solutions | Collection Solutions |

| NEFT/RTGS/IMPS | UPI-QR |

| Debit Cards | POS Machine |

| E-commerce payments using Net Banking | Doorstep Banking services with live tracking facilities |

| Bill Payments | Payment Gateway |

| Bulk transaction facility on Net Banking | Virtual Accounts |

| GST/Direct Tax Payment | Collection API |

| Payment API | NACH/e-NACH |

What are the Trade & Forex solutions available with the Current Account?

Below are the Trade & Forex solutions available to facilitate your international business requirements:

- Letter of Credit

- Bank Guarantee

- Document Collection

- Inward & Outward Remittance

- Hedging and Currency Protection

- FDI/ ODI/ ECB

- Escrow Services

Whatsapp Banking

Through WhatsApp Banking, you can interact with us just like you would with any of our representative

Numbers to connect: 95555 55555

Current Account Blogs

FEATURED

All you need to know about current account

Current accounts can help in managing the finances for your business. Read the following article to learn more about current accounts.

Team FinFIRST19 Oct 2023 • 3 mins read

-

Savings Account vs Current Account: Key differences & benefits

02 Jul 2025 • 3 mins read

-

Traditional vs zero balance current account for Start-ups

17 Aug 2023 • 3 mins read

-

Business benefits of a Start-up current account

14 Aug 2023 • 3 mins read

-

IDFC FIRST Bank’s ‘BOOSTER’ Current Account: A game changer for MSMEs

01 Jul 2023 • 3 mins read