Are you ready for an upgrade?

Login to the new experience with best features and services

Notifications

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

Activate your Credit Card within minutes and enjoy unlimited benefits

Accounts

Deposits

Loans

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

Wealth & Insure

Payments

Cards

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

Premium Metal

0% Forex & Travel

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

Lifetime Free

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

10X Rewards

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

UPI Cards

Fuel & Utility

Showstopper

Credit Builder

More

NRI Savings Account

NRI Fixed Deposit

FOREX Solutions

Transfer to NRE

Corporate Account

Cash Management Services

Corporate Lending

Treasury

MSME Accounts

Trade Services

MSME Loan

MSME Solutions

Offers

About Us

Investors

Careers

IDFC FIRST Academy

ESG

"Money talks, but a joint account sings a duet of trust and shared dreams."

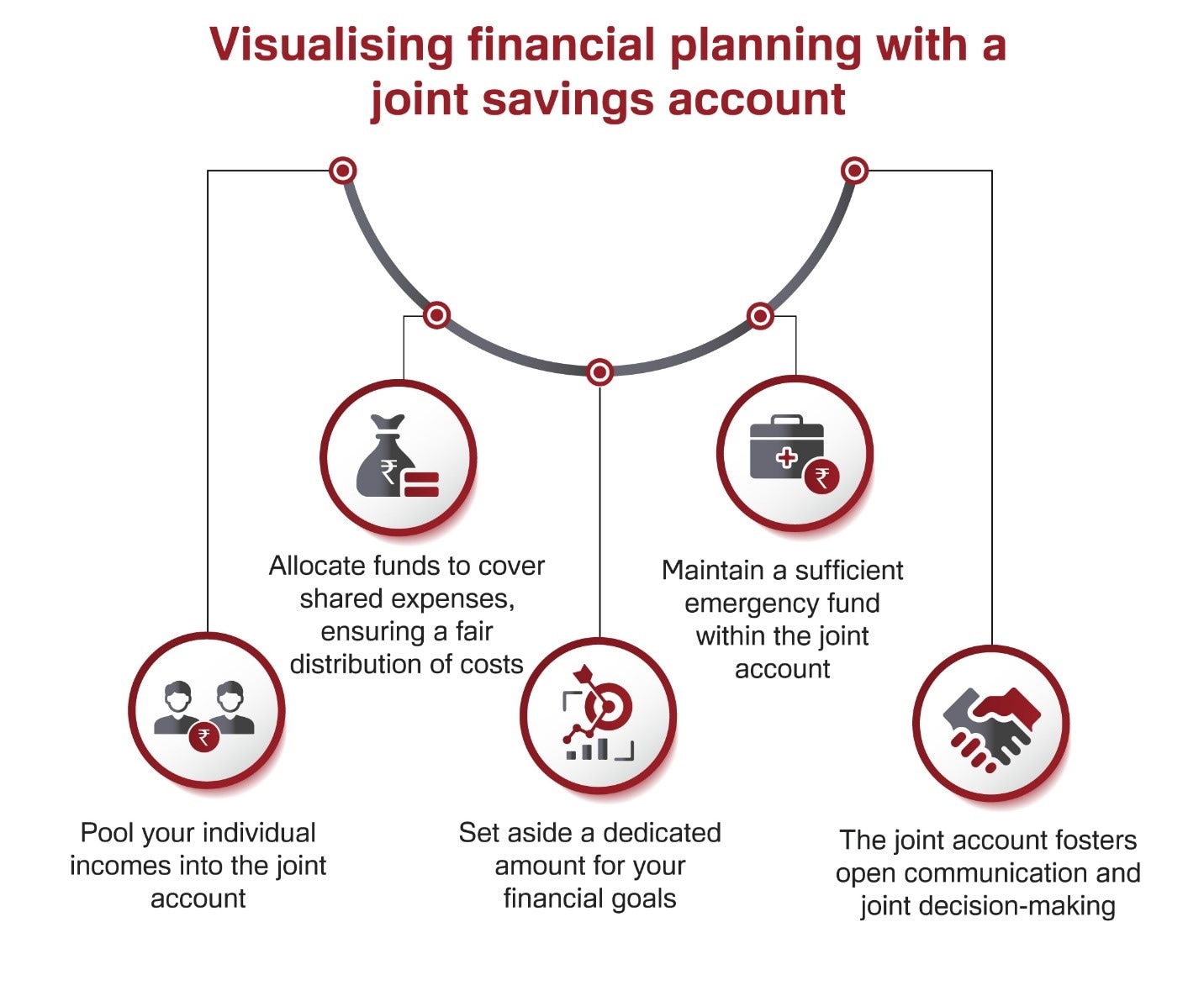

Are you and your partner ready to leap into your financial journey together? Imagine a space where your financial goals align seamlessly, budgeting becomes a breeze, and trust and transparency in your finances deepen. This is the power of a joint savings account. It's more than just an account; it symbolises your shared financial future.

Learn the magic of opening a joint account for couples, exploring its numerous benefits and guiding you through the simple process of starting one.

Why is a joint account for couples a must-have?

Opening a joint account isn't just about convenience - it's about fostering trust, transparency, and shared financial goals. When you combine your finances, you say, "We're in this together." This act of unity can profoundly impact your relationship's financial health.

Here's why a joint savings account for couples is a game-changer –

Shared financial goals -

Easier budgeting -

Convenience -

Emergency preparedness-

Transparency and trust -

Having a joint account makes working towards common financial goals easier, such as saving for a down payment on a house, planning a dream vacation, or investing in the future.

Pooling your incomes and expenses into one account simplifies budgeting. You can track your spending together and make informed decisions about where your money goes.

With a joint account, paying bills, managing household expenses, and handling shared financial responsibilities become much more streamlined.

In case of unexpected financial needs, having a joint account ensures that both partners have access to funds, providing a safety net for both of you.

A joint account promotes openness and transparency about finances, building trust and strengthening your relationship.

Why choose the IDFC FIRST Bank Joint Savings Account?

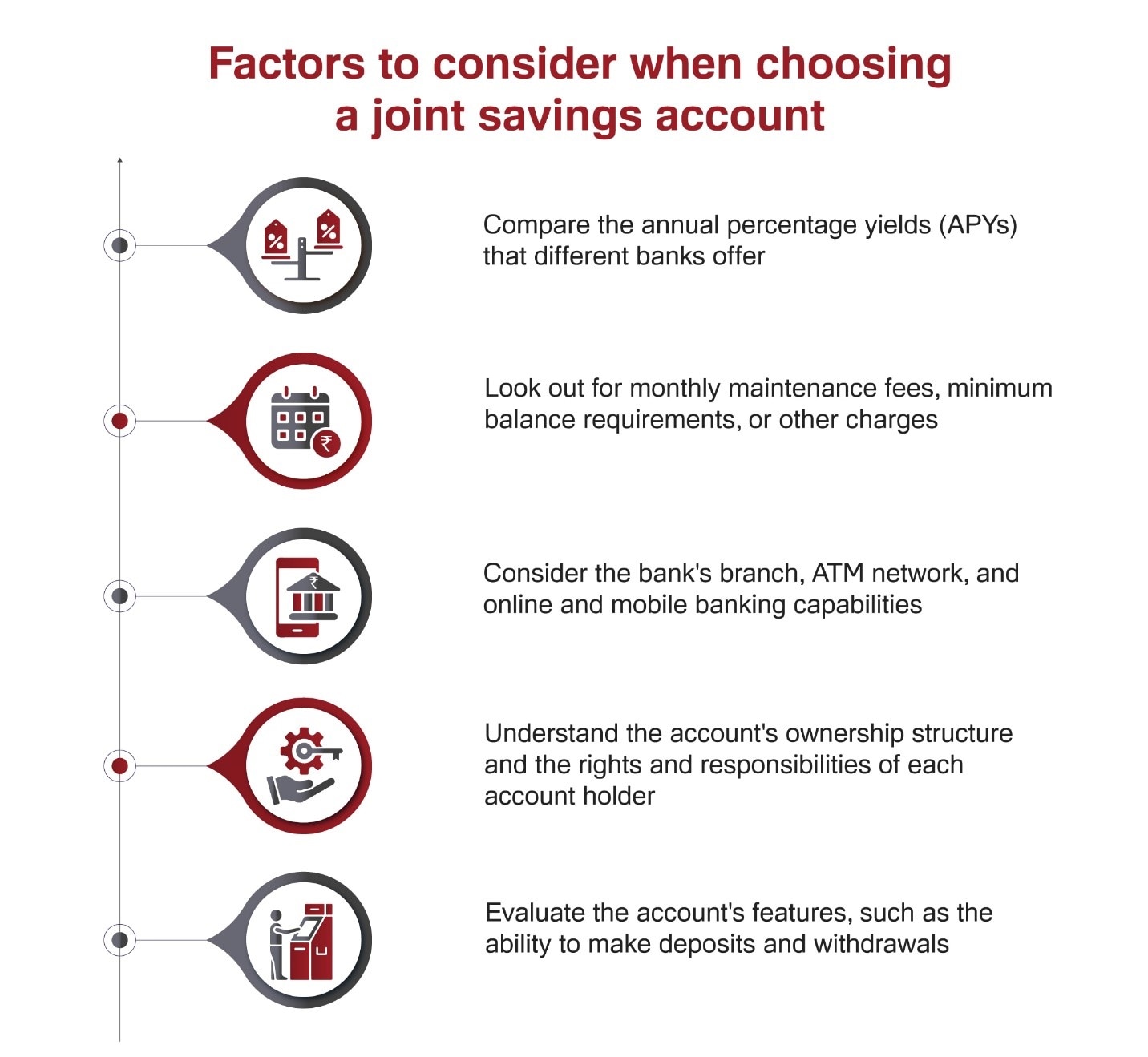

IDFC FIRST Bank offers a comprehensive joint savings account that caters to couples' unique needs. With competitive interest rates and easy online account opening, IDFC FIRST Bank makes managing your joint finances a breeze.

Here's why IDFC FIRST Bank stands out –

Convenient access -

Unlimited transactions -

Attractive interest rates -

Online banking and mobile app -

Personalised debit cards-

With a wide network of branches and ATMs, as well as user-friendly online and mobile banking platforms, IDFC FIRST Bank makes it easy for you to access your account anytime, anywhere.

Enjoy unlimited free transactions at any bank’s ATM.

Earn competitive interest rates on your savings, helping your money grow over time.

With user-friendly online banking tools and a mobile app, you can manage your account conveniently from anywhere.

Each account holder receives a personalised debit card for easy access to funds.

How to open a joint bank account with IDFC FIRST Bank

Opening a joint savings account with IDFC FIRST Bank is a breeze. Follow these simple steps –

Step 1 -

Step 2 -

Step 3-

Step 4 -

Go to the nearest IDFC FIRST Bank branch.

Fill out the account opening form and make sure to include your partner’s name and details

Submit the application along with the required documents.

Complete the verification process and wait for the account activation email or SMS.

Reaping the benefits of opening a joint bank account

Once your joint account is up and running, you can start reaping the rewards of shared financial management. Here are some additional benefits of opening a joint bank account –

Simplified tax filing -

Financial planning-

Building a strong financial foundation-

Filing your taxes as a couple becomes much easier with a joint account, as you can easily track and report your combined income, expenses, and deductions.

With a joint account, you can create a comprehensive financial plan and track your progress towards your shared goals, whether saving for a down payment, planning for retirement, or building an emergency fund.

A joint account can be the foundation of your shared financial future, helping you and your partner achieve financial security and stability as you navigate life's ups and downs together.

Start your financial journey today

Opening a joint account with IDFC FIRST Bank is a smart move for couples looking to streamline their financial planning. By pooling your resources, managing expenses, and working towards shared goals, you can build a stronger financial foundation for your relationship.

Take the first step towards financial collaboration by opening your IDFC FIRST Bank Joint Savings Account today. Experience the convenience, transparency, and trust of managing your finances together.