CKYC Registry

-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Forex Card

-

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Secured - Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Top Products

Popular Searches

Bank Accounts

Populer FAQs

How do I upload my signature?

Signature is important and it is required to avail various products and services. To upload your signature

1. Go to More

2. Select Customer Service Dashboard

3. Select ‘Savings/Current Accounts’

4. Select ‘Upload Signature’ to upload your signature.

How do I track service requests which I have already raised?

That's easy! Follow these steps to track your service requests:

1. From the home page of the app, tap on "Customer Service" section

2. Scroll down to "Track my service requests" to find all your requests

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

Retirement-ready: A Financial Journey

Ease into retirement like never before with IDFC FIRST Bank

What is retirement planning?

Retirement is a major life milestone. As you reach this stage, your needs and priorities will most likely change. Retirement planning means having a steady flow of money to comfortably meet your needs after retirement. It will ensure that you save enough to maintain your current lifestyle and achieve your financial goals with ease.

Why is it important to plan your retirement?

In your retirement, you would most likely rely on your savings and investments to meet your needs. Retirement planning ensures you have ample life savings that comfortably covers your lifestyle, post-retirement. A well-planned retirement will help you:

- Maintain your current lifestyle even in your retirement

- Combat inflation

- Prepare for unexpected expenses

- Stay financially independent

- Prepare for a long life, with increasing life expectancy

Get effective retirement-ready solutions with IDFC FIRST Bank

Senior Citizen Savings Account

Maximise savings for your golden years with ZERO Fee Banking on ALL Savings Account Services

Senior Citizen Fixed Deposits

Earn additional 0.5% interest with no penalty on premature withdrawals

Mutual Funds

Get personalised investment options based on your risk profile, ensuring a portfolio that aligns with your goals

Retirement Insurance

Build a fund through your earning years so you can generate a steady source of income after you retire

Savings Account

Enjoy ZERO Charges on All Savings Account services like IMPS, NEFT, RTGS transactions & more

Fixed Deposit

Secure your retirement fund with guaranteed returns and high interest rates up to 7.75% p.a.

Mutual Funds

Get personalised portfolio inputs based on your risk profile aligning with your goals, conveniently on our App

Health Insurance

Get comprehensive coverage options, giving you the financial security you need during your retirement

What makes us special?

ZERO charges on ALL Savings Account services like IMPS, RTGS, NEFT, ATM transactions & more

Enjoy the power of monthly compounding with Monthly Interest Credits on your Savings Account

Earn attractive interest rates of up to 7.75% p.a. on Fixed Deposits

Take advantage of ACE Funds - a selection of Mutual Funds picked based on rigorous analysis

Senior Citizens get free doorstep banking & priority treatment at IDFC FIRST Bank branches

Earn additional 0.5% p.a. interest with Senior Citizen Fixed Deposits with no penalty on early withdrawal*

*for FDs < ₹3 cr

Protection against unauthorized digital transactions up to ₹2 lakh with our Senior Citizen Savings Account

Award-winning digital banking platform

Recognised as the 'Best Digital Bank' for the year 2021-2022 by Financial Express India's Best Banks Awards 2023.

Enjoy India's #1 Mobile Banking App

Enjoy India's #1 Mobile Banking App

Enjoy India's #1 Mobile Banking App

Start banking with just a

WhatsApp message. Send

'Hi' to 95555 55555

Experience a secure way

to bank on the go with

our mobile banking app

Banking services now

at your fingertips

anytime, anywhere

Step inside the

world of smart

watch banking

Mutual Fund Return Calculator

Estimate the returns on your Mutual Fund investments

Why should you start planning your retirement early?

Retirement is a phase of life that one should gradually ease into. Like every other stage, it comes with its ups and downs. Goals also tend to shift as we grow older. That's why the age of 40 is the ideal time to start securing your future and planning for retirement.

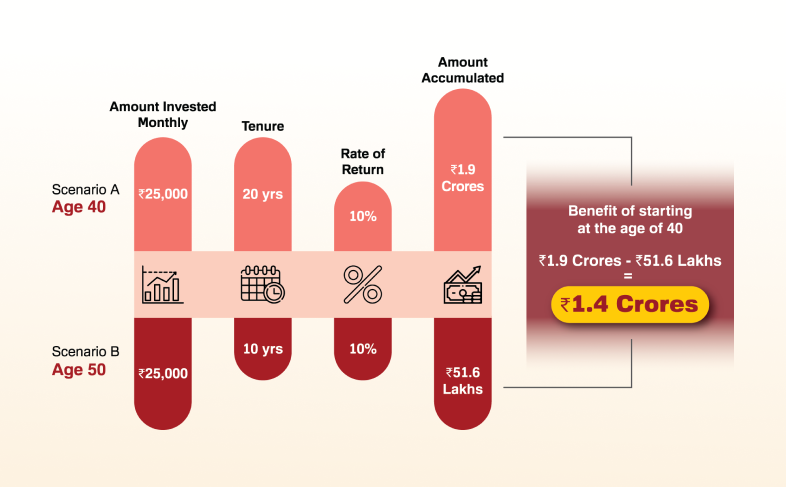

The illustration below presents two scenarios: A and B. In scenario A, the person starts investing at the age of 40, while in scenario B, they start at 50. Both invest ₹25,000 per month until the age of 60. In scenario A, the person builds a corpus of ₹1.9 Crores, while in scenario B, they accumulate only ₹51.6 Lakhs.

Clearly, scenario A results in a larger corpus, gaining an incremental amount of ₹1.4 Crores for retirement.

The illustration is for estimation purposes only and is not to be considered as an advice. The returns mentioned are indicative and not guaranteed in any manner.

Mutual Fund investments are subject to market risks. Please read the relevant documents carefully before investing.

The Bank does not offer Investment Advisory Services.

Please consider your specific investment requirements before choosing a fund or designing a portfolio that suits your needs.

IDFC FIRST Bank is a registered Mutual Fund Distributor (ARN Code 110136)

Read more about Products and

Services

Download IDFC FIRST Bank App

Take advantage of compound interest

Saving for retirement early allows you to take advantage of the power of compound interest. This means you can earn interest on both your initial investment and the accumulated interest over time, resulting in significant growth of your retirement savings.

Lower financial stress

When you start planning for retirement early, you are better equipped to balance other financial goals, such as buying a home, paying for your child’s wedding, or paying for their education. This can help reduce financial stress and give you a sense of security for the future.

Flexibility and control

Early retirement planning gives you the flexibility and control to adjust your savings strategy, explore different investment options, and make informed decisions without rushing or compromising. This can help you make the most of your retirement savings and ensure a comfortable retirement.

Prepare for emergencies

Life is unpredictable, and early retirement planning can provide a financial cushion in case of unexpected events like job loss, medical emergencies, or family needs. Having a solid retirement plan in place can help you weather any unexpected challenges and maintain financial stability.Learn how to manage your finances effectively