CKYC Registry

-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex Services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

Growth, you will agree, is not an issue in India. Mid-teens ROE can be built for sure, most good banks have achieved it. Our incremental margins are strong. Our business is highly scalable. We have a very high level of corporate governance. We focus on the customer. I believe it is inevitable that value will be created in this approach.

Letter to Shareholders

Dear Shareholders,

It gives me great pleasure to write this note for you on the occasion of the Second Annual Report of the merged entity, IDFC FIRST Bank.

Recap

In last year’s report, my note had described the circumstances that led to the creation of IDFC FIRST Bank.

To recap briefly, IDFC Limited was a successful institution, which was initially conceptualised for infrastructure financing in 1997, and expanded into investment banking & institutional securities (2007), Mutual Funds (2008), Infrastructure Debt Fund (2015), and after acquiring a banking license in 2015, successfully built corporate banking and had already commenced the build-up of retail banking.

Capital First was founded in 2012, through a PE backed leveraged buyout of an existing NBFC, and was singularly focused on financing small entrepreneurs and consumers who were largely un-banked in this country. The company grew from ₹ 94 crore to ₹29,625 crore in 8.5 years, acquired 9 million customers, enjoyed a 5-year CAGR loan growth of 29%, and a five year CAGR of 56% in profits, leading to a net profit of ₹327 crore for the year ended on March 31, 2018, the last financial year prior to the merger. The company was first-time credit provider to millions of people. To recap, in last year’s Annual Report, with respect to the Business model of the new bank, I had simplistically said that the high-margin loan business of Capital First (NIM of 8.5%) would be placed atop the low cost liabilities franchise of IDFC Bank. That still holds, but this is an over-simplification intended to drive home the simplicity of the model; that we will be a predominantly retail bank. This does not mean we will exit corporate banking, it’s an important business segment for us; it has trade, forex, cash management, salary accounts, treasury and related businesses, our Bank has developed excellent systems for managing these services.

In December 2018, at merger, we defined our mission as “we want to touch the lives of millions of Indians in a positive way by providing high-quality banking products and services to them, with particular focus on aspiring consumers and entrepreneurs of our new India, using contemporary technologies.”

A new beginning

We were practically a new bank on merger. We had a new Board of Directors, new management, a renewed focus and drive, and we began building a new brand, IDFC FIRST Bank with new colour, logo and positioning.

Like with anything new, say, a new car, new clothes or shoes, with the newness comes a great deal of energy and excitement. Say, if you are building a new house, you would fuss over flooring, tiles, walls and what they would be made of.

The financial year 2019-20 was a year of building the foundation for the Bank. This was a year of non-stop, high octane action at our Bank; we completed the merger, integrated two systems, technology, processes and people, re-defined reporting hierarchies, energised the teams, went all out for retail liabilities (up 157%), grew retail loans (up 40%), changed the composition of the balance sheet, reduced dependence on institutional deposits, reduced Top-20 borrower exposure percentages, reduced Top-20 depositor percentages, dealt with unexpected hits on some wholesale banking accounts, appointed a brand ambassador, dealt with COVID-19 and lockdowns, raised ₹ 2,000 crore of equity capital in the midst of the lockdown, and are submitting this annual report to you from behind screens.

You would plan the placement of your living room, bedrooms, children’s room, parents’ room, study room, prayer room and so on. You would fuss over every input material from the paint to the colour of the tile or marble. The feeling we get at IDFC FIRST Bank today is no different. Every element, from culture, customer first theme, ethics, systems, technology stack, processes, SOPs, governance, grooming, dress codes, and brand colours, we deliberate every one of these.

The year gone by

The financial year 2019-20 was a year of building the foundation for the Bank. This was a year of non-stop, high octane action at our Bank; we completed the merger, integrated two systems, technology, processes and people, re-defined reporting hierarchies, energised the teams, went all out for retail liabilities (up 157%), grew retail loans (up 40%), changed the composition of the balance sheet, reduced dependence on institutional deposits, reduced Top-20 borrower exposure percentages, reduced Top-20 depositor concentration percentages, dealt with unexpected hits on some wholesale banking accounts, appointed a brand ambassador, dealt with COVID-19 and lockdowns, raised ₹ 2,000 crore of equity capital in the midst of the lockdown, and are submitting this annual report to you from behind screens! I would like to now share with you the key priorities we worked upon, the progress we made in FY19-20, and the outlook going forward.

Financials

In the face of the heightened uncertainly in the corporate business environment, the Bank had to provide for certain Corporate accounts this year. In Q2 FY19 (pre-merger), the Bank had provided for ₹ 518 crore towards certain wholesale banking accounts to P&L. In the merger quarter (Q3 FY19), we had to account for ₹ 2,599 crore of Goodwill, with no impact on Networth. In Q4 FY19, it came to light that two of our legacy wholesale banking accounts, Dewan Housing and Reliance Capital, where we had exposures of ₹ 1,784 crore, were in financial trouble. Though technically they were not yet NPA, we came forward and told the shareholders things as they stood, we did not hide behind client confidentiality or technicalities. We provided 15% of such principal exposure to the P&L and posted a pre-tax loss of ₹ 417 crore in Q4 FY19. In the next quarter (Q1FY20), their condition deteriorated significantly. We promptly recognised these issues on our books in Q1 FY20, and took the total provision to ₹ 1,097 crore, or 75% of then principal outstanding, which we believed was an appropriate market value for these bonds. We subsequently sold part of these exposures in the market at similar valuations so our estimate on valuation was correct. We also had to provide for a large infrastructure account and posted a loss of ₹ 617 crore. In Q2 FY20, corporate tax rate in India came down to 25%. Our Bank had historically created deferred tax assets (DTA) of about ₹ 2,800 crore which we promptly revalued based on the new corporate tax rate and provided ₹ 750 crore to tax line of the P&L. Further, we also provided for a troubled infrastructure account and reported a loss of ₹ 680 crore in Q2 FY20. In Q3 FY20, following the Hon. Supreme Court decision on the interpretation of their revenue sharing obligations to the Government, we recognised one large telecom exposure as stressed and recognised ₹ 1,622 crore, or 50% of the exposure to the P&L. We also provided for an infrastructure account and posted a loss of ₹ 1,639 crore in Q3 FY 20. Our Bank has proactively recognised the stress in the corporate loan book in a transparent manner. As mentioned earlier, our Bank was originally an infrastructure lending company converted to a bank. Infrastructure and corporate loans traditionally have been low-yield businesses and our Bank did not have enough pre-provisioning profits to absorb these losses. We are not proud of these P&L numbers and are working towards structurally improving the profitability of the Bank in a steady manner. But the point also is, that every single time, even under extreme pressure of having to face investors, media and other stakeholders with losses quarter on quarter, we chose straightforwardness and transparency and said it as it was. Last month, I heard one motivational speaker mention a mythological story about Krishna, Balarama and a monster, where a monster howled down Balarama, but Krishna rose bigger than the monster by staring back at him and by dealing with him without fear.

He concluded that “if we avoid what we must face, the problem becomes bigger and we become small. If we face the problem and look it in the eye, the problem becomes small and we become bigger”. This also represents one of our foundational philosophies. We will always be straightforward and truthful with our investors and all stakeholders. Our stakeholders can always be rest assured that everything that will be represented by our Bank will be truthful and accurate

Read more about Products and

Services

Download IDFC FIRST Bank App

Progress at the Bank

If for a moment, you look beyond the P&L numbers, and focus on the core value drivers of the Bank, you will see the Bank has made tremendous progress in FY19-20.

Our Bank has a unique history. Prior to merger, IDFC Bank was created by a demerger process of a large infrastructure financing institution (funded loan book of ~ ₹ 75,000 crore).

It had loan assets carved out from IDFC Limited, and was funded largely by wholesale liabilities, as it had started commercial operations only in October 2015. Capital First was a medium size NBFC (loan book of ~ ₹ 30,000 crore) and was also funded by wholesale liabilities. Thus, neither institutions had Retail Deposits in any significant measure, but together had a large loan book of ₹ 1,04,660 crore.

Thus, at merger as of December 31, 2018, the Bank had ₹ 1,08,020 crore of Institutional borrowings and institutional deposits and ₹ 10,400 crore of Retail Deposits. So, our first priority was to retailise (diversify) the liabilities of our Bank. Within just a year, we have grown retail liabilities (Retail CASA and Retail Term Deposits) by ₹ 20,710 crore, up 157%, from ₹ 13,214 crore as on March 31, 2019 to ₹ 33,924 crore as on March 31, 2020. Our CASA ratio grew to 31.87% as of March 31, 2020, as compared to 11.40% as of March 31, 2019.

Our Bank enjoys an excellent brand image. Q4 FY20 was, without doubt, the most trying period of our lifetime. Global indices crashed 20-25%, and NYSE shut down at lower circuit breakers, twice in March 2020. Our own stock exchanges were crashing by the day due to COVID-19. There was total panic in the markets. At the same time, news about one private sector bank was quite negative and that bank was put on moratorium by the regulatory authorities. You will be happy to note even in a quarter of such chaos, the Retail Deposits of our Bank grew by ₹ 4,658 crore in Q4 FY20 alone, representing a sequential QoQ growth of 16%. Such is the confidence our Bank enjoys in the market

.Retail Deposits as a percentage of total customer deposits increased from 32.63% as on March 31, 2019 to 58.77% as on March 31, 2020. To build a granular bank with Retail Deposits is one of the foundations for any bank, and we made strong progress on that.

Usage of Retail Deposits

So what did we do with ₹ 20,710 crore of Retail Deposits we raised during the last financial year? You might think we lent it out as any bank would. But no! We used this money to straightaway reduce our borrowings through Certificate of Deposits (CD). Retail Deposits are highly diversified across millions of customers and are stable, while CDs are low-cost short-term borrowings with tenures generally between 30 days to 180 days and usually subscribed by the Mutual Funds. The liabilities side of the Bank became very stable because of this swap we did during the last financial year.

Our Bank enjoys an excellent brand image. Q4 FY20 was, without doubt, the most trying period of our lifetime. Global indices crashed 20-25%, and NYSE shut down at lower circuit breakers, twice in March 2020. Our own stock exchanges were crashing by the day due to COVID-19. There was total panic in the markets. At the same time, news about one private sector bank was quite negative and that bank was put on moratorium by the regulatory authorities. You will be happy to note even in a quarter of such chaos, the Retail Deposits of our Bank grew by ₹ 4,658 crore in Q4 FY20 alone, representing a sequential QoQ growth of 16%. Such is the confidence our Bank enjoys in the market.

Growth in Retail Assets

We grew retail loan book by 40% from ₹ 40,812 crore as on March 31, 2019 to ₹ 57,310 crore as on March 31, 2020. These are diversified over 9 million customers. To be able to lend millions of small loans with ticket size as low as ₹ 12,000 at scale is one of our strategic capabilities. To build a diversified loan book is one of the foundations for any bank, and we made strong progress on that front. It also goes well with our mission statement of touching millions of lives in a positive way.

So how did we raise funds for growing the retail book by ₹ 16,498 crore if we used all of our incremental deposits to repay CDs? That’s where the second part of the strategy comes in.

Reduction in Wholesale Funded Assets

We reduced the Wholesale funded assets book from ₹ 53,649 crore as on March 31, 2019 to ₹ 39,388 crore as on March 31, 2020, down 27 percent. This released ₹ 14,261 crore of funds for us apart from reducing concentration risk.

One of the issues for our Bank has been our infrastructure financing exposures (as part of the wholesale funded assets), which apart from having low margins, are also prone to execution risks, political risks and project completion risks. Say a state government reneges on a PPA agreement, or a demonstration/ protest stalled the completion of road. We deal with depositors’ money and are unable to take these risks. I’m happy to state that last year, we have brought down our exposure to infrastructure by 31%, from ₹ 21,459 crore as on March 31, 2019 to ₹ 14,840 crore as on March 31, 2020. At one stage, our Bank had 71.2% of the loan book from infrastructure loans, today this is as low as 13.9%.

Margins

A key feature for any bank is Net Interest Margins (NIM)– what we earn from customers’ loans less what we pay to depositors. Strong banks in India have NIM of about 4.2- 4.3%. I’m happy to share with you that under our strategy, our NIM swiftly moved to 4.24% for Q4 FY20. For context, this was 1.56% in Q2 FY19 (pre-merger quarter), so you know profits are not far away.

Culture is not just about how things get done around here, it’s a much longer list such as, about how people conduct themselves in office and in society, how committed they are to the mission, how to resolve conflicts, not using offensive or abusive words, imbibing the organisation’s policy that the customer comes first and so on.

Having a bank with strong margins gives us the ability to invest and is one of the foundational capabilities for growth in the future. A corollary to this is Net interest Income (NII) = Interest Earned less Interest paid. You may have wondered how our NII could go up by 40% from ₹ 1,113 crore during Q4 FY19 to ₹ 1,563 crore during Q4 FY20 even though our loan book did not grow. Now you know the answer.

Equity capital

Equity capital is a key foundational element. In June 2020, we raised ₹ 2,000 crore of equity capital which took our capital adequacy to near 15%. With extreme chaos in markets worldwide and in India, most potential institutional investors wanted to stay in their bunkers. Investors had their own redemption pressures to deal with. Also, from their point of view, there was no visibility on the credit losses that may hit because of COVID-19 disruption, and in the chaos, projections were meaningless. Under these circumstances, we got our Board clearances, pitched to potential investors, got legal clearances, secured shareholders’ approval and all this just operating from behind video screens. Our Bank raised ₹ 2,000 crore of fresh equity capital from top-notch investors by requesting them to look beyond our current P&L numbers and focus on the core business we are building. We thank you, our new investors, for your trust in us, we will not let you down.

The best part is that we did not even engage an investment banker; these were direct deals by our Bank, and in this process our Bank must have saved about ₹ 30 crore in investment banker fees alone!

Many people believe that this capital has been raised to cushion losses that may accrue because of COVID-19 disruption. Indeed this was an insurance availed by us because of COVID-19, but we hope and believe we may not need to use it as we work our way through the next few quarters.

Culture

Culture is not just about how things get done around here, it’s a much longer list such as about how people conduct themselves in office and in society, how committed they are the mission, how to resolve conflicts, not using offensive or abusive words, imbibing the organisation’s policy that the customer comes first and so on. For instance, when recently one private sector bank was in the news for wrong reasons, I wrote a mail to all our employees asking them not to chase down that bank’s customers to move their deposits to us, and not to talk ill about that bank or about any other bank for that matter. If you have to comment, respect other banks for their work. We educated our staff to say that the regulator is monitoring the situation closely and we are sure the situation will stabilise for them soon. To prey on someone else’s customers, particularly, when they are down is not our style and that’s not how we want to grow, was the message. I am happy that our employees stuck to this theme entirely.

The Bank honoured all offers that were made to new hires before the pandemic, including all lateral hires as well as 550 management trainees even when COVID-19 uncertainty was at its peak. This is in keeping with the Bank’s philosophy of honouring its commitments in all circumstances.

So, culture is not a slogan, but it is what is practised day in and day out; and I assure you that we work towards instilling good practices in our people.

It is not without reason that CRISIL, India’s premier rating agency has evaluated and rated our fixed deposit programme FAAA, which is the rating category indicating highest degree of safety. They evaluated all the above factors before assigning us the rating. CRISIL also rated our long-term subordinated unsecured debt at AA stable, the rating for unsecured debt very few banks in India enjoy and that tells you something about the inherent strength of our Bank.

Growth

A number of investors have sought to know when we will see growth at the Bank. I agree we have not grown the overall loan book last year. It’s deliberate. Because as mentioned earlier, on the liability side we had low CASA ratio at merger. If we continue to grow the loan book, then this issue of low CASA ratio and low Retail Deposits % will never get fixed. I see it as my responsibility to get all our foundations firmly in place before we start growing the loan book, and retail liabilities is one of the foundational items for a bank. So, we grew retail liabilities instead.

Safety first

Let me share with you a quick instance of the benefit of not growing loan book in FY20. As mentioned earlier, during the last financial year, we raised ₹ 20,710 crore of Retail Deposits but used it all to retire Certificate of Deposits (short term institutional borrowings) of equivalent amount. Our CD book (short term money) came down from ₹ 28,754 crore as on March 31, 2019 to ₹ 7,111 crore as on March 31, 2020, a reduction of ₹ 21,643 crore within a year!

| Certificate Deposits | Dec-18 | Mar-19 | Jun-19 | Sep-19 | Dec-19 | Mar-20 | YoY% |

|---|---|---|---|---|---|---|---|

| (₹ Cr) | 22,312 | 28,754 | 20,058 | 15,283 | 12,720 | 7,111 | -75% |

It turned out to be very prescient because when COVID-19 struck in March of 2020, which is a once-in-a-century event, suddenly many institutional markets like Insurance companies and Mutual Funds practically froze and stopped investing. CD markets and NCD markets, which was flowing freely until a quarter ago, stalled as Mutual Funds were facing extreme redemption pressures. But we had worked on this matter all through the year, and were well prepared for a crisis, if any. Because we hardly had any significant CD to repay, we were in a comfortable position

We closed March 31, 2020, with high liquidity, with Liquidity Coverage Ratio of 141%. To sum up this point, safety first is one of our foundational principles, and we demonstrated it during the year in ample measure. I assure you we have a highly stable liabilities platform.

As far as our institutional borrowings are concerned, they are the most stable, as they cannot be called on demand, and are payable on maturity, which are generally between 3-5 years.

It is not without reason that CRISIL, India’s premier rating agency has evaluated and rated our fixed deposit programme FAAA, which is the rating category indicating highest degree of safety. They evaluated all the above factors before assigning us the rating. CRISIL also rated our long-term subordinated unsecured debt at AA stable, the rating for unsecured debt very few banks in India enjoy and that tells you something about the inherent strength of our Bank.

Asset quality

Our Bank maintains high asset quality. Our retail loan book, which is the large and growing proportion of our Bank’s book, has seasoned over a large number of credit cycles over 10 years (including both entities’ lifetimes). We have strong monitoring and collection capabilities, and strong checks and balances. Our portfolio and processes have been stress-tested through economic problems of 2010-14, Demonetisation (2016), GST implementation (2017). Through a 10-year period including the stress periods mentioned above, our retail Gross and Net NPA have broadly been at 2% and 1% respectively. In January and February 2020, we were experiencing our lowest quarterly retail credit losses in recent times. As far as the impact of COVID-19 on our retail portfolio is concerned, the exact impact on the portfolio is yet to be known, but we are working our way through this;we have time-tested systems, processes and capabilities. We will share more with you as more clarity emerges.

COVID-19 impact on our business

During April and May 2020, our incremental lending volumes were practically nothing. Our book growth is therefore stalled this quarter. But as things begin to normalise, people will begin consuming again. We are beginning to see that consumption businesses like personal credit, two wheelers etc. have already picked up to about 50-70% of pre-COVID-19 volumes, where ever lockdown is lifted. Demand in SME lending is still low, say 20% of pre-COVID-19 levels. My sense is that we have lost about one year of book growth. Once we see through this phase, then India will be back to its growth phase, and we will be back to our growth ways. We provided moratorium to almost all customers who requested for it. Right now we are actively reaching customers and providing them funding under the Emergency Credit Line Guarantee Scheme from the GOI.

Why 7% on our Savings Deposits make ample sense

Our Bank has a unique history because of two lending institutions merging with each other. Capital First’s borrowing cost for Q2 FY19 (quarter prior to the merger) was ~ 8.5%. IDFC Limited borrowings, specifically pertaining to infrastructure and long-term bonds that were transferred into IDFC Bank at de-merger, were at ~ 8.9%. Together, including some other similar borrowings, we are servicing ` 43,875 crore (as of March 31, 2020) of such borrowings at ~ 8.6% anyway. Hence seen in this light, 7% is pretty inexpensive money for us and is a positive trade for the Bank! Further, the business lines we have chosen for incremental lending comfortably support these rates.

Our responsibility

I often talk to customers from different socio-economic backgrounds and understand their cash flows. In the last one year alone, I have spoken to newspaper vendors, rural microloan customers, buffalo and cow owners, taxi drivers, coconut sellers and the like, at their place. They live in difficult conditions with family income of ` 5,000-15,000 a month. We realise that even if we take a penny from them which does not belong to us, it would be inappropriate. A lot of them are not very literate and may not even know if we did fine-print banking with them. If we take it systemically, it would be terrible; it would be ungainly money for us.

The information arbitrage between them and us is huge, and this adds to the responsibility of our employees to be ethical at all times with all of them. No matter the wealth of the counterparty, to behave appropriately and accurately with them is our responsibility. Through this letter, and even in our internal communication, we say this at large, so that if any employee plans something inappropriate in any segment for pressure of P&L, or tries fine-print banking, then their colleagues will hold them back and point to our principles, which is an inherent check and balance.

Creating value

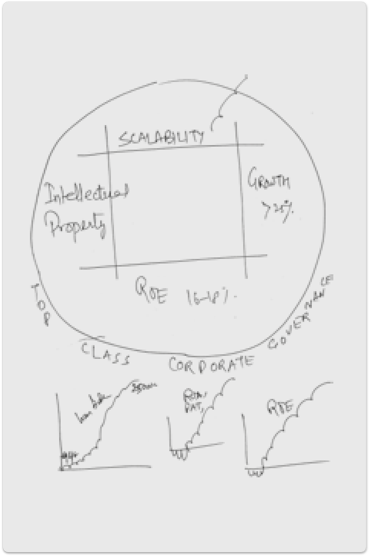

That leads us to the next question - how do we create value from here. In 2010-2012, I used to scribble the following sandbox afresh on any rough paper I found, countless times the same thing, to every new PE or employee I met, on how value will be created or prospective senior employees.

The sandbox was very simple - the pitch was that significant value can be created if we can (a) create Intellectual Property (b) build a scalable business (c) grow at 25% (d) generate ROE of 16-18%, and support it by exceptional corporate governance. When I reflect on this sheet now, many years later, I find the word Customer Experience missing in this theme though, which is something I would fix if I were to remake this sheet today; I’d place the Customer Experience at the center of this sheet.

Over time, I’ve added more elements to the theory, that the businesses we build should be relevant to society, with ability to evolve and other such things.

I believe all of these can be achieved in our Bank in due course. Growth, you will agree, is not an issue in India. Mid-teens ROE can be built for sure, most good banks have achieved it. We have excellent intellectual property both on the liability side and the asset side. We operate in our area of strength, our incremental margins are strong. Our business is highly scalable. We do business that is important for society. We are passionate about serving our customers well. We borrow at 7% and lend at 12-14%. We have a very high level of corporate governance.

I believe it is inevitable that value will be created in this approach.

I believe one of the core value drivers will be to have a certain level of profitability which comes blindfolded; i.e. it is in-built in our business model. Meaning the Core NII plus Core fees minus Normalised credit losses should take us to 16%-18% core return on equity. Core means not having sporadic one-time incomes from rainmakers. I believe the incremental businesses that we do at our Bank is fundamentally structured for this model, and in due course we will be able to get there. I want to assure you that I have been in this situation before. In Capital First including the earlier avatar, in the first few years, the company posted losses but we did not take any short cuts, we built a safe and secure business model. Once we became profitable on a core basis, it was a one-way path to profits and value creation for the next six years.

Customer Experience

Our commitment to customer experience is extreme. When I do come across customer issues in customer review meetings, I take them very seriously. We deal with millions of customers, so any solution we find has to be systemic. We have developed systems whereby every issue is drilled down to the root so that it does not occur for other customers.

Based on customer surveys, the trend of Problem Incidents percentages and their trendlines, the descriptions of customer goodwill by our branch teams, etc. our staff fels that

on the whole, we do provide outstanding service. But “on the whole” is not the “whole thing”. Though in percentage terms mistakes are low, but in terms of absolute numbers we are making many mistakes. This is one of the issues with the early stage of our Bank, because of huge inflow of customers at this early stage of our Bank. Our systems were down on April 1, 2020, our Mobile App was very slow, and it caused great inconvenience to customers who logged in that day. I once came across a customer complaint where our response had rather long-winded pleasantries and platitudes, included a sales pitch for 7% savings account to boot, but did nothing to solve the customer’s problem. In another instance, the call center sent a holding mail to the customer, had redirected the query to another internal department for a solution, while in that case, the call center could themselves have decided in favour of the customer in an empowered way. In another case, instead of giving a customer precise information for a query, we had sent a mail with many links embedded, a lazy job, almost saying “go discover yourselves”. These things upset me. In each of those cases, we have set up teams who are automating the processes, implementing STP, delegating authorities, increasing team capacity if required, empowering them, training them, and eliminating the root cause in each case. We are also introducing technology-led solutions using data analytics and digital workflows to address these issues. Most importantly we are educating our staff to be empathetic to our customers if we want to be a great bank.

However, I must say that the drive of our employees to deliver outstanding services, is unparalleled. On one occasion, our customer, a respected septuagenarian, called us one day at the contact center, expressing urgency for his wife’s operation to be done, and needed cash urgently at the hospital. Our customer service executive reached out to the nearest Ahmedabad branch executive, who carried the FD liquidation form to customer at the hospital, and delivered cash at the hospital. The customer’s wife’s operation was successful and customer was thrilled. On another occasion our staff had gone out of the way to deliver a lost Debit Card to a householder in time for festivities at Kolkata in 24 hours as courier services were not available at that time. Our staff proudly share hundreds of these stories with us, sometimes even customers write in with these stories. We appreciate all those employees immensely. The ideal solutions are of course systemic. Our Bank ensured uninterrupted services at both the Branches and the Contact center during the lockdown. We quickly arranged for telephony apps, VPN and other critical infrastructure, and we ensured that almost all services were available for our customers throughout the pandemic crisis and lock-down.

We are still in our early stages, learning, improving our processes, and finding systemic solutions to every problem. I am quite confident that with this constant process of introspecting, learning, rapid re-learning, willingness to scrap what we built and rebuild, and our willingness to build new technologies, we will improve our services going forward and fill our gaps.

They live in difficult conditions with family income of ` 5,000-15,000 a month. The information arbitrage between them and us is huge, and this adds to the responsibility of our employees to be ethical at all times with all of them. No matter the wealth of the counterparty, to behave appropriate and accurately with them is our responsibility. Through this letter, and even in our internal communication, we say this to them, so that if any employee plans something inappropriate programme in any segment for pressure of P&L, or tries fine-print banking, then their colleagues will hold them back and point to our principles, which is an inherent check and balance.

Stake Sale

Finally, there was a lot of concern expressed by investors about sale of stock by me during COVID-19. I had purchased ESOP stocks on leverage in 2017, and was holding on to it since two years, and in March 2020, had exercised more options and wanted to hold it for four or five years as I was confident of what we are building. I thought that if held for longer period of time, substantial value can be created and I could square the position after a few years. In other words, I thought I could beat the cost of debt by appreciation in the stock. I had earlier leveraged the Capital First buyout successfully; i.e. leveraging the buyout and holding on to the stock for 6-7 years, and was following the same path. But COVID-19 waylaid the best laid plans, and margin calls were triggered. Also, the trading window was closing soon for Q4 FY20 quarterly results and trade by lenders would not be in order. It is my regret that I had to sell the stake under these circumstances. I hope the buyer, on the day I did the sale at COVID-19 prices, makes good returns.

I sincerely thank the past management of IDFC Bank for laying the platform, foundation, and building critical infrastructure for retail liabilities, which, after the merger, we used in full measure to scale up, by introducing customer centric programmes.

We have an extremely strong Board of Directors with highly capable and reputed professionals who have run large institutions. We have very detailed and rich discussions at the Board on all important matters. I thank every one of them for their thoughtfulness, wisdom, their active participation, and guidance at the Board. To each one of our employees, thank you for being with us and working so hard. I express my sincere thanks to our regulator who monitor us closely, guide us and support us particularly well. I thank the media for your forthright reporting. I thank our customers for their trust in our institution. Finally, I thank all of our shareholders for your continued trust and confidence on us.