Need a new product? Call 1800 10 888

Are you ready for an upgrade?

Login to the new experience with best features and services

For Loan Accounts

For Wholesale Accounts

Notifications

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

Activate your Credit Card within minutes and enjoy unlimited benefits

Accounts

Deposits

Loans

- IDFC FIRST Bank Loans

- Personal Loan

-

Consumer Durable

Loan - Home Loan

- Education Loan

- New Car Loan

- Pre-owned Car Loan

- Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan - Gold Loan

- Loan Against Property

- Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

Wealth & Insure

Payments

Cards

- IDFC FIRST Bank Cards

-

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Club Vistara

IDFC FIRST

Credit Card - Forex Card

- Deals

- Debit Cards

- Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card

MSME Accounts

Trade Services

MSME Loan

MSME Solutions

Offers

Cash Management Services

Corporate Lending

Treasury

NRI Savings Account

NRI Fixed Deposit

FOREX Solutions

Transfer to NRE

About Us

- MD & CEO letter about the bank

- MD & CEO

- Our History

- Letter to Shareholders on the 1st Annual Report after Merger

- Letter to Shareholders on the 2nd Annual Report after Merger

- Letter to Shareholders on the 3rd Annual Report after Merger

- Letter to Shareholders on the 4th Annual Report after Merger

- Board of Directors

- Awards & Accolades

- News Room

Investors

Careers

ESG

Credit Card Balance Transfer

Balance Transfer (BT) facility on IDFC FIRST Bank Credit Card enables the customers to transfer their outstanding credit balances from any other bank credit card to their IDFC FIRST Bank Credit Card. BT on EMI is an additional facility offered by IDFC FIRST Bank Credit Card to its cardholders where customers may choose to transfer the balance and convert it to easy, affordable EMIs Every Credit Card company has its own eligibility criteria as per internal policies for customers who wish to avail card to card balance transfer. Read More

Features

Go ahead and fulfill all your dreams with IDFC FIRST Bank Personal Loans!

Low Interest Rates

Customer can avail low interest rates with IDFC FIRST Bank Credit Card by transferring outstanding balances from other bank Credit Cards with higher interest rates.

Easier to pay off debt

Availing Credit Card Balance Transfer will allow the customer a longer timeline to pay off their credit card dues at lower interest rates.

Single Click Application

Customers can easily avail card to card transfer online in one click using our mobile application which is user friendly and seamless.

Consolidation on Balances on Single Card

Managing balances will become convenient for customers as they can do so by consolidating on a single credit card.

Minimal Processing Fee

Customers will be charged a minimal processing fee of 1% (min Rs.99) plus GST

Flexible Tenures

Credit Card Balance Transfer is offered to customers at flexible tenures of 3-, 6-, 9- and 12 months

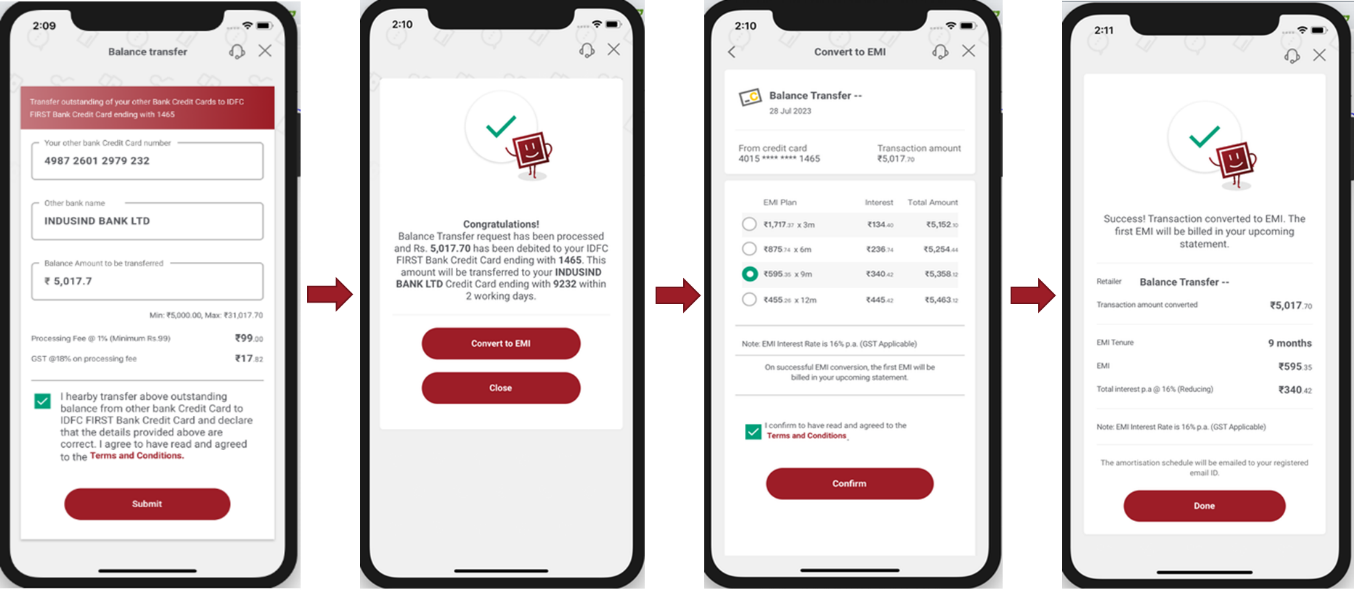

How to apply for a Credit Card Balance Transfer

You can transfer your credit card balance to IDFC FIRST Bank credit card in the following way:

Step 1: Enter your other bank’s credit card number

Step 2: Enter the other bank's name

Step 3: Mentioned the balance amount to be transferred to your IDFC FIRST Bank Credit Card

Step 4: Select your preferred option from the attractive EMI Plans

Step 5: The balance will be transferred to your IDFC FIRST Bank Credit Card

ELIGIBILITY

Who Can Apply?

FREQUENTLY ASKED QUESTIONS

How to use Credit Card Balance Transfer on your IDFC FIRST Credit Card?

What are the benefits of Credit Card Balance Transfer on your IDFC FIRST Credit Card?

Here are the benefits of availing credit card to credit card balance transfer:

· Low Interest Rates

· Easier to pay off debt

· Single Click Application

· Consolidation on Balances on Single Card

· Minimal Processing Fee

· Flexible Tenures

· Fund transfer through NEFT/IMPS

What are the details required for processing Credit Card Balance Transfer?

Customers must provide other Bank Card Number, Bank Name and the billed outstanding amount. We will pay off the outstanding amount on their behalf and they can easily repay it in low-cost EMIs.

For which bank cards customers can avail Credit Card Balance Transfer on EMI?

Customers can avail credit card balance transfer for most of the credit cards, issued by different banks in India. Currently, this facility is not available for Amex Credit Cards.

How will the amount be remitted?

The amount will be directly credited to your Credit Card Account. There is no paper remittance, and the transfer process is seamless.

When can I opt for a credit card balance transfer?

If your credit card dues and credit card interest rates are high, you can opt for a Credit Card Balance Transfer to transfer your outstanding dues to another bank that offers you an economical interest rate.

Why should I choose a credit card balance transfer from IDFC FIRST Bank?

IDFC FIRST Bank’s Credit Cards provide attractive cash back offers and rewards. IDFC FIRST Bank also offers low interest rates and doesn’t charge unnecessary fees.

How can I check the status of my credit card balance transfer application?

A Credit Card Balance Transfer usually takes 1-5 working days to be completed. However, you can contact IDFC FIRST Bank Customer Care to know your credit card balance transfer status.