CKYC Registry

-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex Services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

Open Savings Account & Earn Up to 7% p.a. interest

-

-

-

Recognised among the World's Best Banks 2025 by

Forbes in partnership with Statista.

Compare Savings A/c Interest

Balance you maintain in your account

Set your balance to ₹5L or more to unlock 7% interest p.a.!

Interest payout by other bank

p.a. paid quarterly

Interest you earn from other bank

₹60,678

Interest per year

Interest you earn from IDFC FIRST Bank

₹1,23,926

See interest comparison

We offer higher interest rates compared to other banks with monthly payouts, helping your savings grow faster than other banks.

| Your bank | IDFC FIRST bank | |

|---|---|---|

| Payout cycle | Quarterly | Monthly |

| Int. earned | ₹ 60,678/yr | ₹ 1,23,926/yr |

Interest slabs used for rate comparison:

3.00% p.a. for

<=₹5L

7.00% p.a. for

₹5L - ₹10Cr

Interest will be calculated on progressive balances in each interest rate slab, as applicable.

Disclaimer

With IDFC FIRST Bank

Interest calculated considering monthly interest credit with the power of monthly compounding and on progressive balances in each interest rate slab, as applicable.

With your Bank

Interest calculated considering quarterly interest credit (Most universal banks credit savings interest quarterly).

Savings Account - Open Bank Account Online

A Savings Account is a secure deposit account that lets you store your money safely while earning interest on the balance. It helps you manage everyday expenses by offering instant account access and grow your wealth to meet both short-term and long-term goals.

Open Bank Account online with IDFC FIRST Bank to enjoy exclusive benefits. Experience zero fee banking on all Savings Account services such as unlimited IMPS, NEFT, RTGS, ATM withdrawals with our Savings Account. No hidden charges! No branch visits! Just smart, seamless banking.

Read moreOpen a Savings Account online with IDFC FIRST Bank to enjoy exclusive benefits. Experience zero fee banking on all Savings Account services such as unlimited IMPS, NEFT, RTGS, ATM withdrawals with our Savings Account. No hidden charges! No branch visits! Just smart, seamless banking.

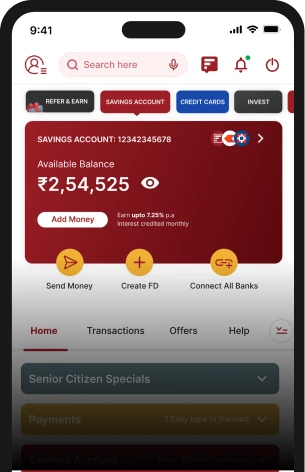

Our advanced mobile banking app lets you manage funds, monitor expenses, invest, and even access rewards—all from one convenient platform.

Start your financial journey today with a Savings Account that gives you more value, more control, and more growth.

Recognised as a “Class Apart” among commercial banks in India by IIT Bombay and Moneylife Foundation, IDFC FIRST Bank stands committed to fair service practices and customer-first innovation. When you open a bank account online with us, you're choosing unmatched transparency, powerful tools, and real value.

Open a Savings Account online with IDFC FIRST Bank now and discover smarter ways to save, earn, and manage your money.

Read lessWhy Choose IDFC FIRST Bank Savings Accounts?

Higher-Interest Earnings

Earn up to 7% p.a. interest on your Savings Account, calculated daily and credited monthly for better and faster returns.

Know more

Monthly Interest Credits

Get monthly interest payouts to help you grow your Savings Account balance with the powerful effect of compounding.

Know more

Zero-Fee Banking

Enjoy zero fee banking on all Savings Account services, including NEFT, IMPS, RTGS, Debit Card, ATM withdrawals, and many more.

Know more

Top-Rated App

Open and manage your account easily with 100% digital onboarding and an intuitive, user-friendly mobile app.

Exclusive Debit Card Benefits

Get instant discounts, earn valuable reward points, and redeem them effortlessly directly from the mobile app.

Seamless Onboarding

Seamless video KYC makes account opening quick and easy. Plus, enjoy 24/7 customer support whenever you need it.

Flexible Banking Options

Choose from an array of account variants, including options for senior citizens, women and minors.

Enhanced Security & Convenience

Benefit from complimentary personal accident insurance and higher daily ATM withdrawal and purchase limits.

We’ve been recognised as a “Class Apart” by IIT Bombay and Moneylife Foundation.

Choose Your Preferred Savings Account Balance Option

Choose from our Savings Account variants that match your lifestyle:

₹ 25K AMB

₹ 10K AMB

₹25K

Average Monthly Balance

Get our World Debit Mastercard ®

Enjoy premium benefits with a Savings Account with ₹25K Average Monthly Balance (AMB)

-

Free and unlimited ATM transactions at any bank, anywhere in India

-

Higher daily purchase limit of ₹6 lakh and higher daily ATM withdrawal limit of ₹2 lakh

-

Free Personal Accident Insurance Cover of ₹35 lakhs and Air Accident Insurance Cover of ₹1 crore

-

Complimentary domestic airport lounge access, once every quarter

₹10K

Average Monthly Balance

Get our VISA Classic Debit Card

Access great features with a Savings Account with ₹10K Average Monthly Balance (AMB)

-

Free and unlimited ATM transactions at any bank, anywhere in India

-

Higher daily purchase limit of ₹4 lakh and higher daily ATM withdrawal limit of ₹1 lakh

-

Free Personal Accident Insurance Cover of ₹5 lakhs and Air Accident Insurance Cover of ₹30 lakh

-

Lost card liability protection up to ₹4 lakh, purchase protection up to ₹50,000

Savings Bank Accounts Tailored for You and Your Family’s Needs

Senior Citizen Savings Account

Women Savings Account

Minor Savings Account

Senior Citizen

Savings Account

-

Complimentary health benefits for 1 year with Medibuddy

-

Cyber Insurance of ₹2 lakh

-

Doorstep banking and priority treatment at branches

-

Preferential rates for your Fixed & Recurring Deposits

-

Auto Sweep Facility

Women Savings Account

-

Complimentary health benefits for 1 year with Medibuddy

-

Up to 50% discount on first-year locker rental

-

Complimentary domestic airport lounge access

-

Exclusive offers on Debit Card across shopping, fashion, entertainment, dining and more

Minor Savings

Account

-

No Average Monthly Balance (AMB) requirement

-

Free child education cover of ₹5 Lakhs

-

Complimentary domestic airport lounge access

-

Unlimited free ATM transactions at any bank, anywhere in India

Interest Rates on IDFC FIRST Bank Savings Accounts

At IDFC FIRST Bank, your Savings Account earns up to 7% p.a. interest, calculated daily and credited monthly for faster growth.

Know all interest ratesHow to Open a Savings Bank Account Online

Open Savings Bank Account online in just 3 simple steps. Online account opening does not require any paperwork or branch visit.

Start

Enter your Aadhaar and

PAN details

Complete Aadhaar OTP

verification

Pick the variant of your choice

and open account

Eligibility and Documentation for Opening a Savings Account

Opening a Savings Account with IDFC FIRST Bank is quick, convenient, and secure—helping you save smarter right away. Unlock the benefits of a feature-rich Savings Account and apply effortlessly with the valid documents.

Read moreWho can apply?

Resident Individuals

(Sole or Joint Accounts)

Foreign Nationals

Residing in India with valid documentation

Hindu Undivided Families

(HUF)

Documents needed

Branch

Visit your nearest IDFC FIRST Bank branch with a passport-size photo, PAN card, and valid ID proof like Aadhaar, passport, or voter ID.

Locate your nearest IDFC FIRST Bank branchEligibility and Documentation for Opening a Savings Account

Opening a Savings Account with IDFC FIRST Bank is quick, convenient, and secure—helping you save smarter right away. Unlock the benefits of a feature-rich Savings Account and apply effortlessly with the valid documents.

Read moreWho can apply?

Resident Individuals

(Sole or Joint Accounts)

Foreign Nationals

Residing in India with valid documentation

Hindu Undivided Families

(HUF)

Documents needed

Branch

Our Award-Winning Digital Platform

Scan this QR code to download our app

Fees and Charges

With IDFC FIRST Bank Savings Account, enjoy Zero Fee Banking on all Savings Account services, such as fund transfers, ATM withdrawals, Debit Card issuance, DDs, chequebooks, and more. All our Savings Accounts offer Zero Fee Banking to keep banking simple and stress-free. The only charge? A clearly communicated AMB non-maintenance charge if applicable—no hidden costs.

Read more Know all fees & chargesHear from our Savings Account customers

"I chose IDFC FIRST Bank for their simple Savings Account opening process. The Bank offers easy net banking and mobile banking facilities and great customer service. Their ATM facilities are convenient too."

Sanju Devi

"As a customer of other leading banks, I found IDFC FIRST Bank's Savings Account opening process very easy and hassle-free. Their services and offers are sure to attract customers. Overall, a great experience!"

Christopher Bagh

"The app is fabulous for savings! I have accounts in almost all top banks, but IDFC FIRST Bank’s mobile banking app stands out. I hope the same experience awaits me when I open a business account with the Bank."

Rahul Sharma

"My Savings Account was opened in just 15 minutes, and all deliverables were received as scheduled. Account features and benefits were clearly explained, making the entire process smooth and efficient."

Venkatesh G

“I have been using the Savings Account for 10 days, and the Net Banking and UPI services have been fantastic—when compared to other banks. Truly fast, efficient, and impressive service from IDFC FIRST Bank!”

Rahul Meena

“I am very happy to have opened a Savings Account with IDFC FIRST Bank. Their fully online services work smoothly, and the interest rates are more attractive than those at other banks. A great experience!”

Aman Khan

"The video KYC was incredibly smooth and effortless—only necessary details were asked, making account opening seamless. The internet banking and mobile app are just as easy to use. Glad to be associated!"

Ankitesh Shahi

"IDFC FIRST Bank’s quick service won me over and I opened a Savings Account without even planning to open one. The Debit Card and Cheque Book arrived quickly, personalised with my name. Truly impressed!"

Jaipal

"I have never seen a Savings Account opening process this fast! Everything was smooth and effortless with IDFC FIRST Bank, I didn’t face any issues. The application and video KYC process were quick and simple too."

Sunil

"With IDFC FIRST Bank, the communication throughout the process of Savings Account opening was very clear, which is a crucial aspect in this domain. I truly appreciate the effort that goes into ensuring this."

T Hemanth Kumar

"What I liked most about my experience with IDFC FIRST Bank is the very efficient and quick Savings Account opening process. The Bank ensured seamless end-to-end procedures completed from the comfort of my home."

Abhishek Iswalkar

"My main concern while opening a Savings Account was about charges and services, but with IDFC FIRST Bank, the details were provided with complete transparency. We are definitely happy with the service."

Johan Patel

Things to keep in mind while opening a Savings Account

When you plan to open a Savings Account, keeping the following tips in mind can help you make an informed decision:

Interest rate and minimum balance

Choose a bank with high interest and a minimum average balance that is comfortable for you to maintain. IDFC FIRST Bank offers up to 7% p.a. with 10K or 25K AMB options.

Reputation of the Bank

Pick a bank known for safety and excellent customer service.

Services and facilities

Look for online banking, mobile app, video KYC, and strong customer support.

Fees and charges

Understand fees like ATM, debit card, and minimum balance penalties, which vary by account.

Savings Account FAQs

All

Open Account

Eligibility and Documentation

Features and Benefits

AMB Requirement

Savings Account Interest Rate

Chequebook and Debit Card

Fees and Charges

Payments and Transfers

Net/Mobile Banking

Account Updation

Customer Care

What is a Savings Account?

A Savings Account is a deposit account offered by banks. This account lets you deposit your funds and earn interest. With the IDFC FIRST Bank Savings Account, available in ₹10,000 Average Monthly Balance (AMB) and ₹25,000 AMB variants, you can safely park your funds and enjoy competitive interest rates.

A Savings Account encourages consistent saving due to the interest component, while also offering liquidity and quick access to funds via ATM, online banking and cheques. Though Savings Accounts offer a lower interest rate compared to Fixed Deposits, they provide greater flexibility.

How to open a Savings Account online?

You can open an IDFC FIRST Bank Savings Account via the online mode by visiting the Bank’s official website or mobile app. First, choose between the ₹10,000 Average Monthly Balance (AMB) or ₹25,000 AMB variant as per your needs. Next, fill out your details, submit your Aadhaar number and PAN, and complete the KYC verification. Setting up your Savings Account online with IDFC FIRST Bank is easy and seamless!

What are the different types of Savings Accounts?

IDFC FIRST Bank offers two types of Savings Accounts based on the AMB (Average Monthly Balance) requirements: one requiring ₹10,000 Average Monthly Balance (AMB) and the other requiring ₹25,000 AMB. These account types offer benefits like high interest rates, monthly interest credits, zero-fee banking, and easy access to digital banking features.

Based on the type of applicants, IDFC FIRST Bank also offers the following Savings Accounts:

• FIRST Power Women’s Savings Account – A savings account specifically designed for women that offers features like complimentary medical benefits through MediBuddy, discount on locker rentals, exclusive offers on Debit Card, monthly interest credits, and higher interest rates.

• Seniors Citizens Savings Account – This account is designed for seniors above the age of 60 years and comes with medical benefits through MediBuddy, ₹2 lakhs coverage against online fraud, 0.5% additional ROI on FD and free doorstep banking.

• Minor’s Savings Account - Designed for minors, this account can be opened jointly with parents or guardians. Also, minors aged between 10 to 18 years can open a FIRST Prodigy Savings Account, a self-operated minor savings account that offers features like monthly interest credits, high daily debit limit of ₹40,000, education cover of ₹5 lakhs, and more.

How can I choose the best Savings Account?

Go for a Savings Account offering high interest rates, zero or minimal charges, easy digital access, and value-added benefits. Value-added benefits may be in the form of Debit Card offers and investment options. Prioritising these factors ensures maximum returns, convenience, and an overall good banking experience.

The IDFC FIRST Bank Savings Account checks all these boxes with high interest rates, monthly interest credits, zero-fee banking and various account types like the Women’s Savings Account, Minor’s Savings Account, Senior Citizen Savings Account, designed to meet your specific needs.

How much money can be deposited in a Savings Account?

There is no upper limit on how much money you can deposit in an IDFC FIRST Bank Savings Account through non-cash (electronic or cheque) modes. However, for cash deposits, particularly for high-value transactions, certain regulatory guidelines may apply. For instance, PAN or Form 60 is mandatory for cash deposits exceeding ₹50,000 in a single transaction.

IDFC FIRST Bank offers distinct kinds of Savings Accounts, each with its own Average Monthly Balance (AMB) requirements, with ₹10,000 and ₹25,000 being common variants. Maintaining the required AMB helps in avoiding non-maintenance charges and ensures access to premium features.

Can I open a Joint Savings Account with IDFC FIRST Bank?

Yes, IDFC FIRST Bank allows you to open a Joint Savings Account. You can open it with a family member or partner, and both account holders can operate the account jointly or as per the instructions given while opening the account.

Can minors open a Savings Account?

Yes, minors can open a Savings Account. IDFC FIRST Bank offers Minor’s Savings Accounts that can be opened jointly with a parent or legal guardian. These accounts help children develop financial awareness while earning interest and accessing digital banking tools under parental supervision.

For young kids between the ages of 10 to 18 years, IDFC FIRST Bank also offers a self-operated minor’s account, the FIRST Prodigy Savings Account. The account offers unique features like high interest rates with a monthly interest credits, total daily debit limit of ₹40,000 to meet the child’s expenses, and free child education cover worth of ₹5,00,000. It also comes with special benefits like domestic airport lounge access once every quarter and extensive insurance coverage.

Which type of Savings Account should I open?

You must open a Savings Account depending on your financial requirements and balance maintenance capacity. If you are looking for increased benefits, then the ₹25,000 Average Maintenance Balance (AMB) variant is a wise choice. It offers a range of benefits like high interest rates, zero fee banking, monthly interest payouts, higher daily transaction limit of ₹6 lakhs and withdrawal limit of ₹2 lakhs. You also get a complimentary domestic airport lounge access per quarter, personal accident cover of worth ₹35 lakhs, and air accident cover of ₹1 crore.

Which is the best bank for opening a Savings Account in India?

The best Savings Account offers high interest, zero fees, easy digital access, varied balance options, and added perks. IDFC FIRST Bank stands out with all these benefits. It offers a high interest rate, monthly interest credits, zero-fee banking, video KYC, and intuitive mobile banking app.

IDFC FIRST Bank Savings Accounts come in two variants, ₹10,000 AMB and ₹25,000 AMB, allowing customers to choose based on their financial needs, making it one of the best banks for opening a Savings Account.

What is a dormant account?

A Savings Account becomes dormant if there are no customer-initiated transactions, such as deposits, withdrawals, fund transfers, or cheque usage, for two consecutive years.

Dormant accounts can still earn interest, but certain services are restricted for security reasons. To reactivate a dormant account, customers need to visit a branch with valid KYC documents. IDFC FIRST Bank alerts customers before dormancy to encourage activity.

How is a Savings Account different from a Current Account?

A Savings Account is meant for individuals to save money and earn interest with limited monthly transactions. For example, the IDFC FIRST Bank Savings Account comes in ₹10,000 and ₹25,000 Average Monthly Balance (AMB) variants, offering attractive interest rates and monthly interest credits.

A Current Account is designed for businesses with higher transaction needs and generally does not offer interest. However, it provides features like Overdraft facilities.

How can I transfer my Savings Account to a different branch?

The process of transferring your IDFC FIRST Bank Savings Account to another branch is simple. You can visit any branch and submit a request with valid ID proof. You can even send a signed request via a bearer. This procedure is hassle-free and ensures your account continues smoothly with the new branch. Your account number as well as services generally remain unchanged, making the transition hassle-free. Keeping the customers first, IDFC FIRST Bank offers zero fees on non-home branches for savings account holders, so that they can enjoy seamless banking services despite having a savings account at a different branch or location.

What is the minimum age requirement to open an IDFC FIRST Bank Savings Account?

The minimum age requirement to open an IDFC FIRST Bank Savings Account is 18 years. Minors can also open and maintain Savings Accounts under a guardian’s supervision through IDFC FIRST Bank’s specially designed Minor’s Savings Accounts. While minors can open a joint account with their parents and guardians, IDFC FIRST Bank also offers a self-operated minors savings account, the IDFC FIRST Prodigy Savings Account, that is designed for those aged between 10 to 18 years. The account comes with benefits like high interest rates with monthly interest credits, high daily debit limit of ₹40,000, education cover of ₹5 lakhs to secure child’s education, and domestic lounge access once every quarter subject to AMB maintenance.

What are the documents required to open a Savings Account online?

To open a Savings Account online with IDFC FIRST Bank, you must submit your Aadhaar number and PAN. These documents assist in completing the KYC procedure via a secure digital verification, allowing you to open your bank account without visiting a bank branch.

What are the eligibility criteria to open a Savings Account with IDFC FIRST Bank?

Resident individuals and eligible foreign nationals living in India with valid documentation can open a Savings Account with IDFC FIRST Bank. To smoothly open the account, applicants must complete the KYC process by providing Aadhaar, PAN, and residential proof.

Is PAN card mandatory to open a Savings Account?

Yes, a PAN card is mandatory to open a Savings Account. If you don’t have one, you must submit Form 60 instead. Online account opening requires Aadhaar and PAN. At a branch, you will need a passport-size photo, PAN (or Form 60), and valid ID proof like Aadhaar, Passport, Voter ID, Driving Licence, NREGA job card, or NPR letter. This ensures compliance with KYC norms. IDFC FIRST Bank offers both online and offline options to make the process seamless and secure.

What are the benefits of opening a Savings Account online with IDFC FIRST Bank?

Opening a Savings Account online with IDFC FIRST Bank is quick, paperless, and convenient. You benefit from high interest rates, zero-fee banking, monthly interest credits, easy video KYC, and 24/7 access to banking services through a secure mobile app and internet banking.

Based on your financial preference, you can choose between two Savings Account variants—₹10,000 and ₹25,000 Average Monthly Balance (AMB) accounts.

What does zero-fee banking mean?

IDFC FIRST Bank’s zero-fee banking means customers pay no charges for commonly used services across Savings Account variants, including the ₹10,000 and ₹25,000 Average Monthly Balance (AMB) account variants. There are no fees for ATM transactions (even at other banks’ ATMs), Debit Card issuance, chequebooks, IMPS/NEFT/RTGS transfers, and more.

How can I maximise the benefits of my IDFC FIRST Bank Savings Account?

To maximise the benefits of your IDFC FIRST Bank Savings Account, begin by choosing the right Average Monthly Balance (AMB) variant, ₹10,000 or ₹25,000, based on your financial needs. Maintain the required minimum balance, use digital banking features, set up automatic savings, and take advantage of the high interest rates.

Also, use your Debit Card for rewards, keep track of monthly interest credits, and explore value-added services like insurance, and investment options, for optimal savings growth.

What is the minimum balance requirement in a Savings Account?

The minimum balance requirement in an IDFC FIRST Bank Savings Account depends on the variant you choose. It is either ₹10,000 Average Monthly Balance (AMB) or ₹25,000 AMB. Maintaining the required balance helps you enjoy the full benefits of zero-fee banking and uninterrupted services without any penalty.

How is the Average Monthly Balance (AMB) calculated?

IDFC FIRST Bank calculates the Average Monthly Balance (AMB) by adding the closing balance of each day in a month and dividing it by the number of days in that month. For instance, if the sum of daily closing balances in a 30-day month is ₹3 lakh, the AMB would be ₹10,000.

IDFC FIRST Bank offers two common types of Saving Accounts based on AMB: ₹10,000 AMB and ₹25,000 AMB, you can choose the account variant based on your financial requirements.

What are the fees that apply when the average monthly balance is not maintained in the Savings Account?

At IDFC FIRST Bank, a nominal fee applies for non-maintenance of the Average Monthly Balance (AMB). From January 1, 2025, charges are 6% of the AMB shortfall or ₹500, whichever is lower.

Maintaining AMB in ₹10,000 or ₹25,000 AMB accounts helps avoid charges and unlocks premium benefits. However, there are no AMB requirements for IDFC FIRST Bank Minor’s Savings Accounts (under guardian).

What is the interest rate that I can earn on my Savings Account?

You can earn up to 7.00% per annum interest on your IDFC FIRST Bank Savings Account. The interest is credited monthly, which helps your money grow faster compared to banks offering quarterly credits. This allows your returns to be compounded more efficiently and boosts your overall savings.

How does the monthly interest credits feature work and how will I benefit from it?

With the IDFC FIRST Bank Savings Account ₹10,000 Average Monthly Balance (AMB) and ₹25,000 AMB variants, interest earned on the Savings Account balance is credited each month instead of quarterly. This enhances your overall interest earnings, provides quicker returns, and helps your savings grow faster compared to accounts that credit interest quarterly.

How is interest calculated on a Savings Account?

At IDFC FIRST Bank, Savings Account interest is computed daily depending on the end-of-day balance and credited monthly. This means the bank considers your account balance at the close of every day and computes the daily interest component using the prevailing annual interest rate.

At the end of the month, the overall interest component is credited to your bank account. This method ensures higher transparency as well as better returns.

Is there a limit to the number of withdrawals I can make from my Savings Account without affecting my interest rate?

IDFC FIRST Bank does not put any kind of limit on the number of withdrawals that can be made from your Savings Account. However, interest rates are applied to different balance ranges (or slabs) in a Savings Account. If frequent withdrawals cause your balance to dip into a lower slab, the interest rate applicable to your account may change. So, while you’re free to withdraw funds at any time, maintaining a higher balance may help you earn better interest.

Can I get a chequebook after opening a Savings Account?

Yes, IDFC FIRST Bank offers a chequebook after you open a Savings Account. You can request one while opening the account or later on via internet banking, mobile banking, or at a branch. The chequebook comes free of charge as part of the bank’s zero-fee banking policy, including re-issuance.

You can use the chequebook for various purposes like paying rent and bills or issuing post-dated cheques. This facility is available with both the ₹10,000 AMB and ₹25,000 Average Monthly Balance (AMB) Savings Account variants.

Will I receive a Debit Card after opening a Savings Account?

Yes, IDFC FIRST Bank offers a complimentary Debit Card with your Savings Account. Customers with the ₹25,000 Average Monthly Balance (AMB) variant receive an exclusive debit card, which includes free and unlimited ATM transactions at any bank in India, a ₹6 lakh daily purchase limit, and ₹2 lakh ATM withdrawal limit.

It also offers quarterly domestic airport lounge access, ₹35 lakhs personal accident insurance, and ₹1 crore air accident cover. These benefits enhance safety, convenience, and value, making your IDFC FIRST Bank Debit Card not just a transaction tool, but a premium lifestyle companion.

How can I activate my Debit Card?

To activate your IDFC FIRST Bank Debit Card, sign in to the mobile app or internet banking, visit the ‘Card Services’ section, and follow the activation prompts. Debit Cards can also be activated by calling on the Bank’s toll free number - 1800 10 888 from your registered mobile number.

What are the fees and charges associated with IDFC FIRST Bank Savings Accounts?

IDFC FIRST Bank offers zero-fee banking across all Savings Account variants, including ₹10,000 and ₹25,000 Average Monthly Balance (AMB) variants. Customers enjoy zero charges on all Savings Account services like IMPS, NEFT, RTGS, ATM withdrawals (even at other banks’ ATMs), Debit Card issuance, annual fees, SMS alerts, chequebook re-issuance, and many more.

There are no hidden charges for services like doorstep banking, ECS returns, and duplicate passbook issuance. For non-maintenance of Average Monthly Balance (AMB), a nominal charge applies: 6% of the shortfall or ₹500, whichever is lower, for both the ₹10,000 and ₹25,000 AMB account variants. However, Minor’s Savings Accounts (under guardian) have no AMB requirement.

Are there any charges on non-home branch transactions?

No, IDFC FIRST Bank Savings Account offers zero-fee banking on all common services, including fund transfers, ATM withdrawals, Debit Cards, Demand Draft (DD) issuance, and chequebook re-issuance, even for non-home branch transactions. This applies to both ₹25,000 Average Monthly Balance (AMB) and ₹10,000 AMB account variants.

How can I transfer money from a Savings Account?

You can transfer funds from a Savings Account via different modes. These include NEFT, RTGS, IMPS, and UPI. These options are available via internet banking, mobile banking app, ATMs, and even branch visits. Note that with IDFC FIRST Bank, you can be assured about seamless and quick fund transfers without any additional charges.

Can I set up automatic payments or standing instructions from my Savings Account?

Yes, you can set up automatic payments and standing instructions from your IDFC FIRST Bank Savings Account. This feature allows you to automate bill payments, Equated Monthly Instalments (EMIs), investments like Systematic Investment Plans (SIPs) in Mutual Funds, or fund transfers, ensuring timely transactions and better financial management without manual intervention.

Can I link my Savings Account to other accounts for automatic transfers?

Yes, IDFC FIRST Bank allows you to set up auto transfers and standing instructions using your Savings Account. This feature supports regular bill payments, Equated Monthly Instalments (EMIs), and fund transfers to other linked bank accounts.

It ensures timely payments, avoids any late fees, and offers convenience by automating recurring transactions based on your instructions.

What are the modes through which I can access and keep a track of transactions in my IDFC FIRST Bank Savings Account?

You can track transactions via IDFC FIRST Bank’s mobile app, internet banking, SMS alerts, email statements, and ATMs. These online and offline platforms provide real-time updates, mini statements, detailed account summaries, and instant notifications for every transaction. This helps maintain full transparency and allows you to stay updated with your banking activities.

How do I register for internet banking and mobile banking services?

To register for IDFC FIRST Bank internet and mobile banking services, visit the Bank's official website or download the IDFC FIRST Bank mobile app. Use your customer ID and registered mobile number to generate a password. Set up security questions and create your login credentials. You can also register at any IDFC FIRST Bank branch.

The process is quick, safe, and user-friendly, allowing you to manage your account, carry out transactions, pay bills, and more from the comfort of your home.

How to generate internet banking password for my Savings Account?

To generate your IDFC FIRST Bank internet banking password, visit the official login page and click on "generate password." Enter your customer ID and registered mobile number. You will receive an OTP to authenticate. After successful verification, set a new login and transaction password. Alternatively, you can visit your nearest branch for assistance.

How do I find my Customer ID?

You can find your Customer ID easily by logging in to the IDFC FIRST Bank mobile banking app or internet banking. Next, just go to the menu and click on ‘Manage Profile’ below your name to view your Customer ID. Alternatively, you can visit any IDFC FIRST Bank branch with valid ID proof to retrieve your Customer ID.

Which digital services are available?

IDFC FIRST Bank offers comprehensive digital services via its mobile banking app and internet banking portal. You can easily check balances, pay bills, transfer funds, manage UPI, set auto-debit mandates, and request services online.

These digital platforms provide high security and convenient access to daily banking needs anytime, anywhere, offering greater control and financial flexibility.

What is the process for updating my personal information in my Savings Account?

With an IDFC FIRST Bank Savings Account, personal details like your mobile number or email ID, address and nominations can be updated through internet banking, the mobile app, or customer care. Ensure you have your Aadhaar, PAN, and other necessary documents handy for verification.

How to update mobile number in my IDFC FIRST Bank Savings Account?

To update your registered mobile number in your IDFC FIRST Bank Savings Account, log in to the IDFC FIRST Bank mobile banking app or the net banking portal. Navigate to the profile or personal details section and follow the instructions to update your number.

Why do I have to add a nominee for my Savings Account?

Adding a nominee to your IDFC FIRST Bank Savings Account ensures that your account proceeds go to the intended person in the event of your unfortunate demise. It simplifies the claim process and prevents legal disputes among family members. Nomination provides peace of mind and financial security to your loved ones. You can nominate anyone, including a family member or a trusted individual.

How can I access customer support for my Savings Account?

You can contact IDFC FIRST Bank’s customer support easily. The customer care hotline number is 1800 10 888. You can refer to it at the top right corner of the Bank’s official website. You can also contact customer care via the mobile app, internet banking chat, or by visiting the nearest branch.

Explore Our Savings Account Blogs

Deep dive into everything finance

The Easiest Way to Open a Minor Savings Account in India

Open bank account for minor with our comprehensive guide.

Open a Savings Account easily: Online vs Offline explained

Open a Savings Account in India easily - go digital for faster, paperless access.

Is interest on savings account taxable?

Interest earned from Savings Accounts is taxable under “Income from Other Sources”.

What is the Savings Account transaction limit per month?

The free cash deposit limit on Savings Accounts with IDFC FIRST Bank, is ₹10 lakh per month.

How to Activate a Debit Card

You can activate your Debit Card via ATM, internet banking, or phone banking.