Are you ready for an upgrade?

Login to the new experience with best features and services

Notifications

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

Activate your Credit Card within minutes and enjoy unlimited benefits

Accounts

Deposits

Loans

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

Wealth & Insure

Payments

Cards

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

Premium Metal

0% Forex & Travel

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

Lifetime Free

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

10X Rewards

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

UPI Cards

Fuel & Utility

Showstopper

Credit Builder

More

NRI Savings Account

NRI Fixed Deposit

FOREX Solutions

Transfer to NRE

Corporate Account

Cash Management Services

Corporate Lending

Treasury

MSME Accounts

Trade Services

MSME Loan

MSME Solutions

Offers

About Us

Investors

Careers

IDFC FIRST Academy

ESG

Anupam sat at his desk, scrolling through financial websites and trying to figure out the best way to grow his savings. He had always been cautious with his money and wanted a secure and steady way to build his savings to accomplish his financial goals. Something better than a regular savings account but without the uncertainty of the stock market. He had heard about fixed deposits (FDs) but wasn’t sure if locking in a lump sum was the right move.

If you can relate to Anupam’s situation, you’re not alone. Many people want to grow their savings but prefer an option that offers stability. This is where a recurring deposit comes in—a simple and safe way to save consistently while earning interest.

Let’s explore how recurring deposits work and why they might be the right choice for you.

What is a recurring deposit?

A recurring deposit is a type of savings scheme offered by banks, post offices, and other financial institutions. So, how does a recurring deposit work? Here’s how –

- You choose an amount you can comfortably deposit every month

- You select a tenure, anywhere between 6 months to 10 years

- The bank pays interest on your deposits, which is generally compounded quarterly

- At the end of the tenure, you receive the total amount saved along with the accumulated interest

Recurring deposits help individuals like Anupam develop disciplined savings habits while earning a stable return. Since the returns are fixed, this is considered a low-risk investment. Moreover, the interest rates on recurring deposits are usually comparable to those of FDs. They vary based on the bank and tenure chosen.

For example, IDFC FIRST Bank Recurring Deposit offers flexible and customer-friendly options. You can start with a minimum monthly deposit of ₹100, making it accessible for individuals across various income groups. The tenure ranges from 6 months to 10 years, allowing you to choose a period that aligns with your financial objectives.

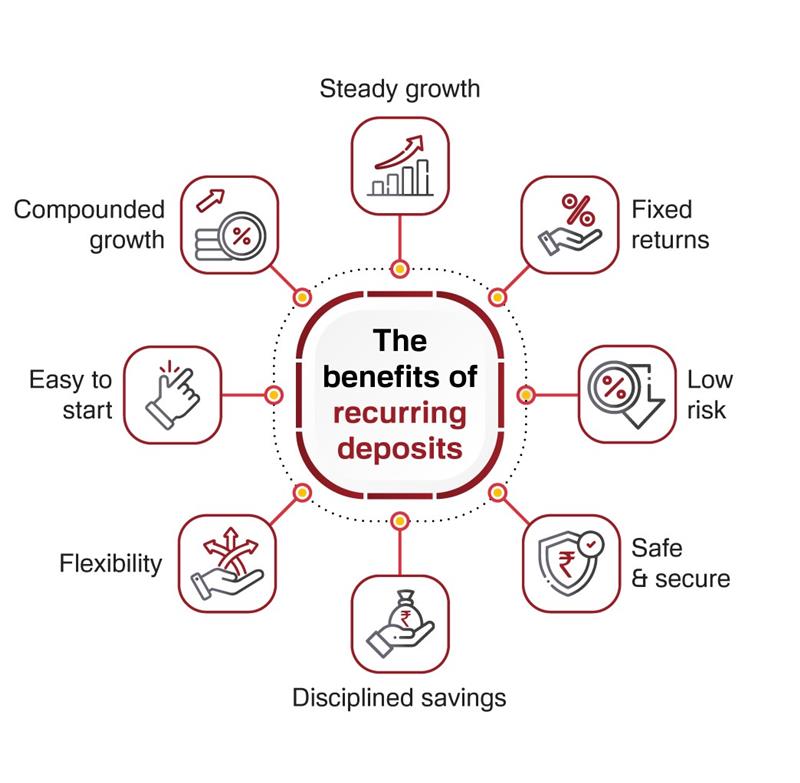

The benefits of recurring deposits

Recurring deposits offer a reliable way to grow your savings with minimal risk. Here are the key benefits –

1. Steady returns

Recurring deposits provide a fixed interest rate throughout their tenure, ensuring predictable returns. This makes them perfect for those who prefer stable earnings without market fluctuations.

2. Risk-free investment

Recurring deposits are a secure investment option offered by banks and post offices. Because the principal and interest are protected, they are suitable for risk-averse investors like Anupam.

3. Flexible deposit options

Many banks allow customers to choose the deposit amount and tenure based on their financial goals. Whether you want to save for a short-term goal like a down payment on a car or a long-term goal like retirement, a recurring deposit can be tailored to meet your needs. This flexibility makes them accessible to individuals with different saving capacities.

4. Encourages saving discipline

Recurring deposits require regular monthly deposits, so they build a disciplined saving habit. This can help you set aside money for your future needs.

5. Loan facility

Some banks offer loans against recurring deposits, which provide liquidity without breaking the deposit. This feature can be useful in financial emergencies.

How recurring deposits differ from FDs and savings accounts

Many wonder how a recurring deposit differs from a fixed deposit or a savings account. Here’s a quick comparison –

Feature |

Recurring deposits |

FDs |

Savings accounts |

Deposit type |

Monthly |

Lump sum |

Flexible |

Interest rate |

Fixed, higher than savings account |

Fixed, usually higher than recurring deposit |

Lower |

Risk |

None |

None |

None |

Liquidity |

Limited (premature withdrawal possible with penalty) |

Limited (withdrawal before maturity attracts penalty) |

High (funds can be withdrawn anytime) |

Ideal for |

Regular savers with a goal |

Those with a lump sum to invest |

Everyday banking needs |

A recurring deposit provides a middle ground between the flexibility of a savings account and the higher returns of an FD, making it an ideal savings option.

The role of recurring deposits in a balanced savings portfolio

A well-structured savings plan should include different types of financial products. While emergency funds should be kept in savings accounts for easy access, a recurring deposit helps accumulate funds for short- to medium-term goals. It ensures steady returns without exposing your money to risks, making it a crucial part of a balanced financial plan.

Key features to look for when choosing a recurring deposit

When selecting a recurring deposit, consider these important factors –

1. Interest rate

Compare interest rates on recurring deposits offered by different banks to find the best return on your investment.

2. Tenure options

Check the available deposit terms and choose one that aligns with your financial goals.

3. Minimum and maximum deposit limits

Understand the amount you can invest each month based on bank requirements.

4. Premature withdrawal rules

Review penalties and conditions for early withdrawal in case of emergencies.

5. Penalty for missed payments

Check if the bank imposes charges for missing a monthly deposit.

6. Auto-renewal facility

Some banks offer automatic renewal options, which may help in continuous savings.

7. Tax implications

Interest earned may be taxable; verify tax rules before investing.

These factors will help you choose a recurring deposit that fits your needs.

Common misconceptions about recurring deposits

While recurring deposits are a reliable savings option, some misunderstandings may prevent people from fully appreciating their benefits. Here are a few clarifications –

1. Recurring deposits offer low returns

While they may not match market-linked investments, recurring deposits provide stable and guaranteed returns, making them a dependable choice for risk-averse investors.

2. They lack flexibility

Many banks offer options to adjust deposit amounts, premature withdrawals, and loan facilities against recurring deposits, adding a level of convenience.

3. Only for conservative investors

Recurring deposits are suitable for anyone looking to build disciplined savings, whether for short-term goals or as part of a diversified financial plan.

How recurring deposits can help achieve financial goals

A recurring deposit can be used to save for various financial needs. Here are some examples –

1. Short-term goals

Anupam wants to buy a new laptop in a year. Instead of making a lump-sum purchase, he starts a recurring deposit for 12 months, ensuring he has enough funds.

2. Medium-term goals

A couple planning a vacation in two years can save a fixed amount every month in a recurring deposit, earning interest along the way.

3. Long-term goal

Parents saving for their child's education can accumulate a substantial amount by choosing a recurring deposit with a longer tenure.

How to open a recurring deposit account

Opening a recurring deposit account is a simple process. Here’s how you can open one using the IDFC FIRST Bank Mobile Banking App –

- Step 1 – Log in to the Mobile Banking App.

- Step 2 – Locate the option to open a recurring deposit and select the account from which you want the monthly deposit amount deducted.

- Step 3 – Enter the monthly deposit amount and choose a tenure that suits your financial goal.

- Step 4 – Click on ‘Best Plan to get a recommended plan’ or select ‘All Plans’ to choose one manually.

- Step 5 – Review the details and click on ‘Create RD’ to complete the process.

That’s it! Your recurring deposit is now active, and you can track your savings growth through the mobile app.

How interest on recurring deposits is calculated

The interest on recurring deposits is typically compounded quarterly. This means that the interest earned is added to the principal amount every quarter, leading to consistent growth of your savings. The interest is usually paid out at the end of the tenure, but some banks may offer the option to receive interest periodically.

Conclusion

IDFC FIRST Bank Recurring Deposits offers competitive interest rates, making it an attractive option for those looking to grow their savings steadily. With an easy online application process, flexible tenures, and assured returns, setting up a Recurring Deposit with IDFC FIRST Bank can be a smart step toward financial stability.

Start your savings journey today and make your money work for you!