CKYC Registry

-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex Services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

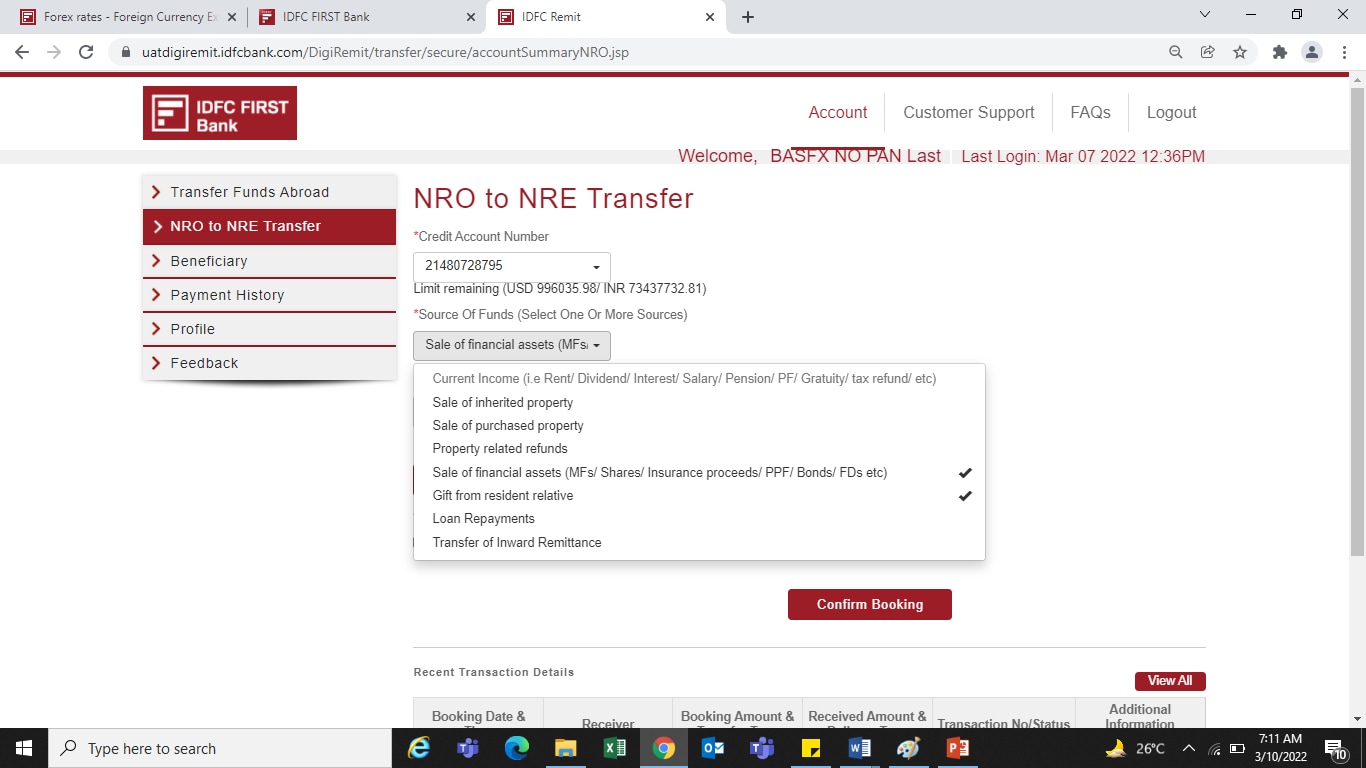

Transfer Funds from NRO to NRE at the Branch with RM assistance

NRO to NRE fund transfers now made simpler and more convenient

-

Get end to end assistance from Branch / NRI RM

-

Document list available on the portal

-

Get end to end assistance from Branch / NRI RM

-

Document list available on the portal

How to Transfer

Transfer funds at the Branch

Sending funds from NRO to NRE account is easy with IDFC FIRST Bank by your side. Follow these steps for a seamless fund transfer.

1. Walk in to your nearest IDFC FIRST Bank branch

2. Submit the NRO Repatriation application form – click here to download

3. Provide the necessary supporting documents

Done! The funds will be transferred once all documents have been verified

Here are the details of limits set for transfer:

| Source of funds | Per Txn Limit | Annual Limit * |

|---|---|---|

| Current Income (rent, dividend, interest, salary, pension, PF, Gratuity) |

No limit | No limit |

| Capital Income (others such as sale of property, sale of financial assets, gift, etc) |

$ 1,000,000 | $ 1,000,000 |

*Annual Limits are applicable on aggregate amount of overseas payments made during a financial year through any Bank or authorized dealer in India.

Documentation

Below supporting documents are required for processing fund transfers from NRO to NRE

1. NRO Repatriation application form – click here to download

2. Form 15 CA: Click here for steps to file

3. Form 15 CB: as applicable

4. Proof of source of funds: Click here to view documents required as proof of source of funds

Payment Tips

1. Source of funds: ‘Source of funds’ are nothing but sources of credits into your NRO account. For example, Rent and sale of purchases property are sources of funds. Sources of funds can be further classified into current income (rent, dividend, interest, salary, pension, PF, gratuity) and capital income (others such as sale of financial assets, sale of purchased property, etc)

• If your source of income is from current as well as capital income, then you need to initiate two separate payments as they cannot be clubbed.

• However, if your source of income is either Current or Capital, you can select multiple sources of funds.

• Depending on the source of fund selected, you should upload the relevant proof (s). For example, if you have selected Sale of financial assets (shares) and Sale of purchased property as sources of funds then you need to upload DMAT statement as well as sale deed

• Ensure all source of funds (i.e. reason for credits) in your account are selected and necessary proofs uploaded otherwise Bank will need to hold your payment and ask for the details.

• If the credits in your NRO account are transfers from other account, then you need to also upload the bank statement of the other account along with aforementioned proof.

2. NRO Repatriation application form

• Tick on Credit NRE Account (enter NRE account and INR amount)

• Tick on correct option for ‘Remittance is on account of’ (as per the source)

• Tick on documents submitted for transfer (do not tick on A2 & FEMA declaration)

Click here for sample form

• 15 CA is a mandatory document.

• 15 CA Should be filed online.

• Acknowledgement number must be mentioned in the form (top right corner)

• Status of remitter will be Individual

• Residential status of remitter will be Non Resident

• Country to which remittance is made will be India

• Currency in which remittance is made will be INR

Click here for sample form

• Mandatory if Form 15 CA part C is submitted

• UDIN number required

Click here for sample form

FREQUENTLY ASKED QUESTIONS

What is Source of Funds?

‘Source of funds’ are nothing but sources of credits into your NRO account. For example, Rent and sale of purchased property are sources of funds. Sources of funds can be further classified into current income (rent, dividend, interest, salary, pension, PF, gratuity) and capital income (others such as sale of financial assets, sale of purchased property, gift from resident relative, etc)

• If your source of income is from current as well as capital income, then you need to initiate two separate payments as they cannot be clubbed.

• However, if your source of income is either Current or Capital, you can select multiple sources of funds.

• Depending on the source of fund selected, you should upload the relevant proof (s). For example, if you have selected Sale of financial assets (shares) and Sale of purchased property as sources of funds then you need to upload DMAT statement as well as sale deed

• Ensure all source of funds (i.e. reason for credits) in your account are selected and necessary proofs uploaded otherwise Bank will need to hold your payment and ask for the details.

• If the credits in your NRO account are transfers from other account, then you need to also upload the bank statement of the other account along with aforementioned proof.

What is the process of NRO to NRE funds transfer at the Branch?

For transferring funds from NRO to NRE, please walk in to any IDFC FIRST Bank branch, and initiate the fund transfer by filling up the NRO Repatriation application form (Click Here to download form). In addition to this you have to provide proof of the source of funds sought to be transferred and C.A certificates in Form 15 CA & 15CB. You may email nriservices@idfcfirstbank.com for any further assistance.

What is the limit for NRO to NRE fund transfer?

When the source of funds is Current Income (e.g Rent, Dividend, Interest, etc.) – No Limit

When the source of funds is Capital Receipts (e.g Sale of Property) – USD 1 million in a financial year (Apr-Mar)

What is Form 15 CA?

Form 15CA is a declaration from sender and is used for collecting information on the taxability of source of funds.

It is a duty of authorized dealer/ banks to ensure that such forms are received by them from the remitter as per Rule 37BB under Section 195(6) of the Income Tax Act.

Form 15CA has 4 parts as mentioned below. Depending on the amount and taxability of remittance, specific parts of Form 15CA need to be filled:

PART |

DESCRIPTION |

Part A |

To be filled up if the remittance is chargeable to tax under the provisions of the Income Tax Act, 1961 and the remittance or the aggregate of such remittances, as the case may be, does not exceed five lakh rupees during the financial year. |

Part B |

To be filled up if the remittance is chargeable to tax under the provisions of the Income Tax Act, 1961 and the remittance or the aggregate of such remittances, as the case may be, exceeds five lakh rupees during the financial year and an order/ certificate under Section 195(3) / 197 of the Income Tax Act has been obtained from the Assessing Officer. |

Part C |

To be filled up if the remittance is chargeable to tax under the provisions of the Income Tax Act, 1961 and the remittance or the aggregate of such remittances, as the case may be, exceeds five lakh rupees during the financial year and a certificate in Form 15CB from an accountant as defined in the explanation below sub-section (2) of Section 288 has been obtained. |

Part D |

To be filled up if the remittance is not chargeable to tax under the provisions of the Income Tax Act, 1961 other than the payments referred to in Rule 37BB(3) by the person referred to in Rule 37BB(2). |

How to generate Form 15 CA?

Form 15CA has to be filled online on the website of the Income Tax Department. The printout generated from this website has to then be signed by the remitter and submitted along with the Form 15CB. The detailed process of filling up the form is also available on the Income Tax Department website.

Steps to be followed to file Form 15CA online:

https://www.incometax.gov.in/iec/foportal/help/statutory-forms/popular-forms/form-15ca-um

What is form 15 CB?

Form 15CB is a certification by a Chartered Accountant concerning the rates and the relevant taxes paid by a taxpayer. Form 15CB (with UDIN number) is mandatory if Part C of form 15 CA is applicable and filled by the remitter. Form 15CB needs be filed on Income Tax Department Website.