-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex Services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

A special salary account for Government employees

-

Monthly interest credit on savings

-

Personal accidental cover of ₹1 crore

-

Zero Balance Savings account

-

Purchase protection of up to ₹1 lakh

-

Free and unlimited ATM transactions at any bank ATM

-

Monthly interest credit on savings

-

Personal accidental cover of ₹1 crore

-

Zero Balance Savings account

-

Purchase protection of up to ₹1 lakh

-

Free and unlimited ATM transactions at any bank ATM

Salary Account for Government Employees - Nation FIRST

IDFC FIRST Bank brings a unique salary account proposition for employees working in the Public sector enterprises and Central/State government departments of India.Read More

With this salary account, enjoy a host of benefits including free personal accident cover, child education grants, girl child marriage cover, air accident insurance, purchase protection, and lost card liability on your account.Read Less

₹1 crore free personal accident insurance cover | Free ₹1 crore Air accident cover

Benefits

Personal accident insurance cover

Personal Accidental Insurance cover (death or permanent disability) of up to ₹1 crore

Air accident cover

Complimentary Air accident cover of up to ₹1 cr.

Zero Balance Savings Account

No minimum balance required in your Nation FIRST Salary Account

Purchase protection & Lost card Liability

Purchase protection of up to ₹1 Lakh & Lost Card Liability of up to ₹8 Lakhs on your debit card

Free & Unlimited ATM access

Free & unlimited ATM access at any IDFC FIRST Bank ATM or any other bank ATM

Cyber Insurance

Complimentary Cyber Insurance Cover of Rs 2 Lakh

Features & Benefits | Food order and Dining

Enjoy the convenience of ordering food and groceries with Swiggy One Lite

- Enjoy 10 free deliveries on food orders above ₹149.

- Get 10 free deliveries on Instamart orders above ₹199.

- Receive up to 30% extra discounts across 20,000+ restaurants over and above the regular offers.

Features & Benefits | Shopping & Entertainment

Get unlimited entertainment benefits and FREE 1-day delivery with Amazon Prime

- Free unlimited same-day/1-day delivery

- Access to HD-quality movies and shows on Prime Video on any one device of your choice (mobile/TV)

- Early access to deals and shopping events

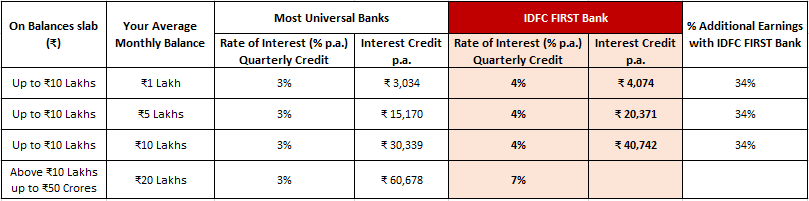

Monthly Interest Credit on your Savings Accounts

- Earning Interest on Interest with IDFC FIRST Bank

- Monthly interest credits versus the industry norm of Quaterly interest credit.

- Free and unlimited ATM transactions at any bank anywhere in india

- Industry best Giveaways!

VISA Platinum Debit card

- Personal Accidental Insurance cover (death or permanent disability) of up to ₹1 crore: includes ₹90 Lakhs for personal accident + ₹4 Lakhs each for max 2 child education grant + ₹2 Lakhs for girl child marriage

- Air accident cover of up to ₹1 Crore

- Purchase protection of up to ₹1 Lakh & Lost Card Liability of up to ₹8 Lakh on your debit card

- Lounge access across major airports

ELIGIBILITY

For Physical Bank Account Opening:

- Passport-size photograph

- If you have a PAN Card, it is mandatory to provide it while opening your account

- Any one of the following document:

- Aadhaar Card

- Passport

- Voter’s Identity Card (Election Card)

- Permanent and valid driving license with photograph

- Job Card issued by NREGA duly signed by an officer of the State Government

- Letter issued by the National Population Register containing details of name and address.

FREQUENTLY ASKED QUESTIONS

Who can open Nation FIRST Salary Account?

Nation FIRST Salary Account can be opened by personnel serving in the Public sector enterprises and Central/State government departments of India.

What is the initial pay-in amount required to open a Nation FIRST Salary Account?

The IDFC FIRST Bank Nation FIRST Salary Account is a Zero Balance Account as long as salary is being credited in your salary account. No initial pay-in amount is required to open Nation FIRST Salary Account. However, if salary credit has been stopped due to any reason for three or more months, then you are required to maintain Average Monthly Balance (AMB) as per the account variant, otherwise applicable charges will be levied.

What happens if salary credit from employer is not received in the account for more than 3 months?

If salary credit has been stopped due to any reason for three or more months, then you are required to maintain Average Monthly Balance (AMB) as per the account variant, otherwise applicable charges will be levied.

What benefits & features would I get on opening an IDFC FIRST Bank Nation FIRST Salary Account?

You can enjoy a superior banking experience with IDFC FIRST Bank Nation FIRST Salary Account with benefits such as:

- Attractive interest rates on your savings, so you can earn more

- Zero charges on 28 commonly used Salary Account services like IMPS, NEFT, RTGS, ATM transactions, cheque book issuance, SMS alerts, cash transactions, etc.

- Monthly Interest Credits, so you can earn 'interest on interest'

- Higher Personal Accident and Air Accident Cover with your Debit Card

- Exciting offers on food, shopping, travel, & more with your Debit Card

and much more

How does the Monthly Interest Credits feature work and how will I benefit from it?

With an IDFC FIRST Bank Nation FIRST Salary Account, experience the joy of earning Monthly Interest Credits on your Salary Account. You earn 'interest on interest' with the power of monthly compounding. I IDFC FIRST Bank is the first universal bank in India to provide this feature, against the standard practice of crediting interest on your Salary Account every quarter.

Monthly compounding interest payout is better for you than Quarterly interest payout because when you get interest credit in Month 1, the interest for Month 2 is paid on your opening balance + interest received in Month 1 and so on. So, you earn more on your savings!

Interest will be calculated on progressive balances in each interest rate slab, as applicable. Please note, interest rates are subject to periodic change. Can you afford to not have an IDFC FIRST Bank Nation FIRST Salary Account?

What does the Zero Charges feature mean?

With IDFC FIRST Bank Nation FIRST Salary Account you can enjoy ZERO Charges on 28 commonly used Salary Account services like IMPS, NEFT, RTGS, ATM transactions, Cash transactions, Cheque book issuance, SMS alerts and more. You can know more about services offered at Zero Charges here.

What are the documents required to open a Nation FIRST Salary Account?

To open a Nation FIRST Salary Account, you require Aadhar Card and PAN Card along with proof of employment, which can be offer letter, Organisation ID card, or pay slips.

What are the different ways I can add money/transfer funds to my account?

You can add funds to your Nation FIRST Salary Account by one of the following ways:

- Via any other bank’s NetBanking/Mobile app. Simply add your IDFC FIRST Bank account details – Account number and IFSC code

- Through our Mobile app by clicking on “Add funds” option which lets you add transfer money from your other bank accounts

- Depositing a cheque at any of our branches

- Depositing a cheque at any IDFC FIRST Bank ATM

- Using any UPI app using your UPI ID

What are the modes through which I can access and keep a track on transactions in my IDFC FIRST Bank Nation FIRST Salary Account?

We offer multiple methods to track your IDFC FIRST Bank Nation FIRST Salary Account. Here are a few ways you can do it:

- NetBanking

- Mobile App

- WhatsApp Banking

- Monthly Account statements sent to your registered email ID

Can I add a nominee to my Nation FIRST Salary Account? How many nominees can I add?

Yes, you can add 1 nominee to your Nation FIRST Salary Account.

How can I add a nominee to my IDFC FIRST Bank Nation FIRST Salary Account?

You can add a nominee to your Nation FIRST Salary Account in one of the following ways:

- Via NetBanking or Mobile Banking App

- By visiting your nearest IDFC FIRST Bank branch

What is the Times Prime membership and what are the eligibility conditions to avail it?

Times Prime is a comprehensive digital membership service that lets you enjoy premium subscriptions like Disney+ Hotstar, YouTube Premium, EazyDiner, Google One, ET Prime among 20+ subscriptions. Additionally, get exclusive offers and discounts from brands like Myntra, Uber, Urban Company, etc.

Customers will get the complimentary Times Prime membership only for the first year of onboarding.

Eligibility Conditions: Download and activate IDFC FIRST Bank Mobile Banking App within first 3 month of account opening.

Customer should have an active salary account (>25K)

Redemption: Customers receive the voucher through WhatsApp on their registered mobile number within 30-45 days of meeting the eligibility criteria.

The voucher will be available for redemption for 60 days after receiving. Post this, the bank will not entertain any queries regarding the same.

What is the Swiggy One Lite membership and the eligibility requirement?

Swiggy One Lite is a membership offered by Swiggy that allows customers to enjoy 10 free deliveries on food orders & groceries. Customers also receive up to 30% extra discounts across 20,000+ restaurants over and above the regular offers.

Customers will get a complimentary Swiggy One Lite quarterly membership (renewed every 3 months based on eligibility conditions).

Fulfillment Conditions

DC & UPI Spends worth ₹5000 at merchant establishment in the last three months through IDFC FIRST Bank Salary A/C. P2P transfers through UPI & cash withdrawal through ATM will not be considered. – Renewed quarterly.

AND

Active Salary Account: Salary credit in last 3 consecutive months (>50k)

Redemption: Customers receive the voucher through WhatsApp on their registered mobile number within 30-45 days of meeting the eligibility criteria.

The voucher will be available for redemption for 60 days after receiving. Post this, the bank will not entertain any queries regarding the same

What is the Amazon Prime membership and what are the eligibility conditions to avail it?

Amazon Prime is a membership that offers free same day/next day delivery, early access to sales, access to Prime Video and Prime Music, among other Amazon services.

Customers will get a complimentary Amazon Prime quarterly membership (renewed every 3 months based on eligibility conditions).

Eligibility Conditions: Payment of Loan EMI or CC bill from IDFC FIRST Bank Salary A/C. Payment amount >₹5000 will be considered (3 months cumulative) – Renewed quarterly.

AND

Active Salary Account: Salary credit in last 3 consecutive months (>50k)

Redemption: Customers receive the voucher through WhatsApp on their registered mobile number within 30-45 days of meeting the eligibility criteria.

The voucher will be available for redemption for 60 days after receiving. Post this, the bank will not entertain any queries regarding the same.