-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

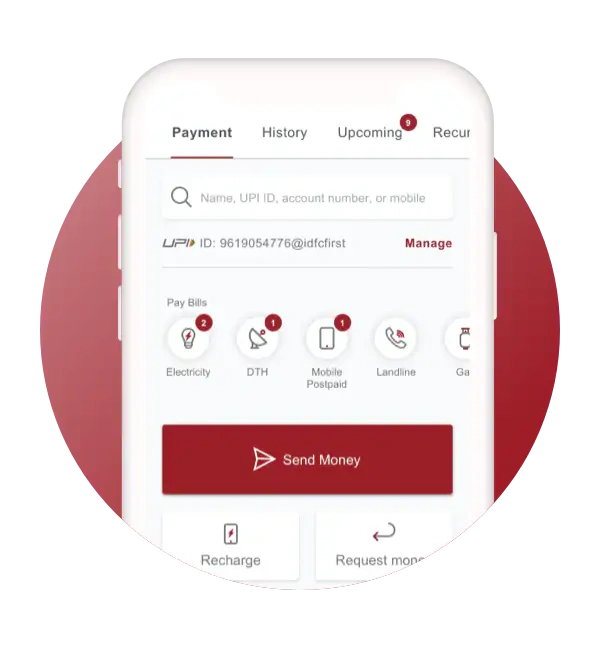

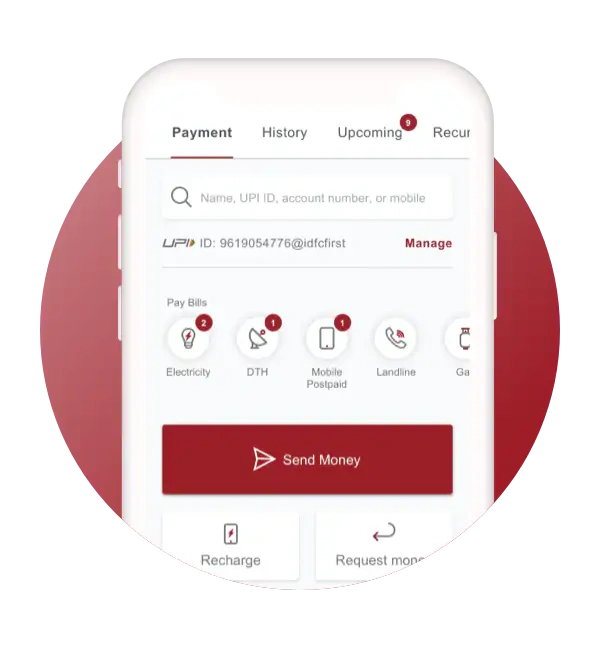

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex Services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

Credit Card Against Fixed Deposit

Obtaining a credit card against a fixed deposit can be an excellent idea for someone building their credit history. They eliminate the odds of being denied a credit card due to low credit scores or lack of income proof. No more extended wait times and documentation processes - with the FIRST WOW! Credit Card, you can enjoy the benefits of IDFC FIRST Bank Credit Cards just by opening a fixed deposit. Get the WOW! factor every time you spend and enjoy unmatched benefits!

The FIRST WOW! Credit Card is secured against your fixed deposit, provides a 100% withdrawal limit, and offers freedom to access funds anywhere.

Enjoy ultimate convenience and comfort with this lifetime-free premium credit card.

WOW! REWARDS

Experience the WOW life now!

-

Convenience at its best. Zero documentation required

-

No joining fee or annual fees, only a lifetime of premium benefits and rewards on VISA Infinite

-

Earn up to 4X Rewards on every spend

-

Enjoy up to 6.3% interest p.a. on your fixed deposit backing the credit card

-

Experience cost-effective and hassle-free international travel with zero forex markup

-

Make the most of 300+ merchant offers and 20% discounts across 1,500+ restaurants

-

Splurge without worry with a credit limit of a minimum of 100% of your FD value

-

Enjoy 100% cash withdrawal of your FD value, interest-free for up to 45 days

*Consider FD with 367 days period. Rates are dynamic and applicable till revised further.

*1X = 1 Reward Point per ₹150 spent | 1 Reward point = ₹0.25. Rewards program not applicable on Fuel, EMI transactions & Cash withdrawals. Insurance premium payments and Utility bill payments will earn 1x reward points.

***Cash advance fee of INR 199

SECURED CREDIT CARD FOR EVERYONE

With our fixed deposit at 6.3% interest rates, you can grow your wealth and access liquidity instantly..

-

The fixed deposit must be in cumulative/auto-renew/re-invest mode

-

The applicant must have an FD account in their name with minimum deposit of ₹20,000

WOW! PRIVILEGES

Best-in-class features.

Designed to delight, year after year.

Complimentary roadside assistance worth ₹1399

Fuel charges waiver of 1% at all the fuel stations across India, up to ₹200/month

Personal Accident Cover of ₹2,00,000* and Lost Card Liability Cover of ₹25,000

Up to 20% discount at 1500+ restaurants | Up to 15% discount at 3000+ Health & Wellness outlets

*valid on doing at least one transaction on FIRST WOW! Credit Card in last 30 days

FD-backed, Virtual Credit Card

Benefits of FIRST EA₹N Credit Card

-

Cashback Rewards: Enjoy up to 1% cashback on transactions made through the IDFC FIRST Bank mobile app & 0.5% cashback on UPI spends

-

Welcome Offer: Get 100% cashback up to ₹500 on your first UPI transaction. (Effective from 23rd November 2024)

-

Exclusive Discounts: 25% discount up to ₹100 on movie tickets booked via District by Zomato.

-

Security and Insurance: Benefit from complimentary roadside assistance worth ₹1,399 & personal accident cover of ₹2,00,000 with secured credit card

-

Additional Benefits: Earn 6.3% p.a. interest on your fixed deposit with access to funds anytime with the best FD Rupay credit card in the market.

-

Fees and charges: Joining Fee: ₹499 + GST

-

Click here to apply for FIRST EA₹N Credit Card

Welcome Benefits 5% cashback (up to ₹1000) on the first EMI done within 30 days of card generation

WOW! Convenience

WOW! Convenience

you want

you want

-

Instantly convert your transactions above ₹2500 into easy and convenient EMIs

-

Pay off your other credit card balances with our balance transfer privileges

-

Pay using reward points at partner merchants and online purchases

-

The perfect companion to start your credit journey and build a credit score, as it offers one of the lowest interest rates

-

Have complete control with our intuitive and easy-to-use mobile app

EASY PAYMENT OPTIONS

Explore our various online credit card payment options.

View your standing instructions (recurring payments) set at various merchants here and modify/cancel them effortlessly.

Now, convert your outstanding balance into easy EMIs with a flexible tenure of 3 - 18 months

Frequently asked questions

What is a credit card against FD?

An FD-backed credit card, also known as a credit card against FD, is a type of credit card where the credit limit is secured by a fixed deposit. By pledging a certain amount in a fixed deposit account, you establish collateral for your credit card. This reduces the risk of defaulting and makes it easier for individuals without a credit history to obtain one. This includes students, housewives, and those with variable incomes.

What are the benefits of credit cards on FD?

FD credit cards offer numerous benefits, such as:

• No documentation required to apply for credit card against FD.

• Easily integrate the credit cards with any UPI app and earn exciting cashback and reward points on every eligible UPI payment.

• Enjoy a credit limit of more than 100% of your deposit while earning FD interest of up to 7.25% per annum.

• Low annual percentage rates for the FD-based credit card, starting at just 8.5% per annum.

• Access to exclusive rewards and benefits programs and offers at over 300 merchants and 1500 restaurants across the country.

What is the minimum FD amount for an FD credit card?

To obtain the FIRST WOW! Credit Card — a credit card with FD from IDFC FIRST Bank — you need a minimum deposit of ₹20,000 in your fixed deposit.

We also offer one more FD backed credit card – FIRST EA₹N credit card. This is a virtual credit card enabled with UPI. To get this card you need to have a fixed deposit of minimum amount of ₹ 5,000 with IDFC FIRST Bank.

What are the eligibility criteria to apply for an IDFC FIRST WOW! Credit Card?

Age Policy:

· Applicant must be 18 years of age or older to apply for an IDFC FIRST WOW! Credit Card

Indian Resident & Sourcing Locations:

· Applicant must qualify as an Indian resident and have a current and permanent residential address within India

· IDFC FIRST Banks maintains a set of cities which are allowed for sourcing

NRI Customers with a pre-approved FIRST WOW! Credit Card offer can apply through the IDFC FIRST Bank mobile app by following any one of the steps below:

1. Easy Banking >> Accounts & Deposits >> Secured Card

2. Easy Banking >> Credit Cards >> Secured Card

Eligibility:

· The applicant needs to have a fixed deposit in their name with IDFC FIRST Bank

· Fixed Deposit should be in cumulative/re-invest and auto-renewed mode

Internal Policy Criteria

· Bank runs certain internal policy criteria to select a customer for issuing credit cards

· Internal Policy criteria are based on bureau history, any existing Bank relationship, customer demographics, and credit exposure

· The Bank reserves the right to issue a Credit Card to the applicant on the basis of an assessment of his / her credentials.

The final decision is at the Bank’s sole discretion, in line with the mentioned internal policies, and notwithstanding the applicant meeting the above criteria.

We have launched FIRST WOW! Credit Card for NRI Customers as well. (NRI Customer can only apply basis PA offer)

Is there a Joining/Membership/Annual fee on IDFC FIRST WOW! Credit Cards?

There is no joining, membership, or annual fee applicable on the best credit card against FD. Your card is free for life.

How can I redeem the Reward Points I have earned on my card?

You can directly use your points to pay for online purchases or store shopping. Choose 'pay with points'. You can also redeem your Reward Points against amazing offers at idfcfirstrewards.poshvine.com.

Is the FIRST EA₹N Credit Card physical or virtual?

The FIRST EA₹N Credit Card is a virtual card, accessible on your smartphone, making it the best FD backed Rupay credit card for UPI and online payments.

Do I require a credit history or income proof to apply for the FIRST EA₹N Credit Card?

No, you don’t need a credit history or income proof. This Rupay credit card on FD is designed for everyone, including first-time credit card users.

How can I apply for the FIRST EA₹N Credit Card?

To apply, register on the IDFC FIRST Bank platform, fund a fixed deposit of ₹5,000 or more, and complete the KYC process. Your FD-backed Rupay credit card will be ready instantly.

What are the eligibility criteria to apply for a FIRST EA₹N Credit Card?

You must:

- Be an Indian citizen with a valid permanent address.

- Be 18 years or older.

- Hold a fixed deposit of at least ₹5,000 with IDFC FIRST Bank.

- Final approval is at the bank’s discretion.

What determines my credit limit for First EA₹N Credit Card?

Your credit limit will be 100% of the fixed deposit amount, making this the best FD-based credit card for secured transactions.

Is there an add-on card available for the FIRST EA₹N Credit Card?

Currently, the FIRST EA₹N Credit Card does not offer add-on cards.

What cashback benefits can I enjoy with this Rupay credit card against FD?

Earn:

- 1% cashback on spends via the IDFC FIRST Bank app.

- 0.5% cashback on UPI spends via other apps, online transactions, utility bills, insurance, and wallet loads.

Can I use FIRST EA₹N Credit Card FD-backed Rupay credit card for UPI payments?

Yes, this UPI credit card against FD allows you to pay at over 60 million merchants using UPI.

What is the joining and annual fee for FIRSTEA₹N FD-backed credit card?

The joining fee is ₹499 + GST, and the annual fee (from the second year onwards) is ₹499 + GST.

Can I use FIRST EA₹N Rupay FD credit card internationally?

Yes, you can use this FD-backed Rupay credit card for international transactions, subject to a forex markup fee of 3.5%.

What happens to my FD if I close the credit card?

If you close the credit card, the fixed deposit linked to it will remain unaffected, ensuring your funds stay secure.

Why is this the best Rupay credit card against FD?

It offers UPI convenience, up to 1% cashback, and exclusive privileges like movie discounts and personal accident cover, making it the best FD-based Rupay credit card.

What makes the FIRST EA₹N Credit Card the best FD-based Rupay credit card?

The card combines the power of UPI payments, cashback rewards, and FD-backed security with benefits like movie offers, roadside assistance, and accident cover, making it a secured Rupay credit card ideal for first-time credit users.

Are there any surcharges on the Rupay credit card on FD?

Yes, the card incurs:

- A 1% surcharge on utility spends exceeding ₹20,000 per statement cycle.

- A 1% surcharge (minimum ₹249 + GST) on rent and property management payments.

What happens if I fail to pay the dues on my FD-backed credit card?

In case of non-payment, the bank may utilize your fixed deposit to recover the outstanding dues, ensuring the credit card remains a secured Rupay credit card option.

How to Apply for FD Credit Card Online?

You can easily apply for an FD credit card online from IDFC FIRST Bank by visiting their official website. Once your fixed deposit is in place, you can quickly fill out the application form and get started.