-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex Services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

Maximize

your earning

with up to 7.25%

interest p.a.*

Enjoy monthly interest credits with your IDFC FIRST Bank Corporate Salary account

-

₹35 lakhs free personal accident insurance cover

-

Enjoy monthly interest credits with your IDFC FIRST Bank Corporate Salary account

-

Zero Balance Account with unlimited ATM access

-

₹35 lakhs free personal accident insurance cover

-

Enjoy monthly interest credits with your IDFC FIRST Bank Corporate Salary account

-

Zero Balance Account with unlimited ATM access

Corporate Salary Account

With an IDFC FIRST Bank Corporate Salary Account, you can boost your earnings and access a host of perks like never before! Our salary account offers a competitive interest rate, monthly interest credits, zero-fee banking on commonly used services, unlimited ATM withdrawals, no transfer fees, and additional benefits to grow your savings quickly.Read More

Easily manage your finances on-the-go and track your expenses with our award-winning mobile banking app. Take advantage of complimentary banking services such as cash withdrawals, IMPS, RTGS and NEFT, and enjoy exclusive discounts on various lifestyle and shopping apps.

That’s not all! You get the option to open an Employee Reimbursement Account instantly via Internet Banking. This account functions as a Savings Account and accumulates interest over time.Read

Less

₹35 lakhs free personal accident insurance cover | Free air accident insurance cover

Interest up to 7.25%

Features and Benefits of IDFC FIRST Bank Salary Account

Grow your personal savings with a high-interest salary account

Earn monthly interest credits for enhanced savings

Keep what you earn with no minimum balance requirements

Get attractive discounts and offers on dining, food, and beverages with IDFC FIRST Bank Debit Card

Enjoy free and unlimited access to ATMs across the country

Take advantage of exclusive VISA privileges with your debit card

Stay insured against mishaps with personal accident and air accident coverages

Corporate Salary Account With VISA Platinum Debit Card

- Free Personal Accidental Insurance Cover (death or permanent disability) of ₹35 lakhs

- Free Air Accident Insurance cover of ₹1 Cr

Corporate salary account with Visa Classic debit card

- Daily cash withdrawal of ₹1 lakh and higher purchase limit of ₹4 lakh

- Personal accident insurance coverage up to ₹5 lakh

- Lost card liability protection up to ₹4 lakh

Salary account with amazing benefits

Enjoy exciting dining deals on delicious food and beverages with your IDFC FIRST Bank Debit Card

Free Personal Accidental Insurance Cover (death or permanent disability) of ₹35 lakhs

Free & unlimited ATM access

The on-boarding vouchers/benefits offered in the first 30 days post Salary Account opening have been discontinued w.e.f .1st July'22

Travel Benefits

Flight & Hotel cancellation up to Rs. 25,000/-

- Valid for both Domestic & International sector

Travel Insurance worth 5,000 USD on International trip

- Loss of Checked in Baggage, Delay of checked in Baggage, Delay in Flight, Missed Connecting Flight, Loss of Passport & travel related documents

Road-Side assistance to Card holder 4/year

- Towing of Vehicle on breakdown/accident , Alternate Battery or Jump Start, Tyre Change among Others

ELIGIBILITY

For Digital Bank Account Opening:

- Aadhaar number

- PAN number/ Form 60

For Physical Bank Account Opening:

- Passport-size photograph

- If you have a PAN Card, it is mandatory to provide it while opening your account

- Any one of the following document:

- Aadhaar Card

- Passport

- Voter’s Identity Card (Election Card)

- Permanent and valid driving license with photograph

- Job Card issued by NREGA duly signed by an officer of the State Government

- Letter issued by the National Population Register containing details of name and address.

FEES & CHARGES

Find out about our minimal and transparent fees & charges

Disclaimer: With IDFC FIRST Bank Savings Accounts, enjoy Zero Charges on all Savings Account services. These services are being offered free in good faith, and in case of misuse of services, the Bank reserves the right to levy charges. Forex mark-up fee will be applicable on International ATM/POS/Debit card transactions. T&Cs are subject to periodic changes. All rights reserved.

FREQUENTLY ASKED QUESTIONS

What is a Salary Account?

A Salary Account is a type of Zero Balance Savings Account, where an employer deposits monthly salary of an employee to the Bank Account. IDFC FIRST Bank Salary Accounts offer 24x7 access to your Account through NetBanking/ Mobile Banking App. It allows you to track spends, earn rewards, check your risk profile, invest in Mutual Funds in a click, experience Google-like search, cash flow analysis and much more.

What is the initial pay-in amount required to open a Salary Account?

The IDFC FIRST Bank Salary Account is a Zero Balance Account as long as salary is being credited in your salary account. No initial pay-in amount is required to open Salary Account. However, if salary credit has been stopped due to any reason for three or more months, then you are required to maintain Average Monthly Balance (AMB) as per the account variant, otherwise applicable charges will be levied.

What happens if salary credit from employer is not received in the account for more than 3 months?

If salary credit has been stopped due to any reason for three or more months, then you are required to maintain Average Monthly Balance (AMB) as per the account variant, otherwise applicable charges will be levied.

Can I continue with my IDFC FIRST Bank Salary Account, if I change my job?

Yes, you can continue with your existing Salary Account with IDFC FIRST Bank if your new employer has a banking relationship with IDFC FIRST Bank. You can check the same with your company HR and can get your IDFC FIRST Bank Salary Account mapped to the payroll system.

What benefits & features would I get on opening an IDFC FIRST Bank Salary Account?

You can enjoy a superior banking experience with IDFC FIRST Bank Salary Account with benefits such as:

- Attractive interest rates on your savings, so you can earn more

- Enjoy ZERO charges on all Saving Account services like IMPS, NEFT, RTGS, ATM transactions, cheque book issuance, SMS alerts, cash transactions, etc.

- Monthly Interest Credits, so you can earn 'interest on interest'

- Higher Personal Accident and Air Accident Cover with your Debit Card

- Exciting offers on food, shopping, travel, & more with your Debit Card

and much more

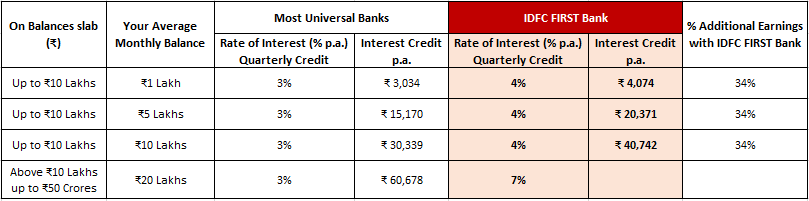

How does the Monthly Interest Credits feature work and how will I benefit from it?

With an IDFC FIRST Bank Salary Account, experience the joy of earning Monthly Interest Credits on your Salary Account. You earn 'interest on interest' with the power of monthly compounding. IDFC FIRST Bank is the first universal bank in India to provide this feature, against the standard practice of crediting interest on your Salary Account every quarter.

Monthly compounding interest payout is better for you than Quarterly interest payout because when you get interest credit in Month 1, the interest for Month 2 is paid on your opening balance + interest received in Month 1 and so on. So, you earn more on your savings!

Interest will be calculated on progressive balances in each interest rate slab, as applicable. Please note, interest rates are subject to periodic change. Can you afford to not have an IDFC FIRST Bank Salary Account?

What does the Zero Charges feature mean?

IDFC FIRST Bank Savings Account you pay ZERO charges* on all Saving Account services ike IMPS, NEFT, RTGS, ATM transactions, Cash transactions, Cheque book issuance, SMS alerts and more. You can know more about services offered at Zero Charges here

What are the documents required to open a Salary Account?

To open a Salary Account, you require Aadhar Card and PAN Card along with proof of employment, which can be offer letter, Company ID card, or pay slips.

What are the different ways I can add money/transfer funds to my account?

You can add funds to your Salary Account by one of the following ways:

- Via any other bank’s NetBanking/Mobile app. Simply add your IDFC FIRST Bank account details – Account number and IFSC code

- Through our Mobile app by clicking on “Add funds” option which lets you add transfer money from your other bank accounts

- Depositing a cheque at any of our branches

- Depositing a cheque at any IDFC FIRST Bank ATM

- Using any UPI app using your UPI ID

What are the modes through which I can access and keep a track on transactions in my IDFC FIRST Bank Salary Account?

We offer multiple methods to track your IDFC FIRST Bank Salary Account. Here are a few ways you can do it:

- NetBanking

- Mobile App

- WhatsApp Banking

- Monthly Account statements sent to your registered email ID

Can I add a nominee to my Salary Account? How many nominees can I add?

Yes, you can add 1 nominee to your Salary Account.

How can I add a nominee to my IDFC FIRST Bank Salary Account?

You can add a nominee to your Salary Account in one of the following ways:

- Via NetBanking or Mobile Banking App

- By visiting your nearest IDFC FIRST Bank branch

Salary Account Blogs

FEATURED

What is Salary Account & its features and benefits

A Salary Account is a type of Savings Account for salaried individuals that has some specific features and benefits, apart from helping the individual to save money on a regular basis. Learn more about Salary Account in detail in this article.

Team FinFIRST10 Dec 2023 • 3 mins read

-

How to save money each month from your salary

10 Dec 2023 • 3 mins read

-

How to open a salary account in India

10 Dec 2023 • 3 mins read