-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex Services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

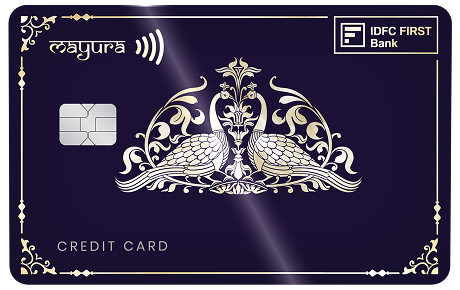

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

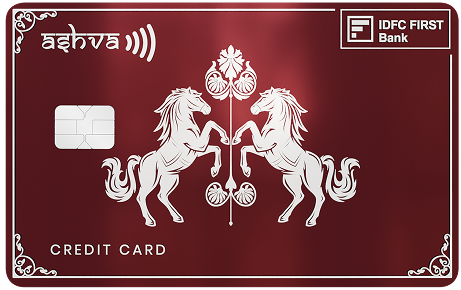

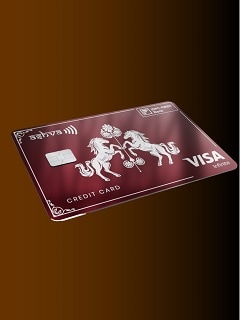

Ashva Metal

Credit Card

Metal Credit Card

In the era of Indian royalty,

horses or Ashva, were symbols of pride and

revered for their prowess.

A galloping horse symbolizes the

drive to keep moving forward, succeed

and become the best versions of ourselves.

Experience the unwavering spirit

of Ashva in a metal credit card with its

strength and exceptional privileges.

Fees and charges

- Primary Credit Card:

- - Joining fees₹2,999 + GST

- - Annual Fee₹2,999 + GST

- Upfront payment of Joining Fee + GST required for dispatch of metal credit card the fee is non-refundable.

- Add-on Credit Card:

- - Joining Fee (Metal Variant)₹2,000 + GST

- - Joining Fee (Plastic Variant)₹1,500 + GST

- - Annual Fee (Both Variant)₹1,000 + GST

- The above mentioned fee will be charged for every add-on credit card.

Rooted in India, embracing the world

Introducing the Ashva Metal Credit Card – add a touch of enchantment to everyday adventures.

#MadeOfIndia

A metal marvel

With its embedded metal body and solid 12g weight, the card symbolizes the strong and durable bond between a rider and his steed.

#MadeOfIndia

A fusion of tradition and modern luxury

Featuring two regal horses reminiscent of ancient folklore - it’s more than just a credit card – it’s a piece of Indian heritage in your hands.

#MadeOfIndia

Ashva

- Primary Credit Card:

- - Joining fees₹2,999 + GST

- - Annual Fee ₹2,999 + GST

- Upfront payment of Joining Fee + GST required for dispatch of metal credit card the fee is non-refundable.

- Add-on Credit Card:

- - Joining Fee (Metal Variant) ₹2,000 + GST

- - Joining Fee (Plastic Variant) ₹1,500 + GST

- - Annual Fee (Both Variant) ₹1,000 + GST

- The above mentioned fee will be charged for every add-on credit card.

Key Benefits of the Ashva Credit Card

Higher Tier of rewards

Earn Up to 60X Reward Points Redemption value of up to ₹0.40 per Reward Point

Joining Fee Payment Benefit

Earn 7,500 Reward Points worth up to ₹3,000

Annual Fee Payment Benefit

Worth up to ₹3,000

1% forex markup

With a low forex markup of just 1%, ensure that your international transactions are seamless and cost-effective.

Reward Points on Ashva Credit Card

Earn

• 50X Bonus Reward Points* on Hotel Bookings

• 30X Bonus Reward Points* on Flight Bookings

* * via “Travel and Shop” Section on IDFC FIRST Bank Mobile App

Plus

• Up to 10X Reward Points incremental spends above ₹ 20,000 in a statement cycle.

1X = 1 Reward Point per ₹150 spent

Redemption

1 Reward Point = ₹0.40 for hotel and flight bookings via “Travel and Shop” Section on IDFC FIRST Bank Mobile App

Joining Fee Payment Benefit *

Get 2,500 reward points when you pay your joining fee. Earn another 2,500 points on spends over ₹20,000 in your second statement cycle, and 2,500 more on spends over ₹20,000 in your third statement cycle. Applicable for cards generated on or after 1st September 2025.

Excluded transactions: Cash withdrawals, fees, charges, and GST are not eligible for rewards.

T&C Apply

*The Joining Fee Payment Benefit is offered once per customer on the Ashva Credit Card. If you have previously held the Ashva Credit Card, you will not be eligible for this benefit again.

For cards generated till 31st August 2025, get up to ₹ 2,000 as cashback. For every transaction above ₹500, you receive ₹500 as cashback, up to a maximum of four times. Valid for the first 60 days after the virtual credit card is generated. On payment of joining fee, the cashback will be credited within 7 days of completing the eligible transactions. T&C Apply

Elevate every experience with metal card excellence

Exceptionally low forex markup fee

Save on international transactions with forex markup at just 1%. T&C Apply*

Airport lounge perks

Complimentary access to airport lounges 4 times in India & 2 times overseas, every quarter. T&C Apply*

Free trip cancellation protection

Get reimbursed for non-refundable flight and hotel cancellations by up to ₹25,000, twice a year. T&C Apply*

Railway lounge access

Get 4 complimentary railway lounge visits per quarter. T&C Apply*

The Postcard Hotels & Resorts

Enjoy a flat discount of ₹5000 on a minimum booking of ₹25,000. T&C Apply*

Premium golf privileges

2 complimentary golf rounds/lessons every month when you spend over ₹20,000 in a month. T&C Apply*

Exclusive movie delights

Enjoy buy one, get one free movie tickets with a minimum discount of ₹400, twice a month. T&C Apply*

Fuel surcharge waiver

Save on fuel costs with 1% waiver of up to ₹300 on fuel surcharges across India. T&C Apply*

Get a free stay at ITC Hotels

Enjoy exclusive offers on your hotel bookings

Get a free stay at Elivaas

Unlock exclusive discounts on your next trip

Airport Meet and Greet Service

Travel in style with personalised airport assistance.

Delectable dining discounts

Enjoy up to 20% off total bill* when you pay with your card at any participating restaurants.

Airport transfer discounts

Save on airport transfers with exclusive discounts on limousine services. T&C Apply*

Concierge at your fingertips

Get personalized assistance for all your travel needs. T&C Apply*

Luxury hotel benefits

Enjoy exclusive benefits and discounts at 900+ luxury hotels around the world. T&C Apply*

Accident and lost card liability cover

Stay protected with air and personal accident cover, and Lost Card Liability Cover of ₹50,000. T&C Apply*

Comprehensive travel insurance cover

Get comprehensive travel insurance coverage up to USD 1200. T&C Apply*

Roadside assistance

Receive 24/7 roadside assistance for any emergencies while traveling. T&C Apply*

Airport Lounge Privileges

View the list of eligible airport lounges

How to access lounges:

• Indian airport lounges – Present your Ashva Credit Card at the airport lounge.

• Global airport lounges – Present your Dreamfolks card. For easier access, do advance bookings online.

Spend ₹20,000 in the current calendar month to avail the benefit in the next month.

Avail 4 complimentary visits to lounges at select Indian Railway Terminals. T&C apply

Disclaimer: Effective 20th February 2025, spend ₹20,000 within the current calendar month to access railway lounge benefits in the following month.

Avail a buy one get one free offer on Movie Tickets with up to ₹400 off on the second ticket, twice in a calendar month.

The benefit can be availed via District App by Zomato . T&C apply

Air Accident Cover of ₹1 Crore, Personal Accident Cover of ₹10,00,000 and Lost Card Liability Cover of ₹50,000. Valid on doing at least one transaction on the Ashva Credit Card in the last 30 days.T&C apply

Loss of Checked-in Baggage: USD 500

Delay of Checked-In Baggage: USD 100

Loss of Passport and other documents: USD 300

Delay in Flight: USD 300

T&C apply

Complimentary Roadside Assistance worth ₹1,399 T&C apply

Stay for 3, Pay for 2 at ITC Hotels

Enjoy a complimentary 3rd night for every 2 consecutive paid nights at ITC Hotels.

Use promocode ITCVIS to unlock the offer on the ITC website.

Get 50% off your 2nd night at ITC Hotels

Stay for 2 nights and enjoy the 2nd night at 50% off at ITC Hotels. Use promocode ITCV50 to unlock the offer on the ITC website.

To know more, visit https://visaitcoffer.poshvine.com/

Note: The offer cannot be clubbed with other offers in a single transaction. This is an exclusive offer provided by VISA and is subject to change or discontinuation without prior notice.

Stay for 3, Pay for 2 at Elivaas

Enjoy a complimentary 3rd night for every 2 consecutive paid nights booked at Elivaas’ properties

Get 50% off your 2nd night at Elivaas

Stay for 2 nights and enjoy the 2nd night at 50% off at Elivaas’ properties

To know more, visit https://www.elivaas.com/explore/visa-offers/

Note: This is an exclusive offer provided by VISA and is subject to change or discontinuation without prior notice. The offer can be availed on the merchant website and cannot be clubbed with other offers in a single transaction.

Stay across The Postcard’s luxury hotels and resorts in India at attractive discounts with your Ashva Credit Card. Enjoy a flat discount of ₹5000 on a minimum booking of ₹25,000.

The benefit can be availed once every calendar quarter using promo code: IDFCVIP

T&C apply

Valid till: 10th Feb 2027

Airport Meet and Greet Service

Offer 1: Complimentary meet & greet service

Offer details: You can enjoy a complimentary meet and greet service at major Indian airports once a year with your credit card. This offer is available by spending USD 1000 (approx. INR 85,000) on international point-of-sale transactions in the past 12 months before the booking date.

Note:The offer cannot be combined with other offers. This is an exclusive offer provided by VISAand is subject to change or discontinuation without prior notice. Click Here to know more.

Offer 2: Flat 10% discount on meet-and-greet service

Offer details: For all other instances, or more than one guest, enjoy a flat 10% discount on meet & greet service at major Indian airports

Eligibility: Available to all eligible VISA Infinite cardholders

Note: The offer cannot be combined with other offers. This is an exclusive offer provided by VISAand is subject to change or discontinuation without prior notice. Click Here to know more.

Offer 3: Discounted Meet and Assist Service

Enjoy discounts on Airport Fast-track immigration service at over 450 destinations worldwide.

Delectable dining discounts

Experience luxury dining at its finest—handpicked restaurants, bespoke menus, and priority access await you with your VISA Infinite card. Reserve now on https://dinewithvisa.in

Terms and conditions apply. View here

Reward Points on Ashva Credit Card

Earn Up to 60X Reward Points

Earn Up to 60X Reward Points

50X Bonus Points on Hotels, 30X Bonus Points on Flights Plus Up to 10X Points on credit card purchases

Reward Point value of upto ₹0.40

Reward Point value of upto ₹0.40

Maximize your reward point value by redeeming them for hotel & flight bookings via “Travel & Shop” Section on IDFC FIRST Bank Mobile App

Earn Up to 60X Reward Points

Earn 15,000 bonus reward points every month with

• 50X Bonus Reward Points* on Hotel Bookings

• 30X Bonus Reward Points* on Flight Bookings

*via “Travel and Shop” Section on IDFC FIRST Bank Mobile App

Plus

Earn unlimited reward points on your credit card purchases with

• 10X Reward Points incremental spends above ₹20,000 in a statement cycle

• 5X Reward Points on spends up to ₹20,000 in a statement cycle

• 3X Reward Points on Rent, Education, Government and Wallet Load transactions. 1X Reward Points on Insurance and Utility transactions. Spends on these transaction categories are not counted towards 10X milestone.

And, your reward points never expire. 1X = 1 Reward Point per ₹150 spent.

Reward Points in Action

| Details | |

| Base Earn (A) | Up to 10 Points/ ₹150 |

| Accelerated Earn (B) On Bookings via IDFC FIRST Mobile App | +50 Points/₹150 (On Hotel Bookings via IDFC FIRST Bank Mobile App) +30 Points/₹150 (On Flight Bookings via IDFC FIRST Bank Mobile App) |

| Total Earn(A+B) On Bookings via IDFC FIRST Mobile App | 60 Points/₹150 (On Hotels) 40 Points/₹150 (On Flights) |

| Illustration: For ₹6,000 spends on Bookings via IDFC FIRST Mobile App | 2,400 Points Worth ₹960 (On Hotels) 1,600 Points Worth ₹480 (On Flights) |

Maximize The Reward Point Value

Each reward point is worth ₹0.40 when you redeem them for hotel and flight bookings via “Travel and Shop” section on IDFC FIRST Bank Mobile App.

On other redemption options – purchasing gift vouchers, products on “Travel and Shop” section on IDFC FIRST Bank Mobile App, and “Pay using reward points” on online transaction, the value of each reward point is ₹0.25.

| Details | |

| Value Per Point | 1 Point = ₹0.4 (On Hotel/Flight Bookings via “Travel and Shop” Section on IDFC FIRST Bank Mobile App) 1 Point = ₹0.25 (Everywhere else) |

| Illustration For 10,000 Points in action | 10,000 Points = ₹4,000 (On Hotel/Flight Bookings via “Travel and Shop” Section on IDFC FIRST Bank Mobile App) 10,000 Points = ₹2,500 (Everywhere else) |

Fees and charges

- Joining fees₹2,999 + GST

- Annual Fee ₹2,999 + GST

- Upfront payment of Joining Fee + GST required for dispatch of metal credit card the fee is non-refundable.

Fees and charges

- Primary Credit Card:

- - Joining fees₹2,999 + GST

- - Annual Fee ₹2,999 + GST

- Upfront payment of Joining Fee + GST required for dispatch of metal credit card the fee is non-refundable.

- Add-on Credit Card:

- - Joining Fee (Metal Variant) ₹2,000 + GST

- - Joining Fee (Plastic Variant) ₹1,500 + GST

- - Annual Fee (Both Variant) ₹1,000 + GST

- The above mentioned fee will be charged for every add-on credit card.

IDFC FIRST Bank

Latest Blog Posts

Deep dive into Credit Card

Enjoy Free Hotel Stays with the Ashva Credit Card

Discover how to unlock free hotel stays with IDFC FIRST Bank’s Ashva Credit Card.

Travel Insurance Benefits via Credit Cards

Explore the different types of travel insurance offered with select credit cards.

Top 3 Benefits of the Ashva Credit Card

Discover the major perks that make Ashva a top pick for smart spenders.

Ashva Card: Where Heritage Meets Modern Finance

Explore how the Ashva card blends Indian tradition with financial innovation.

What Makes a Metal Credit Card Special?

Understand the unique features and appeal of owning a metal credit card.

Answering all your questions

All

Fee and card dispatch

Benefits

Credit Limit

Reward Points

International Helpline

Offers

Airport Lounge

Card Usage

The Ashva Credit Card comes with a Joining Fee of ₹2,999 + GST and an Annual Fee (applicable from second card anniversary year) of ₹2,999 + GST. The Joining Fee will be levied on credit card application approval.

IDFC FIRST Bank believes in complete transparency, and we want our customers to make an informed decision about their Joining Fee and its associated benefits. By asking for payment upfront, we are aligning with our core values of openness and trust, ensuring you have full cognizance about the applicable fee, before committing to this premium metal card. This process allows you to make a conscious choice in a responsible and transparent manner. By choosing this process we also aim to minimize wastage due to cancelled and returned cards.

•You will receive communication from the bank to pay the Joining Fee as soon as your credit card application is approved.

•You can also pay the Joining Fee of 2,999 + GST by clicking here

•On the next page you must authenticate using the mobile number and date of birth as mentioned during the card application. The payment can be made using UPI and net banking.

Once your Ashva Credit Card application is approved, upfront Joining Fee payment of ₹2,999 + GST is required to get the credit card dispatched. To pay the Joining Fee, click here

•As per the process, upfront Joining Fee payment is required to activate your digital card and dispatch of the metal card.

•On card application approval, you will receive communication to pay the Joining Fee. To pay the Joining Fee now, click here

Once the Joining Fee is paid, please make sure that you have enabled online (Ecom) transactions on the card. To enable online transactions, please click here

Once the Joining Fee payment is completed, the credit card can be used for online transactions. To enable online transactions and to get the card details, please use the IDFC FIRST Mobile Banking App

On payment of joining fee, the metal credit card will be dispatched to your mailing address registered with the bank and should arrive in 5 working days. If your address has changed, please visit a nearby branch and get your address updated in the bank records. Once, the address is updated, please call 180010888 to get the card dispatched to the updated address.

On payment of joining fee, you can earn up to 7,500 reward points as a joining benefit. These are awarded in three parts:

• 2,500 reward points on successful payment of the joining fee

• 2,500 reward points on net spends of ₹20,000 or more in your 2nd statement cycle

• 2,500 reward points on net spends of ₹20,000 or more in your 3rd statement cycle

The benefit is available only once per customer. If you close the card and reapply, you will not be eligible for the benefit.

If you are applying for your first IDFC FIRST Bank unsecured credit card, you will get a credit limit as per our internal policies.

If you already have an IDFC FIRST Bank unsecured credit card, your new credit card will also have the same credit limit. The credit limit, however, will be shared across all unsecured credit cards.

Yes. You will earn:

- 10X reward points for incremental spends above ₹20,000 in a statement cycle and on your birthday.

- 5X reward points on spends up to ₹20,000 in a statement cycle.

- 3X reward points on Education, Wallet Load, Government, Rent and Property Management/Purchase transactions. 1 reward point on utilities and insurance transactions. Spends in these categories will not be considered for the 10X monthly milestone.

- Reward points will not be given on spends converted to EMI, Cash Withdrawal, Fuel, Fee and Charges.

- 1X reward point is given for every ₹150 spent in a transaction. Value of 1 reward point is ₹0.25.

Education, Wallet Load, Government, Rent and Property Management/Purchase transactions, Utilities, Insurance, EMI, Cash Withdrawal, Fuel, Fee and Charges.

Only those transactions which are settled by the merchant before the statement generation will be considered. If a transaction is settled after the statement is generated, it will not accrue 10X rewards. Rewards for such transactions will be credited after the next statement generation.

The Ashva Credit Card provides the benefit of never-expiring reward points. The reward points remain valid till the credit card remains active.

The Ashva Credit Card comes loaded with benefits like discounts on 300+ brands, movie tickets, complimentary airport lounge access, etc. The full list of benefits is mentioned above.

For brand offers, you can visit the offers website

The Ashva Credit Card offers one of the lowest forex markups in the industry at just 1%. Spend seamlessly while travelling abroad as well as on international purchases made from India.

Yes. With Ashva Credit Card, you can enjoy:

- 4 complimentary visits per quarter to airport lounges at airport terminals in India. Use your credit card to access Indian airport lounges.

- 2 complimentary visits per quarter to global airport lounges. Use the DreamFolks card to access global airport lounges. Some global lounges require prebooking via the link

To view the list of airport lounges, click here

The lounge benefit can be availed in the next calendar month by spending ₹20,000 or more in the current calendar month.

Yes. You can avail up to 2 rounds/lessons in a month. Each round/lesson is unlocked for every ₹20,000 spent in the previous statement cycle.

Yes, you can! All ATM cash withdrawals are interest-free for up to 45 days – in India or abroad. Cash withdrawal from ATMs outside India will attract a forex markup fee of 1% (+GST). Please keep in mind, however, that a Cash Advance Fee of ₹199/- + GST is applicable per transaction, irrespective of your location or the withdrawal amount. The maximum cash withdrawal limit per transaction is ₹10,000.

For transactions in India, yes, you will be asked for a PIN for completing the transactions. However, outside India, you will be asked for the PIN only if the POS terminal is enabled for PIN authentication.

On spending ₹8,00,000 or more in a card anniversary year, you will get 7,500 reward points. The reward points will be credited on payment of annual fee for the next year. Transactions on primary, add-on and associated FIRST Digital (UPI) Credit Card will be considered towards the milestone, including EMI transactions. Cash withdrawal, fee charges and EMI amortization will be excluded from the benefit.

The reward points will get credited upon statement generation.

Using the Ashva Credit Card, you get a buy-one-get-one movie offer with up to ₹400 off on the second ticket, twice a month. Starting 1st July 2025, use District by Zomato App to book ticket. Till 30th June 2025, you can use BookMyShow to book tickets.

The Ashva Credit Card comes loaded with benefits like discounts on 300+ brands, movie tickets, complimentary airport lounge access, etc. The full list of benefits is mentioned above.

For brand offers, you can visit the offers website

Yes. With Ashva Credit Card, you can enjoy:

- 4 complimentary visits per quarter to airport lounges at airport terminals in India. Use your credit card to access Indian airport lounges.

- 2 complimentary visits per quarter to global airport lounges. Use the DreamFolks card to access global airport lounges. Some global lounges require prebooking via the link

To view the list of airport lounges, click here

The lounge benefit can be availed in the next calendar month by spending ₹20,000 or more in the current calendar month.

Ashva, a premium metal credit card by IDFC FIRST Bank, is a must-have for frequent travellers. It can make your travel experience much more convenient with benefits such as:

1. Low Forex Markup Fee of 1%, making international transactions cost-effective.

2. Complimentary access to airport lounges and spas, including 4 domestic lounge or spa visits and 2 international lounge visits per quarter.

3. Free Trip Cancellation Cover. With a cancellation cover of up to ₹25,000 for non-refundable hotel and flight bookings, you won’t feel guilty about changing your travel plans at the last minute.

4. Robust travel insurance with coverage up to $1,200 USD for loss of luggage, flight delays, etc.

The Ashva Credit Card stands out as a versatile and cost-effective option for international travel compared to multi-forex or multi-currency cards. With only a 1% forex markup fee, it is highly competitive, offering significant savings compared to the typical 3-3.5% forex markup charged by most traditional credit cards.

Unlike multi-currency cards, which require pre-loading foreign currency and may involve reload fees, the Ashva Credit Card offers seamless usage across most currencies without additional setup or top-up hassles. Furthermore, its 45-day interest-free cash withdrawal feature provides unmatched flexibility and convenience while traveling abroad—something that is typically unavailable with multi-currency cards.

In addition to these financial benefits, the Ashva Credit Card also offers travel perks like complimentary lounge access, trip cancellation cover, travel insurance, and reward points, making it a superior all-in-one solution for globetrotters.

In case of any questions regarding your credit card while abroad, please contact us at +91 22 6248 5152

Important Documents

Related Credit Card Searches