-

Customer Service

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Forex Card

-

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

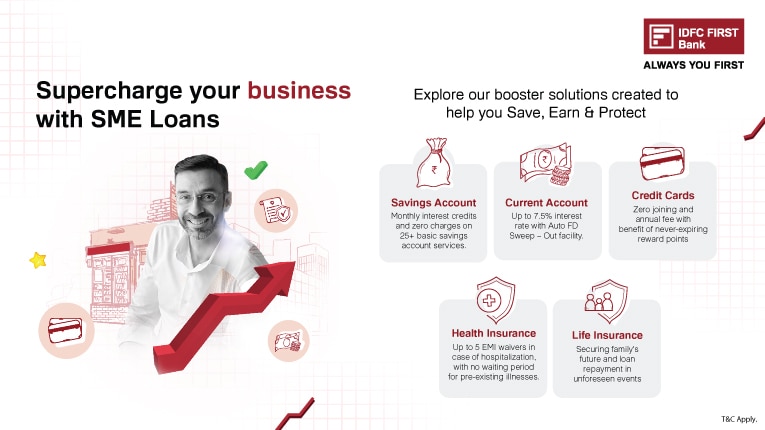

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Unsecured - Business Loan

-

Unsecured - Professional Loan

-

Secured - Loan Against Property

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Top Products

Popular Searches

Bank Accounts

Populer FAQs

How do I upload my signature?

Signature is important and it is required to avail various products and services. To upload your signature

1. Go to More

2. Select Customer Service Dashboard

3. Select ‘Savings/Current Accounts’

4. Select ‘Upload Signature’ to upload your signature.

How do I track service requests which I have already raised?

That's easy! Follow these steps to track your service requests:

1. From the home page of the app, tap on "Customer Service" section

2. Scroll down to "Track my service requests" to find all your requests

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

Enjoy Zero Mark-up on Forex Transactions on your FIRST WOW! Credit Card

Apply Now

Get the assured, FD-backed FIRST Ea₹n Credit Card

Apply Now

Set milestones for the future

With Professional Loans exclusively for

Doctors/CAs/Consulting Engineers/Architects/CS

by IDFC FIRST Bank

Set milestones for the future

With Professional Loans exclusively for Doctors/CAs/Consulting Engineers/Architects/CS by IDFC FIRST Bank

-

Collateral-free funding up to ₹1 Cr with an extended tenor of 84 months

-

Quick funding up to ₹30 lacs for Doctors and CA’s with minimum documents

-

Attractive financing solutions for Salaried CA’s and Doctors

-

Funding options also available for Hospitals & Diagnostic centers

-

Collateral-free funding up to ₹1 Cr with an extended tenor of 84 months

-

Quick funding up to ₹30 lacs for Doctors and CA’s with minimum documents

-

Attractive financing solutions for Salaried CA’s and Doctors

-

Funding options also available for Hospitals & Diagnostic centers

Professional Loans

A self-employed professional loan is a type of financing specifically designed for professionals like doctors, chartered accountants, company secretaries, architects and consulting engineers. You can use it to manage cash flow, invest in growth, or seize new opportunities for your practice with no collateral requirements. These loans offer flexible repayment options and competitive interest rates. They are also quick to process, so you can get the funds you need quickly.Read More

| Loan Amount | Loan Tenure | Interest Rates |

| ₹5 Lakhs to ₹1 Crore | 12 Months to 84 Months | Starting at 11% |

How can a Professional Loan help you?

EXPAND YOUR PRACTICE

You can improve your services and reach a broader audience by investing in new equipment, hiring additional staff, or expanding your office space.

IMPROVE YOUR CASH FLOW

Meet unexpected expenses, manage seasonal fluctuations, or invest in marketing and promotion by bridging gaps in your cash flow.

MANAGE DEBT

Streamline debt repayment by consolidating high-interest debts into a single loan with a lower interest rate.

SEIZE OPPORTUNITIES

Take advantage of new business opportunities, such as acquiring a new client or launching a new service, by having the necessary funds readily available.

Key Features of Self Employed Professional Loan

Collateral-free loan

up to ₹1 Cr

Flexibility to choose

between Term Loan and Dropline Overdraft

Instant loan up to ₹30 Lakhs

based on professional qualification

Extended loan tenor

up to 84 months

CALCULATOR

Professional Loan EMI Calculator

Choose the amount

1L 50L

Choose the period

1 Year 30 Year

Choose the interest rate

8 % 15 %

You will pay an EMI of only monthly

Rates & Charges

| TYPE OF FEE | CHARGES |

| Rate of Interest | Starting at 11%* |

| Processing fee | Up to 3.5% of the loan amount |

| Stamp charges | Applicable as per state |

| Other charges | View Other fees & Charges |

*At IDFC FIRST Bank, we provide competitive interest rates based on the customer’s credit profile. Click here to understand the factors that impact your rate of interest.

Dropline Overdraft

Are you facing unexpected expenses and need quick access to funds? Look no further!

A Dropline Overdraft Loan is a versatile financial product that allows you to access a pre-approved line of credit whenever you need it. This facility allows you to utilize amount up to an agreed limit. The withdrawal limit reduces every month till the end of the loan tenure. The interest is levied only on the utilized amount and not on the total amount borrowed. The amount can be deposited to the account anytime to reduce the outstanding balance.

Avail your Professional Loan as a Dropline Overdraft Facility and enjoy amazing benefits like interest only on the amount utilized, instant access to funds, collateral free funding up to 1 Crore, and much more.

Key Features:

1. 24/7 instant access to funds

2. Continuous access to a predetermined line of credit

3. Flexibility to repay the borrowed amount

4. Pay interest only on the amount utilized

5. Financial security against unexpected financial emergencies

ELIGIBILITY

We have detailed our professional loan eligibility as below

Loan to doctors:

- Can be availed by doctors (MD, MBBS, BAMS, BHMS, MDS, BDS and Veterinary, Physiotherapist)

Loan to other professionals:

- Can be availed by Engineers, Chartered accountants, Company secretaries & Architects

Loan to non-individuals:

- Can be availed by Diagnostic Centers, Clinics & Hospitals

Age Limit

- Minimum - 23 years (21 years if parents are in the same profession)

- Maximum - 68 years (at the time of loan maturity)

Profitability

- Positive net worth and cash profit in last 2 years

Salaried Professionals

- Photo identity proof, address proof: As per RBI defined KYC guidelines.

- Education Proof- Degree certificate, Degree registration

- 3 Months Bank Statement

- Employee ID Card

- Residence Ownership proof

- 3 Months Salary Slip

Self Employed professionals and Entities such as Hospitals, Diagnostic centers

- Photo identity and Address proof: As per RBI defined KYC guidelines

- Education Proof- Degree certificate, Degree registration

- Ownership proof of residence or office as applicable

- Business Proof: Shop Act License/MOA & AOA/GST registration/ITR, Partnership Deed, Udyam Certificate

Any one of the additional documents as per program

- Basis Banking – 2 years ITR & Computation, 12 months banking

- Or Basis Degree - 3 months banking

- Or Basis Income - 2 years ITR & financials, 12 months banking

FREQUENTLY ASKED QUESTIONS

What is a Professional Loan?

A Professional loan is a collateral-free loan offered to self-employed professionals such as doctors, chartered accountants, architects, etc. for the purpose of upgrading their skills, expanding their practice, purchasing equipment, etc.

Which profiles are eligible for a Professional Loan from IDFC FIRST Bank?

IDFC FIRST Bank Professional Loan is offered to a wide range of profiles, as below:

• Graduate Allopathic Doctors

• Post Graduate Allopathic Doctors

• BDS/ MDS

• Veterinary Doctor

• Physiotherapists

• BAMS, BHMS

• CA, CS, Architects

• Consulting Engineers

What is the range of loan amounts, minimum and maximum, that I can apply for?

The minimum loan amount one can avail of is ₹5 Lakhs and up to a maximum of ₹1 Crore.

What is the minimum and maximum Professional loan tenure offered?

Being one of the leading banks in the Professional loan segment, we are currently offering our customers a loan tenure from a minimum of 12 months up to a maximum of 84 months.

What are the benefits of availing a Professional Loan from IDFC FIRST Bank?

We have one of the best Professional Loan solutions. Some of our major features are:

• Collateral-free loan up to ₹1 Crore with an extended tenure of 84 months

• Attractive interest rates

• Quick loan up to ₹30 Lakhs with minimum documentation based on your professional qualifications

• Loan based on bank statements or basis your ITR documents

• Funding also available for salaried professionals

• Superior customer experience with easy documentation and a hassle-free digitized process

What are the different types of loans offered under Professional Loan?

Professional Loan can be availed in the form of a term loan or a dropline overdraft facility.

How does a term loan facility work?

A term loan gives you a one-time amount of money that you repay over a pre-determined period in regular instalments. The interest rate stays the same throughout, making it easier to plan and budget your repayments.

What is a Dropline Overdraft facility and how does it work?

Dropline Overdraft is another type of credit facility that allows you to withdraw funds from pre-approved credit limit as and when required.

With the dropline feature, the Overdraft limit gradually decreases over time until it reaches zero. You will be charged interest only on the overdraft amount utilized.

What is the eligibility criteria to apply for an IDFC FIRST Bank Professional Loan?

To apply for IDFC FIRST Bank Professional Loan, you need to have a minimum work experience 3-5 years based on your profile and you should be at least 23 years of age and a maximum of 68 years of age at the time of loan maturity.

If your parents are in the same profession, the age criterion has been relaxed to a minimum of 21 years.

How do I apply for IDFC FIRST Bank Professional Loan?

You can apply for IDFC FIRST Bank Professional Loan via –

Our Website - https://www.idfcfirstbank.com/business-banking/loans/professional-loans

Our Mobile App - https://my.idfcfirstbank.com/digital-banking-app

Our Branches - https://nearme.idfcfirstbank.com/

Our Loan Centres - https://www.idfcfirstbank.com/support/asset-branch

Or you can call us on 1800 10 888 and speak to our representative

What is the loan application process?

Here's a break-down of our Professional Loan application process:

• Submit the application form with the required documents

• Document verification (mandatory verifications instituted to ensure validation of the documents provided)

• Personal discussion (for assessment & to understand the customer profile from a risk perspective)

• Loan sanction

• Loan disbursement

Does IDFC FIRST Bank offer insurance for my Professional Loan in case of an unforeseen event?

At IDFC FIRST Bank, we aim to safeguard our customer's interest by offering the below insurance covers:

• Life Group Credit Protect - In event of death, disability or illness of the insured member, it will protect their families from the burden of repaying the outstanding loan to the financial institution.

• Health Protect Plans - Covers medical expenses that arise due to an illness.

• Accident Protect Plan - Covers medical expenses pertaining to injuries like a broken limb, loss of a limb, burns, lacerations, or paralysis.

• EMI Protect Plan - Protection plan that offers insurance coverage on EMI in case you are unable to pay an EMI

How will my EMI be calculated?

The principal amount and the interest rate applied to the principal make up your EMI. The amount you borrow, the rate of interest charged, and the loan tenure are the variables that affect the EMI. If the interest rate increases, EMIs may alter.

You can calculate your potential EMI here

What are the various charges incurred?

Click on the link to know more about the charges.

How is Dropline Overdraft different from an overdraft facility?

Unlike a standard overdraft, a dropline overdraft is a revolving credit line, meaning you can borrow, repay, and borrow again up to your credit limit. The interest needs to be paid only on the amount utilized.

How is the interest charged on the borrowed amount for a Dropline Overdraft facility?

The interest is levied only on the utilized amount and not on the total amount borrowed. Interest is calculated daily and levied at the end of each month.

How does the limit drop for a Dropline Overdraft facility?

The withdrawal limit reduces every month till the end of the loan tenure. The limit can be renewed every year based on the repayment behaviour.

Does IDFC FIRST Bank offer insurance for my Professional Loan, in case of an unforeseen event?

At IDFC FIRST Bank, we aim to safeguard our customers’ interest by offering the below insurance covers:

• Life Group Credit Protect - In the event of death, disability or illness of the insured member, it will protect the insurer’s family from the burden of repaying the outstanding loan.

• Health Protect Plans - Covers medical expenses that arise due to an illness.

• Accident Protect Plan - Covers medical expenses pertaining to injuries like a broken limb, loss of a limb, burns, lacerations, or paralysis.

• EMI Protect Plan - Protection plan that offers insurance coverage on EMI in case you are unable to pay an EMI