CKYC Registry

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Scan, get our app

Access 300+ features on our 4.9⭐️ rated app

Select a

Select a Product

Apply for a product now

On a mission to build the world’s most customer friendly bank

-

Savings Account

Savings Account

-

FIRST Select Credit Card

-

Corporate Salary Account NEW

Corporate Salary Account NEW

-

FIRST Wow! Credit Card NEW

-

Personal Loan

-

Business Loans

Business Loans

-

Home Loan

-

Two Wheeler Loan

-

Pre-Owned Two Wheeler Loan

-

Non-Resident Indian Savings Account

-

Fixed Deposit

-

Loan Against Property

-

New Car Loan

-

Pre-owned Car Loan

-

Consumer Durable Loan

-

FASTag

FASTag

-

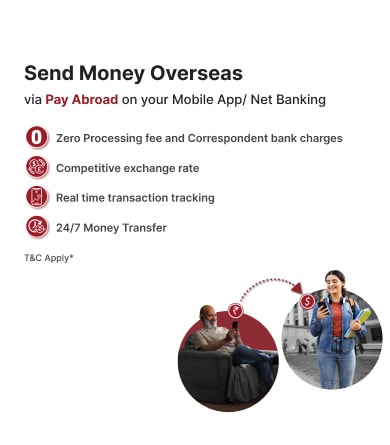

Forex services

Zero fee banking

The only bank in India to offer zero fee banking on all savings account services

ZERO

CHARGES on

IMPS

NEFT

RTGS

Cheque Book

SMS Alerts

Cash Transactions

3rd Party Cash Transactions

Manager’s Cheque/DD/PO

Duplicate Statements Issuance

Duplicate Passbook Issuance

Balance Certificate Issuance

Interest Certificate Issuance

Account Closure

ECS Return

Stop Payment of Cheque

International ATM/POS transactions

Decline Charges for Insufficient Balance

Standing Instructions

Photo Attestation

Signature Attestation

Retrieval of Transactional Records

Address Confirmation

Deliverable Returned by Courier

Debit Card Issuance

Debit Card Annual Fee

ATM Transactions

Cheque Bounce

Doorstep Banking

ZERO

CHARGES on

Financial Calculators

Hassle-free financial planning with IDFC FIRST Bank

**Interest calculated considering quarterly interest credit (Most universal banks credit savings interest quarterly).

In the spotlight

Quick actions for you

Activate UPI

Get the Power of UPI and earn cashback up to ₹200

FASTag

Upgrade to FASTag Max and enjoy benefits worth ₹5000*

Scholarships

Applications open for batch of 2025-27 MBA students with less than 6 lacs p.a income.

Dining Offers

Avail up to 25% discounts with live screening of T20 matches

Professional Loan

Enjoy unsecured loans up to ₹1 crore tailored for Doctors, CAs, and Architects

Explore Bikes

and ride your dream bike with an instant loan

FIRST Rewards

Our exclusive Savings Account loyalty programme

Explore Cars

Shop, compare and choose your perfect car with the best financing options

Activate UPI

Get the Power of UPI and earn cashback up to ₹200

FASTag

Upgrade to FASTag Max and enjoy benefits worth ₹5000*

Scholarships

Applications open for batch of 2025-27 MBA students with less than 6 lacs p.a income.

Dining Offers

Avail up to 25% discounts with live screening of T20 matches

Professional Loan

Enjoy unsecured loans up to ₹1 crore tailored for Doctors, CAs, and Architects

Explore Bikes

and ride your dream bike with an instant loan

First Rewards

Our exclusive Savings Account loyalty programme

Explore Cars

Shop, compare and choose your perfect car with the best financing options

Award-winning digital banking platform

Recognised as the 'Best Digital Bank' for the year 2021-2022 by Financial Express India's Best Banks Awards 2023.

Enjoy India's #1 Mobile Banking App

Enjoy India's #1 Mobile Banking App

Enjoy India's #1 Mobile Banking App

Download IDFC FIRST Bank App

Start banking with just a

WhatsApp message. Send

'Hi' to 95555 55555

Experience a secure way

to bank on the go with

our mobile banking app

Banking services now

at your fingertips

anytime, anywhere

Step inside the

world of smart

watch banking

But don’t take our word for it, Hear from our customers

"Dear Sir, I would like to sincerely appreciate Anand Bhushan Sir for his outstanding support and service. He always provides the best and fastest assistance whenever required. His dedication, professionalism, and quick response to every query make a huge difference. Such commitment and efficiency are truly commendable and set a great example for others...." Rahul Roy 10 July 2025

"Mr Anand Bhushan is super excellent employee with empathy for me and technical very professional went all out to ensure timely solution for technical issues. Thanks a tonn This attitude will go long way in flying the flag of IDFC FIRST Bank." Rajendra Kumar Talwar 5 July 2025

"I'm glad to express my heartfelt gratitude to Ms Biolin madam for an effective support to solve this issue of payment Emi. Thank you for your complete support n concerning the subject and customer satisfaction" Salma Kouser 4 July 2025

"I have a lot of faith in IDFC. IDFC has solved many of my problems. I feel proud that I am a customer of IDFC. Whenever I had a need, IDFC has supported me.😊🙏" Sujata Singh 3 July 2025

"Very good service and experience all better 👍" Sita Ram Meena 3 July 2025

"Varsha Gangaramani, Elite Banker-NRI Engagement. She has gone above and beyond with extreme patience and excellent support in my NRI banking process. Thanks to her brilliant support!" Santhini Periyaswamy 2 July 2025

"I loved the way of banking with IDFC FIRST Bank, literally zero fee, one of the best mobile application i have used." Amit Sarkar 27 June 2025

"Highly appreciate the support of the camp branch Pune. IDFC is the best bank and am so happy with their services. I was also able to transfer money abroad very quickly and with great ease." Parinaz 27 June 2025

"All the Questions were answered crystal clear. The information providing is very helpful and they are highly professional . Thank You So Much" Sankararao Telukala 27 June 2025

"Big thanks to IDFC First bank and their FASTag team for resolving my issue promptly! 🙏 Your quick action and personal involvement in getting my money back is truly appreciated. Great customer service! 👏 #FASTag #CustomerSupport #Gratitude" Pooja Rani 26 June 2025

Learn how to manage your finances effectively

Awards & Accolades

A glimpse of IDFC FIRST Bank's testament to excellence

Know more

IDFC FIRST Bank recognized amongst the 'World's Best Banks 2025’ by Forbes in partnership with Statista

![]()

![]()

IDFC FIRST Bank wins the 'Digital Sourcing & Decisioning Excellence' award at Lentra CNBC-TV18 Digital Lending Summit

![]()

![]()

Helping our communities grow with us

9.3 Million Beneficiaries

Supported since March 2023

70,000 Villages

Served across the country

9000 Residents

Impacted positively through our Swachh Worli Koliwada program

351 Students

Awarded post-graduate scholarships this year

9.3 Million Beneficiaries

Supported since March 2023

70,000 Villages

Served across the country

9000 Residents

Impacted positively through our Swachh Worli Koliwada program

351 Students

Awarded post-graduate scholarships this year

Disclaimer: With IDFC FIRST Bank Savings Accounts, enjoy Zero Charges on all Savings Account services. These services are being offered free in good faith, and in case of misuse of services, the Bank reserves the right to levy charges. Forex mark-up fee will be applicable on International ATM/POS/Debit card transactions. T&Cs are subject to periodic changes. All rights reserved.