CKYC Registry

-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Top Products

Popular Searches

Bank Accounts

Populer FAQs

How do I upload my signature?

Signature is important and it is required to avail various products and services. To upload your signature

1. Go to More

2. Select Customer Service Dashboard

3. Select ‘Savings/Current Accounts’

4. Select ‘Upload Signature’ to upload your signature.

How do I track service requests which I have already raised?

That's easy! Follow these steps to track your service requests:

1. From the home page of the app, tap on "Customer Service" section

2. Scroll down to "Track my service requests" to find all your requests

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

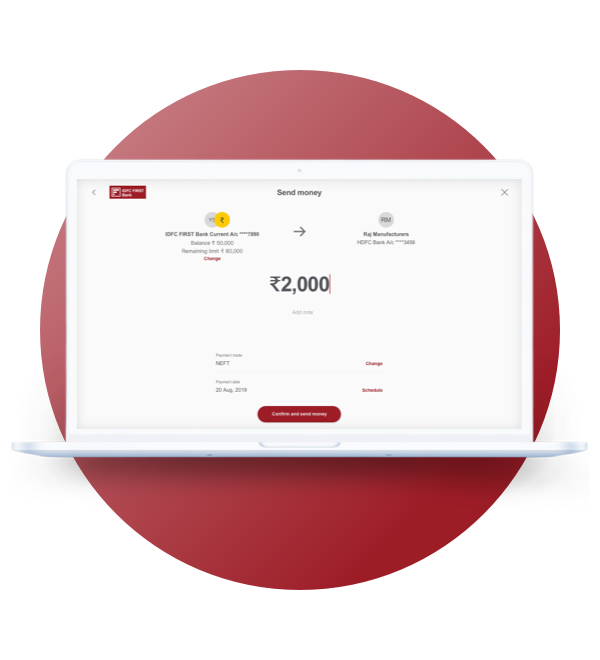

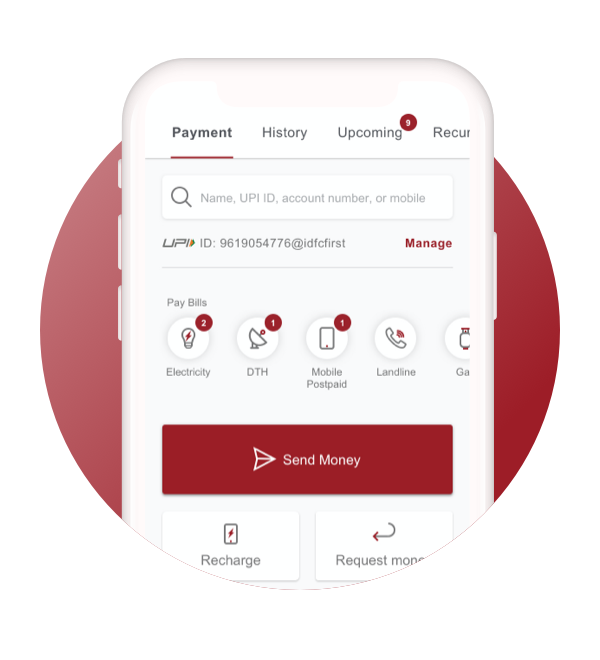

3-Click Payments

money transfers

Transfer funds from your IDFC FIRST Bank’s account in a safe and secure manner

3-Click Payments

money transfers

Transfer funds from your IDFC FIRST Bank’s account in a safe and secure manner

-

Quick and Secure Payments

-

No charges for transactions

-

Easy Access through Internet & Mobile Banking

-

Quick and Secure Payments

-

No charges for transactions

-

Easy Access through Internet & Mobile Banking

Online Money Transfer

Transfer funds quickly and effortlessly with IDFC FIRST Bank. We offer multiple services to safely and securely move your money. Our bank money transfer services are available for you anytime, anywhere. We provide online money transfers through NEFT, IMPS, RTGS as well as our mobile banking app. You can even step into your nearest IDFC FIRST Bank branch and easily transfer funds.Read More

Experience the ease of online fund transfers with IDFC FIRST Bank and get the following features –

· Fund transfer within your own or other persons' IDFC FIRST Bank account.

· Fund transfer to Non-IDFC FIRST Bank accounts and to make Non-IDFC FIRST Bank Credit Cards payments.Read Less

IMPS

Instantly transfer funds from one account to another with our Immediate Payment Service, (IMPS). Available 24/7, you can access this bank money transfer service through internet banking or the IDFC FIRST Bank mobile app. You can transfer funds up to ₹5,00,000 with just the IFSC code of the recipient’s bank. Our IMPS service is brought to you by the National Payments Corporation of India, (NPCI), in collaboration with its member banks.

Transfer through IMPS

What are the benefits of online fund transfers through IMPS?

With IDFC FIRST Bank Funds Transfer, you can avail many benefits through IMPS:

· Send & receive money instantly

· Transfer funds 24/7

· Transfer funds online safely & securely

· Receive instant confirmations

What are the steps required for bank money transfers through IMPS?

Successfully carry out bank money transfers through our IMPS channels by following these simple steps:

1. Log onto internet banking/ mobile banking app

2. Select ‘Fund transfer’ on the left

3. Select ‘Transfer Now’

4. Enter the amount you want to transfer (must be between ₹1 and ₹5,00,000 only)

5. Select a beneficiary, or use our ‘One Time Beneficiary’ option to transfer funds without registering a beneficiary

6. IMPS will be selected for by default

7. Click ‘Submit’ and enter in the OTP sent to your registered mobile number

8. Once verified, the funds will be transferred to the beneficiary

NEFT

Transfer funds to a third-party account through our National Electronic Fund Transfer service. You can complete online money transfers to an account from any bank that is a participating member of RBI’s National Electronic Fund transfer (RBI – NEFT) scheme. You can execute online fund transfers through our internet banking portal, mobile banking app or at your nearest IDFC FIRST Bank branch. We have a minimum transfer limit of ₹1 and a maximum of ₹20,00,000.

Link for NEFT- FAQ - https://rbi.org.in/Scripts/faqview.aspx?Id=60

Transfer through NEFT

What are the steps required to carry out online money transfers through NEFT?

To complete online money transfers through our NEFT channels, kindly follow these simple steps:

1. Log onto internet banking/mobile banking app

2. Select ‘Fund transfer’ on the left

3. Select ‘Transfer Now’

4. Enter the amount you want to transfer (minimum ₹1.00 and maximum up to ₹20,00,000)

5. Select a beneficiary or use our ‘One Time Beneficiary’ option to transfer funds without registering a beneficiary

6. Select NEFT as the payment method

7. Click ‘Submit’ and enter in the OTP sent to your registered mobile number

8. Once verified, the funds will be transferred to the beneficiary

Kindly note, you will only be able to make payments through internet banking, if you have a single or unconditional signing authority on your account.

• Requests received between 8:00 AM and 6:59 PM on weekdays (except Sundays & Bank holidays) will be processed on the same day.

The time taken to credit the Beneficiary's account will be dependent on the time taken by the Beneficiary's bank to process the payment.

How can I track status of NEFT transactions initiated? Who should be approached to know status of the NEFT transaction?

Visit any of IDFC FIRST Bank Branch or call our Customer Care at 1800 10 888, You can also raise a service request by visiting Raise a request | IDFC FIRST Bank or contact beneficiary bank through their Customer Facilitation Center (CFC) by visiting https://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=2070

For the purpose of faster tracking of transaction, you may need to provide few details related to transaction such as Unique Transaction Reference (UTR) number / transaction reference number, date of transaction, sender IFSC, amount, beneficiary name, beneficiary IFSC, etc., to bank.

RTGS

Immediately transfer funds to any third-party beneficiary with our Real Time Gross Settlement System (RTGS). The only requirement that needs to be fulfilled is – the beneficiary’s account must be associated with a bank that participates in RBI’s Real Time Gross Settlement System (RBI – RTGS) scheme. Send money on-the-go through internet banking or our mobile banking app. Alternatively, you can visit our branch to initiate an RTGS online fund transfer. You can transfer a minimum of ₹2,00,000 and above.

Link for RTGS - FAQ - https://www.rbi.org.in/commonman/English/Scripts/FAQs.aspx?Id=275

Transfer through RTGS

What is the process to carry out fund transfer through RTGS?

To transfer funds through our RTGS channels, kindly follow these simple steps:

1. Log onto internet banking/ mobile banking app

2. Select ‘Fund transfer’ on the left

3. Select ‘Transfer Now’

4. Enter the amount you want to transfer (must be ₹2,00,000 and above)

5. Select a beneficiary or use our ‘One Time Beneficiary’ option to transfer funds without registering a beneficiary

6. Select RTGS as the payment method

7. Click ‘Submit’ and enter in the OTP sent to your registered mobile number

8. Once verified, the funds will be transferred in the respective RTGS cycle to the beneficiary

Kindly note, for any requests received between 8:00 AM and 6.59 pm on weekdays – (except Sundays & Bank holidays) will be processed on the same day.

The time taken to credit the Beneficiary's account will be dependent on the time taken by the Beneficiary's bank to process the payment.

How much time will it take to process the online money transfer?

Here is a detailed breakdown of our timings for processing of your requests on the same day:

| Cut Off Timings for Same Day Processing | |||

| Transaction Type | Monday-Saturday | Sunday | RBI Holidays |

|---|---|---|---|

| IMPS | --------------24 X 7 Available all year around!!!-------------- | ||

| NEFT | --------------24 X 7 Available all year around!!!-------------- | ||

| RTGS | --------------24 X 7 Available all year around!!!-------------- | ||

Transaction Limits of IMPS / NEFT / RTGS

| Online | Branch | |||

|---|---|---|---|---|

| Transaction Type | Minimum Limit | Maximum Limit | Minimum Limit | Maximum Limit |

| IMPS | ₹ 1 | ₹5,00,000 | ₹1 | ₹5,00,000 |

| NEFT | ₹1 | ₹20,00,000 | ₹1 | No Limit |

| RTGS | ₹2,00,000 | ₹20,00,000 | ₹2,00,000 | No Limit |

UPI

Unified Payment Interface” (UPI) is a payment method powered by the National Payment Corporation of India (NPCI) to simplify and provide a single interface for merchant payments and funds transfer. UPI is a channel that enables linking of multiple bank accounts into a single mobile app. UPI enables customers to send and receive money from their smart phones with a single identifier, Virtual payments address; without needing to disclose any confidential details like bank account information or card number

Internet Banking or Mobile Banking App

Conveniently transfer funds in a few clicks through our internet banking portal or our mobile banking app. We offer online money transfer services through IMPS/NEFT/RTGS. Here’s a detailed list of the many services you can avail while banking through our portals:

- Transfer funds to an existing beneficiary

- Transfer funds to a non-existing beneficiary by selecting our ‘One Time Beneficiary’ option

- Schedule a transfer through one of the following methods:

- Set the start and end date for the transfer, specifying the frequency of the transfer at your convenience. This can be weekly, monthly, quarterly, half-yearly and yearly.

- Set the number of times the online money transfer should occur from the start date using our ‘Repeat’ feature.

Branch

- Date

- Your account details

- Your beneficiary’s account details

- Select transfer method (this can be NEFT/RTGS or if it is a transfer to an IDFC FIRST Bank account)

- Transfer amount in figures and words

- Your signature (if it is a joint account, signatures of both account holders will be required)

- Directly from a branch executive at your nearest branch

- Downloading it from our website

Step into your nearest IDFC FIRST Bank and easily complete online money transfers through our NEFT/RTGS channels. To transfer funds online, you will need to fill out the following details in your money transfer form:

Submit this filled form to our branch executive and we will process the transfer as per the NEFT/RTGS cycles. If it is a transfer to an IDFC FIRST Bank account, the money transfer will be processed immediately.

Kindly note, IMPS is an online transaction and cannot be done through our branch. You can get a money transfer form from the following places: