-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex Services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

TASC

Institutional

Banking

Comprehensive Payments & Collections

Solutions customised for your

institution’s needs.

TASC Institutional Account

IDFC FIRST Institutional banking provides innovative products & services to suit the needs of Trusts, Associations, Societies, Clubs, Educational Institutions, Hospitals, Non-Government Organizations (NGOs) etc.Read More

Our tailor made solutions are perfect for managing your collections, payments and other CMS requirements which help in making your banking experience easy and efficient.

Our growing network of branches & dedicated relationship managers will help you with a variety of products and services needed in growing your business.Read Less

Dynamic TASC Accounts

Revolutionary Net Banking & Mobile Banking Platforms

Integrated Cash Management Services

Payment Gateway & POS

Doorstep Banking

Dynamic Cash Deposit Limits

Free funds transfer across NEFT / RTGS / IMPS

Bulk Uploads, UPI QR & Virtual Accounts

Free cheque book and DD issuance

Unlimited ATM Transactions

Beyond Banking Solutions

Dedicated Relationship Manager

TASC Segments

Schools and Colleges

The most comprehensive financial solutions which are perfect for your Education Institute.

- Virtual Accounts for Reconciled Fee Collections

- Bulk salary & vendor payment

- Payment Gateway and POS Solutions

- UPI Collections

- Competitive Fixed Deposits rates

- Comprehensive ERP solutions

- Dedicated Relationship Manager

- API Banking & H2H Payments Integration

Hospitals and Healthcare

You save lives; we’ll save you the trouble of handling your finances.

- Payment Gateway and POS Solutions

- UPI Collections

- Hassle free bulk salary / vendor payment

- Free Demand Drafts

- Free RTGS / NEFT / IMPS

- Free At-Par cheque books

- Comprehensive ERP Solutions

- Dedicated Relationship Manager

NGOs

Keep your cause in focus; your finances will be managed.

- POS Solutions

- UPI Collections for donations

- Customized payment & collection solutions

- Free Demand Drafts

- Free RTGS / NEFT / IMPS

- Dedicated Relationship Manager

Housing Societies

Financial Solutions for you and your residents

- Complete Apartment management solutions

- Online Maintenance Collection

- Cheque Collection and Reconciliation

- Utility Bill Payments

- Bulk Salary/Vendor Payment

- Competitive Fixed Deposits Rates

- Comprehensive ERP solutions

- Dedicated Relationship Manager

Clubs & Associations

One stop solution for you and your members.

- NACH / e-NACH Solution for recurring subscription fee

- Bulk salary & vendor payment

- POS Solutions

- UPI Collections

- Cash/ Cheque pick-up management

- Comprehensive ERP Solutions

- Dedicated Relationship Manager

Religious Institutions

Peace of mind. Peace of Financial Solutions.

- Virtual Accounts to manage donations

- Payment Gateway and POS Solutions

- UPI Collections

- Bulk payment of Vendor & Salary

- Competitive Fixed Deposits Rates

Schools and Colleges

The most comprehensive financial solutions which are perfect for your Education Institute.

- Virtual Accounts for Reconciled Fee Collections

- Bulk salary & vendor payment

- Payment Gateway and POS Solutions

- UPI Collections

- Competitive Fixed Deposits rates

- Comprehensive ERP solutions

- Dedicated Relationship Manager

- API Banking & H2H Payments Integration

Hospitals and Healthcare

You save lives; we’ll save you the trouble of handling your finances.

- Payment Gateway and POS Solutions

- UPI Collections

- Hassle free bulk salary / vendor payment

- Free Demand Drafts

- Free RTGS / NEFT / IMPS

- Free At-Par cheque books

- Comprehensive ERP Solutions

- Dedicated Relationship Manager

NGOs

Keep your cause in focus; your finances will be managed.

- POS Solutions

- UPI Collections for donations

- Customized payment & collection solutions

- Free Demand Drafts

- Free RTGS / NEFT / IMPS

- Dedicated Relationship Manager

Housing Societies

Financial Solutions for you and your residents

- Complete Apartment management solutions

- Online Maintenance Collection

- Cheque Collection and Reconciliation

- Utility Bill Payments

- Bulk Salary/Vendor Payment

- Competitive Fixed Deposits Rates

- Comprehensive ERP solutions

- Dedicated Relationship Manager

Clubs & Associations

One stop solution for you and your members.

- NACH / e-NACH Solution for recurring subscription fee

- Bulk salary & vendor payment

- POS Solutions

- UPI Collections

- Cash/ Cheque pick-up management

- Comprehensive ERP Solutions

- Dedicated Relationship Manager

Religious Institutions

Peace of mind. Peace of Financial Solutions.

- Virtual Accounts to manage donations

- Payment Gateway and POS Solutions

- UPI Collections

- Bulk payment of Vendor & Salary

- Competitive Fixed Deposits Rates

TASC Savings Account – Self-Help Group

Get more out of your savings account with:

-

No minimum balance requirement

-

Free Cash Deposit at Home Branch of ₹1 Lakh per month

-

Attractive interest rate on Savings Account

-

Withdraw cash from anywhere, across any branch, without extra charge

ELIGIBILITY

Who can apply for a Savings Account?

- Societies registered under the Societies Registration Act, 1860, or any other corresponding law in force in a State or a Union Territory, except societies registered under the State Co-operative Societies Acts and specific state enactment creating Land Mortgage Banks.

- Section 25 Companies (as per Companies Act, 1956) or Section 8 Companies (as per Companies Act,2013)

- Institutions/entities whose entire income is exempt from payment of income-tax under Income-Tax Act, 1961

- Government departments/bodies/agencies in respect of grants/ subsidies released for implementation of various programmes/ schemes sponsored by Central/State Government (subject to production of an authorisation from the respective Government departments to open a savings bank account)

- Development of Women and Children in Rural Areas (DWCRA)

- Self-Help Groups (SHGs), registered or unregistered, which are engaged in promoting savings habits among their members.

FEES & CHARGES

Find out about our minimal and transparent fees & charges

FREQUENTLY ASKED QUESTIONS

Who can open a TASC Savings Account?

1. Societies registered under the Societies Registration Act, 1860, or any other corresponding law in force in a State or a Union Territory, except societies registered under the State Co-operative Societies Acts and specific state enactment creating Land Mortgage Banks.

2. Section 25 Companies (as per Companies Act, 1956) or Section 8 Companies (as per Companies Act,2013)

3. Institutions/entities whose entire income is exempt from payment of income-tax under Income-Tax Act, 1961

4. Government departments/bodies/agencies in respect of grants/ subsidies released for implementation of various programmes/ schemes sponsored by Central/State Government (subject to production of an authorisation from the respective Government departments to open a savings bank account)

5. Development of Women and Children in Rural Areas (DWCRA)

6. Self-Help Groups (SHGs), registered or unregistered, which are engaged in promoting savings habits among their members.

What is a Self-Help Group?

A Self-Help Group (SHG) is a small voluntary, informal association of people, preferably from the same socio-economic background. They come together to inculcate a habit of savings among their members through self-help and mutual help. The SHG promotes small savings among its members. The savings are kept with a bank.

In terms of banking, an SHG comprises of 10-20 members who are brought together normally by NGOs, and are encouraged to take up livelihood activities like tailoring, handicrafts, fabric making from e-charkhas etc., The members save individually and these savings can be lent to any of the members in time of their need. Some banks also lend to SHGs.

As per regulations, SHGs are allowed to open Savings Accounts

What is AMB and how is it calculated for IDFC FIRST Bank Dynamic TASC account?

AMB or Average Monthly Balance of your Dynamic TASC account is the average of the day-end balance in the account for all the days in a month.

Every day, from the 1st to the end of the month, we take the balance in your account at the end of the day. We total them all up and divide by the number of days in the month. That’s it!

What are the modes through which one can track the IDFC FIRST Bank Dynamic TASC account?

You can track your IDFC FIRST Bank Dynamic TASC account through the following modes:

· Internet Banking & Mobile Banking

· 24x7 Banker on Call

· Monthly email statements sent to registered email address

· Alerts through email and SMS

What are the digital payment solutions available IDFC FIRST Bank Dynamic TASC for an account?

Below are some of the digital payment and receivable solutions, available to TASC Current Account holders:

· Free bulk upload facility on net banking

· Payment Gateways

· Virtual Accounts

· UPI – QR

· Point of Sales

· API Integration

· NACH/e-NACH

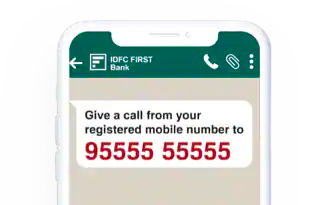

Whatsapp Banking

Through WhatsApp Banking, you can interact with us just like you would with any of our representative

Numbers to connect: 95555 55555