-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator -

EMI Calculator

-

Personal Loan Eligibility Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex Services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

Streamline your business banking with our reliable and secure Current Account

-

Best-in-class Netbanking and Mobile Banking Platform

-

Bank from anywhere, across any branch, without extra charge

-

Suite of payment and collection solutions to optimize cash flows

-

Doorstep Banking Service- Free document & cheque pickup

-

Best-in-class Netbanking and Mobile Banking Platform

-

Bank from anywhere, across any branch, without extra charge

-

Suite of payment and collection solutions to optimize cash flows

-

Doorstep Banking Service- Free document & cheque pickup

Fuel Your Business Growth with IDFC FIRST Bank’s Gold Current Account.

The Gold Current Account is more than just a banking solution—it’s a tool designed to help your business succeed. Benefit from easy access to current account services with cutting-edge features, including a unified Internet and Mobile Banking platform, Trade Forex offerings and efficient payment and receivable management solutions. With our commitment of Zero Banking fee (40+ services), we ensure you can focus on your business while we do the rest for you.Read More

Start your journey toward business success today—open your Gold Current Account with IDFC FIRST Bank.Read Less

Empower Your Enterprise with the Ultimate Current Account Solution

ZERO Charges: Enjoy commonly used current account services without fees.

Free Cash Deposit: Free cash deposit up to 12 times of current month AMB

Cash Management Solutions: Benefit from a suite of payment and collection solutions to optimize your cash flows

All-in-one app: A single app with 100+ features that meet both personal and business financial needs

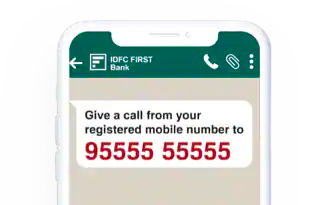

WhatsApp Banking: Access your accounts anywhere, anytime. Just send a 'hi' to 95555 55555 to get started

Beyond Banking Services: We offer 100+ Beyond Banking offerings to suit your enterprise's needs, including ERP, HRMS, Payroll, Taxation, Legal, Cloud Services, CoWorking Spaces, etc.

Gold Current Account

Discover the amazing perks of our Gold Current Account

- Zero charges on 40+ commonly used Current Account services*

- Free Cash deposit limit of 12 times of current month AMB

- Free Visa Platinum Debit Card with lounge access

- Complimentary insurance with the debit card

- Free NEFT, RTGS, IMPS transactions*

- Daily ATM limit of ₹1 Lakh & Purchase limit of ₹2 Lakhs

- Preferential Trade & Forex pricing

- Leverage our Payment and Collection solutions to optimize your business

- Get complimentary General Insurance Cover with your Current Account

*on maintenance of average monthly balance of ₹50,000

Eligibility

The following constitutions are broadly eligible to open an account:

- Hindu Undivided Family (H.U.F.)

- Sole proprietorship

- Partnership

- OPC / Private / Limited Company

- Limited Liability Partnership

- Resident Individual

Sole proprietorship

- 2 documents in the name of Entity

- Address proof in the name of entity

- Proprietor Document – (Photo, PAN copy and 1 OVD document copy)

- Nature of Industry proof (In case not indicative in Entity documents, please check for Invoice Copy, Bill of Entry, Freight Invoice, Agreement Copy)

Partnership

- Partnership Deeds

- Partnership Firm Declaration

- Entity PAN card copy

- Address Proof in the name of the Entity

- OVD copy of the Partners / Authorised Signatories / Beneficial Owners (Including Latest Photograph and PAN card copy)

- Click here to read the Schedule of Charges

FEES & CHARGES

Find out about our minimal and transparent fees & charges

FREQUENTLY ASKED QUESTIONS

What is a Current Account?

A Current Account is an account that is used by business enterprises or self-employed professionals to carry out business-related transactions. It allows businesses to carry out a higher number of transactions daily.

Who can apply for a Current Account?

Anyone who meets any of the following requirements can apply:

- Self Employed Professionals

- Hindu Undivided Family (H.U.F.)

- Sole Proprietorship

- Partnership

- OPC / Private & Public Limited Company

- Limited Liability Partnership

How do I open a Current Account?

You can open an IDFC FIRST Bank Current Account by visiting your nearest bank branch or click here to apply online.

What are the documents required for opening a Current Account?

The documents required to open a Current Account are based on your constitution type. Click here to view the list of documents.

What is the minimum Average Monthly Balance (AMB) required to be maintained in the IDFC FIRST Bank Gold Current Account?

Minimum Average Monthly Balance (AMB) requirement for Gold Current Account is ₹ 50,000.

What is an Average Monthly Balance?

The average monthly balance is calculated by taking the average of end of the day/ daily closing balances in your Current Account, in a given month. E.g., For a 31-day month, the average is calculated by adding the closing day balances for all the days in the month and dividing it by 31.

What are the benefits of having an IDFC FIRST Bank Current Account?

After opening a Current Account with IDFC FIRST Bank, you can avail of below benefits:

- State-of-the-art Mobile Banking App & Net Banking platform

- Bank from anywhere, across any branch, at ZERO charges

- Seamless POS, QR & Payment Gateway facility

- Doorstep Banking Service - Free document & cheque pickup

What are the fees and charges on IDFC FIRST Bank Current Account?

IDFC FIRST Bank has minimal and transparent fees & charges. Click here to view.

Are all services offered free of charge in the Gold Variant?

All current account services (except cash deposit) are offered free of charge to the customer provided they maintain the required balance.

Name of the Product |

Criteria |

Gold |

AMB: >=50,000 - CA services are free, |

What is the free cash deposit limit for Gold Current Account?

Gold Current Account offers free cash deposit limit of 12 times the current month AMB with no restriction on maximum amount.

Can I deposit or withdraw cash in any IDFC FIRST Bank branch?

Yes, every Branch is a Home Branch with IDFC FIRST Bank which means you can get banking service like cash deposits or withdrawals at any IDFC FIRST Bank branch in the country. These services are provided without any additional charges.

What are the digital modes through which I can access IDFC FIRST Bank Current Account?

Current Account can be accessed through the following digital modes:

- Internet Banking & Mobile Banking

- 24x7 Banker on Call 1800-10-888

- Alerts through Email and SMS

- WhatsApp Banking

What all Beyond Banking offer will I get with my Current Account?

IDFC FIRST Bank Beyond Banking offers premium banking services with 100+ partners. You can benefit from 150+ offers across ERP &Accounting, HRMS Solutions, Legal, Logistics, Travel & more.

Click here to view the Beyond Banking offers.

What is the digital Payment & Collection solutions available for my Current Account?

Below are some of the digital payment and collection solutions available with IDFC FIRST Bank Current Account:

| Payment Solutions | Collection Solutions |

| NEFT/RTGS/IMPS | UPI-QR |

| Debit Cards | POS Machine |

| E-commerce payments using Net Banking | Doorstep Banking services with live tracking facilities |

| Bill Payments | Payment Gateway |

| Bulk transaction facility on Net Banking | Virtual Accounts |

| GST/Direct Tax Payment | Collection API |

| Payment API | NACH/e-NACH |

What are the Trade & Forex solutions available with the Current Account?

Below are the Trade & Forex solutions available to facilitate your international business requirements:

- Letter of Credit

- Bank Guarantee

- Document Collection

- Inward & Outward Remittance

- Hedging and Currency Protection

- FDI/ ODI/ ECB

- Escrow Services

Whatsapp Banking

Through WhatsApp Banking, you can interact with us just like you would with any of our representative

Numbers to connect: 95555 55555

Current Account Blogs

FEATURED

All you need to know about current account

Current accounts can help in managing the finances for your business. Read the following article to learn more about current accounts.

Team FinFIRST19 Oct 2023 • 3 mins read

-

Savings Account vs Current Account: Key differences & benefits

02 Jul 2025 • 3 mins read

-

Traditional vs zero balance current account for Start-ups

17 Aug 2023 • 3 mins read

-

Business benefits of a Start-up current account

14 Aug 2023 • 3 mins read

-

IDFC FIRST Bank’s ‘BOOSTER’ Current Account: A game changer for MSMEs

01 Jul 2023 • 3 mins read