CKYC Registry

-

Customer Service Contact us Service request Locate a branch

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

Support topics, Contact us, FAQs and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex Services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% Cashback₹499

-

FIRST DigitalVirtualUPI₹199

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

- Fuel and Savings

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

FIRST EA₹NVirtualCashback₹499

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

Car Loan

Missed your car loan EMI? Here's the aftermath and its solutions!

Key Takeaways

Missing a car loan EMI can hurt your credit score and increase financial stress

Take immediate steps to avoid severe consequences

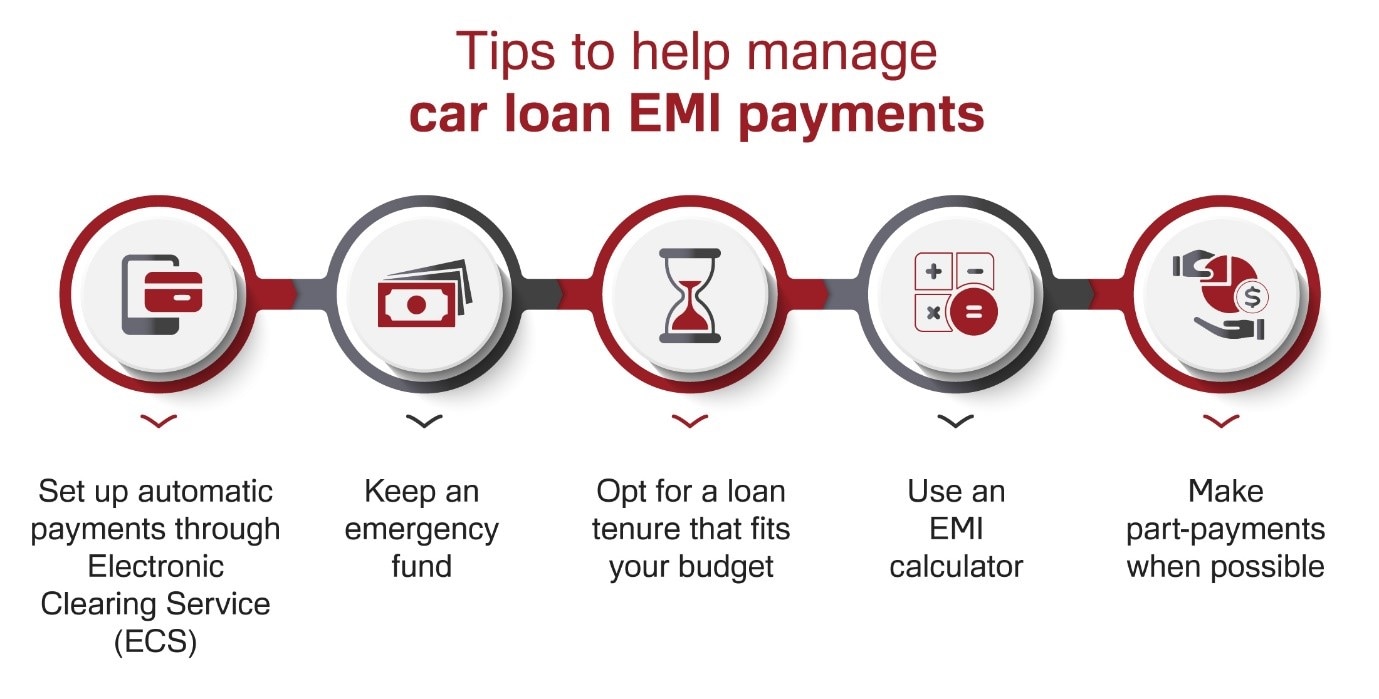

IDFC FIRST Bank offers flexible loan terms, affordable rates, minimal charges, and extensive support to help manage your car loan EMI payments easily

Missing an equated monthly instalment (EMI) for your car loan can be more than just a minor hiccup in your financial plan. If you’re financing your car using a loan, skipping even a single payment can lead to a cascade of consequences that affect your creditworthiness, financial stability, and even your legal standing. Understanding these repercussions is crucial for maintaining a healthy financial profile.

When you miss a car loan EMI, it doesn’t just impact your immediate finances. The ripple effects can influence your future credit opportunities, the cost of borrowing, and your peace of mind. Let’s dive into what happens if you miss a car loan payment and how to handle the situation effectively.

Consequences of missing a car loan payment

Below are some of the key consequences you should be aware of –

Impact on your credit score

Your credit score is a numerical representation of your creditworthiness, and it plays a significant role in your ability to secure loans in the future. Missing a car loan EMI can cause an immediate dip in your credit score.

In India, certain agencies like CIBIL track credit scores, and even a single missed payment can damage your financial reputation and increase your default risk. This can make it more difficult for you to get approved for loans or credit cards in the future, or you might be offered higher vehicle loan interest rates due to the perceived risk.

EMI bounce charges and additional penalties

If you miss a payment, your lender may impose EMI bounce charges. These charges can vary depending on the bank but typically go up to ₹400 or range from 2% to 3% of the missed amount. Additionally, you may also incur late payment fees, which can further strain your finances.

Increased financial burden due to accrued interest

When you miss a car loan payment, the unpaid amount continues to accrue interest. This means that the longer you delay the payment, the more you’ll end up paying in the long run. The accumulated interest can increase your financial burden and make catching up on future payments even more challenging.

Legal implications and repossession risks

In India, missing multiple car loan EMI payments can lead to serious legal consequences. After a certain period of non-payment, your loan can default, and the lender may initiate legal proceedings to recover the debt. This can result in the repossession of your vehicle.

Repossession means losing your car and dealing with the negative impact on your credit score and potential legal fees.

Steps to take if you miss a payment

If you’ve missed a car loan EMI payment, you must act swiftly to minimise the financial ramifications. Here are some steps you can take to manage the situation –

Contact your lender immediately

The first step is to contact your lender as soon as possible. Banks in India are generally open to negotiating repayment terms, especially if you have a valid reason for missing the payment. Prompt communication can help you avoid further penalties and may even allow you to restructure your loan to make it more manageable.

Explore EMI deferment options

Some banks offer EMI deferment options, allowing you to delay your payments without affecting your credit score or incurring additional charges. However, this usually comes with conditions, such as a slight increase in the interest rate or an extension of the loan tenure.

Consider a loan restructuring

Loan restructuring involves altering the terms of your loan to reduce your monthly car loan EMI payments. This could mean extending the loan tenure, which might increase the overall interest but make monthly payments more affordable. This option is particularly useful if you foresee long-term financial difficulties.

Make a partial payment

If you can’t afford to pay the full EMI, consider making a partial payment. While this won’t completely prevent the consequences of missing a payment, it can reduce the severity of the impact. Some banks may accept partial payments and work with you to create a repayment plan.

Advantages of taking a car loan from IDFC FIRST Bank

Choosing the right lender can make a significant difference in managing your car loan EMIs. Here’s why IDFC FIRST Bank stands out –

Competitive interest rates

IDFC FIRST Bank offers lucrative interest rates starting at 9% for new car loans. This low rate can make your car loan EMIs more manageable and reduce the overall cost of the loan. The vehicle loan interest rate is crucial in determining your EMI, and IDFC FIRST Bank designs these rates to be affordable.

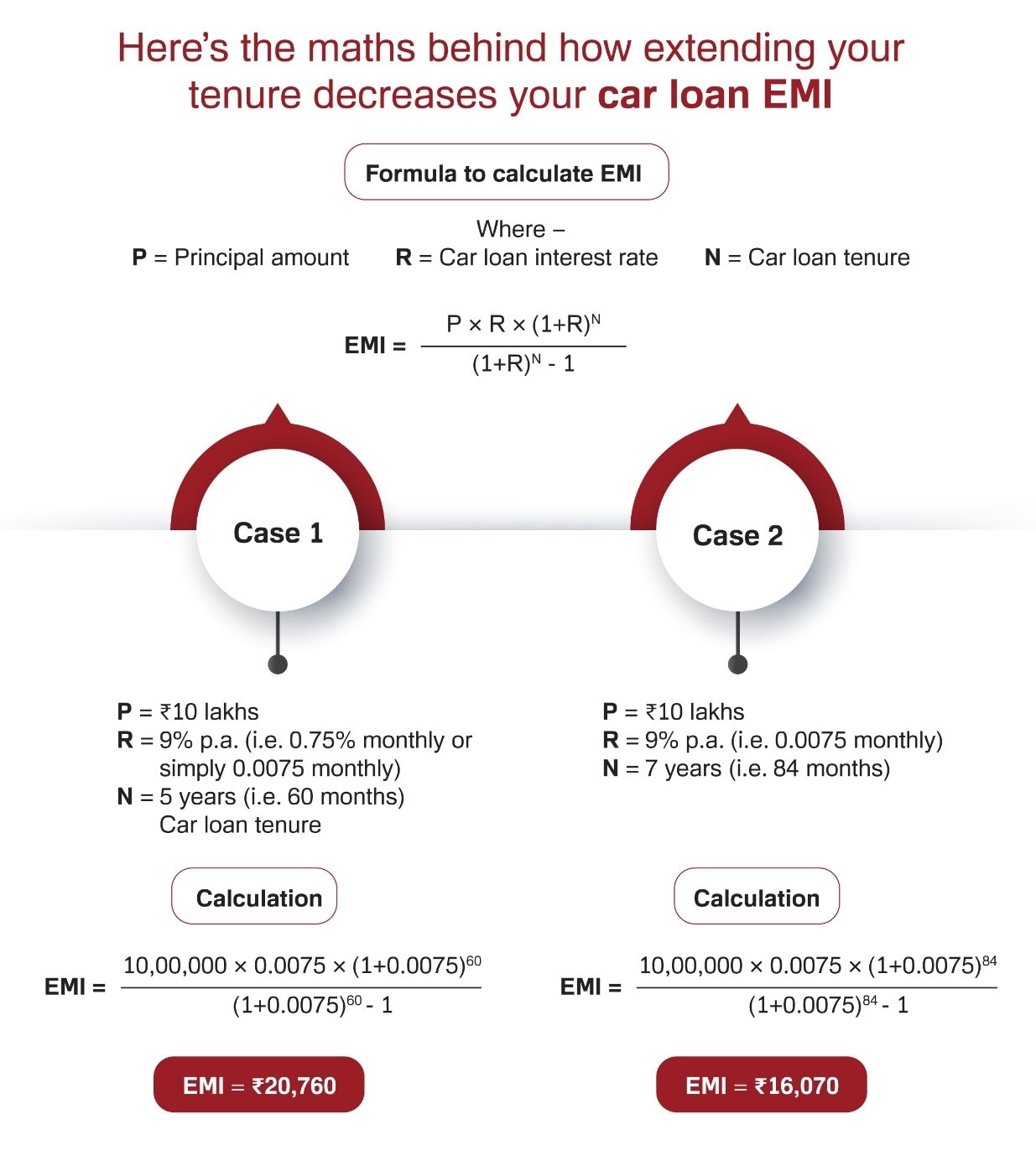

Flexible loan tenure

With a loan tenure of up to ten years, IDFC FIRST Bank allows borrowers to choose a repayment schedule that fits their budget. This flexibility can help you avoid the stress of high monthly payments and reduce the risk of missing an EMI payment. A longer tenure means lower EMIs, making it easier to manage your finances over time.

An extension in your loan tenure results in a decrease in your car loan EMI—but keep in mind that there’s also an increase in the overall interest paid.

Zero foreclosure charges on floating interest rates

If you choose a floating interest rate, IDFC FIRST Bank does not impose foreclosure charges. This allows you to repay the loan early without incurring additional costs, giving you more control over your financial future.

Comprehensive loan options for pre-owned cars

IDFC FIRST Bank also offers attractive terms for pre-owned car loans, with interest rates of up to 10% on repurchase loans and up to 12.50% on refinance loans. Whether you’re buying a pre-owned car or need funds for other financial needs, you will always find flexible and affordable solutions here.

Advanced online tools and customer support

With IDFC FIRST Bank, you can access an easy-to-use online car loan EMI calculator to plan your finances in advance. Additionally, you can manage your loan and EMI details through the bank’s WhatsApp service and mobile banking app, making it convenient to stay on top of your car loan payments.

Conclusion

Missing a car loan EMI payment can have serious repercussions, including a negative impact on your credit score, financial penalties, and even the risk of legal action and repossession. However, taking prompt action and exploring available options can mitigate these consequences and protect your financial well-being.

If you’re looking for a reliable and supportive lender, consider applying for a car loan with IDFC FIRST Bank. With affordable interest rates, flexible loan tenures, and robust customer support, they make it easier to manage your car loan payments and your financial stability. Apply for a new or pre-owned car loan today to drive your dream car without worries!

The features, benefits and offers mentioned in the article are applicable as on the day of publication of this blog and is subject to change without notice. The contents herein are also subject to other product specific terms and conditions and any third party terms and conditions, as applicable. Please refer our website www.idfcfirstbank.com for latest updates.