CKYC Registry

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Scan, get our app

Access 300+ features on our 4.9⭐️ rated app

Select a

Select a Product

Apply for a product now

On a mission to build the world’s most customer friendly bank

-

Savings Account

Savings Account

-

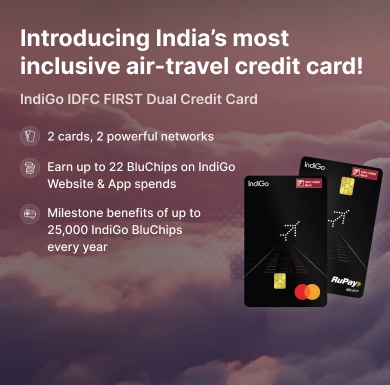

FIRST Select Credit Card

-

Corporate Salary Account NEW

Corporate Salary Account NEW

-

FIRST Wow! Credit Card NEW

-

Personal Loan

-

Business Loans

Business Loans

-

Home Loan

-

Two Wheeler Loan

-

Pre-Owned Two Wheeler Loan

-

Non-Resident Indian Savings Account

-

Fixed Deposit

-

Loan Against Property

-

New Car Loan

-

Pre-owned Car Loan

-

Consumer Durable Loan

-

FASTag

FASTag

-

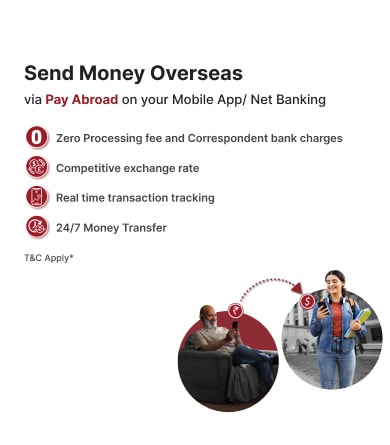

Forex services

Zero fee banking

The only bank in India to offer Zero Fee Banking on all Savings Account services

ZERO

CHARGES on

IMPS

NEFT

RTGS

Cheque Book

SMS Alerts

Cash Transactions

3rd Party Cash Transactions

Manager’s Cheque/DD/PO

Duplicate Statements Issuance

Duplicate Passbook Issuance

Balance Certificate Issuance

Interest Certificate Issuance

Account Closure

ECS Return

Stop Payment of Cheque

International ATM/POS Transactions

Decline Charges for Insufficient Balance

Standing Instructions

Photo Attestation

Signature Attestation

Retrieval of Transactional Records

Address Confirmation

Deliverable Returned by Courier

Debit Card Issuance

Debit Card Annual Fee

ATM Transactions

Cheque Bounce

Doorstep Banking

ZERO

CHARGES on

Financial Calculators

Hassle-free financial planning with IDFC FIRST Bank

**Interest calculated considering quarterly interest credit (Most universal banks credit savings interest quarterly).

In the spotlight

Quick actions for you

Activate UPI

Get the Power of UPI and earn cashback up to ₹200

FASTag

Upgrade to FASTag Max and enjoy benefits worth ₹5000*

Dining Offers

Avail up to 25% discounts with live screening of T20 matches

Professional Loan

Enjoy unsecured loans up to ₹1 crore tailored for Doctors, CAs, and Architects

Explore Bikes

and ride your dream bike with an instant loan

FIRST Rewards

Our exclusive Savings Account loyalty programme

Explore Cars

Shop, compare and choose your perfect car with the best financing options

Activate UPI

Get the Power of UPI and earn cashback up to ₹200

FASTag

Upgrade to FASTag Max and enjoy benefits worth ₹5000*

Dining Offers

Avail up to 25% discounts with live screening of T20 matches

Professional Loan

Enjoy unsecured loans up to ₹1 crore tailored for Doctors, CAs, and Architects

Explore Bikes

and ride your dream bike with an instant loan

First Rewards

Our exclusive Savings Account loyalty programme

Explore Cars

Shop, compare and choose your perfect car with the best financing options

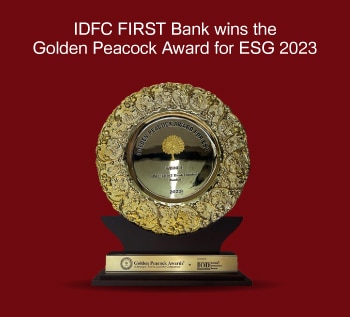

Award-winning digital banking platform

Recognised as the 'Best Digital Bank' for the year 2021-2022 by Financial Express India's Best Banks Awards 2023.

Enjoy India's #1 Mobile Banking App

Enjoy India's #1 Mobile Banking App

Enjoy India's #1 Mobile Banking App

Download IDFC FIRST Bank App

Start banking with just a

WhatsApp message. Send

'Hi' to 95555 55555

Experience a secure way

to bank on the go with

our mobile banking app

Banking services now

at your fingertips

anytime, anywhere

Step inside the

world of smart

watch banking

But don’t take our word for it, Hear from our customers

"Dear Indu Singh, I wanted to send a quick note of appreciation for the exceptional and highly efficient service you provided while opening my new NRI account. The entire process was seamless and completed incredibly smoothly within just two to three days...." Pravin Pillai 30 September 2025

"Thanks to my RM Mr. Adwiteeya for reversal of deduction within 24 hours from Loungkey . Fantastic job, many thanks for quick response and kind support!!" Ravindra Kumar 29 September 2025

"Seamless rtgs and neft transfer in minutes in Branch" Mohd Ammar 29 September 2025

"Thank you idfc first bank finance Good job to peoples thank you . RAJA RAO" Thumati Raja Rao 28 September 2025

"As this is my first experience, it's too good 👍" Shekhar Chauhan 26 September 2025

"I'm happy to see good Transaction to EMI / Balance Transfer to EMI conversation rates when compared to large cap banks like SBI. You are charging in range of 12% to 16% where as these arrogant banks are charging from 19% to 23%. Please keep up the good work. I'm not renewing my SBI credit cards just due to this reason and continuing with your credit cards only." Vaibhav Agarwal 25 September 2025

"Appreciation Note I would like to express my sincere appreciation to Aripta Nathan, Relationship Manager – Elite Banker, NRI Engagement, for her outstanding support during my onboarding journey. Although she was not officially assigned to assist me, I reached out to her based on a friend’s recommendation — and I’m truly glad I did...." Jai Kishan Raghav 20 September 2025

"IDFC Bank truly stands out for its customer-centric approach, innovative digital banking solutions, and transparent services. The ease of use, quick response, and professionalism make banking not just convenient but also trustworthy. Keep up the excellent work in setting benchmarks for modern banking" Imran Saiyed 16 September 2025

"Hi All , Just wanted to appreciate Kalpesh and Harshit from Bandra Branch for the efforts in helping with the KYC for Living Word Church" Russell Pinheiro 9 September 2025

"Thanks to Credit Card team, my RM Mr. Rahul and Mr. Akhilesh of NRI team for getting a new card to me in time after a fraud charge on account. I was worried the card would not arrive in time but it came just at the right time. Fantastic job by all, thanks!" Tarun 7 September 2025

Learn how to manage your finances effectively

Awards & Accolades

A glimpse of IDFC FIRST Bank's testament to excellence

Know more

IDFC FIRST Bank recognized amongst the 'World's Best Banks 2025’ by Forbes in partnership with Statista

![]()

![]()

IDFC FIRST Bank wins the 'Digital Sourcing & Decisioning Excellence' award at Lentra CNBC-TV18 Digital Lending Summit

![]()

![]()

Helping our communities grow with us

9.3 Million Beneficiaries

Supported since March 2023

70,000 Villages

Served across the country

9000 Residents

Impacted positively through our Swachh Worli Koliwada program

351 Students

Awarded post-graduate scholarships this year

9.3 Million Beneficiaries

Supported since March 2023

70,000 Villages

Served across the country

9000 Residents

Impacted positively through our Swachh Worli Koliwada program

351 Students

Awarded post-graduate scholarships this year

Disclaimer: With IDFC FIRST Bank Savings Accounts, enjoy Zero Charges on all Savings Account services. These services are being offered free in good faith, and in case of misuse of services, the Bank reserves the right to levy charges. Forex mark-up fee will be applicable on International ATM/POS/Debit card transactions. T&Cs are subject to periodic changes. All rights reserved.