CKYC Registry

-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Top Products

Popular Searches

Bank Accounts

Populer FAQs

How do I upload my signature?

Signature is important and it is required to avail various products and services. To upload your signature

1. Go to More

2. Select Customer Service Dashboard

3. Select ‘Savings/Current Accounts’

4. Select ‘Upload Signature’ to upload your signature.

How do I track service requests which I have already raised?

That's easy! Follow these steps to track your service requests:

1. From the home page of the app, tap on "Customer Service" section

2. Scroll down to "Track my service requests" to find all your requests

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

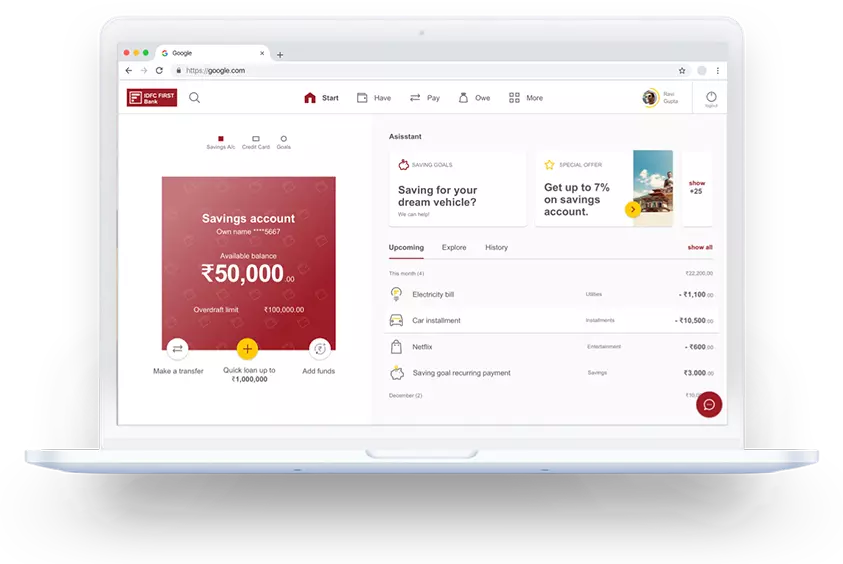

Bank from Anywhere, Anytime – Safely and Seamlessly

Making banking effortless —so you can focus on what truly matters

Bank from Anywhere, Anytime – Safely and Seamlessly

Net Banking

Paying bills, depositing money, opening accounts, receiving loan approvals, and withdrawing money once meant travelling to the branch office, long queues at the Bank, and a whole day wasted. But what were tedious tasks once, can now be managed within a few clicks and from the comfort of your home. Financial transactions have changed for the better with the advent of internet banking services. E-banking services have made the process of banking much simpler today. At IDFC FIRST Bank, you can avail internet banking services – quite like the ones you would receive at a physical bank – without moving out of your own home. Every banking service you ever needed is now just a click away with IDFC FIRST Bank’s personal e-banking facilities. Whether it is checking your account balance or taking out a personal loan, internet banking makes all of it possible with utmost ease. It’s everyday banking, simplified for you!

Benefits of IDFC FIRST Bank Internet Banking Services

With us, banking isn’t just digital—it’s personal. Here’s how Internet Banking with IDFC FIRST Bank makes your life easier:

Bank from anywhere

View balances, download statements, and manage money without visiting a bank branch

Easy money transfers

Instantly and securely transfer funds via NEFT, RTGS, IMPS, or UPI

Seamless savings account integration

Stay on track with your savings goals with ‘Connect all Banks’ feature

Online loan management

View and download statements, pay your loans online, and more from the comfort of your home

Auto-Pay feature

Make sure you’re never late for a payment with seamless auto-pay options

24x7 Access

Internet banking lets you access your accounts and associated services 24x7, from anywhere

100% Secure platform

Built with end-to-end encryption, OTP verification, and two-factor authentication

Don’t have a Savings Account yet? Open one online in minutes - no branch visits, no paperwork.

Features of IDFC FIRST Bank Internet Banking Services

Internet Banking at IDFC FIRST Bank is built to empower. Here’s what you can do:

Access all your IDFC FIRST Bank products in one place—from savings accounts to credit cards, loans, and beyond

Instant money transfer via NEFT, IMPS or RTGS

Set up deposits and investments with just a few clicks

Pay utility bills, recharge your phone, or schedule future payments with ease

The smarter way to manage your money starts with your Savings Account

Get full access to Internet Banking instantly.

Ways to Transfer Funds

With NEFT, you can instantly transfer money between your bank accounts or to any Third Party Beneficiary holding an account with any other bank. These funds transfers are executed using (RBI) Reserve Bank of India's InterBank Transfer Scheme.

With RTGS, you can transfer money instantly to any Third Party (Beneficiary) holding an account with a bank other than IDFC FIRST Bank, if the beneficiary's bank participates in RBI Real Time Gross Settlement (RBI - RTGS).

Internet Banking FAQs

What is internet banking?

Internet banking is an electronic solution that allows you to make transactions, payments, and other activities on the Internet via the Bank's secure platform.

What are the benefits of using internet banking Services?

You can use internet banking to execute your banking transactions from any place that is convenient for you. Internet banking offers a wide range of electronic transactions and data to aid in the management of your financial holdings. It's safe and practical.

What are the services and transactions which can be accessed through internet banking?

The services and transactions that can be accessed through internet banking are:

- Checking your account balance

- Viewing the transaction history of your banking accounts and credit card

- Transferring money between various accounts

- Transferring funds overseas

- Transferring funds to a different bank account

- Making online payments

- Enquiring on interest rates

- Opening new Term/ Fixed Deposit

- Maintaining old and new cheque books

- Updating personal information

Will there be any charges for signing up for internet banking?

No, there are no signing up charges.

Is internet banking easy to use?

Yes, internet banking is very easy to use and people from all age-groups and ways of life can avail of this service.

What are the types of transactions I can carry out through my IDFC FIRST Bank Net Banking?

If you’d like to view a complete list of all the transactions you can do on online, and through mobile Net Banking, click here

What does Funds Transfer mean?

A funds-transfer is simply transferring funds from your own account to any of the following:

1. Your other accounts under your user ID

2. To other beneficiaries (within IDFC FIRST Bank/outside IDFC FIRST Bank), also known as Third Party Funds Transfer

It’s one of the many advantages of Net Banking with IDFC FIRST Bank.

Funds Transfer for online Net Banking to other Banks can be of 3 types:

• IMPS, (Immediate Payment Service), is a real-time service which allows customers to transfer funds from their account to another bank account in an electronic manner. This transaction can be done 24x7. The beneficiary receives the credit instantly.

• NEFT, (National Electronic Funds Transfer) allows bank customers to transfer funds, pay credit card bills of other banks in an electronic manner to other Bank. NEFT follows RBI’s working calendar.

• RTGS, also known as Real Time Gross Settlement, is the fastest way to transfer funds in an electronic manner. Transactions are done and payments are received in real-time.

What are the charges of IMPS, NEFT and RTGS?

There are NO charges for any funds transfer or transaction/transfer types for online Net Banking. They are free of cost.

How do I add a beneficiary to my personal Net Banking?

In order to conduct a Third Party Transfer process for online and mobile Net Banking, you’ll need to add a beneficiary to your online bank account. Here are the steps to add one:

- Log into IDFC FIRST Bank Net Banking.

- Select ‘Add Beneficiary’ under ‘Funds Transfer’

- Select the type of beneficiary and fill necessary details

- Enter the OTP received on your registered mobile number

- A notification about beneficiary addition will be sent to your registered mobile number

- The beneficiary will be activated after 30 minutes of being successfully added in the account

How do I create a User ID and Password for my personal Net Banking?

To access online Net Banking, you can create a user ID between 6-10 characters, which can be alphanumeric in nature.

For your personal Net Banking, please do select a user ID which is easy to remember and yet personal to you in nature. The Mobile Net Banking Password should be between 6-15 characters, and you can use a combination of characters, alphabets and numbers to create one.

How do I register for online Net Banking?

Steps to register for IDFC FIRST Bank Net Banking services are as follows:

1. Visit the IDFC FIRST Bank website, and click on ‘Login’

2. Click on ‘Create Username’

3. Enter UCIC/Customer ID & mobile number, and click on ‘submit’

4. Enter Account Number, or Debit Card Number, or Loan Account Number

5. Enter the OTP received on your registered mobile number

6. Select your Username and create your own IDFC FIRST Bank Net Banking Password and click on submit

7. IDFC FIRST Bank will never ask for customer-sensitive details like Username/Password in any of their communications or in person. Please do not reveal the same. To know more about safe banking practices, please click here.

How can I retrieve my Username?

Follow these steps to retrieve your Username:

1. Visit the IDFC FIRST Bank website, and click on Login

2. Click on ‘Forgot Username’

3. Enter your Customer ID & mobile number, and click on submit

4. Enter your Account Number or Debit Card details

5. Enter the OTP received on your registered mobile number

6. Your Username will be sent to your registered email id. A notification about retrieval of username will be sent on your registered mobile number.

7. You will be able to view your username on the screen as well.

How do I retrieve my Password (IPIN)?

One of the many benefits of Net Banking is that you can set a new password for your IDFC FIRST Bank Net Banking in a few simple steps:

1. Visit the IDFC FIRST Bank website, and click on ‘Login’

2. Click on ‘Forgot Password’

3. Enter the username and mobile number

4. Enter the OTP received on your registered mobile number

5. Enter New Password and click on ‘submit’

Discover Our Banking Products

Savings Account

High interest, Monthly interest credits, zero-fee banking on all services

From the FinFIRST Blog

Looking for tips, ideas, and insights to grow your savings?

FEATURED

What is a digital Savings Account? A complete guide

Digital Savings Accounts offer unparalleled convenience with 24/7 access and lower fees compared to traditional accounts. Opening an account is quick and easy, requiring minimal documentation, and can often be completed online with institutions like IDFC FIRST Bank. Consider potential drawbacks such as transaction limits, technical issues, and security concerns, but leverage advanced features and robust security measures to maximise benefits.

Team FinFIRST10 Sep 2024 • 3 mins read

-

Paying bills on time: A simple step towards financial stability

28 Apr 2025 • 3 mins read

-

Explore easy banking with IDFC FIRST Bank Digital Savings Account

24 Apr 2025 • 3 mins read

-

Account aggregation: Your secret weapon for financial management

31 Jul 2024 • 3 mins read

-

What are the benefits of choosing digital savings accounts?

27 Mar 2024 • 3 mins read