Are you ready for an upgrade?

Login to the new experience with best features and services

Notifications

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

Activate your Credit Card within minutes and enjoy unlimited benefits

Accounts

Deposits

Loans

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

Wealth & Insure

Payments

Cards

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Forex Card

-

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

Premium Metal

0% Forex & Travel

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

Lifetime Free

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

10X Rewards

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

UPI Cards

Fuel & Utility

Showstopper

Credit Builder

More

NRI Savings Account

NRI Fixed Deposit

FOREX Solutions

Transfer to NRE

Corporate Account

Cash Management Services

Corporate Lending

Treasury

MSME Accounts

Trade Services

MSME Loan

MSME Solutions

Offers

About Us

Investors

Careers

IDFC FIRST Academy

ESG

Credit cards have become an integral part of our lives. They offer convenience, from swiping for daily purchases to availing instant credit for emergencies. In the financial year 2023 alone, 290 crore credit card transactions worth over ₹14 lakh crores were processed nationwide. These statistics highlight the widespread use of credit cards in India. However, with these numbers comes the responsibility of managing credit cards to avoid debt.

One way to manage your debt is to have a credit card with a low Annual Percentage Rate (APR). But what is APR on a credit card? Let’s figure it out.

What is APR on a credit card?

The meaning of APR on a credit card is pretty simple – it is the annual interest rate you pay on your outstanding credit card balance. It includes the interest rate and other fees representing the cost of borrowing money on your credit card.

Simply put, the lower the APR on a credit card, the less you pay in interest charges over time. This allows you to carry a balance and repay it more affordably over time. On the other hand, a high APR can significantly inflate your credit card dues.

Understanding your card’s APR helps you make smarter financial decisions, such as –

- Choose a credit card with a cheaper interest rate to get the most favourable borrowing terms and minimise interest costs

- Reduce interest charges by strategically paying your balance with a low APR

- Ultimately, manage credit card debt by understanding the interest charges

However, you should know that APR on a credit card is charged only when you carry a balance from month to month. You can avoid any interest if you pay off your balance in full each month.

5 Benefits of low APR credit cards

Now that you know what APR on a credit card is, let’s explore why a lower APR is important. Here are some key benefits –

1. Lower interest charged - High interest rates can quickly escalate your debt, making it challenging to pay. However, reducing your APR by even a few percentage points can save you thousands in interest charges annually.

For example, IDFC FIRST Bank Credit Cards have APRs starting from just 8.5% per annum (0.71% per month). This makes paying on credit far more affordable than other competitor card issuers.

2. Easier debt management - When you have a high APR, your monthly payments may barely cover the interest, leaving the principal untouched. A lower APR reduces the interest portion of your monthly payment, allowing a larger portion to go toward the principal balance. This helps you clear your debt faster.

3. Financial flexibility - Lower interest charges allow you to allocate more funds towards savings, investments, or other financial goals. This flexibility can be particularly beneficial for unexpected expenses. These saved funds can act as emergency funds, giving you breathing room without falling deeper into debt.

4. Improved credit score - Consistently clearing dues can positively impact your credit score. A low APR facilitates easier repayment, which reduces the chances of missed or late payments. A higher credit score opens doors to better financial products and interest rates in the future. It creates a positive feedback loop for your financial health.

If you have been wondering whether it’s a high or low APR that is good, now you know. The lower the APR, the less interest you will pay overtime. This makes it easier to manage and reduce debt.

What are low APR balance transfer credit cards?

A credit card balance transfer is a debt management tool. It moves your existing credit card debt to a new card, ideally with a much lower interest rate. The main benefit of a balance transfer is the introductory 0% or reduced APR on transferred balances. This period can last anywhere from 6 to 21 months, giving you a window to chip away at your debt without accruing high interest.

For example, a CreditPro Balance Transfer allows you to move your outstanding balance from a high-interest credit card to a low-interest IDFC FIRST Bank Credit Card. By activating CreditPro, you enjoy an interest-free period of 105 days. After that, you pay an interest of just 19.99% p.a. on your outstanding balance, which is one of the most competitive rates in the market.

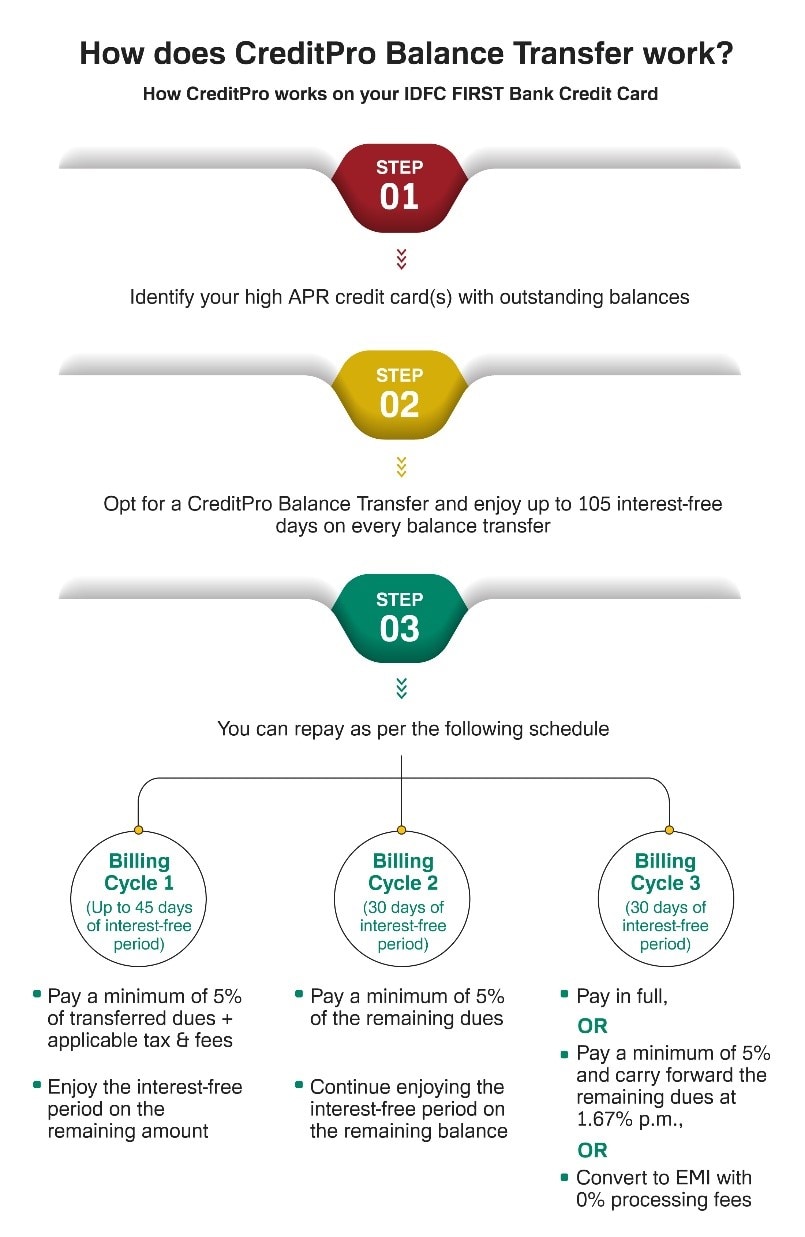

How does CreditPro Balance Transfer work?

This structured repayment plan gives you up to 105 days of interest-free repayment, helping you manage your balance transfer effectively.

Benefits of CreditPro Balance Transfer with IDFC FIRST Bank Credit Cards

Here are some of the key benefits –

1. Interest-free period - With CreditPro, you can enjoy up to 105 interest-free days on your transferred balance. This extended grace period gives you time to focus on repaying the principal without accruing additional interest.

2. Low APR - With APR on a credit card of 19.99% p.a., CreditPro offers one of the most competitive rates in the market. This lower APR leads to substantial savings compared to the average credit card APR rate.

These benefits make CreditPro an excellent option for individuals who –

- Carry a balance on their existing credit cards and are looking to reduce their interest burden

- Want to consolidate debt from multiple high-interest credit cards into a single, manageable payment plan

- Seek a better APR on a credit card to optimise their credit card usage and save money on interest charges

- Want to manage their credit responsibly while improving their credit score

How to leverage low APR effectively

Leveraging CreditPro to transfer outstanding balances to a low APR credit card can be a smart move toward managing your debt efficiently. However, to maximise the benefits, here’s how to leverage a lower APR strategically -

Consolidate debt –

Pay more than the minimum due during interest-free periods -

Use the CreditPro Balance Transfer facility to consolidate your high-interest credit card debts. Transferring your balances to a single card with a low APR allows you to streamline your payments and reduce your total interest expenditure.

Take advantage of a credit card that charges low APR on its use and offers interest-free periods. Make substantial payments during them, not just the minimum amount due. This strategy can significantly reduce your outstanding balance before interest charges start accumulating.

The bottom line

Choosing a lower APR on a credit card is a strategic step towards a more secure financial future. It reduces interest costs and lets you settle outstanding balances more efficiently. You can save money and achieve your financial goals by leveraging the benefits of a low APR.

So, take control of your finances today. Apply for a balance transfer via CreditPro and explore how a lower APR strategy can empower you on your path to financial freedom.

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject IDFC FIRST Bank or its affiliates to any licensing or registration requirements. IDFC FIRST Bank shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.