-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex Services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

Arrive In Style, Always

Discover a world of luxury travel & experiences with Club Vistara IDFC FIRST Credit Card

Relax, Don’t Wait

Experience smooth Lounge access

Tee Off In Opulence

Explore exclusive Golf Courses

![]() Club Vistara IDFC FIRST Credit Card Features & Benefits

Club Vistara IDFC FIRST Credit Card Features & Benefits

-

Joining Benefits:

• Get 1 complimentary Premium Economy Ticket Voucher*

• Get 1 One Class Upgrade Voucher*

• Enjoy 3 months complimentary EazyDiner Prime membership

-

Complimentary Maharaja Club Silver Membership:

• Priority airport check in

• Increased Check-In Baggage allowance within and outside India

• Priority Waitlist Clearance & Complimentary In flight Wi-fi

-

Power Up Your Spends:

• Earn up to 6 Maharaja Points* on all spends including Utility bill payments, Insurance, Fuel, Rent & Wallet Load

-

Bonus Maharaja Points:

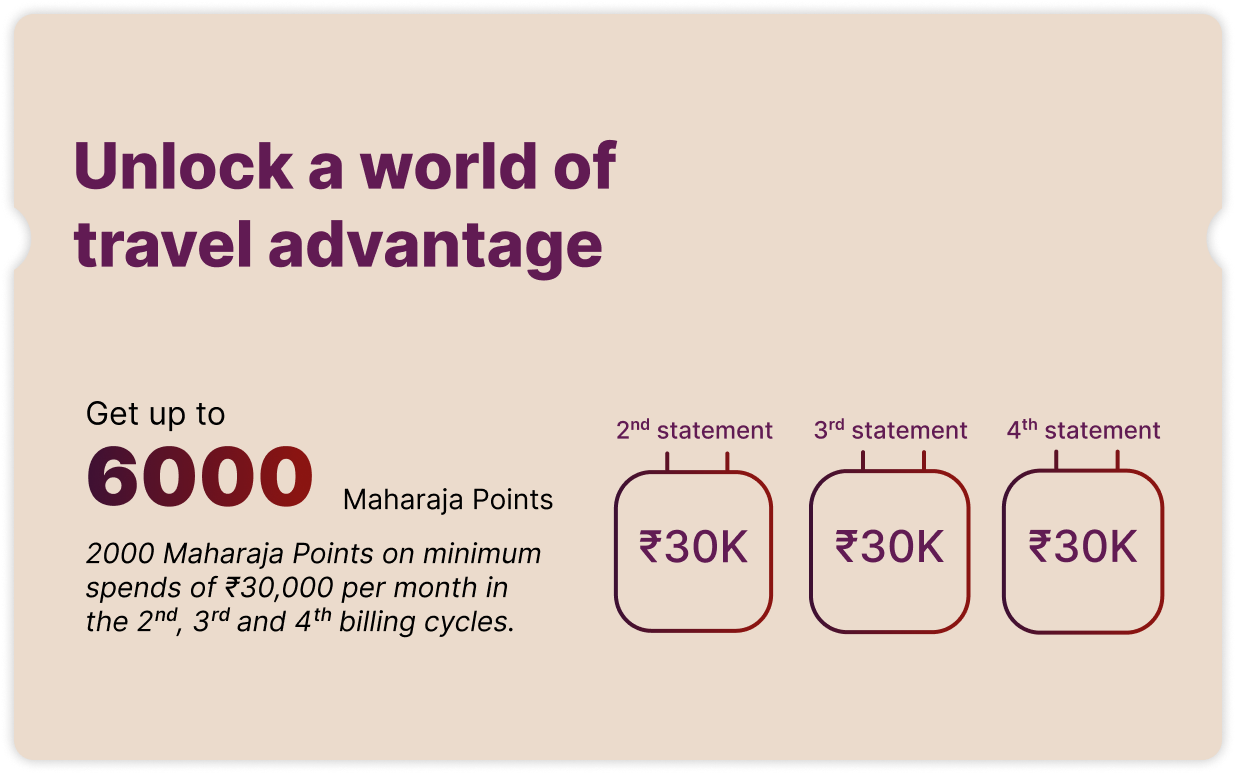

• Get up to 6000 bonus Maharaja Points on crossing monthly spend milestones in the first 3 months*

-

Spend Milestone Benefits:

• Unlock up to 5 Premium Economy Ticket Vouchers every anniversary year

-

Airport Lounge Access:

• Enjoy 8 complimentary visits to domestic airport lounges and spas along with 4 complimentary visits to international airport lounges yearly*

-

Golf Benefits:

• Enjoy 12 complimentary golf lessons and 4 complimentary rounds of golf every year

-

Trip Cancellation Cover:

• Get trip cancellation cover up to ₹ 10,000 on flight and hotel booking (2 claims annually)

-

Savings On International Spends:

• Take advantage of competitive forex mark-up of just 2.99% on international transactions

-

Fees:

• Joining Fee (1st Year) - ₹ 4,999 + GST

• Annual Fee (2nd Year onwards) - ₹ 4,999 + GST

*Terms & Conditions Applicable

![]() Club Vistara IDFC FIRST Credit Card Joining Benefits & Privileges

Club Vistara IDFC FIRST Credit Card Joining Benefits & Privileges

-

1 Premium Economy Ticket Voucher1 One – Class Upgrade e–Voucher

-

Maharaja Club Silver MembershipEazyDiner Prime membership for 3 months

Club Vistara IDFC FIRST Credit Card Reward Points

Club Vistara IDFC FIRST Credit Card Reward Points

-

6 Maharaja Points: Spends up to ₹1 lakh

-

4 Maharaja Points: Spends above ₹1 lakh

-

10 Maharaja Points: On dining spends on your birthday

-

1 Maharaja Point: On every Fuel, Insurance, Utility, Rent & Wallet Load spend (industry practice: 0 CV Points)

-

Maharaja Point earn rate calculated on spend of every Rs. 200. Maharaja Points are not applicable on EMI Transactions, Balance Transfer & Cash Withdrawal.

Terms & Conditions on Club Vistara Benefits

Any taxes and surcharge appearing separately on a statement shall be excluded from Maharaja point calculation.

Monthly payments over ₹20,000 towards utilities (Electricity, Gas, Telecom, etc.) will attract 1% surcharge on all spends on utilities.

Accelerate Your Benefits

Unlock a world of benefits

Club Vistara IDFC FIRST Credit Card Activation & Milestone Benefits

Club Vistara IDFC FIRST Credit Card Activation & Milestone Benefits

*Applicable Billing Cycles: Billing statement for month 2, 3 and 4 from date of joining

Maharaja points shall be credited in your Maharaja Club account within 5 working days after statement generation.

Below is an illustrative example, considering the billing cycle starts from 17th of the month to 18th of the next month

|

Statement 1 |

Statement 2 |

Statement 3 |

Statement 4 |

Card generated |

11 July |

|

|

|

Statement date |

17 July |

17 Aug |

17 Sep |

17 Oct |

No. of days |

|

30 days |

30 days |

30 days |

Spend threshold |

Spends will NOT to be considered for activation Maharaja points |

30 K |

30 K |

30 K |

Bonus reward |

|

2000 Maharaja Points |

2000 Maharaja Points |

2000 Maharaja Points |

Elevate Your Travel Experience

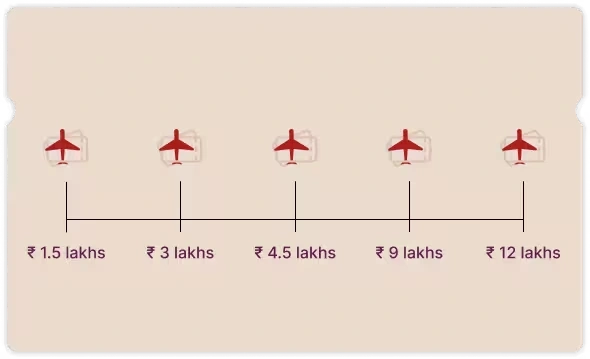

Earn up to 5 Complimentary Premium Economy Ticket Vouchers on achieving spend milestone

Premium Flight Ticket Vouchers

Premium Flight Ticket Vouchers

Each anniversary year, unlock up to 5 complimentary Premium Economy Ticket Vouchers, and travel more!

Spend in a year |

Unlock |

₹ 1,50,000 |

1st Ticket Voucher |

₹ 3,00,000 |

2nd Ticket Voucher |

₹ 4,50,000 |

3rd Ticket Voucher |

₹ 9,00,000 |

4th Ticket Voucher |

₹ 12,00,000 |

5th Ticket Voucher |

Anniversary year is calculated as the 12-month period from the card generation date

Vouchers shall be credited in your Maharaja Club account within 5 working days after statement generation.

Any Taxes & Surcharges will have to be borne by the card member. For more details on your vouchers, please click here

![]() Premium Lifestyle Benefits from Club Vistara IDFC FIRST Credit Card

Premium Lifestyle Benefits from Club Vistara IDFC FIRST Credit Card

-

Golf Benefits on Vistara Credit Card

India Golf Program Know More

• 4 complimentary rounds of green fees per calendar year (1 round in a 1 calendar month)

• 12 complimentary golf lessons per calendar year (1 lesson per calendar month)

• 50% Off on the green fee beyond complimentary sessions

APAC Golf Program Know More

• 50% Off on Golf rounds or lessons across Australia, Bangladesh, China, Hong Kong, Japan, Macao, New Zealand, South Korea, Sri Lanka and Taiwan.

-

Get Airport Lounge Access with Vistara Credit Card

• 2 complimentary visits to Indian airport lounges and spas per quarter on monthly spends of Rs.20,000 w.e.f 1st May 2024 (Check the list here)

• 1 complimentary visit to Global airport lounge per quarter on monthly spends of Rs.20,000 w.e.f 1st May 2024 (Check the list here)

How to access lounges:

• Indian airport lounges – Present your Club Vistara IDFC FIRST Credit Card at the airport lounge

• Global airport lounges – Present your Dreamfolks card. For easier access, do advance bookings online

Click here to Know More..

-

Trip Cancellation Reimbursement:

• Cancellation For Any Reason (CFAR) Insurance: Get reimbursement up to Rs. 10,000 on 2 claims, available for hotel and flight booking cancellations.

For Terms & conditions: Click here

-

Other Travel Insurance Reimbursement:

• Get Air Accident Cover of ₹1 crore*.

• Secure your trip with Personal Accident Cover of ₹10,00,000* and Lost Card Liability Cover of ₹50,000.

• Additional Coverage for loss of checked-in baggage, delay of checked-in baggage, loss of passport & other documents, and flight delay of USD 1200#.

*valid on doing atleast one transaction on FIRST Wealth Credit Card in last 30 days

#Loss of Checked-in Baggage- USD 500; Delay of Checked-In Baggage USD 100;

Loss of Passport and other documents – USD 300; Delay in Flight – USD 300For Terms & conditions: Click here

Discover More

At a fee of ₹4,999

Fees & Charges of Club Vistara IDFC FIRST Credit Card

Fees & Charges of Club Vistara IDFC FIRST Credit Card

• Joining Fees (on 1st year) ₹4,999 + GST

• Annual Fees (from 2nd year onwards) ₹4,999 + GST

• Low Interest Rates: From 0.75% - 3.5% per month

• Forex Mark-up: 2.99%

• Interest-Free ATM Cash Withdrawal: On Domestic and International ATMs for up to 45 days

Frequently Asked Questions

Yes, there is a Joining fee on the Club Vistara IDFC FIRST Credit Card. The card comes with a joining fee (1st year) of Rs. 4,999 + GST and an annual fee (2nd year onwards) of Rs. 4,999 + GST.

Paying the Joining Fee or Annual fee for the Club Vistara IDFC FIRST Credit Card comes with several benefits. These include:

Joining fee payment benefits:

· 1 complimentary premium economy ticket voucher

· 1 one-class Upgrade voucher

· Maharaja Club Silver Membership

· 3 months complimentary EazyDiner Prime membership

Annually recurring fee payment benefits:

· 1 complimentary premium economy ticket voucher

· 1 one-class upgrade voucher

· Maharaja Club Silver Membership will be renewed

You will receive the joining benefits within 5 working days after paying the joining fee.

If you have an existing IDFC FIRST Bank Credit Card you will be able to apply for Club Vistara IDFC FIRST Credit Card. In this case, the credit limit from your existing card will be the overall credit limit across your multiple IDFC FIRST Bank Credit Cards.

Annual Fee of Rs. 4,999 + GST will be levied exactly after 12 months (365 days) from the day of card issuance, but customer will be expected to pay the same within the 12th statements due date to avoid any late payment or interest charges.

For example, if the card is issued on 5th July 2023. Annual fee of Rs. 4999 + GST will be charged on 5th July 2024. This fee will reflect in the 12th month statement which will be generated on 17th July 2024 (statement date for Club Vistara IDFC FIRST Credit Card) having a due date after 18 days which will be 4th August 2024. Customer can pay the annual fee anytime between 5th July to 4th August 2024.

You can receive up to 6 premium economy class ticket vouchers in a year. This includes 1 complimentary ticket as a joining benefit and 5 additional tickets as an annual spend milestone benefit.

Yes, you will earn Maharaja Points on every transaction using the Club Vistara IDFC FIRST Credit Card. Here's how the points are calculated:

- 6 Maharaja points on spends up to Rs. 1,00,000 in a billing cycle and 4 Maharaja points for all spends above Rs. 1,00,000.

- 1 Maharaja point on every transaction done on Fuel, Utility, Insurance, Wallet Load and Rent.

- Maharaja points will not be given on transactions converted to EMI, Balance Transfer and on Cash Withdrawals.

- Earn of Maharaja point will be calculated per Rs. 200.

- Maharaja points will be calculated every billing cycle.

Yes, in addition to the Bonus 2000 Maharaja points received for qualifying monthly spend milestones in the 2nd, 3rd, and 4th billing cycles, you will also earn regular Maharaja points on every transaction made using the credit card.

The Bonus 2000 Maharaja points for qualifying monthly spend milestones in the 2nd, 3rd, and 4th billing cycles are only applicable for the first year of card membership. Subsequent years will not have this specific bonus point offer.

The forex mark-up fee on the Club Vistara IDFC FIRST Credit Card is competitively set at 2.99%.

Yes. You are entitled to 2 complimentary domestic airport lounge & spa visits and 1 complimentary international airport lounge visit per quarter on monthly spends of Rs.20,000. This will become applicable w.e.f 1st May 2024. Please spend min Rs. 20,000 in April 2024 to get access in May 2024.

You can avail the complimentary lounge/spa benefit by using your credit card at domestic airport lounges and your Dreamfolks card at international airport lounges.

Yes, as part of the Mastercard Network benefits, you can avail golf offers with your Club Vistara IDFC FIRST Credit Card. This includes:

· 4 complimentary rounds of green fees per calendar year (only 1 round in a calendar month)

· 12 complimentary golf lessons per calendar year (1 lesson per calendar month)

· Discounted golf services at 50% of the green fee beyond complimentary sessions

For bookings, queries, or complaints, please call Mastercard toll free helpline no. 1800-102-6263

You can gift an Add -on Club Vistara IDFC FIRST Credit card to a loved one.

· The add-on card comes without any joining or annual fees.

· While the add-on member does not receive a separate Maharaja Club ID, Maharaja Club, Maharaja points, or complimentary flight tickets, all spends made by the add-on customer contribute towards helping the primary cardholder reach their milestones faster to unlock free tickets and earn more Maharaja points.

· The add-on customer can also enjoy airport lounge access, as it is fungible between both the primary and add-on cardholders.

You can activate your complimentary lounge visits in the next month by spending a minimum of ₹20,000 in the current calendar month.

For e.g., Meet spend criteria between 1st to 31st Jan 2024. Benefit activated for Feb-2024.

The spends condition stands revised from 1st May 2024. ₹5,000 spends in March 2024 will unlock access in April 2024. ₹20,000 must be spent in April 2024 to get complimentary access in May 2024.

Maharaja points can be used to book flights subject to terms and conditions of Maharaja Club. To know the number of Maharaja points required for flight bookings for your preferred destination, please visit: https://www.airindia.com/in/en/maharaja-club/points-calculator.html

Maharaja Club, launched in 1994 as Air India’s Flying Returns, is one of India’s oldest and most rewarding frequent flyer programmes. The programme expanded its member benefits in 2014 when Air India joined Star Alliance, expanding its benefits to the Star Alliance network. Through this programme, members earn Maharaja Points they fly with Air India or the 24 Star Alliance Partner Airlines, or when they spend with programme Partners. These points can later be redeemed for Award Flights and Cabin Upgrades.

Yes, Club Vistara has merged with Air India’s Flying Returns to become Maharaja Club. Members can log-in with their Maharaja Club ID to view their account summary.

If you had an existing Air India account and had authorized Vistara to migrate your Club Vistara account data to Maharaja Club by not choosing to opt-out, then the membership has been automatically transferred, and you would have received e-mail confirmation regarding the same.

If you did not have an existing Maharaja Club account, a new account would have been created for you, the details of which would have been communicated to you on your registered e-mail ID.

Yes, your Club Vistara IDFC FIRST Credit Card will continue to function as usual. You can continue using it for transactions and all existing benefits will remain unchanged. You will earn Maharaja Points and Vouchers instead of Club Vistara Points and Vouchers.

All your CV Points, Tier Points, and Vouchers have been automatically transferred to your linked Maharaja Club account from 12th November 2024 onwards. The CV Points have been transferred to Maharaja Points in a 1:1 ratio. These points will remain valid for at least 1 year, even if they are due to expire sooner. For example, if you had 500 CV Points, then these would have moved to your Maharaja Club account as 500 Maharaja Points.

Your existing Silver tier membership has been extended till November 2025 in your Maharaja Club account and for Club Vistara IDFC FIRST Credit Cards getting renewed after November 2024, the silver memberships will get the extended in Maharaja Club accounts for a period of 1 year aligned with the renewal date.

Yes, Air India will honour all your valid/active tickets and vouchers issued by Club Vistara. These have been transferred to your Maharaja Club Account, ensuring that you can continue to use them as planned.

Maharaja Club members get multiple benefits such as Cabin Upgrade vouchers, Excess Baggage Allowance, Priority Check in etc. For more details, please click here.

All Cabin Upgrade Vouchers issued by Maharaja Club are valid for 6 months from the date of issuance for Silver Tier members, 9 months for Gold Tier members and 12 months for Platinum Tier members. All Complimentary Ticket Vouchers will have a fixed validity of 9 months, irrespective of the tier. For more details, please click here.

Yes, you can renew your Club Vistara IDFC FIRST Credit Card until March 2025. Upon renewal, all card benefits and features will be honoured for 1 year from the renewal date.

The benefits earned on the card i.e. Points as well as Ticket Vouchers shall remain the same which means you will receive 1 Complimentary Premium Economy Ticket Voucher, 1 Cabin Upgrade Voucher and Silver Tier Status as part of renewal benefits on payment of annual fee. You will also continue to earn up to 5 Premium Economy Ticket Vouchers based on your spends. Instead of CV Points, you will earn Maharaja Points that can be used to book Award Flights and Cabin Upgrades with Air India and the 24 Star Alliance Partner Airlines.

Members can use the Premium Economy Ticket Vouchers for bookings via the Air India website or app or reach out to the Customer Service team to get a booking made.

Once you arrive at the airport check-in counter, you can request the Airport Executive for an upgrade (as per booked cabin class and subject to seat availability). You can show the active voucher in your Maharaja Club Account from the Air India app or website. After confirmation of seat availability, you can validate the voucher using the OTP received on your registered mobile number and e-mail ID. Once the OTP is verified, the executive will hand over the boarding pass for the upgraded cabin class.

Yes, you can use your vouchers for friends and family as well. Please note, all benefits are subject to terms & conditions. For more details, please click here.

You can calculate the number of Maharaja Points required to book a flight to your preferred destination using the Points Calculator.

In case of any questions regarding your credit card while abroad, please contact us at +91 22 6248 5152

Yes, your Club Vistara IDFC FIRST Credit Card will be renewed on its renewal date and will remain active until March 31, 2026. However, the benefits associated with the card will be modified.

No, annual fee will not be charged when your Club Vistara IDFC FIRST Credit Card is renewed on or after 1st April’25.

Following the merger of Vistara with Air India, Club Vistara was integrated into Maharaja Club on November 12, 2024. As part of this transition, Club Vistara IDFC FIRST Credit Cards will not be renewed beyond March 31, 2026

While you can continue using your card until March 31, 2026, the following changes will apply post-renewal:

• Since the annual fee will not be levied, the renewal benefits including 1 premium economy ticket voucher, 1 cabin upgrade voucher and silver membership will not be provided.

• Flight ticket vouchers based on spending milestones will not be issued after your renewal date.

• Earning of Maharaja Points remains unchanged: You will continue to earn Maharaja Points on your eligible transactions, which will be credited to your linked Maharaja Club account.

Yes, all Maharaja Points earned before and after renewal will continue to be credited to your linked Maharaja Club account, and you can redeem them as per Air India’s policies.

Yes, your Club Vistara IDFC FIRST Credit Card will remain functional for all transactions until March 31, 2026. However, after this date, the card will be discontinued, and you will not be able to use it.