Are you ready for an upgrade?

Login to the new experience with best features and services

Notifications

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

Activate your Credit Card within minutes and enjoy unlimited benefits

Accounts

Deposits

Loans

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

Wealth & Insure

Payments

Cards

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

Premium Metal

0% Forex & Travel

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

Lifetime Free

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

10X Rewards

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

UPI Cards

Fuel & Utility

Showstopper

Credit Builder

More

NRI Savings Account

NRI Fixed Deposit

FOREX Solutions

Transfer to NRE

Corporate Account

Cash Management Services

Corporate Lending

Treasury

MSME Accounts

Trade Services

MSME Loan

MSME Solutions

Offers

About Us

Investors

Careers

IDFC FIRST Academy

ESG

Meet Priya. She’s got a stable job, manages her expenses well, and even puts aside a little each month for emergencies. But life, as it often does, threw her a curveball. Her father needed an urgent medical procedure, and the cost was far beyond what her savings could cover.

Priya spent hours considering her options. Should she break into her fixed deposits? Or tap into the investments meant for her future? That’s when Priya came across the idea of a personal loan. At first, it sounded intimidating—but was it really a bad financial move, or could it be the right solution?

If you’ve ever faced a situation like Priya’s—an unexpected expense, a financial goal just out of reach, or even mounting debts weighing you down—you might be wondering the same thing. When does taking a personal loan make sense? And how do you decide if it’s the right finance planning for you?

Let’s walk through the scenarios where a personal loan could be a smart choice.

When does a personal loan make sense?

When used wisely, personal loans can be a strategic tool in your financial planning. While it’s always advisable to have a strong savings buffer, there are times when a loan is the best option. Let’s look at a few scenarios where personal loans make sense.

1. Handling medical emergencies without draining your savings

Since medical emergencies can’t be predicted, having access to funds through a personal loan can prevent you from tapping into your savings or putting off critical treatment. In such instances, a smart finance move is a loan with manageable terms to relieve the immediate financial pressure of medical expenses.

2. Consolidating your debts for better financial planning

Some of us juggle multiple loans with varying interest rates. Debt consolidation is a strategy that allows you to combine all your existing loans into a single loan with a lower interest rate. This can make it easier to manage repayments and reduce the total interest burden.

For example, if you have credit card debt, a personal loan, and a car loan, you can consolidate your debt into a single personal loan with a more favourable interest rate. This way, you can ensure simple finance planning and reduce monthly payments, giving you more control over your finances.

3. Upgrading your home without emptying your pockets

Homeowners often need to invest in repairs or upgrades, but the cost can sometimes exceed their available savings. A personal loan can be ideal in this scenario. You can make necessary improvements without draining your emergency funds. With low-interest options and flexible repayment terms, a personal loan for home renovation can be one of the smartest financial strategies.

4. Investing in your education for a brighter future

Education is one of the best investments you can make. However, with the rising costs of tuition and associated expenses, it can be difficult to afford higher education upfront. Many students and professionals opt for personal loans to finance their studies and pay for tuition, books, and living expenses.

5. Fueling your business dreams with smart financial support

Starting or expanding a business can require a substantial capital investment in the initial stages. A personal loan can provide the necessary funds to cover startup costs, inventory, or marketing efforts.

For instance, you can use a personal loan to expand your small business and hire additional staff. With a well-thought-out financial planning strategy, you can pay off the loan as your business grows, making it a smart investment.

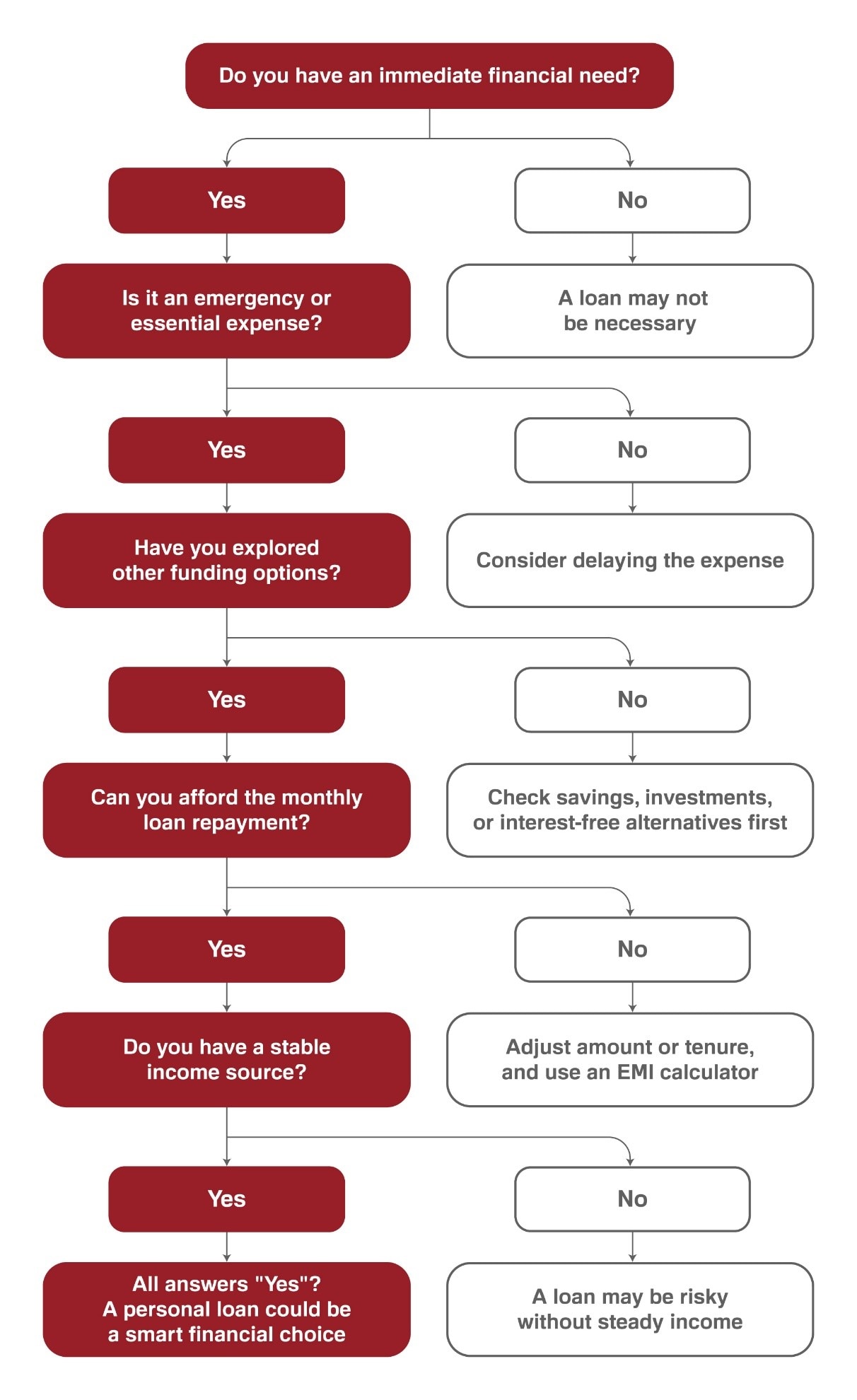

Should you take a personal loan?

Not sure if a personal loan is the right choice for you? Use this simple decision flowchart to evaluate your situation and determine whether taking a loan makes financial sense.

Can you afford a personal loan? Here’s how to find out

When considering whether a personal loan is the right choice for your situation, the most important question is – can you afford to repay the loan? Smart finance planning requires a clear understanding of your income, expenses, and the potential impact of loan repayment on your monthly budget.

Here’s how you can assess your affordability –

1. Track your income and expenses to see where you stand

Begin by evaluating your monthly income and expenses. Are you able to cover all your essential expenses (like rent, utilities, groceries, etc.) while making the loan repayment? If yes, you can consider taking a loan.

2. Use an equated monthly instalments (EMI) calculator to understand your monthly payments

Lenders offer tools to calculate your EMIs based on the loan amount, interest rate, and tenure. Ensure that your monthly EMIs won’t exceed your financial comfort zone, which could lead to stress or potential defaults.

You can understand the impact of monthly payments on your budget with the help of the IDFC FIRST Bank EMI calculator.

3. Think about your future financial goals before borrowing

Consider any short-term or long-term financial goals, such as savings for retirement, children’s education, or a future home purchase. A personal loan should not derail these goals in your financial planning roadmap.

When it comes to smart finance, choosing the right loan provider is just as important as choosing the right loan amount. FIRSTmoney from IDFC FIRST Bank offers smart, instant personal loans with attractive features like –

- 100% digital application process to help you access funds instantly

- Competitive interest rates starting at just 10.99% p.a.

- Flexible repayment options ranging between 9 and 60 months

- Zero foreclosure charges allowing you to repay early without any extra cost

Whether you’re facing an unexpected medical expense or looking to renovate your home, FIRSTmoney can provide you with a financial solution tailored to your needs.

Know what you’re signing up for!

Before signing any loan agreement, here are the key elements to focus on –

1. Interest rate

This is the cost of borrowing. A higher interest rate means higher EMIs. Always compare rates across different lenders to ensure you get a good deal. Smart finance planning is choosing a loan with the lowest possible interest rate while meeting your financial needs.

2. Loan tenure

The tenure refers to the duration of the loan. Shorter tenures may have higher EMIs but cost less overall in terms of interest. Longer tenures reduce the EMI but increase the total amount paid in interest. Financial strategies suggest opting for a tenure that balances affordable EMIs and the total cost of the loan.

3. Your EMI

The EMI depends on the loan amount, interest rate, and tenure. Using an EMI calculator helps you visualise the financial commitment. Such informed decisions based on these calculations contribute to safe financial planning.

Is all debt bad? Understanding good debt vs. bad debt

In smart finance planning, it’s essential to differentiate between good and bad debt.

Good debt is money borrowed to fund investments that are likely to increase in value or generate income, such as a home loan, education loan, or business loan. These types of debt are generally tools for wealth-building.

On the other hand, bad debt refers to borrowing for depreciating assets or consumption, such as using credit cards to buy non-essential items. Bad debt can quickly spiral out of control, especially when the interest rates are high.

When a personal loan makes sense vs. when it doesn’t

When a personal loan makes sense |

When a personal loan doesn’t make sense |

Medical emergency |

Luxury purchases |

Home renovation |

Vacations |

Debt consolidation |

Unstable income |

Higher education |

Impulse spending |

Business investment |

Existing overwhelming debt |

How to borrow wisely with a clear financial strategy

Here are some tips for responsible borrowing, essential for effective financial planning –

1. Borrow what you need, not what you can get

Resist the temptation to borrow more than necessary. Stick to the amount required to meet your specific needs. Overborrowing increases your debt burden and interest payments, hindering your smart finance progress.

2. Choose a repayment tenure you can afford

Carefully consider your financial situation and choose a tenure that allows for comfortable monthly repayments. While a longer tenure reduces EMIs, it increases the total interest paid. Find a balance that suits your budget.

3. Have a clear repayment plan

Before taking the loan, have a clear plan for how you will repay it. Factor the EMIs into your monthly budget and ensure you have a reliable source of income to meet these obligations. This is a fundamental aspect of responsible financial planning.

4. Avoid taking multiple loans simultaneously

Taking on multiple loans can significantly increase your debt burden and make it difficult to manage repayments. Focus on repaying your current loan before taking on new debt.

5. Maintain an emergency fund

Even when taking a loan, maintain an emergency fund to cover unexpected expenses. This will prevent you from taking out additional loans in the future.

Make financial decisions with confidence

Smart finance planning isn’t just about avoiding debt—it’s about using debt wisely when it aligns with your needs and long-term goals. If you’re considering a personal loan, explore FIRSTmoney. With competitive interest rates, custom repayment terms, and more, you can stay on track with your financial planning and make decisions that put you on the path of stability and success.

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject IDFC FIRST Bank or its affiliates to any licensing or registration requirements. IDFC FIRST Bank shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.