Are you ready for an upgrade?

Login to the new experience with best features and services

Notifications

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

Activate your Credit Card within minutes and enjoy unlimited benefits

Accounts

Deposits

Loans

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

Wealth & Insure

Payments

Cards

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

Premium Metal

0% Forex & Travel

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

Lifetime Free

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

10X Rewards

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

UPI Cards

Fuel & Utility

Showstopper

Credit Builder

More

NRI Savings Account

NRI Fixed Deposit

FOREX Solutions

Transfer to NRE

Corporate Account

Cash Management Services

Corporate Lending

Treasury

MSME Accounts

Trade Services

MSME Loan

MSME Solutions

Offers

About Us

Investors

Careers

IDFC FIRST Academy

ESG

A credit card can bring about plenty of savings. “How?” - you may ask. The answer is to identify where you spend most money on and select a credit card that offers rewards for those specific categories. If fuel, grocery, and utility bills make up a large chunk of your spending, then it’s time to consider the FIRST Power Credit Card to enjoy greater savings.

Let’s understand how.

Features and benefits of the FIRST Power Credit Card

Given below are the main features and benefits of the FIRST Power Credit Card, which make it suitable for saving money -

● Welcome benefits

As you apply for the card and activate it, you can enjoy a slew of welcome benefits, which include the following -

- Enjoy a cashback of ₹250 on your first fuel transaction worth ₹250 or above at any HPCL outlet within the first 30 days of card set-up

- Convert your transactions into EMIs within the first 30 days and enjoy 5% cashback, up to ₹1,000, on the overall transaction value

- Get a discount of ₹1,000 on Zoomcar rentals

- Get a 50% discount on international and domestic rental cars with Europcar and Eco Rent-a-Car, respectively

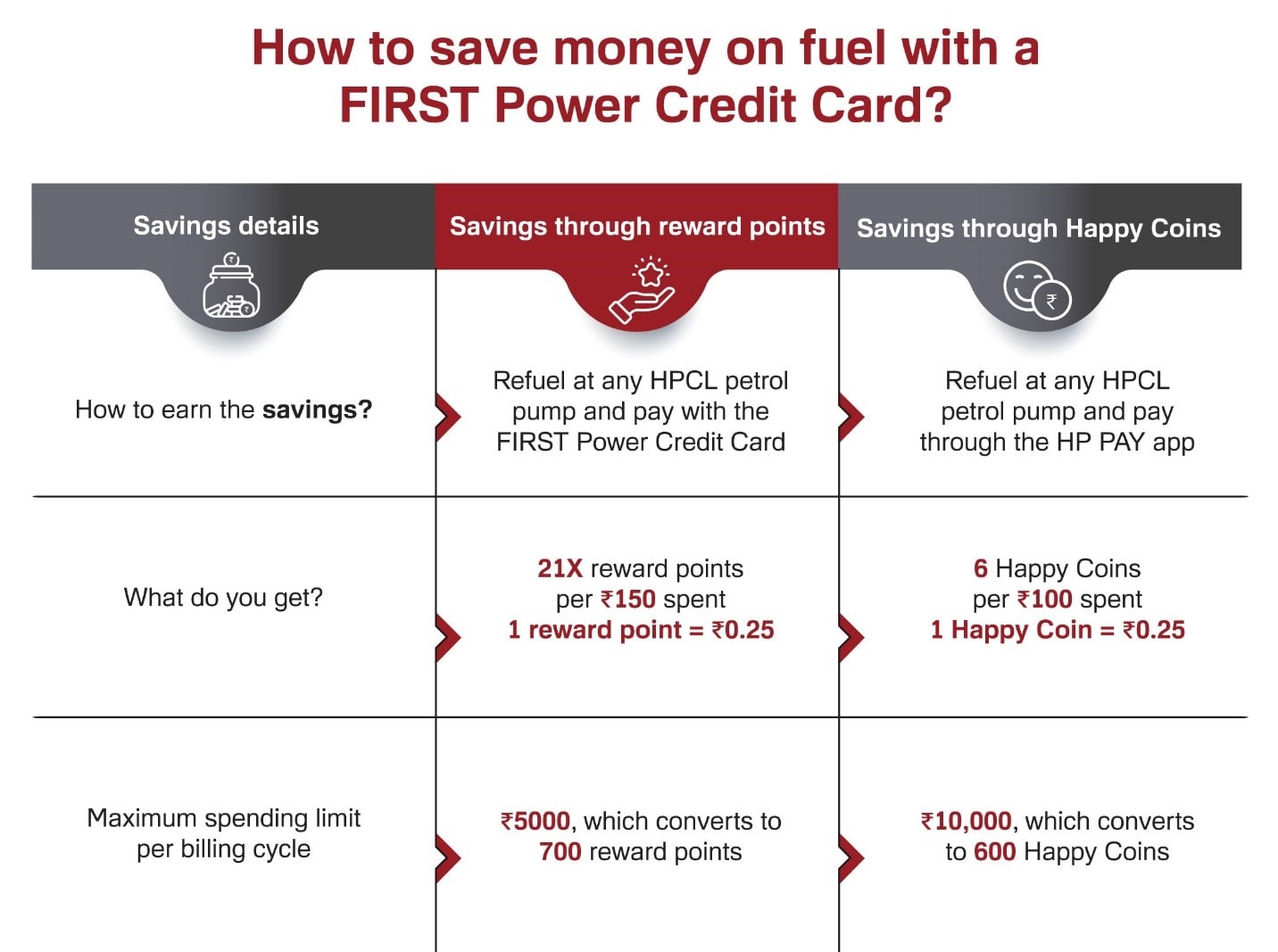

● Savings on fuel

The FIRST Power Credit Card gives you considerable savings on fuel transactions. You can save up to 5% on fuel transactions and travel to your heart’s desire without worrying about fuel costs.

Check out the illustration to understand how the card helps with money-saving on fuel -

Scan the QR code at the fuel station and pay via the HP PAY app using the FIRST Power Credit Card to unlock maximum savings.

● Free insurance coverage

The FIRST Power Credit Card provides you with a host of complimentary insurance coverage benefits for financial security. Check out the benefits available -

- Roadside assistance cover worth ₹1399

- Lost card liability cover worth ₹25,000

- Personal accident cover worth ₹2 lakhs

Enjoy these coverages free of cost and get compensated in the case of unforeseen financial losses.

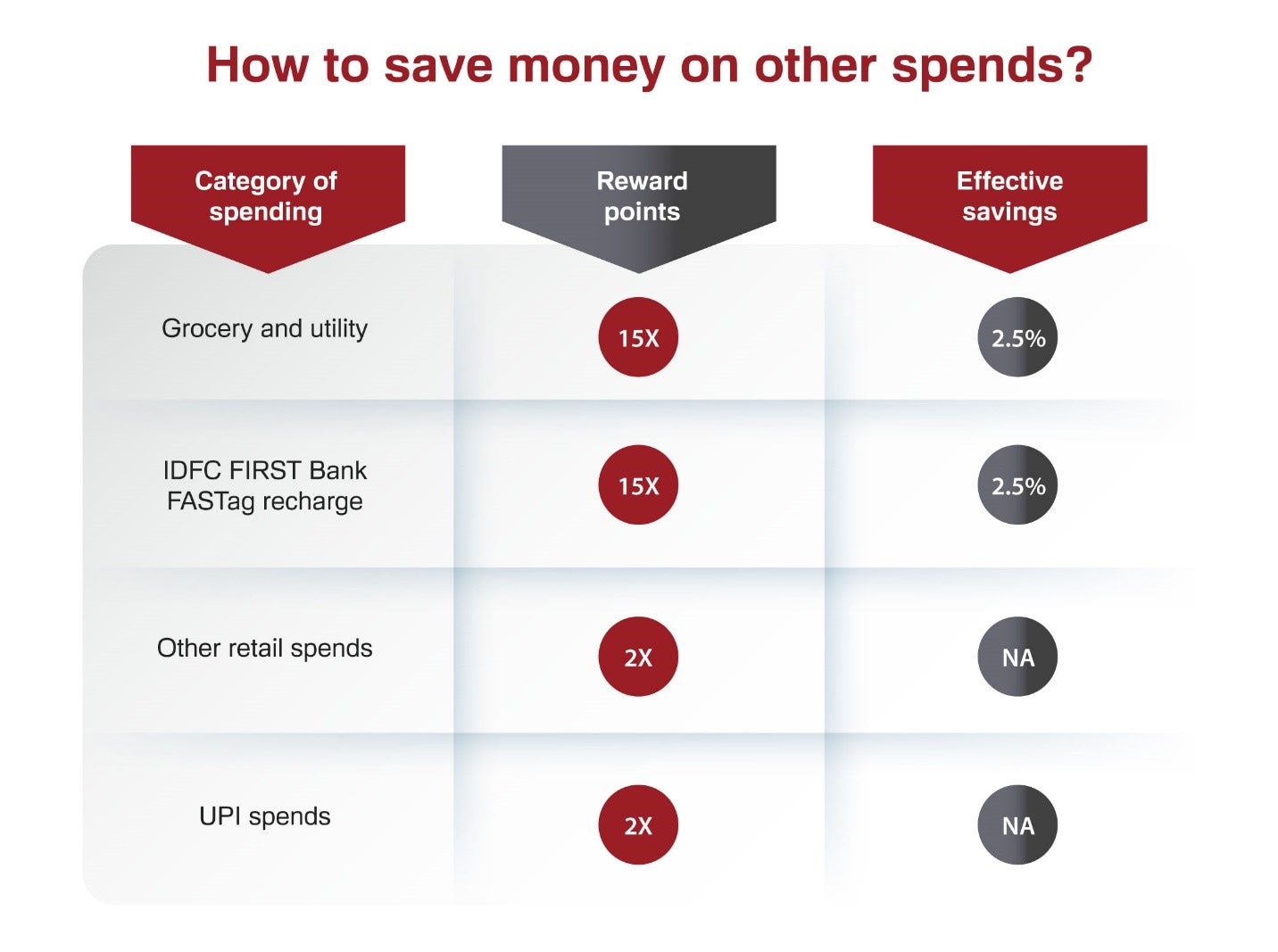

● Savings on other spends

Besides offering savings on fuel costs, the FIRST Power Credit Card offers savings on other transactions, too. Whether it is grocery shopping or simple UPI spends, you can save every time you use the card. Find out how -

● Cost-effective

The FIRST Power Credit Card is cost-effective, too. The Annual Percentage Rate (APR) is low and dynamic, starting at 9% per annum. Plus, there is 0% interest on ATM cash withdrawals until the due date.

● Additional benefits

If savings and cost-effectiveness are not enough, there are also additional benefits. Here’s what you can get -

- The facility of converting your purchases or credit card balance into affordable EMIs

- Get an add-on card for the pillion rider and double the savings without added charges

- Earn up to 2000 reward points when you refer your friends, and they activate the card. You can earn a maximum of 10,000 reward points through referrals

Tips for maximising the benefits of the card

With so many credit card offers, the FIRST Power Credit Card is an effective money-saving tool. To maximise its benefits, here are some tips that can help -

- Try and use the credit card for most of your transactions to maximise earning the reward points

- Choose the UPI-enabled credit card for additional reward points on UPI spends

- Pay your credit card dues on time to avoid added interest outgo

How to apply for the FIRST Power Credit Card?

You can apply for the FIRST Power Credit Card online. Here’s how -

Step 1-

Step 2-

Step 3-

Visit the online application page for the FIRST Power Credit Card

Fill out your details and submit the application

Once approved, complete your V-KYC and address verification to receive the credit card

Financial management made easy with FIRST Power Credit Card

Manage your finances effectively with the FIRST Power Credit Card. Earn never-expiring Reward Points on your transactions and redeem them on future purchases for added savings. Plus, the cashback and discounts offered by the credit card can give you direct savings across merchants.

Apply for the FIRST Power Credit Card and make it your money-saving companion. It will help you save on refuelling, shopping, grocery and lifestyle spending, and more. Save more, invest more, and manage your finances better.

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject IDFC FIRST Bank or its affiliates to any licensing or registration requirements. IDFC FIRST Bank shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.