Welcome Onboard

Joining Benefits worth ₹3,000+

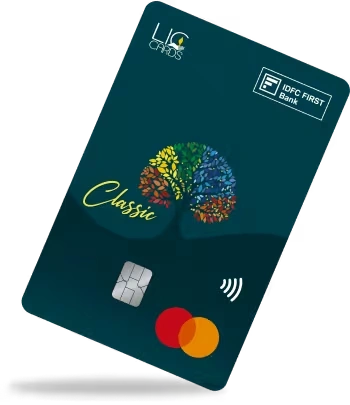

No Joining fee and Annual Fee

Interest free ATM cash withdrawals for up to 45 days