Are you ready for an upgrade?

Login to the new experience with best features and services

Notifications

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

Activate your Credit Card within minutes and enjoy unlimited benefits

Accounts

Deposits

Loans

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

Wealth & Insure

Payments

Cards

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

Premium Metal

0% Forex & Travel

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

Lifetime Free

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

10X Rewards

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

UPI Cards

Fuel & Utility

Showstopper

Credit Builder

More

NRI Savings Account

NRI Fixed Deposit

FOREX Solutions

Transfer to NRE

Corporate Account

Cash Management Services

Corporate Lending

Treasury

MSME Accounts

Trade Services

MSME Loan

MSME Solutions

Offers

About Us

Investors

Careers

IDFC FIRST Academy

ESG

India already has over 7.7 million gig workers, and that number is expected to soar to 23.5 million by 2030. If you’re one of them, or a self-employed professional, small business owner, or freelancer, you already know the perks of independence. But when it comes to getting quick financial support, things can feel stacked against you. No salary slips? No traditional job? That often means no loan approval.

But here’s the good news: today, it’s absolutely possible to get an instant loan for self-employed individuals without needing piles of paperwork or a fixed monthly income. With the rise of instant online approval systems for loans and digital lending tools, even those looking for a small loan online without income proof can find flexible, fast, and accessible funding options.

Here’s how.

Can you get a personal loan without a salary slip?

Traditionally, lenders ask for salary slips to assess your income stability. It helps them understand whether you can repay the loan on time. But if you’re self-employed, this becomes a roadblock: even if you earn well, you may not have the standard documents to prove it.

The good news is that a salary slip isn’t the only way to qualify. In fact, you can absolutely get an instant personal loan for self-employed individuals using other forms of income verification.

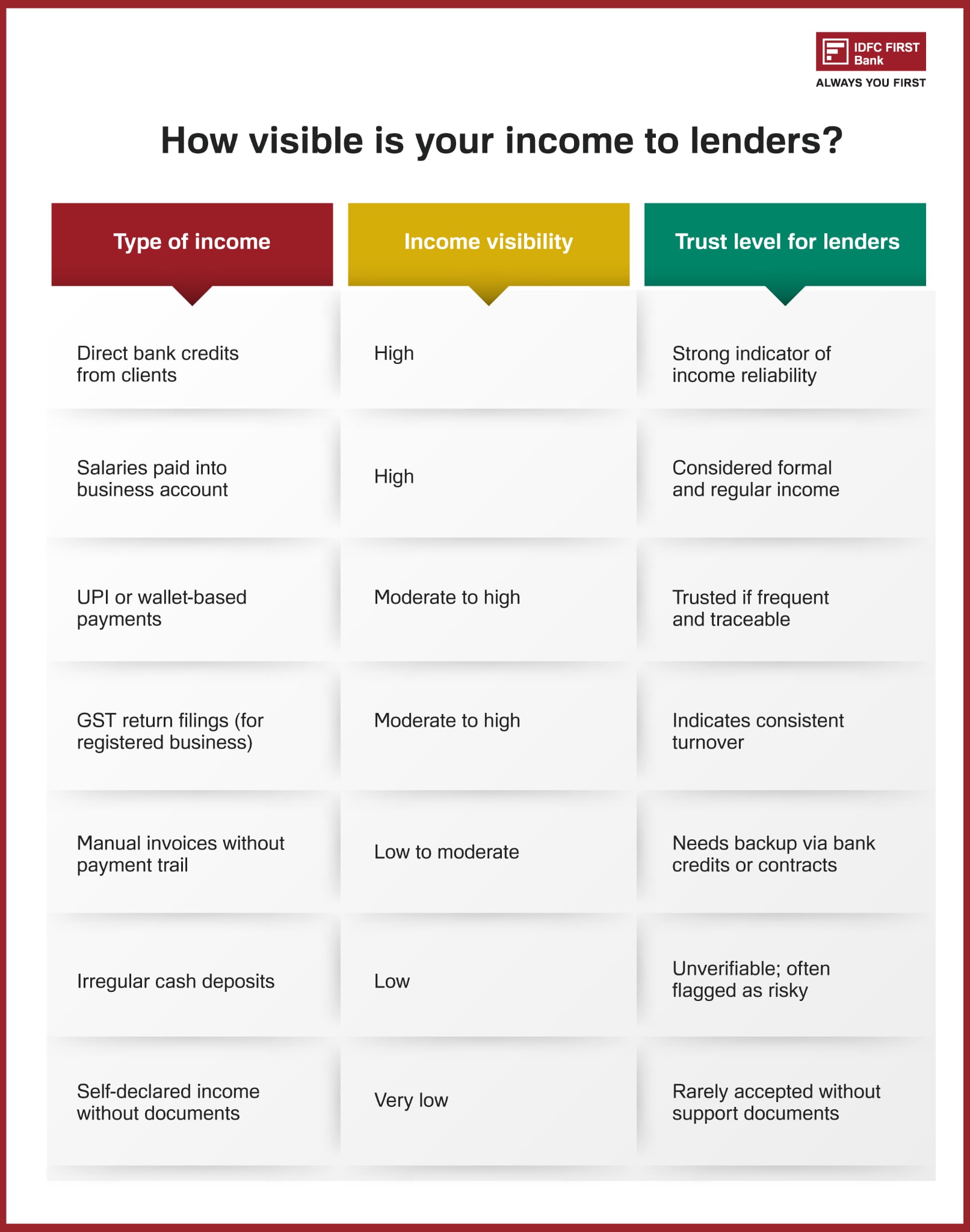

Lenders today are more focused on income visibility — they want to see that your cash flow is regular, your earnings are consistent, and your repayment history is healthy. As being self-employed becomes more popular, many banks have started offering instant loans without salary slips as well. After all, it’s not about where you work. It’s about whether your finances tell a stable story.

What are the challenges faced by self-employed borrowers?

Even with rising income opportunities, getting an instant loan for self-employed individuals isn’t always straightforward. Here are some common hurdles that often get in the way:

1. Irregular income flow

Unlike salaried employees, self-employed individuals often have fluctuating monthly earnings. This unpredictability makes lenders cautious about your repayment capacity.

2. Limited formal documentation

Many self-employed people don't have salary slips or official letters of employment. This makes it harder to even get a small online loan without income proof, unless alternative documents are available.

3. Lack of income visibility

Even if you earn well, a cash-heavy business or informal invoicing can hide your income from lenders. Digital earnings and bank credits help increase income visibility.

4. Traditional bias in lending

Banks often favour salaried profiles. As a result, an instant loan for self-employed people in India can be harder to access through conventional channels.

How to get an instant loan for self-employed individuals: Alternatives to salary slips

If you are a self-employed individual with no salary slips to show, don't be disheartened. You can still apply for a personal loan using alternative documents that show income reliability and financial discipline. Here are some valid options:

1. Bank statement

Your last 6–12 months of bank statements can show regular deposits, average monthly balance, and spending habits. Most lenders consider this a key proof of income visibility.

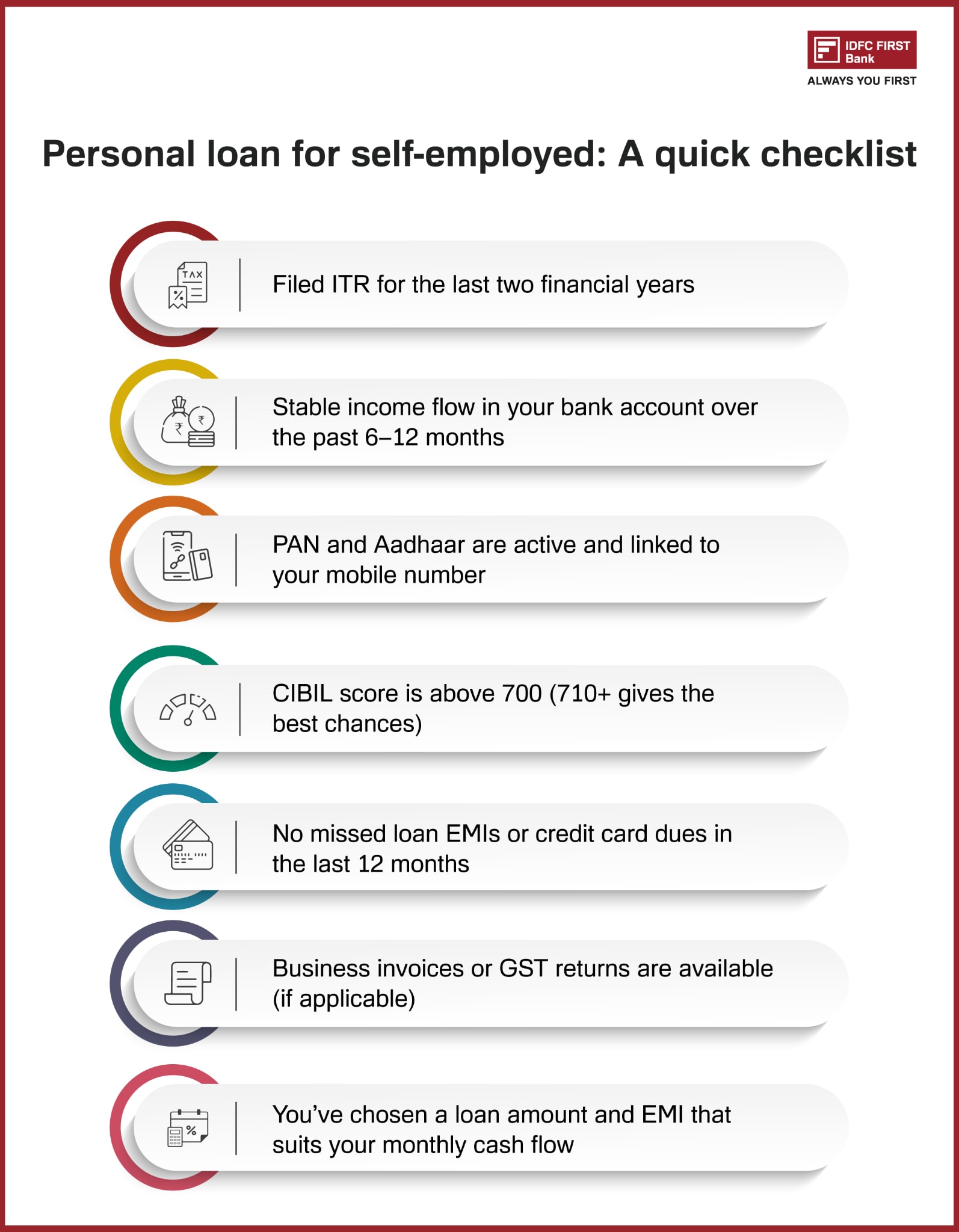

2. Income Tax Returns (ITRs)

ITRs filed for the past two to three years validate your annual income and tax compliance. You can download them from the Income Tax portal if e-filed.

3. GST returns

If you run a registered business, GST filings can highlight your monthly or quarterly turnover. They act as proof of consistent business income and help support your personal loan application.

4. Client invoices or contracts

Freelancers and consultants can submit current or past client invoices or signed contracts. These documents show expected income and project credibility.

5. Business registration certificate

A trade license, MSME registration, or business incorporation certificate builds credibility with lenders, especially when applying for a personal loan for self-employed individuals.

6. CA-certified profit & loss (P&L) statement

A chartered accountant can prepare a P&L statement detailing your earnings and expenses. This document helps justify income when filing ITRs isn’t enough for instant loan approval.

How to improve your chances of loan approval

Even without a traditional salary slip, getting an instant loan for self-employed individuals is very achievable, especially if you prepare smartly. Here are some practical steps to boost your chances of instant loan approval:

1. Maintain a strong credit score

Pay all EMIs, credit card bills, and existing debts on time. A score above 700 signals reliability and can fast-track your loan application.

2. Show consistent bank activity

Ensure your business or personal bank account reflects steady income and regular transactions. This builds trust when applying for an instant loan without income proof.

3. File ITRs regularly

Even if your income is modest, filing Income Tax Returns adds legitimacy. It supports applications for personal loans with no proof of income.

4. Avoid unnecessary debt

Limit new credit card usage or multiple loan applications. Lenders prefer applicants with a lower debt-to-income ratio.

5. Use a co-applicant or guarantor

Adding a financially stable co-applicant increases approval chances, especially when you’re seeking a larger sum of instant loan without salary slips.

6. Keep documents ready

Digital lenders process loans fast, so having our PAN, Aadhaar, bank statements, or invoices ready supports a more seamless application process.

You can get FIRSTmoney personal loan without any documentation. All you need is your PAN and Aadhaar number, and display your physical PAN card during the video KYC.

Why FIRSTmoney is the perfect personal loan option for the self-employed

If you're self-employed and tired of running into roadblocks when applying for credit, a FIRSTmoney personal loan from IDFC FIRST Bank offers a refreshingly accessible alternative. You can apply for FIRSTmoney if you're aged between 21 and 60 years and have a CIBIL score of 730 or higher. This makes it one of the most inclusive and flexible options for those seeking an instant loan for self-employed professionals.

Here’s how FIRSTmoney empowers you:

1. Get up to ₹10 lakh with zero paperwork

With simple eligibility and transparent terms, you can borrow up to ₹10 lakh without salary slips, making it ideal for freelancers and business owners seeking stress-free funding.

2. Enjoy competitive interest rates from 9.99% p.a.

Lower interest means lower EMIs. This makes your personal loan more affordable and less of a long-term burden.

3. Pick a repayment term that suits you

Choose flexible tenures ranging from 9 to 60 months so you can set an EMI that fits your cash flow without straining your budget.

4. Apply digitally with instant approval and quick disbursal

The 100% online process offers instant loan approval and transfers the funds to your account within 30 minutes — no branch visits, no paperwork hassles.

5. Repay on your terms with zero foreclosure charges

Want to close your personal loan ahead of schedule? You’re free to do so anytime without any foreclosure charges — perfect for those with uneven income streams.

Smart ways to repay your FIRSTmoney personal loan as a self-employed individual

Once your instant loan is approved via FIRSTmoney, the real work begins: repayment. And when your income isn’t fixed each month, being strategic becomes crucial. Here are actionable, no-fluff tips to stay ahead on your EMIs without hurting your cash flow:

1. Align your EMI with your income cycle

Choose a repayment date that aligns with your client payments or peak revenue periods. With FIRSTmoney's flexible tenure, structure EMIs around when money actually comes in — not just calendar dates.

2. Use the zero-foreclosure charge to your advantage

Closed a big project? Use the surplus to close your loan early without penalties. A FIRSTmoney personal loan’s zero foreclosure fee gives you full repayment freedom.

3. Create a buffer account just for EMIs

Maintain a dedicated bank account with 1–2 months of EMI as a buffer. This protects you during lean months without affecting your track record for future credit.

4. Track EMI debits with auto-reminders

Even if your income fluctuates, missing an EMI can harm your credit. Set multiple reminders or link to an account that gets client payments to ensure timely debit.

5. Avoid taking multiple loans at once

It’s tempting to take on new credit when funds are short — but that can trap you in a cycle. A FIRSTmoney personal loan offers up to ₹10 lakh, so plan carefully and borrow only what you can realistically repay.

Why choose IDFC FIRST Bank for an instant loan for the self-employed

Getting access to funds shouldn't be a hurdle just because you work for yourself. With IDFC FIRST Bank, securing an instant loan for self-employed individuals is no longer a challenge. Whether you’re a freelancer, consultant, or small business owner, FIRSTmoney is designed to work around your income patterns — not against them.

Here’s why it’s the go-to choice:

- Quick, 100% digital process so that you can apply and get funds in your account within minutes

- Zero paperwork, with only your physical PAN card needed for video KYC

- Flexible repayment options to choose a tenure that fits your income and lifestyle

- Competitive interest rates starting from 9.99% p.a.

- Zero foreclosure charges if you choose to close the loan early

- Real-time tracking so you always know your application status

- Trusted by millions and rated among the World’s Best Banks 2025 by Forbes, in partnership with Statista

Need quick, hassle-free funds to power your goals? Click here to apply for your FIRSTmoney personal loan today.

Frequently Asked Questions

Yes, as long as your income is consistent over time, you can get a personal loan. Lenders offering an instant loan for self-employed individuals check the overall cash flow and digital credits, and not just the fixed monthly income. Moreover, if you choose an option like FIRSTmoney, you can apply and get approved without needing to show consistent income.

No. You can still apply for an instant loan without income proof using ITRs, bank statements, or client invoices if you're a freelancer or consultant.

Cash-only income may reduce your approval chances with lenders who give a lot of importance to income proof. However, when you apply for a FIRSTmoney personal loan, your application is judged based on your credit history and overall profile, allowing you to access a loan more easily.

Most lenders prefer at least one year of self-employment when evaluating a personal loan application. If you are not confident about your self-employment tenure, opt for options like FIRSTmoney, which have simpler eligibility and a straightforward application process.

Yes. While it may be tempting to apply for multiple loans to maximise your chances of approval, frequent applications can hurt your score. Apply only when you’re confident of qualifying.

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject IDFC FIRST Bank or its affiliates to any licensing or registration requirements. IDFC FIRST Bank shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.