CKYC Registry

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

-

Customer care hotline Call 1800 10 888

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Forex Card

-

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

- Max benefits, Free for life

-

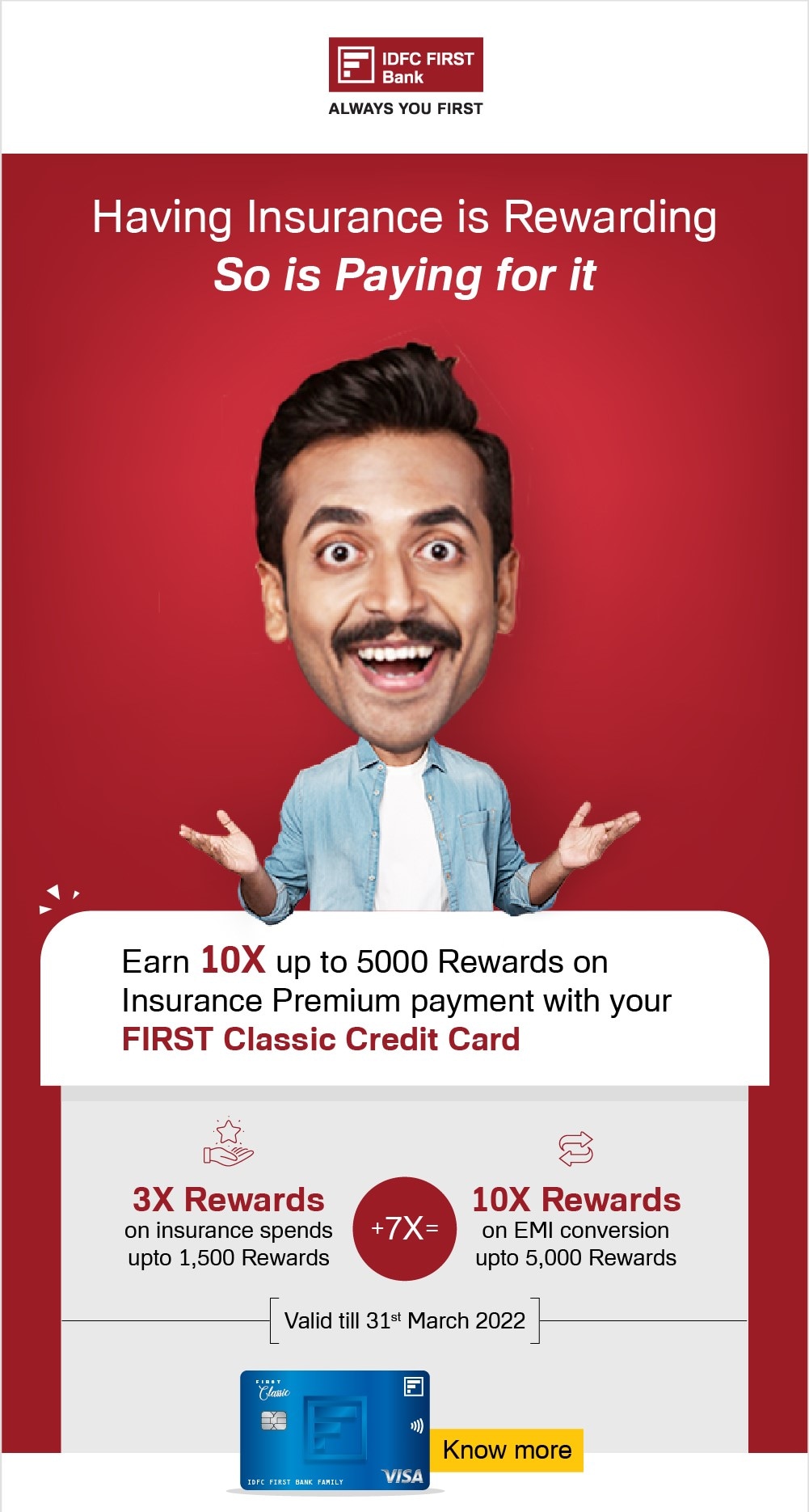

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Unsecured - Business Loan

-

Unsecured - Professional Loan

-

Secured - Loan Against Property

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payments

-

Collections

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Top Products

Popular Searches

Bank Accounts

Populer FAQs

How do I upload my signature?

Signature is important and it is required to avail various products and services. To upload your signature

1. Go to More

2. Select Customer Service Dashboard

3. Select ‘Savings/Current Accounts’

4. Select ‘Upload Signature’ to upload your signature.

How do I track service requests which I have already raised?

That's easy! Follow these steps to track your service requests:

1. From the home page of the app, tap on "Customer Service" section

2. Scroll down to "Track my service requests" to find all your requests

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

Enjoy Zero Mark-up on Forex Transactions on your FIRST WOW! Credit Card

Apply Now

Get the assured, FD-backed FIRST Ea₹n Credit Card

Apply Now

Offer Terms & Conditions:

• The offer is valid only on FIRST Classic Credit Card.

• The Offer can be availed as per terms mentioned herein and period is from 05th February 2022 (Offer Start Date) to 31st March 2022 (Offer End Date) both dates inclusive.

• Transactions done only on Insurance category of merchants will be eligible for this Offer

• This is a targeted offer. A Cardmember is eligible for this offer only if he/she has received an offer communication directly from IDFC FIRST Bank through any of its channels.

• Any FIRST Classic Credit Card on which the offer is not applicable, will not be considered eligible for the offer.

• Cardmember will be eligible for a maximum of 5,000 Rewards points during the entire offer period.

• 3X rewards upto maximum of 1,500 Reward points can be earned during the offer period

• Incremental rewards (7X) on EMI conversion for 10X upto maximum of 3,500 reward points can be earned during the offer period.

• Only EMI transaction amount of more than ₹2,500 and EMI tenure of more than 6 Months will be eligible for 10X rewards.

• There is no minimum transaction amount to be eligible for 3X rewards.

• Incomplete / rejected / invalid / returned / cancelled / refunded / disputed or unauthorized / fraudulent transactions will not be considered for the offer.

• Multiple transactions done on the insurance category merchants during the offer period shall also be considered eligible for 3X rewards, however only the transactions which are further converted to EMI shall only be considered for 10X rewards

• EMIs conversion needs to be done after the offer start date and before the offer end date to be eligible

• Any insurance transaction done before the offer start date which is converted to EMI after offer start date will not be eligible for this offer.

• Transactions will NOT be automatically converted into EMIs except if explicitly mentioned on the merchant platform. In all other cases the cardmember has to select the relevant option on the merchant website or convert the transaction post-facto using IDFC FIRST Bank mobile app or website or can request the same by calling the customer care number 1860-500-1111

• Reward Points applicable will be credited within 30 days after the offer end date (i.e. 30 April 2022) to the eligible Credit Card account of the qualified customers only.

Amount Transaction done on Insurance Category |

Reward Points (3X) |

EMI Conversion |

EMI Tenure |

Additional Reward Points |

Total Reward Points (10X) |

₹ 50,000 |

1,500 RP |

Yes |

6 Months |

3,500 RP |

5,000 RP |

₹1,00,000 |

1,500 RP |

No |

N.A |

0 RP |

1,500 RP |

₹20,000 |

600 RP |

Yes |

9 Months |

1400 RP |

2,000 RP |

₹20,000 |

600 RP |

Yes |

3 Months |

0 RP |

600 RP |

• Multiple transactions done within the offer period will be considered collectively for the eligibility of the offer.

• All other reward points available on your credit card will continue to hold valid.

• Transactions meeting the eligibility criteria done with FIRST Classic Add-On card shall also be considered eligible for this offer, however maximum of 5,000 Rewards can be earned by the Primary and the Add-On cardmember combined and the reward accrual capping shall be considered at the billing account.

• Classification of merchant into Insurance category will be solely basis the transaction data received at the time of transaction and as per the guidelines of the card networks. Transactions done through an merchant aggregator platform may not trigger Rewards points if the transaction data sent is incorrect.

• EMI interest rate and Processing fee applicable as per the EMI T&C https://www.idfcfirstbank.com/personal-banking/tnc-portfolio

• The Offer is non-transferable, non-cashable and non-negotiable.

• The Offer is made solely and entirely by IDFC FIRST BANK Limited ("Bank") to the Bank's Credit Card Members ("Customers"), who have received communication by the Bank through emailer, SMS, Push Notification, Banner and / or any other direct communication channel intended for the customer only.

• The Bank reserves the right to disqualify any Customer from the benefits of the Offer if any fraudulent activity is identified as being carried out for the purpose of availing the benefits under the Offer (including any default in payments).

• Any Customer eligible for the offer shall be deemed to have read, understood and accepted these terms and conditions, the Offer terms and conditions mentioned in the communication sent, as well as, general terms and conditions Of the Bank, before availing the Offer.

• Bank reserves the right, at any time, without prior notice and without assigning any reason whatsoever, to add/alter/modify/change or vary all or any of these terms and conditions or to replace, wholly or in part this Offer by another offer whether similar to this Offer or not or to extend or withdraw this Offer altogether.

• The Bank holds out no warranty and makes no representation about the quality, delivery or otherwise of the goods and services offered by any merchant with regards to this offer. Customer is expected to take any grievance, pertaining to quality, delivery or any other issue of purchased goods and services, to the respective merchant and not to the Bank.

• The decision Of the Bank limited in all matters in connection with and incidental to this Offer is final and shall be binding on all persons.

• Disputes, if any, arising out of or in connection with or as a result of above Offer or otherwise relating hereto shall be subject to the exclusive jurisdiction of the competent courts / tribunals in Mumbai.

• All taxes, duties, levies or other statutory dues and charges payable in connection with the offer shall be borne solely by the Customer and the Bank will not be liable in any manner whatsoever for any such taxes, duties, levies or other statutory dues and charges.