CKYC Registry

-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex Services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

Personal Loan

8 types of personal loans available in India and everything you need to know about them

Key Takeaways

Learn about the most common types of personal loans and how they can support different financial needs.

Discover how to choose the best personal loans by comparing features, interest rates, and flexibility.

Understand the growing demand for different types of personal loans in India and the trends driving it.

See how a FIRSTmoney personal loan from IDFC FIRST Bank offers transparency, speed, and low interest rates.

Whether it’s fixing something that can’t wait, investing in yourself, or simply staying prepared, borrowing isn’t always a last resort. Personal loans in times of urgent financial needs can be a saviour for many.

They don't just help as a quick fix — they also help you fulfil your bucket list comfortably. But with so many types of personal loans available today, how do you decide what fits best?

In this guide, we’ll unpack the different types of personal loans, how they’re commonly used in India, the benefits and pitfalls to watch out for, and how you can choose one that works for your goals, and not against them.

READ MORE

Why are personal loans such a popular financial choice?

You already know what a personal loan is — or at least, you’ve seen it offered in some form while scrolling through your banking app. At its core, it’s a way to borrow money without needing to explain every detail or putting up an asset as security. That’s exactly why it appeals to so many people: it’s simple, quick, and puts the decision-making in your hands.

With so many types of personal loans available today, it’s no surprise they’ve become a go-to option for people across income levels. But what really makes them stand out? Let’s break down the core benefits that make personal loans worth considering, even when you have other choices.

1. No collateral required

You don’t need to mortgage your home, gold, or any asset to qualify, making personal loans less risky and more convenient.

2. Flexible usage

Personal loans offer unmatched freedom and control. Unlike loans tied to specific goals, these loans can be used however you see fit.

3. Quick processing

Reputed lenders like IDFC FIRST Bank often offer instant personal loan approvals with minimal documentation, especially through digital applications.

4. Competitive interest rates

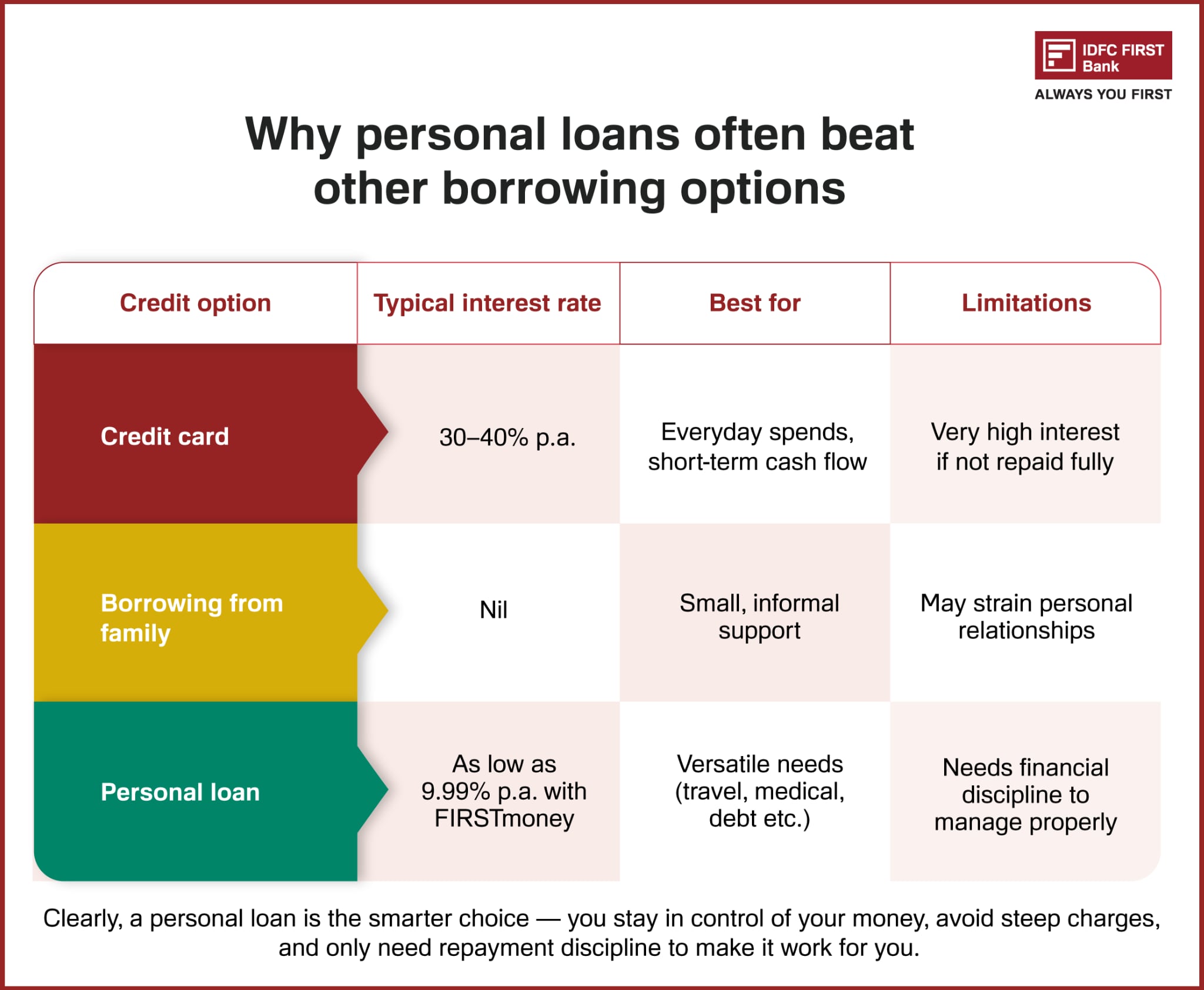

With so many options available today, you can easily choose a personal loan with low interest rates, making them cheaper than credit cards or informal borrowing.

5. Simple repayment options

With tenures ranging from nine months to five years, personal loans give you the flexibility of choosing a repayment plan that aligns with your financial comfort.

Types of personal loans you can consider

The mix of accessibility, affordability, and flexibility explains why there are so many types of personal loans offered by banks today. As demand continues to increase, some of the most common loan types include:

1. Debt consolidation personal loan

If you’re juggling multiple credit card bills or EMIs, a personal loan for debt consolidation allows you to merge them into one. This means a single monthly repayment, often at a lower rate, and far less stress.

2. Personal loans for travel

Whether it’s a family holiday or a solo trip abroad, a personal loan for travel can cover flights, accommodation, and experiences without draining your savings upfront. Repayment in EMIs makes planning easier.

3. Personal loan for shopping

Big-ticket purchases like electronics, furniture, or festive shopping can be heavy on your wallet. A personal loan for shopping gives you the flexibility to buy what you need upfront and repay in manageable EMIs, instead of relying on high-interest credit cards.

4. Medical emergency loans

Health expenses don’t always wait. With instant approvals, these personal loans ensure quick access to funds for hospitalisation, surgery, or urgent treatments — minimising the financial strain during emergencies.

5. Personal loans for home renovations

From structural repairs to interior upgrades, home renovation loans let you improve or maintain your property without dipping into long-term investments. Their flexible tenures help spread out the cost.

6. Personal loans for celebrations

Weddings, anniversaries, or milestone birthdays often come with big price tags. Taking out a small personal loan for celebrations can help you plan stress-free events, with repayments spread across months or years.

7. Loans for cash flow management

Particularly useful for freelancers or small business owners, these loans help smoothen irregular income cycles. They ensure steady working capital, covering operational or household expenses during lean months.

8. Personal loans for upskilling

Short-term courses, certifications, or specialised training often don’t qualify for education loans. Choosing the right type of personal loan can help you bridge this gap and invest in your career without financial roadblocks.

Shifts in borrowing patterns across types of personal loans

Personal loans are now among the most widely used credit products in the country. A 2023 TransUnion CIBIL report showed a 23% year-on-year increase in personal loans, with growth led by debt consolidation loans and emergency funding. This points to a clear trend: people are choosing personal loans not only for aspirations but also as a dependable safety net.

Loan sizes are also shifting. The share of loans above ₹10 lakh has risen to 30.9% in FY25, reflecting growing confidence in using credit for big-ticket needs. At the same time, small personal loans under ₹1 lakh are gaining popularity thanks to digital platforms and instant approvals. Together, these changes show how personal loans are becoming both inclusive and versatile — serving everyone from first-time borrowers to those seeking the best personal loans for larger commitments.

In short, whether small or high-value, personal loans today are more convenient and widely accepted than ever.

Borrowing smart: How to keep your personal loan experience safe

There’s no doubt that the many types of personal loans available today make borrowing more convenient than ever. But with convenience also comes responsibility. Without the right precaution, helpful credit can quickly turn into a burden.

Here are some common pitfalls and risks you should be aware of:

1. Borrowing more than you can repay

Choosing EMIs that don’t fit your income can make even the best personal loans overwhelming.

2. Falling for hidden charges

Some types of personal loans may appear affordable but include processing fees or penalties that raise the total cost.

3. Late or missed payments

Irregular repayments not only add charges but also impact your credit score for future borrowing.

4. Fraudulent lenders or scams

Unverified apps promising instant personal loan approvals often misuse personal data or impose predatory rates.

5. Not comparing options

Skipping your research on personal loans with low interest rates can leave you locked into expensive EMIs.

While these risks might sound scary, don't let them discourage you. When you choose a trusted solution, such as a FIRSTmoney personal loan from IDFC FIRST Bank, you can enjoy the benefits of personal loans without the stress.

Meet FIRSTmoney: A personal loan designed for speed and flexibility

If you're wondering which is the best type of personal loan available today, look no further. With safety, simplicity, and speed, FIRSTmoney from IDFC FIRST Bank is built to be flexible, transparent, and user-friendly — helping you access funds when you need them, without unnecessary stress.

1. Access up to ₹10 lakh without hassle

Cover anything from urgent expenses to big milestones with a high loan amount, backed by a 100% digital application process and zero paperwork.

2. Keep EMIs light with interest rates from 9.99%

Borrow smart with low interest rates, helping you save significantly compared to high-cost credit options.

3. Choose repayment on your terms

With tenures ranging from 9 to 60 months, you can tailor your EMI to match your monthly budget, whether you want to repay quickly or keep it comfortable.

4. Get money in your account as quickly as within 30 minutes

Thanks to a 100% digital process, your loan is approved and disbursed instantly, making funds available right when you need them.

5. Enjoy the freedom to repay early

FIRSTmoney charges zero foreclosure fees, giving you complete flexibility to clear your loan ahead of time and reduce your interest outgo.

The best part? Eligibility for a FIRSTmoney personal loan is simple. If you’re between 21 and 60 years old, salaried or self-employed, and have a CIBIL score of 730 or above, you’re already on your way to qualifying for a FIRSTmoney personal loan.

Smart tips to make the most of your FIRSTmoney personal loan

Getting a personal loan is only half the journey — handling it wisely is what truly makes the difference. No matter which of the many types of personal loans you choose, responsible repayment is the key to keeping your finances stress-free. Here are some quick tips to help you borrow smart with FIRSTmoney personal loan:

- Borrow only what you truly need, not the maximum amount you qualify for

- Use the EMI calculator provided by IDFC FIRST Bank to choose a tenure and repayment plan that fits your budget

- Prioritise timely EMI payments to protect your credit score and avoid penalties.

- Whenever possible, use any bonuses to close your loan early and become debt-free without any foreclosure charges

- Keep track of all loan-related documents and monitor your repayment progress regularly

Why choose IDFC FIRST Bank for your personal loan needs

The many types of personal loans available in India can help you achieve different goals — from managing emergencies to funding aspirations. But the real difference lies in choosing a lender who makes borrowing safe, transparent, and truly customer-friendly. That’s where a FIRSTmoney personal loan from IDFC FIRST Bank stands out.

Some of the reasons FIRSTmoney stands out as one of the best personal loans include:

- Quick, 100% digital process so that you can apply and get funds in your account within minutes

- Zero paperwork, with only your physical PAN card needed for video KYC

- Flexible repayment options to choose a tenure that fits your income and lifestyle

- Competitive interest rates starting from 9.99% p.a.

- Zero foreclosure charges if you choose to close the loan early

- Real-time tracking so you always know your application status

- Trusted by millions and rated among the World’s Best Banks 2025 by Forbes, in partnership with Statista

A personal loan should simplify life, not complicate it. With FIRSTmoney by IDFC FIRST Bank, you can borrow with confidence, knowing your loan is designed around your needs. Ready to get started? Check your eligibility and apply for a FIRSTmoney personal loan today.

Frequently Asked Questions

Which bank is best for a personal loan in India?

The best bank for a personal loan depends on its interest rates, processing speed, and repayment flexibility. For instance, FIRSTmoney personal loan from IDFC FIRST Bank stands out with competitive rates starting at 9.99% p.a, instant approval, and zero foreclosure charges.

What is the average interest rate on a personal loan?

Personal loan interest rates can greatly vary by lenders, with some options charging as high as 18–20%. This is where a FIRSTmoney personal loan from IDFC FIRST Bank simplifies borrowing with competitive interest rates starting at only 9.99% p.a.

How to get a personal loan instantly?

Choose banks offering digital applications and fast processing. With IDFC FIRST Bank, you can apply online with zero paperwork and get an instant personal loan disbursed within 30 minutes.

How are personal loan EMIs calculated?

EMIs are based on loan amount, tenure, and interest rate. Most lenders, including IDFC FIRST Bank, provide online EMI calculators to help you test affordability before applying.

Do personal loans improve your credit score?

Yes. Timely repayment of personal loans can help build a positive credit history and can improve your CIBIL score, making it easier to qualify for larger loans later.

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject IDFC FIRST Bank or its affiliates to any licensing or registration requirements. IDFC FIRST Bank shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

The features, benefits and offers mentioned in the article are applicable as on the day of publication of this blog and is subject to change without notice. The contents herein are also subject to other product specific terms and conditions and any third party terms and conditions, as applicable. Please refer our website www.idfcfirstbank.com for latest updates.