CKYC Registry

-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex Services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

No Joining Fee | No Annual Fee

Lifetime Free

10X Never Expiring Rewards

Lifetime Free

10X Never Expiring Rewards

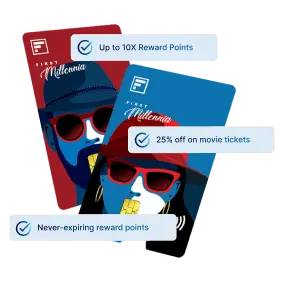

FIRST Millennia Credit Card

Do more of

what you love

FIRST Millennia Credit Card

#UnlockTheNewAge

Earn up to 3X

Reward Points

on UPI Spends

Already have the FIRST Millennia Credit Card?

₹500 gift voucher from choice of brands

Choose a gift voucher worth ₹500 from brands like- Amazon, BigBasket, Uber and Lifestyle on spending ₹5,000 or more within 30 days of card generation*.

*30 days from the day you receive SMS/email confirmation that your card is issued.

Eligibility:

• Spends of ₹5,000 within 30 days of card generation

• Spends is only eligible for Primary Card

Fulfilment:

• After meeting the spends criterion of ₹5,000, you will receive a SMS/email communication (within 4-5 working days) on your registered mobile number/ email with a link to reward section of our mobile banking app.

• Click on the welcome benefit banner to pick a voucher of your choice. The voucher will be available for redemption up to 90 days of receiving the SMS/email.

Exclusion

• Not applicable on UPI, Add-on card transactions, wallet load, EMI converted transactions & ATM cash withdrawal.

• If any of the transactions are reversed/cancelled/ disputed by the cardholder or merchant, that transaction will be excluded.

Up to ₹1,000 cashback on first EMI

Enjoy 5% cashback of up to ₹1,000 on your first EMI transaction within the first 30 days card generation*.

*30 days from the day you receive SMS/email confirmation of issued.

Eligibility:

• This offer is applicable only on first EMI conversion within first 30 days of card generation.

• A transaction above ₹2,500 and above can be converted into EMI

Fulfilment:

• Eligible customers will receive cashback within 90 days of the offer end date

Exclusion:

• Transactions done on gold and jewellery are not eligible for EMI conversion

• If the customer is delinquent at the time of offer fulfilment, that customer will not be eligible for the offer

• If any of the transactions are reversed/cancelled/foreclosed by the cardholder or merchant, that EMI transaction will be excluded. Similarly for any disputed transaction by the cardholder, that EMI transaction will be excluded

Exclusive privileges with the

FIRST Millennia Credit Card

24/7 Roadside assistance

Receive 24/7 roadside assistance for any emergencies while traveling

Complimentary Roadside Assistance worth ₹1,399. Valid up to 4 times in a year on your FIRST Millennia Credit Card.T&C apply

Experience convenience like never before

Instant EMI conversion for all online transactions

above ₹2,500 on the bank’s OTP page

Low interest rates(APR)

starting at just 8.5% per annum.

Interest-free* cash withdrawals

from ATMs for up to 45 days

*one-time cash withdrawal fee of ₹199 + GST applicable

Activate UPI at just ₹199

Joining and Annual fee (2nd year onwards) of just ₹199 + GST

Limited period offer: 100% cashback up to ₹200 i.e. ₹50 each on the first 4 UPI transactions

Earn up to 3X reward points on your spends

This card is perfect for you because...

No annual fees

Lifetime-free credit card!

Easy EMI options

Convert all transactions above ₹2,500 into EMIs

300+ merchant offers

Every deal gets sweeter with the FIRST Millennia Credit Card

Fees and charges

-

Joining and Annual Fees

NIL

-

Interest rates /Annual Percentage Rate (APR)

From 8.5% - 46.2% per annum

-

Cash Withdrawals

Across domestic and international ATMs

0% Interest

for up to 45 days ₹199 + GST per transaction

Click here for more details

Accelerated Rewards on Travel

Earn Bonus Reward Points on booking flights and hotels via 'Travel and Shop' section on IDFC FIRST Bank Mobile App

- Bonus 50 Reward Points on every ₹150 spent on all Hotel bookings Over and above your Credit Card Reward Program

- Bonus 20 Reward Points on every ₹150 spent on all Flight bookings Over and above your Credit Card Reward Program

- Redeem your Reward Points For flight and hotel bookings

Book your travel now!

Step 1

Open the IDFC FIRST Mobile Banking App

Step 2

Tap ‘Travel & Shop’ in the menu

Step 3

Choose Hotels or Flights and Book

Never-expiring reward points

10X Reward points

10X Reward points

on incremental spends above ₹20,000 per statement cycle and spends done on your birthday.

3X Reward points

3X Reward points

on spends till ₹20,000 in a statement cycle

1X Reward points

1X Reward points

on Insurance premium payments and Utility bill payments

10X Reward points

1X = 1 Reward Point per ₹150 spent | 1 Reward point = ₹0.25

Reward redemption will attract a small convenience charge of ₹99 (+GST) per redemption.

Reward program not applicable on Fuel, EMI transactions & Cash withdrawals.

Rental & Property Management, Government Services, Education, Wallet Load, Utility and Insurance. These transaction will not be counted towards 10X spends milestone.

3X Reward Points

1X = 1 Reward Point per ₹150 spent | 1 Reward point = ₹0.25

Reward redemption will attract a small convenience charge of ₹99 (+GST) per redemption.

Reward program not applicable on Fuel, EMI transactions & Cash withdrawals.

Rental & Property Management, Government Services, Education and Wallet Load transactions will earn 3X reward points. These transactions will not be counted towards 10X spends milestone.

1X Reward points

1X = 1 Reward Point per ₹150 spent | 1 Reward point = ₹0.25

Reward redemption will attract a small convenience charge of ₹99 (+GST) per redemption.

Reward program not applicable on Fuel, EMI transactions & Cash withdrawals.

Insurance and utility transactions will not be counted towards 10X spends milestone.

Deals you can't miss

Sweeter benefits await

Your go-to app for managing all your Credit Card needs

Install Now

Enjoy India’s #1 Mobile Banking App

Manage Your Card:

Access your virtual credit card, view transaction details, e-statements, and outstanding amounts seamlessly.

Control Usage:

Instantly manage your credit card settings, including online, contactless, and international transactions, or set/reset your card PIN.

Convenient Repayments:

Pay your credit card bill effortlessly through multiple options or set up autopay for hassle-free repayments.

Exclusive Offers:

Discover curated merchant offers and redeem your Reward Points for exciting deals.

Testimonials

IDFC FIRST Bank's credit card application is completely digital and paperless, featuring a smooth, clear interface. The entire process has excellent clarity. After completing VKYC, I received my card the very next day. Overall, excellent service.

Varun Kumar

FIRST Millennia

February 11, 2025

IDFC FIRST Bank's app is superior, user-friendly and enjoyable to use. The Video KYC process was smooth and convenient, which was greatly appreciated. The card packaging is also premium. Overall, the experience has been positive.

Mayank Malik

FIRST Millennia

January 24, 2025

I'm incredibly pleased about my experience with IDFC FIRST Bank; everything is great and very easy to use. This card is exceptionally beneficial for online shopping and digital transactions, proving to be excellent overall.

Rehan Raza

FIRST Millennia

January 24, 2025

All of IDFC FIRST Bank's services are great; their process is quick and fast. Unlike other banks this bank understood the value of my CIBIL score and provided me a credit card without any hassle. I'd appreciate it if you could increase my credit limit.

Tapanshri Gupta

FIRST Millennia

January 23, 2025

FinFIRST Blog

Learn all about credit cards

Benefits of the IDFC FIRST Millennia Credit Card

The FIRST Millennia Credit Card is a lifetime-free credit card, carefully crafted with millennial lifestyles in mind.

Is the FIRST Millennia Credit Card right for you? Find out here

Understand the eligibility criteria of the FIRST Millennia Credit Card – your key to making your lifestyle dreams come true.

Flexibility of UPI with your IDFC FIRST Bank Credit Card

Get an add-on FIRST Digital RuPay Credit Card linked to you IDFC FIRST Credit Card and enjoy the convenience of UPI.

Answering all your questions

All

Fee and Card Usage

Benefits

Reward Points

Credit Limit

Payments

No, the IDFC FIRST Bank Millennia Credit Card is lifetime-free. There are no joining, membership, or annual fees, making it a cost-effective choice for cardholders seeking premium benefits without recurring charges.

The Annual Percentage Rate (APR) on IDFC FIRST Bank Credit Cards range from 8.5% to 46.2% p.a. IDFC FIRST Bank is one of the first banks in India to offer credit card interest rates as low as 8.5% p.a.

Yes, cash withdrawals are allowed globally. A one-time fee of ₹199 + GST applies per transaction. There's no interest for up to 45 days. You can withdraw up to ₹10,000 per transaction, subject to your cash limit.

You can generate your PIN via Net Banking, the IDFC FIRST Bank App, or Customer Care. For full steps, visit the Credit Card Help section.

You can personalise your card during application by selecting an image or uploading your own. This service is available for a nominal joining fee and annual fee of ₹499 + GST.

Yes, you can share your credit limit by issuing Add-On cards with a₹499 + GST, joining and annual fee per card. These cards share the same credit limit and the primary cardholder is liable for all payments.

Yes, for transactions in India, PIN entry is required. Internationally, PIN entry depends on the terminal. You can also enable contactless (tap-and-pay) transactions up to ₹5,000 via the mobile app.

If you lose your credit card, block it immediately using any of the following methods and request a replacement:

Customer care helpline

Call 1800 10 888 and ask to block your lost card. You may be asked to verify certain details before the card is blocked.

IDFC FIRST Bank Mobile banking app

Log in to the mobile app, navigate to the credit card section, and choose the option to block your card.

Net banking portal

Log in to the IDFC FIRST Bank’s website using your net banking credentials and block your card from the credit card section.

SMS service

Send an SMS in the format: CCBLOCK<space><Last 4 digits of credit card number> to 5676732 to block your card instantly.

The FIRST Millennia Credit Card comes with no joining, or annual feesWhile offering value to customers through benefits like discount on movie tickets , fuel surcharge waiver , GV worth Rs. 500 as welcome offer on card activation and year round deals from partnered merchants* without the burden of additional fees.

You can enjoy joining benefits worth ₹1,500 with your FIRST Millennia Credit Card:

1. Receive a ₹500 welcome voucher when you spend ₹5,000 or more within 30 days of card activation.

2. Get 5% cashback, up to ₹1,000, on the first EMI transaction made within 30 days of card activation.

Your FIRST Millennia Credit Card is designed to offer multiple benefits, offers, and features to suit your diverse needs and lifestyle. Discounts on shopping, dining, and movies run all year round. Frequent travellers can enjoy benefits like complimentary railway lounge access, complimentary travel insurance, and discounted hotel bookings. In-app online offers on your favourite brands, health and wellness offers, and more. Explore here: Offers & Privileges - IDFC FIRST Bank (poshvine.com)

Existing IDFC FIRST Millennia Credit Card holders can refer their family and friends for IDFC FIRST Bank Credit Cards and earn 2000 bonus reward points for each successful card generation. One can earn a maximum of 10,000 bonus reward points. The referred person also stands a chance to earn 2000 bonus reward points by making a minimum transaction of ₹500 within 30 days of setting up their credit card. For more details, please click on the link below:

A low-interest credit card is designed to make borrowing more affordable with lower interest rates on outstanding balances. The FIRST Millennia Credit Card not only offers the advantage of being a low-interest credit card but also comes with exceptional benefits such as accelerated reward points, cashback on EMI conversion, fuel surcharge waiver and exclusive discounts on purchases. With no joining or annual fees, it stands out among low-interest credit cards, ensuring you enjoy maximum savings and value with every spend.

Getting a FIRST Millennia Credit Card has many benefits, some of which are listed below:

- Welcome benefits of up to ₹1,500 on card activation

- Host of discounts and offers on offline and online transactions with over 300+ merchant offers*

- 4 complimentary railway lounge visits per quarter*

- Complimentary Roadside Assistance worth ₹1,399

- Upto 10X never-expiring reward points

- 25% discount on movie tickets up to ₹100 on District by Zomato mobile app (valid once per month)

Yes. You will earn:

- 10X never-expiring reward points for incremental spends above ₹20,000 in a statement cycle and spends done on your birthday.

- 3X never-expiring reward points on spends up to ₹20,000 in a statement cycle.

- 3X reward points on Education, Wallet Load, Government payments, Rent and Property Management/Purchase transactions.

- 1X never-expiring reward point on utilities and insurance transactions. Spends in these categories will not be considered for the 10X monthly milestone.

- Reward points will not be given on spends converted to EMI, Cash Withdrawal, Fuel, Fee and Charges.

(1X reward point is given for every ₹150 spent in a transaction. Value of 1 reward point is ₹0.25)

Education, Wallet Load, Government payments, Rent and Property Management/Purchase transactions, Utilities, Insurance, EMI, Cash Withdrawal, Fuel, Fee and Charges.

Only transactions settled by the merchant before the statement generation will be considered. If a transaction is settled after the statement is generated, it will not accrue 10X rewards. Rewards for such transactions will be credited in the next statement generation.

Redeeming the accumulated reward points of your FIRST Millennia Credit Cards is a breeze.

Reward points are never expiring.

• You can use reward points to pay for any online purchase and also at some physical stores. This option is available for both online and offline transactions and can be accessed by selecting the ‘pay with points’ option at the payment gateway.

• You can also redeem your reward points against a range of amazing offers available here. Browse through various reward points redemption options and choose from an extensive range of products, services, and experiences.

• The reward points redemption process is hassle-free and straightforward, a reward redemption fee of ₹99 + GST will be applicable.

No. Reward points earned on the FIRST Millennia Credit Card do not expire, giving you the flexibility to redeem anytime.

Reward points are credited at the time of monthly statement generation and are available for redemption thereafter.

Your FIRST Millennia Credit Card is designed to offer multiple benefits, offers, and features to suit your diverse needs and lifestyle. Discounts on QSR ,shopping, dining, movies and travel run all year round. Frequent travellers can enjoy benefits like complimentary railway lounge access, Explore here: Offers & Privileges -IDFC FIRST Bank (poshvine.com)

If you are applying for your first IDFC FIRST Bank unsecured credit card, you will get a credit limit as per our internal policies.

If you already have an IDFC FIRST Bank unsecured credit card, your new credit card will also have the same credit limit. The credit limit, however, will be shared across all unsecured credit cards.

The Bank may revise your limit based on eligibility. You can also request a limit enhancement via Net Banking or mobile app by submitting required documents.

You can pay via IDFC FIRST Bank Net Banking, Mobile App, UPI, IMPS, NEFT, debit card, cheque, or by visiting an IDFC FIRST Bank branch. Know More

Transactions can get declined when customers cross their credit limit. That’s why we provide an overlimit facility which offers an additional 10% credit limit for customers for a hassle-free experience. Customer consent is required to enable the OVL facility, this can be done through the Credit Cards section on the IDFC FIRST Bank mobile application.

The payment due date is the last date to pay at least the Minimum Amount Due (MAD) to avoid late charges and credit score impact. It’s fixed each month and follows your statement generation.

TAD includes all purchases, EMIs, charges, and interest accrued during the billing cycle. Paying in full avoids interest charges.

MAD is usually ~5% of the total outstanding (including EMIs and charges). Paying only MAD avoids late fees but interest continues on the unpaid amount.

If MAD is unpaid by the due date, late payment fees are charged based on the balance. Interest also applies on the overdue amount until cleared.

The APR ranges from 8.5% to 46.2% per annum. Responsible credit usage and timely repayment help you maintain a lower interest rate.

Interest is calculated daily from the transaction date until the payment date. It varies based on transaction type and history. Paying the full amount avoids interest.

To apply for a low interest credit card online like the FIRST Millennia, follow these simple steps:

• Visit the IDFC FIRST Bank Credit Cards page

• Choose the FIRST Millennia Credit Card

• Click ‘Apply Now’, and complete the form

• Once approved, the card is dispatched to your registered address

Up to 45 days of interest-free credit on retail purchases, if the full outstanding from the previous cycle is paid by the due date.

Yes. Withdraw cash interest-free for up to 45 days. A fee of ₹199 + GST applies per transaction. Interest is charged after the free period if unpaid.