-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex Services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

Apply for

Credit Card Online &

Get Instant Approval

Apply Now

Introducing India’s most inclusive air-travel credit card!

IndiGo IDFC FIRST Dual Credit Card

Explore Now

Just Tap.

Swipe.

Scan.

Apply Now

Never-Expiring Credit Card

Reward Points – Up to 10x!

Apply Now

Manage your

Credit Card

effortlessly

Apply Now

Low, dynamic

Interest Rate

starting at 8.5% p.a.

Apply Now

Get help

View all cards

Credit Cards - With Instant Approval & Exclusive Benefits

Looking for a smarter way to pay? Apply for an IDFC FIRST Bank Credit Card and unlock the freedom to manage your finances effortlessly. Whether you’re upgrading your lifestyle or handling an unexpected expense, our credit cards give you just the financial flexibility you need. With interest rates starting from just 0.71% per month, you can spend confidently and repay conveniently. Enjoy seamless transactions, never-expiring reward points, and flexible repayment options — only with IDFC FIRST Credit Cards. Apply now and get instant approval!

With IDFC FIRST Bank Credit Cards, you enjoy:

• Dynamic and Low APRs – Interest rates starting at just 8.5% per annum (0.71% per month)

• Never-Expiring Reward Points – Earn and redeem rewards at your convenience

• Exclusive Merchant Discounts & Offers – Save on shopping, dining, and travel

• Flexible Repayment Options – Carry forward balances at affordable interest rates

• Instant Approval & Seamless Application – Apply online and start using your card quickly

With IDFC FIRST Bank’s competitive APR, you can enjoy financial flexibility without excessive interest costs. Apply online today and experience a smarter way to manage your finances.

Explore our Wide Range of Credit Cards

Credit Cards designed for every need

How to Find Your Perfect Credit Card

03

mins

Just answer a few easy questions, and we’ll find the perfect credit card for you!

When do you celebrate your birthday?

You must be 18 or older to get a credit card

With great power comes great savings!

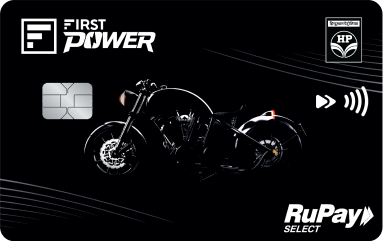

Introducing the HPCL co-branded FIRST Power & FIRST Power+ Credit Cards & their power-packed privileges:

- Up to 6.5% savings on Fuel & LPG

- Up to 5% savings on IDFC FASTag recharges, utility & grocery spends

- Up to 3X never-expiring rewards on other spends

- Complimentary domestic airport lounge access*

- 25% off on movie tickets*

- Personal Accident Cover worth ₹2 lakhs

- Complimentary Roadside Assistance worth ₹1,399

*T&Cs Apply

Get it all ! Get it now !

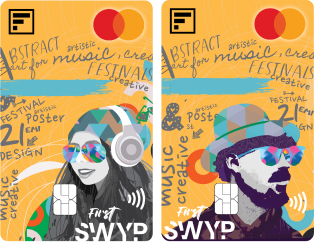

Introducing the FIRST SWYP Credit Card with annual benefits worth ₹30,000+ . Get a sneak peak of a few benefits below:

- Welcome Offer of 2000 Reward Points worth ₹500

- Other Welcome offers: 1000 Reward Points, EaseMyTrip vouchers worth ₹2,100 & free Lenskart Gold Membership

- Year -long discounts starting from 10% on your fav brands: Domino's, EaseMyTrip,SUGAR Cosmetics, TATA CLiQ & Zomato

- Get up to 1400 Reward Points on monthly spends

- Annual fee waiver, cash backs, movie discount vouchers and many more benefits on succesful referrals

- 25% off on movie tickets up to ₹100 per month

- Pay in full or EMIfy at a flat monthly EMI conversion fee & no other processing charges!

- Enable UPI and earn 100 Reward Points on every ₹5,000 UPI spends in a statement month

*T&Cs Apply

Credit Card Eligibility Criteria

Know the factors that impact your credit card application.

Things to consider before applying for a credit card

Learn about Credit Card Interest Rates

IDFC FIRST Bank Credit Cards offer dynamic interest rates starting at just 9% p.a.

Credit card fees and charges

Know the varied fees and charges applicable on your credit cards.

Credit Card Joining and Lounge Access Benefits

Here’s how to get the most out of your credit card.

Book your travel with us to make the most of your Credit Card benefits

Redeem rewards on-the-go

Discover how to make the most of your credit card reward points.

EMI options on Credit Card

Here's everything you should know about EMI on your Credit Card.

Credit Card Balance Transfer

Here is everything you should know about Balance Transfer on your Credit Card.

Credit Card Bill Payment Options

Choose from multiple convenient options to pay your credit card bills.

Credit Card Security Tips

Learn ways to prevent unauthorised use of your credit card in the digital age.

Activate UPI on Credit Card ![Unified Payments Interface (UPI) logo]()

Use your existing card or apply for a new RuPay credit card today.

Credit Card Application Status check

Track your card status in an instant, all you need is your application number.

Shop, Earn, Redeem, Repeat!

An all-in-one shopping platform exclusively for IDFC FIRST Bank Credit and Debit cardholders!

Pre-Approved Loan against Credit Card Online Instantly

Here's everything you should know about Quick Cash on your Credit Card.

Online Credit Card Management from Mobile Banking App

Track, view offers, get support and more with our mobile banking app.

How to convert Credit Card Bills into Monthly EMIs

IDFC FIRST Bank Credit Cards let you convert any transaction above ₹2,500 into EMIs with just a few clicks. These EMIs are offered at attractive interest rates, with flexible tenure options from 3 to 36 months. Here’s how to convert purchases to EMI:

During purchase: Online or in-store purchases (at eligible merchants) can be converted to EMI at the time of Credit Card payment confirmation.

After purchase: You can convert to EMI through the IDFC FIRST Bank mobile app or Net Banking with the following steps:

- Navigate to your 'Credit Card' page

- Click on 'Convert to EMI'

- Transactions eligible for EMI will appear under this section

- Select “Convert to EMI” against the transaction you wish to convert

- Choose an EMI repayment plan

- Accept the T&Cs and “Confirm” the EMI conversion

- Alternatively, you can contact our customer care to convert transactions into EMI

IDFC FIRST Bank CreditPro: Smart Balance Transfer for Easier Repayments

A credit card balance transfer is a facility that lets you move outstanding dues from one or multiple credit cards to a credit card with better repayment terms and helps you manage debt efficiently. With IDFC FIRST Bank CreditPro, you enjoy a unique way to streamline other banks’ credit card repayments while enjoying benefits such as an extended interest-free period, lower interest rates, and the convenience of consolidating multiple credit card dues in one place.

Switch to CreditPro today and take control of your finances with ease!

Credit Card Joining & Complimentary Lounge Access Benefits

Here are some of the benefits that you can avail with IDFC FIRST Bank Credit Cards:

- Welcome voucher* worth ₹500 on spending ₹5000 or more within 30 days of card generation.

- 5% cashback (up to ₹1000) on the transaction value of first EMI done within 30 days of card generation

- Gift a card to your family, friends or anyone you trust with their name on the card

- Share your credit limit and all the benefits of your credit card with up to 3 persons

- Reach the 10X rewards milestone faster by combining the spends of all your Add-on cards with your primary card

- Get an assured card with no credit checks and a completely online process

- Track and manage all your purchases from primary and Add-on cards in real time on our mobile app

-

FIRST Millennia & FIRST Classic Credit Card

- 4 complimentary railway lounge visits per quarter

- 2 complimentary domestic airport lounge visits per quarter*

- 4 complimentary railway lounge visits per quarter

- 2 complimentary domestic airport lounge and spa visits, and 2 complimentary international airport lounge visits per quarter*

- 2 complimentary golf rounds per month^

- 2 complimentary domestic and 1 international airport lounge visit per quarter*

- 1 complimentary domestic airport lounge visit per quarter*

FIRST Select Credit Card

FIRST Wealth Credit Card

Club Vistara IDFC FIRST Bank Credit Card

FIRST Power+

*On minimum spend of ₹20,000 in the previous calendar month

^On spends of ₹20,000 and above in a monthly statement cycle

Apply for Credit Card Loan with Instant Approval

Need Quick Cash for your last-minute plans? Here’s your solution! Get a pre-approved loan with your IDFC FIRST Bank Credit Card. The funds are transferred instantly to your bank account with zero paperwork. Pay back in flexible EMI tenure of 3 to 48 months with interest rates starting from 1% p.m. Avail Now or Call on 1800 10 888.

Credit Card Eligibility Criteria

Your credit card approval depends on the specific eligible requirements that you meet. This includes your age, income, credit score, credit utilization ratio, and nationality. In addition, factors such as your locality and past credit card ownership may also affect your credit card eligibility.

Interest Rates on Credit Card offered by IDFC FIRST Bank

Credit card interest rates are applied when you carry forward your outstanding balance beyond the due date. Other credit cards in the market charge a standard and fixed interest rate up to 42% p.a.

IDFC FIRST Bank Credit Cards offer low and dynamic interest rates starting at just 9%.

Interest rates are typically stated as 'yearly' rates, also known as the Annual Percentage Rate (APR). If you repay your credit card balance in full by the due date, there is no interest charge. To avoid any charges, you must always pay the Total Amount Due each month. Paying the Minimum Amount Due is mandatory.

Fees and Charges applicable on Credit Cards

Zero Joining/Annual Fees

Most credit cards have annual fees, with waiver only on meeting certain spend conditions. In contrast, most IDFC FIRST Bank Credit Cards are lifetime-free i.e., with no annual fees and no conditions applied.

Our current lifetime free Credit Cards are FIRST Millennia, FIRST Classic, FIRST Select, FIRST Wealth & FIRST WOW!

0% Interest on Cash Withdrawal

When using a credit card for ATM cash withdrawals, most banks charge interest rates as high as 3.5% per month, plus a minimum transaction fee of ₹500.

IDFC FIRST Bank Credit Cards offer ATM cash withdrawals at 0% interest until your bill’s due date and at a flat transaction fee of just ₹199.

For more information about our credit card fees and charges, click here.

Tips to keep your Credit Card details safe from banking frauds

In the face of rising cybercrime, it’s important to keep your credit card details safe to prevent any financial losses.

- Choose credible websites and apps when paying with your credit card. Always remember that secure websites begin with HTTPS and HTTP. Only these websites should be used to make online credit card transactions. Watch out for dubious websites by checking for misspellings, ‘Not secure’ warnings, and online reviews.

- Never share your Card Verification Value (CVV) with anyone. It is a unique number that protects your card from malpractices on the Internet.

- Avoid swiping your credit card in an ATM or POS machine that looks tampered with.

- Do not click on suspicious links in emails and text messages.

- Avoid making online payments over public Wi-Fi networks.

- If you have lost your credit card, immediately block it by calling the customer support team.

IDFC FIRST Bank Credit Cards come with advanced security features, including Tokenisation, two-factor authentication, and secured payment gateways for safe transactions. If you suspect any unauthorized activity on your credit card, contact our customer care or block your card immediately.

Check eligibility for a credit card

Your credit card approval depends on the specific eligible requirements that you meet. This includes your age, income, credit score, credit utilization ratio, and nationality. In addition, factors such as your locality and past credit card ownership may also affect your credit card eligibility.

Eligibility Factor |

Requirement |

Age |

Adult applicants, 18 years or older |

Income |

Stable income, specific minimum varies by card. |

Employment status |

Regular employment or steady income source |

Credit History |

Positive credit history preferred |

Banking Relationship |

Not mandatory, but may improve approval chances |

Looking for a credit card that doesn’t consider your income or credit score? The IDFC FIRST WOW! Credit Card is your answer, offering a hassle-free way to obtain credit, backed by your fixed deposit.

Things to keep in mind when applying for a credit card

1. Credit score: Your credit score significantly influences the approval process and the interest rates offered. A higher score increases your chances of approval and access to better rates.

2. Interest rates and fees: It is important to compare interest rates, annual fees, and other charges. Opt for a IDFC FIRST Credit Card which suits your needs and comes with an affordable annual fee and interest rate to minimise costs as you build your credit history.

3. Credit limit: Assess the credit limit offered to ensure it meets your spending requirements without encouraging excessive debt. A higher limit can be beneficial for your credit score if managed responsibly.

4. Rewards and benefits: Look for cards that offer rewards, cashback deals, or travel benefits that match your lifestyle. Consider if the rewards are worth any additional costs.

5. Repayment terms: Understand the importance of paying your bill on time. Familiarise yourself with the billing cycle, grace period, and minimum payment requirements to avoid late fees and interest charges.

6. Eligibility criteria: Confirm that you meet the card’s eligibility criteria, including age, income, and employment status, to increase your approval chances.

Enhance Travel Experience with Credit Cards from IDFC FIRST Banks

Introducing the ultimate travel platform designed specifically for IDFC FIRST Bank Debit and Credit Card holders. Access exclusive benefits, including:

• 20 Bonus Reward Points on every ₹100 spent on Hotel Bookings

• Seamless in-app booking experience

Book Now* with the IDFC FIRST Mobile Banking app!

How to book your flights and hotels

1. Login to the IDFC FIRST Mobile Banking App

2. Visit Travel and Shop

3. Click Flight Booking or Hotels to explore and book your flight or stay

Note: The travel portal is powered by Tripstacc that solely displays offers extended by merchants/partners to IDFC FIRST Bank Customers. The Bank facilitates the payment but do not directly own the offers made on the portal.

This service is available only through the IDFC FIRST Mobile Banking app. Payments on the platform can be made through any IDFC FIRST Bank Credit or Debit Card. Bonus reward points are not applicable on payments made with the Club Vistara IDFC FIRST Credit Card.

*Book now link is only applicable via mobile considering IDFC FIRST Mobile Banking App is installed on your phone.

#T&C Apply. Features & Benefits are subject to Terms & Conditions as mentioned on the platform

Earn Bonus Reward Points with Every Purchase

You can now multiply the Reward Points you earn with your IDFC FIRST Bank Credit Card or Debit Card by shopping on our in-app platform, powered by Shopstacc. Enjoy exclusive shopping deals, offers on merchandise, gift vouchers and much more across various categories like mobile & accessories, electronics, home & kitchen, personal grooming and more.

How to use:

1. In the mobile app, select ‘Travel & Shop’ section and click on the Shopping button

2. Make your payment through your IDFC FIRST Bank Debit Card or Credit Card

Here are the benefits that you enjoy:

• Shop for products & vouchers at attractive discounts

• Earn bonus reward points - over and above your card’s reward program

• Free delivery (No minimum order value needed)

• Exclusive deals & offers only for IDFC FIRST Cardholders

Please note:

- The shopping platform is powered by Shopstacc that solely displays offers extended to IDFC FIRST Bank customers. IDFC FIRST Bank does not own or control the platform.

- The benefits are available to all the IDFC FIRST Bank Debit Card and Credit Cardholders.

- The reward point benefit won’t be available on the Club Vistara IDFC FIRST Credit Card.

Testimonials

I wanted to extend a huge thanks to IDFC FIRST Bank for the amazing credit card! As a student, it's truly been a lifesaver, and I genuinely appreciate the convenience and flexibility it provides. Keep up the fantastic work!

Ramendra Pandey

FIRST WOW!

March 20, 2025

My experience with IDFC FIRST Bank's credit card issuance was remarkably smooth, particularly the simple document verification. I value their innovative customer engagement, evident in their proactive offers and partnerships with brands. They prioritise making credit accessible to their cardholders.

Virender Singh

FIRST Classic

February 28, 2025

IDFC FIRST Bank consistently delivers exceptionally fast service, unparalleled by other banks. A significant highlight of this bank is their reward points programme. These reward points never expire, adding immense value to my card usage and purchases.

Dharmendra Kumar

FIRST Classic

February 1, 2025

I appreciate the excellent service regarding my newly issued IDFC FIRST Bank Credit Card. The prompt approval process and clear communication throughout have truly impressed me. Additionally, the digital banking app and customer service team have been incredibly responsive and helpful.

Bipan Roy

FIRST Select

January 16, 2025

IDFC FIRST Bank provides exceptional services, notably its user-friendly net banking with easy balance transfers, and lower USD to INR conversion charges. As a traveler, the FIRST WOW Credit Card is ideal.

S. Manikandan

FIRST WOW!

January 14, 2025

Learn about Credit Card in Detail

Discover more about IDFC FIRST Bank Credit Cards

What sets metal credit cards apart as the ultimate status symbol?

Metal credit cards are highly prized for their luxe features. Discover how these cards can enhance your lifestyle.

10 Benefits of the FIRST Power and FIRST Power+ Credit Cards

Enjoy up to 6.5% savings per month on fuel expenses with IDFC FIRST Bank and HPCL co-branded credit cards.

Ways to redeem your credit card reward points

IDFC FIRST Bank offers simple and convenient ways to redeem your never-expiring credit card reward points.

How to link your RuPay Credit Card with UPI

Here’s a detailed guide to linking your RuPay Credit Card to UPI apps like BHIM, PayTM, PhonePe, GooglePay, and CRED.

Top benefits & features zero forex markup Credit Cards

Forex markup fees are charges that apply when transacting in a foreign currency with your credit card.

The advantages of having an IDFC FIRST Millennia Credit Card

The FIRST Millennia Credit Card is a lifetime-free credit card, carefully crafted with millennial lifestyles and financial needs in mind.

Credit Card FAQs

Reward points

Card Features

Privileges

Card Controls

EMI

Add-on Cards

Statement

Re-payment

Card Blocking

Apply for credit card

Credit limit

All

A Credit Card is a plastic, metallic or virtual payment tool issued by a financial institution that allows you to borrow funds up to a pre-approved limit. Cardholders can use credit cards for making purchases, paying bills, or withdrawing cash. It lets you make cashless transactions, offering a short-term credit facility. A credit card usually offers an interest-free period of up to 45 days (can vary depending on the bank), where you can repay the borrowed amount in full without any interest. You can also opt for EMI payments for a large purchase to divide your payment into monthly instalments.

Having a Credit Card is important because it provides you with financial flexibility, helps you manage unexpected expenses, builds your credit history, and gives you access to a host of rewards, cashback, and travel benefits. When you opt for an IDFC FIRST Bank Credit Card, you unlock the potential to enjoy numerous lifestyle advantages, attractive reward programmes, and superior customer service.

Read more:- What is Credit Card?

When you use your Credit Card to make a payment, the issuing bank pays the amount to the merchant on your behalf. You then must pay the amount by the due date specified in your statement. If the total outstanding amount is paid before the due date, no interest will be charged.

With IDFC FIRST Bank Credit Cards, you also enjoy an interest-free period of up to 45 days, subject to terms and conditions. The card helps you manage your cash flow efficiently while earning reward points and cashback offers on eligible spends.

Understand how credit card functions in detail with us.

Applying for an IDFC FIRST Bank Credit Card is a simple and hassle-free process. You may apply through the IDFC FIRST Bank website, mobile app, or by visiting a branch. You must fill out the application form, submit identity and income proof documents, and complete the KYC verification.

Additionally, IDFC FIRST Bank offers an instant online application facility where you can check your eligibility and receive digital approval within minutes, subject to terms and conditions.

A Credit Card statement is a detailed monthly summary showing your credit card activities, including purchases, payments, fees, interest charges, reward summary, and the outstanding balance. It provides the due date for payment and the minimum amount due.

An IDFC FIRST Bank Credit Card statement can be accessed easily through email, internet banking, or the mobile banking app. Reviewing your statement regularly helps you stay informed about your spending habits and enables prompt repayments.

The outstanding balance on a credit card refers to the total amount you owe to the bank. It includes purchases, fees, interest charges, and any unpaid balances from previous months.

If you hold a credit card, it is advisable to clear your outstanding balance in full before the due date to avoid interest charges and maintain a good credit score. IDFC FIRST Bank also offers multiple convenient payment options for clearing your dues without any hassle.

The credit limit is the maximum amount you can spend using your credit card. This limit is determined by the bank based on your income, credit score, repayment behaviour, and other eligibility factors. However, once you have acquired a credit card, you may request periodic enhancements in your credit limit based on your usage and payment track record.

Typically, credit cards come with various fees such as:

- • Annual fees

- • Joining fees

- • Interest charges on unpaid balances

- • Late payment fees

- • Cash advance fees

- • Foreign transaction fees, etc

IDFC FIRST Bank Credit Card fees and charges: IDFC FIRST Bank Credit Cards are renowned for their customer-friendly and transparent fees. Many variants like the FIRST Millennia, FIRST Classic, and FIRST Select Credit Cards and more come with zero annual or joining fees, and the interest rates are highly competitive, offering you greater value.

A credit card offers a host of benefits, including but not limited to cashback, reward points, travel and lifestyle perks, dining discounts, fuel surcharge waivers, and EMI conversion options.

By choosing an IDFC FIRST Bank Credit Card, you gain access to exclusive benefits such as complimentary airport lounge access, attractive rewards that never expire, low-interest rates starting at just 0.75% per month, and insurance covers such as personal accident cover, air accident cover, and more depending on the card you opt for. This ensures a well-rounded financial experience.

Also read: Top 10 Benefits and Uses of Credit Car

An over-limit facility allows you to exceed your sanctioned credit limit for an emergency or important transaction. However, using this facility may attract additional charges and impact your credit score if not managed properly.

IDFC FIRST Bank Credit Cards have an over-limit fee/charge of 2.5% of the over-limit amount or ₹550, whichever is lower. The over-limit facility is not available on FIRST WOW!, FIRST EA₹N, FIRST Corporate, FIRST Business & FIRST Purchase Credit Card.

You can generate or reset your IDFC FIRST Bank Credit Card PIN by:

- • Logging in to the IDFC FIRST Bank mobile app or internet banking.

- • Then, navigate to the credit card section and selecting ‘Set/Reset PIN’.

- • Enter the OTP sent to your registered mobile number.

Alternatively, you may also use any IDFC FIRST Bank ATM to generate your PIN securely.

Once you receive your IDFC FIRST Bank Credit Card, you can activate it by:

- • Logging in to the mobile app or internet banking.

- • Navigating to the ‘Credit Cards’ section and clicking on ‘Activate Card’.

- • Setting your PIN as part of the activation process for eligible cards* (Terms and Conditions applicable).

Card activation via the mobile app ensures safety and convenience.

*Some cards may include a joining fee during the activation process.

You can view your IDFC FIRST Bank Credit Card statement through multiple convenient channels:

Mobile Banking app/Net Banking:

- Internet banking: Log-in to the net banking portal and navigate to the credit cards section. You can view or download your statement from here.

- Mobile banking app: Open the IDFC FIRST Bank mobile app and choose the ‘Credit Card’ option on the dashboard. You can view or download your statement as per your requirement.

- Email: Monthly statements are mailed to your registered email-ID.

You can redeem your IDFC FIRST Bank Credit Card reward points in the following ways:

- Visit Rewards website

- On Net banking/Mobile Banking go to “Reward redemption” section

- Select “Pay with Reward points” for online purchases on the OTP page at time of making the transaction

- Choose “Pay with Reward points” for in-store purchases at the time of the transaction (at select Pine Lab terminals). Please note that a reward redemption fee of ₹99 + GST will be applicable on redemption

To increase your credit card limit at IDFC FIRST Bank you can opt for following two ways:

- Mobile banking app: Submit a limit enhancement request.

- Customer Care: Speak to a banking representative.

Upon reviewing your payment history, income documents, and spending behaviour, the bank will decide on an appropriate limit enhancement.

You can get your IDFC FIRST Credit Card if you meet the eligibility criteria such as:

- • You must be at least 21 years old

- • You must be an Indian citizen

- • You must have a healthy credit score

- • Your credit usage ratio must be within an acceptable level

- • You must have an Annual Income of:*

- o ₹3 lacs or more for FIRST Classic & FIRST Millennia

- o ₹12 lacs or more for FIRST Select

- o ₹36 lacs or more for FIRST Wealth

Issuance of our Credit Card is subject to bank's internal assessment and at the sole discretion of IDFC FIRST Bank.

For the FIRST WOW Credit Card:

You must be an Indian citizen at least 18 years of age.

Currently, purchases above ₹2,500 or more made using an IDFC FIRST Bank Credit Card can be converted into EMIs. These include:

- Retail transactions (both online and offline).

- • Electronics, travel bookings, insurance, and more.

Cash withdrawals or rent payments are usually excluded. You can convert eligible transactions into EMIs within a specific period, often up to 30 days from the purchase date.

To learn more about credit card EMI payments, click here.

In an unfortunate event if your credit card gets lost, stolen, or damaged, it is crucial to:

• Immediately block the card via mobile banking or customer care.

• Request a replacement card through the app, website, or branch.

• Lodge a police complaint if needed, for stolen cards.

Also read: Steps to follow if your Credit Card is lost or stolen

To set up auto debit on your IDFC FIRST Bank Credit Card:

- • Log in to IDFC FIRST Bank mobile app or internet banking.

- • Navigate to ‘Credit Cards’ → ‘Auto Debit Settings’.

- • Choose to pay either ‘Minimum Amount Due’ or ‘Total Amount Due’.

- • Authorise the auto debit and confirm using OTP.

While there are no specific eligibility requirements to apply for an instant loan through your IDFC FIRST Bank Credit Card, the loan approval usually depends on:

- • Your transaction history and repayment behaviour.

- • Your available credit limit.

- • Internal risk assessment by the bank.

Eligible customers will see a pre-approved loan offer in their mobile app or net banking, which can be instantly availed without paperwork.

IDFC FIRST Bank offers multiple channels to help you pay your credit card bills on time. You may choose from:

- Auto-debit: Link your IDFC FIRST Bank account to ensure timely payments automatically.

- Mobile and internet banking: Use the IDFC FIRST Bank app or net banking portal.

- UPI payments: Pay via any UPI-enabled app using your Virtual Payment Address (VPA).

- NEFT/IMPS: Transfer funds from any bank account using the IFSC code: IDFB0010221.

- Third party: Pay through third-party platforms authorised by the bank.

To learn more, click here

By following these best practices, you can make the most of your IDFC FIRST Bank Credit Card benefits.

Dos:

- • Always pay your bills in full and on time.

- • Monitor your credit card statements monthly.

- • Use credit responsibly and stay within the credit limit.

- • Redeem your reward points before expiry (where applicable).

- • Report lost or stolen cards immediately.

Don’ts:

- • Don’t withdraw cash unless necessary.

- • Avoid only paying the minimum due.

- • Don’t exceed your credit limit frequently.

- • Avoid sharing your card details.

To learn more about smart credit card usage, click here.

You can customise your IDFC FIRST Bank Credit Card’s transaction limits by:

- • Logging in to the IDFC FIRST Bank mobile app or internet banking.

- • Selecting your credit card and tapping ‘Manage Card’.

- • Adjusting the daily domestic/international, online, ATM or POS limits.

This provides better control over your IDFC FIRST Bank Credit Card usage and enhances security.

The eligibility requirements vary depending on the type of credit card you are applying for. You can choose a specific card from the IDFC FIRST Bank Credit Card list to know the specific criteria. Here are the key factors that influence credit card eligibility:

- 1. Age: You must be at least 18 years old.

- 2. Income: Applicant must have a stable and sufficient income. Income requirements can vary depending on the credit card you are applying for.

- 3. Credit score: A good credit score enhances your chances of approval.

- 4. Employment status: Regular employment or a steady source of income through self-employment is required.

- 5. Existing debt: Your current debt levels will be assessed to determine your ability to handle additional credit.

Specific credit cards may have tailored criteria based on income levels, credit usage, and banking relationship with IDFC FIRST Bank.

Yes, one of the most rewarding features of your IDFC FIRST Bank Credit Card is that the reward points never expire. You can earn up to 10X rewards on incremental spends over ₹20,000 and on your birthday, depending on the card, and redeem them whenever you like. This ensures you can accumulate points over time and redeem them for high-value items, gift cards, travel vouchers, or cashback deals as per your convenience.

Yes, EMI conversions on your IDFC FIRST Bank Credit Card includes:

- • A one-time processing fee (depending on tenure and transaction value).

- • Interest rates based on your tenure selection.

However, IDFC FIRST Bank often offers no-cost EMI options on select partner brands and merchants, which can be a cost-effective financing solution.

Yes, you can apply for one or more add-on cards with your IDFC FIRST Bank Credit Card. These cards can be issued to your immediate family members such as parents, spouse, or children above 18 years. You can easily apply online for an add-on card through the IDFC FIRST Bank mobile app or net banking.

Add-on cards share the same credit limit and offer most benefits of the primary card. The application can be submitted online through your banking profile.

Yes, you can conveniently pay your IDFC FIRST Bank Credit Card bill online using NEFT from any bank account. All you need to do is, fill up the following details:

- • Beneficiary Name: Your name as it appears on the Credit Card.

- • Beneficiary Account Number: Your 16-digit IDFC FIRST Bank Credit Card number.

- • IFSC Code: IDFB0010225.

- • Bank Name: IDFC FIRST Bank Ltd.

Ensure that you schedule the NEFT transfer at least one working day prior to the due date to avoid late payment charges.

Yes, you can use your IDFC FIRST Bank Credit Card for international transactions. To do so, ensure that international usage is activated via the IDFC FIRST Bank mobile app or internet banking. Once activated, you may use your card for purchases abroad or on international websites. Be mindful of foreign exchange mark-up fees that may apply.

We offer an international credit card with zero forex markup called FIRST WOW! Its an secured credit card to be availed against fixed deposit.

Yes, you can withdraw cash using your IDFC FIRST Bank Credit Card at any ATM. However, you might need to pay a cash advance charge of ₹199 + GST and an interest rate as applicable from the day of withdrawal. It is advisable to use this facility only in emergencies due to the higher costs involved.

Some credit cards from IDFC FIRST Bank like the Mayura and FIRST Power+ cards, offer interest-free cash withdrawals until the due date, providing you with affordable cash withdrawal whenever needed.

Also read: What is Credit Card cash withdrawal?

IDFC FIRST Bank Credit Cards offer competitive and dynamic Annual Percentage Rates (APR) starting at just 9% per annum or 0.75% per month. The APR varies based on your credit profile and repayment history. Responsible usage and timely payments can help you enjoy lower interest rates on your card.

IDFC FIRST Bank issues contactless credit cards equipped with Near Field Communication (NFC) technology. This allows you to make secure payments by simply tapping your card at contactless-enabled POS terminals, enhancing convenience and reducing transaction time.

IDFC FIRST Bank Credit Card holders can enjoy exclusive movie ticket benefits. To avail:

- • Book tickets through partnered platforms as specified by the bank.

- • Use your IDFC FIRST Bank Credit Card for payment.

- • The discount will be automatically applied at checkout, subject to terms and conditions.

Regularly check the bank's official website or mobile app for ongoing offers and participating platforms.

IDFC FIRST Bank Credit Cards like Mayura, Ashva and FIRST Wealth offer complimentary access to Indian and Global airport lounges.

- • Present your credit card at participating Indian lounges.

- • Present your DreamFolks card to gain access at participating global lounges. Some global lounges require pre-booking via https://webaccess.dreamfolks.in

- • Access is subject to usage limits and terms specified by the bank.

In case of loss or theft, you can promptly block your IDFC FIRST Bank Credit Card through:

- Mobile app: Navigate to 'Manage Cards' and select 'Block Card'.

- Internet banking: Access the 'Credit Cards' section and choose 'Block Card'.

- Customer care: Call the 24x7 helpline to request card blocking.

- Through SMS: You can also block your card via SMS. Send an SMS in the format given: SMS ‘CCBLOCK1234’ to 5676732. Here, the numbers “1234” represent the last 4 digits of your card.

Blocking your card immediately helps prevent unauthorised transactions.

Upon activation and usage of your new IDFC FIRST Bank Credit Card, welcome benefits are credited automatically. To ensure you receive them:

- • Complete the required number of transactions within the stipulated time frame.

- • Monitor your reward points or benefits section via the mobile app or internet banking.

- • Contact customer care if benefits are not reflected.

Refer to the welcome offer terms provided at the time of card issuance for specific details.

To learn more, click here.

You can convert eligible transactions of ₹2,500 and above into EMIs through:

- • Mobile app: Open your IDFC FIRST Bank mobile app and tap on the credit card option. Later, select the transaction and choose 'Convert to EMI'.

- • Internet banking: Log in to your net banking account and navigate to the 'Credit Cards' section and opt for 'EMI Conversion'.

- • Customer care: Call the helpline and request EMI conversion.

Ensure the transaction meets the minimum amount criteria and is within the eligible conversion period.

To manage transaction settings:

- • Mobile app: Go to 'Manage Cards' and toggle ‘online’ or ‘POS’ transaction settings.

- • Internet banking:. Access 'Credit Cards' and adjust transaction preferences.

- • Customer care: Call the helpline to request changes.

For security reasons, the CVV number is not stored or retrievable without the physical card. If you've misplaced your card, it's advisable to block it immediately and request a replacement through the mobile app, internet banking, or customer care.

IDFC FIRST Bank Credit Cards offer accelerated rewards on specific categories, on events such as birthdays, and when meeting the monthly threshold spending of ₹20,000 or more. 10X rewards imply earning 10 times the regular reward points on eligible spends. The calculation is as follows:

- • Regular spend: 1 reward point per ₹150 spent.

- • 10X category: 10 reward points per ₹150 spent.

Yes, existing cardholders can apply for an additional IDFC FIRST Bank Credit Card, subject to eligibility criteria and credit assessment. Having multiple cards allows you to leverage different benefits tailored to various spending habits.

Yes, you can modify your auto-debit settings by the following options:

- • Mobile app: Navigate to 'Auto Debit Settings' under 'Credit Cards'.

- • Internet banking: Access 'Credit Cards' and select 'Auto Debit Options'.

- • Customer care: Call the helpline to request changes.

Adjusting your auto-debit preference helps manage your monthly payments effectively.

IDFC FIRST Bank Credit Cards offer reward points that do not expire, allowing you to accumulate and redeem them at your convenience. This feature provides flexibility and maximises the value of your rewards over time.

APR, or Annual Percentage Rate, represents the annualised interest rate charged on outstanding credit card balances. It includes the interest rate and any associated fees, providing a comprehensive view of borrowing costs. IDFC FIRST Bank Credit Cards offer competitive APRs, which vary based on your credit profile and repayment history.

Several IDFC FIRST Bank Credit Cards provide complimentary domestic and international airport lounge access, including a range of travel benefits. For instance, the IDFC FIRST Bank Metal Credit Cards like Ashva and Mayura, FIRST Wealth, and FIRST Select Credit Cards offer multiple lounge visits annually, making your travel experience more comfortable and luxurious.

These cards not only offer free lounge visits but also come with travel insurance and a range of shopping, lifestyle, and travel privileges.

Learn about Airport Lounge Access and Railway Lounge Access benefits offered by IDFC FIRST Bank

A credit card enables you to borrow funds from the issuing bank, subject to repayment terms, while an ATM card (or debit card) draws directly from your savings or current account.

An IDFC FIRST Bank Credit Card offers numerous benefits over an ATM card, including reward programmes, EMI facilities, and enhanced security features, empowering you with greater purchasing power. Additionally, a few credit cards like Mayura and FIRST Power+ also offer zero interest cash withdrawals until the due date, making it synonymous to using a debit card. However, you need to pay a cash advance fee of ₹199 each time you withdraw money from the ATM.

Also read: Debit Card vs Credit Card: What Should You Choose?

Currently, you can add the digital version of your existing IDFC FIRST Bank RuPay Credit Card on third-party payment apps and pay by just scanning any UPI QR code. Here is how you can add a credit card on other payment apps:

Google Pay App

- Tap your profile on the top right

- Under ‘Set up payment methods’, tap ‘RuPay credit card’

- Select ‘IDFC Bank RuPay Credit Card’

- Enter your card details and its expiry date, then proceed

- Tap on ‘Create Pin’ and enter the six-digit OTP you receive from IDFC FIRST Bank

- Choose a four-digit UPI PIN to finish the linking process.

PhonePe App

- Tap your profile on the top left

- Under ‘Payment Methods’, select ‘RuPay Credit on UPI’

- Click on ‘Add New Card’

- Select ‘IDFC FIRST Credit Card’ as your RuPay credit card issuer

- Select your IDFC FIRST Bank RuPay Credit Card

- Enter the last six digits of your card and its expiry date, then proceed

- Verify your details using OTP received from IDFC FIRST Bank

- Choose a strong four-digit UPI PIN to finish the linking process.

Paytm App

- Under ‘UPI MONEY TRANSFER’, tap on ‘Link RuPay Card to UPI’

- Choose ‘IDFC FIRST RuPay Credit Card’

- Tap on ‘Set Payment PIN’

- Enter the last six digits of your card, expiry month and year, and proceed

- Complete the verification by entering the OTP received from IDFC FIRST Bank

- Choose a strong four-digit UPI PIN to finish the linking process.

Flipkart app

To add your IDFC FIRST Bank Credit Card on Flipkart:

- • Proceed to checkout while shopping.

- • Choose ‘Credit Card’ as your payment mode.

- • Enter your card details and save the card for faster payments.

To check your IDFC FIRST Bank Credit Card balance, you have multiple convenient options:

- Mobile Banking App:

• Log in to the IDFC FIRST Bank mobile app.

• Tap on ‘Credit Cards’ from the dashboard.

• View your current outstanding balance, available credit limit, and transaction details instantly. - Internet Banking:

• Visit IDFC FIRST Bank netbanking portal and log in.

• Navigate to the ‘Credit Cards’ section.

• View your real-time balance, statements, and transaction history.

- SMS Banking:

• Receive an instant SMS for all your transactions in real time including your outstanding balances. - WhatsApp Banking:

• Send 'Hi' on IDFC FIRST Bank WhatsApp Banking to check your credit card balance.

Balance transfer is a facility that allows you to transfer outstanding balances from one or more credit cards to another card, typically at a lower interest rate. This helps you consolidate debt and repay comfortably over time.

Credit Pro is the credit card balance transfer service offered by IDFC FIRST Bank with interest free period up to 105 days on every Balance Transfer.

The Kisan Credit Card (KCC) is primarily designed for farmers to meet agricultural credit needs. While it is not offered under the regular IDFC FIRST Bank Credit Card list, farmers can visit their nearest IDFC FIRST Bank branch to apply for a Kisan credit card. Documents like land ownership proof, KYC papers, and income declarations may be required.

The IDFC FIRST Bank Ashva, Mayura and FIRST Wealth Credit Cards offer complimentary access to Indian and global airports lounges, access to railway lounges at select locations in India. Among others, the FIRST Select Cards offer access to airport lounges. These are some of the best options for lounge access as they offer multiple entries every quarter:

• Ashva Credit Card: 4 complimentary visits to Indian airport lounges, 2 complimentary visits to global airport lounges, and 4 complimentary railway lounge visits every quarter.

• Mayura Credit Card: 4 complimentary visits to Indian airport lounges including 1 guest visit, 4 complimentary visits to global airport lounges, and 4 complimentary railway lounge visits every quarter.

• FIRST Wealth Credit Card: 2 complimentary visits to Indian airport lounges, 2 complimentary visits to global airport lounges, and 4 complimentary railway lounge visits every quarter.

• FIRST Select Credit Card: 2 complimentary visits to domestic airport lounges and 4 railway lounge visits every quarter.

A lounge access credit card offers cardholders complimentary or discounted access to airport lounges and railway lounges across various locations.

Such cards, including select IDFC FIRST Bank Credit Cards, provide amenities like comfortable seating, free Wi-Fi, beverages, and meals, adding value to your airport waiting time.

Airport lounge access refers to the privilege extended to credit card holders to relax and unwind in airport lounges before boarding their flights. With an IDFC FIRST Bank Credit Card offering this benefit, you get:

• Complimentary lounge access per calendar quarter.

• Access to partnered lounges across major Indian airports

This benefit is valuable for business and leisure travellers alike.

The eligibility criteria for IDFC FIRST Bank Credit Cards include a stable income and a minimum age of 18 years. Students can check if they meet the income criteria or they can apply for these credit cards against FD like the FIRST WOW! Credit Card and FIRST EA₹N Credit Card. These cards do not require any income proof or credit history and are available to all types of applicants who meet the age requirement. You can get these cards by opening a fixed deposit account with IDFC FIRST Bank.

Another option for students is an add-on credit card over an existing IDFC FIRST Bank Credit Card issued to the student’s family member. The add-on card can help students become acquainted with credit cards and begin their credit journey.

IDFC FIRST Bank’s Ashva and Mayura Metal Credit Cards as well as the FIRST Wealth Credit Card offer international lounge access via a Priority Pass membership. These premium cards are ideal for high-spending, travel-savvy customers who frequently travel abroad and seek added comfort during layovers.

• Ashva Credit Card: 2 international lounge accesses, every quarter.

• Mayura Credit Card: 4 international lounge accesses, every quarter.

• FIRST Wealth Credit Card: 2 complimentary visits to global airport lounges every quarter.

IDFC FIRST Bank offers several credit cards to suit your international travel requirements. These cards are designed to offer you a comprehensive benefit for your trips abroad. Here are the top picks for you:

• Mayura Credit Card:

o 4 complimentary accesses to international airport lounges every quarter

o Zero forex markup fee on international transactions

o Interest-free cash withdrawals up to 45 days, making it as good as a forex card

o Comprehensive trip insurance worth USD 1200 against loss and delay of baggage and documents

o Free trip cancellation worth ₹50,000 twice a year, as well as air accident cover worth ₹1 crore

• Ashva Credit Card:

o 2 complimentary accesses to international airport lounges every quarter

o Low forex markup fee of just 1%

o Comprehensive trip insurance worth USD 1200 against loss and delay of baggage and documents

o Free trip cancellation cover worth ₹25,000 twice a year, as well as air accident cover worth ₹1 crore

• FIRST Wealth Credit Card:

o 2 complimentary accesses to international airport lounges every quarter

o Low forex markup fee of just 1.5% to avoid unnecessary charges

o Interest-free cash withdrawals up to the due date, making it as good as the forex card

o Comprehensive trip insurance worth USD 1200 against loss and delay of baggage and documents o Free trip cancellation worth ₹10,000 twice a year

These features enhance your travel experience and provide value-added services during your international journeys.

Several IDFC FIRST Credit Cards are suitable for movie enthusiasts, providing exclusive discounts on movie ticket bookings and reward points on entertainment spends. Here are the most popular credit cards for a memorable movie experience.

• Mayura Credit Card: Enjoy a Buy-One-Get-One free offer on movie tickets with up to ₹500 off on the second ticket. The benefit can be availed twice in a calendar month.

• Ashva Credit Card: Avail a Buy-One-Get-One free offer on movie tickets with up to ₹400 off on the second ticket, twice in a calendar month.

• FIRST Wealth Credit Card: Enjoy unforgettable movie experiences using the Buy-One-Get-One movie ticket offer via the District mobile app and get up to ₹250 off on the second ticket twice in a calendar month.

• FIRST SWYP and FIRST EA₹N Credit Card: Enjoy a 25% discount on movie tickets on the District app.

An add-on credit card is a supplementary card issued under the primary cardholder’s account. It allows family members to use the same credit limit and access most features, such as reward points, fuel surcharge waivers, and more.

With IDFC FIRST Bank Add-on Credit Cards, add-on cardholders benefit from the same privileges while helping manage household or shared expenses under a single billing cycle. Moreover, spends on add-on cards are eligible for reward points with the primary card and the card holder can easily achieve accelerated reward points.

Related Credit Card Searches

Get in touch with us

Back

Back

All Cards (11)

All

Premium Metal

Zero Forex & Travel

Lifetime Free

10X Rewards

UPI Cards

Fuel & Utility

Showstopper

Credit Builder

IndiGo IDFC FIRST Credit Card

Power of 2 Cards – Mastercard & RuPay

- Earn up to 22 IndiGo BluChips/ ₹100

- Welcome Benefits: Vouchers of 5,000 IndiGo BluChips + 1 IndiGo meal voucher

- Milestone Benefits: Up to 25,000 IndiGo BluChips

Mayura

Eligibility: Annual income > ₹25 Lacs

- Premium metal credit card

- Cashback up to ₹4,000 as welcome benefit

- Up to 10X reward points

- ZERO forex markup

- Complimentary golf rounds and airport lounge visits

- Movie benefit worth ₹1,000 every month

Ashva

Eligibility: Annual income > ₹12 Lacs

- Premium metal credit card

- Cashback up to ₹2,000 as welcome benefit

- Up to 10X reward points

- 1% forex markup

- Complimentary golf rounds and airport lounge visits

- Movie benefit worth ₹800 every month

FIRST EA₹N

Eligibility: No Income document required

- Up to 1% cashback on all UPI spends.

- Welcome offer - 100% cashback of upto Rs 200

- Fixed Deposit (FD)-backed assured, virtual credit card

FIRST Millennia

Eligibility: Annual income > ₹3 Lacs

- Lifetime free

- Welcome benefits worth up to ₹1,500

- Up to 10X never expiring rewards

- 300+ merchant offers everyday

- Movie ticket offers, Fuel surcharge waiver & more

FIRST SWYP

Eligibility: Annual income > ₹3 Lacs

- Welcome benefits worth ₹2,000+

- Up to 1,400 Reward Points on monthly spends

- Up to 20% off on Featured Partners & more

FIRST Classic

Eligibility: Annual income > ₹3 Lacs

- Lifetime free

- Up to 10X never expiring rewards

- 25% Off on PayTM Movies

- Complimentary Railway Lounge Access

FIRST Power

Eligibility: Annual income > ₹3 Lacs

- Powered with UPI

- Welcome benefit worth ₹1,400

- 5% savings on fuel spends

- 2.5% savings on Grocery & Utility spends

FIRST Power+

Eligibility: Annual income > ₹3 Lacs

- Powered with UPI

- 6.5% savings on fuel spends

- 5% savings on Grocery & Utility spends

- Complimentary Airport Lounge Access

LIC IDFC FIRST Bank Credit Cards

Eligibility: Annual income > ₹ 3 Lacs

- Up to 10X Rewards on LIC Insurance Premium Payment

- Domestic Airport & Railway Lounge Access

- Welcome offers worth ₹3,000+

- Up to 5X Rewards on other eligible spends

FIRST Select

Eligibility: Annual income > Rs 12 Lacs

- Lifetime free

- Up to 10X never expiring reward points

- Domestic Airport Lounge Access

- Movie ticket offers, Fuel surcharge waiver & more

FIRST Wealth

Eligibility: Annual income > ₹36 Lacs

- Lifetime Free

- Up to 10X never expiring reward points

- Domestic & International Airport Lounge Access

- Complimentary Golf Access

FIRST WOW!

Eligibility: No Income document required

- Lifetime Free

- 0% Forex Markup fee

- No Credit history needed

- Fixed Deposit (FD)-backed assured, premium Credit Card

FIRST Private

Eligibility: By Invitation only Metal Credit Card

- Taj Dining Vouchers, Complimentary Hotel Memberships

- 0% Forex Mark Up. 0 Over limit fee. 0 interest on Cash Withdrawal, 9% APR

- Unlimited complimentary Airport Lounge access

- Unlimited complimentary Golf rounds