Are you ready for an upgrade?

Login to the new experience with best features and services

Notifications

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

Activate your Credit Card within minutes and enjoy unlimited benefits

Accounts

Deposits

Loans

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

Wealth & Insure

Payments

Cards

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

Premium Metal

0% Forex & Travel

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

Lifetime Free

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

10X Rewards

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

UPI Cards

Fuel & Utility

Showstopper

Credit Builder

More

NRI Savings Account

NRI Fixed Deposit

FOREX Solutions

Transfer to NRE

Corporate Account

Cash Management Services

Corporate Lending

Treasury

MSME Accounts

Trade Services

MSME Loan

MSME Solutions

Offers

About Us

Investors

Careers

IDFC FIRST Academy

ESG

Aditi is a talented graphic designer freelancing from the comfort of her home. She cherishes the flexibility and freedom that comes with being her own boss. But she often finds herself stressed about how to manage her money. Some months, she juggles multiple projects, her inbox overflowing with briefs. For the others, she is waiting for that one big project to land, often left scrambling to make ends meet.

Sounds familiar? This is the reality for many freelancers and creators—a thrilling ride of creative freedom often accompanied by a rollercoaster of income. This article is here to help freelancers like Aditi—and you—develop a predictable and effective budget planner to bring stability and peace of mind to your finances.

The challenge of being a freelancer or creator

Freelancing, gig work, and content creation come with immense perks—freedom, creativity, and often a higher potential for earnings. Yet, they also come with a unique set of challenges. Unlike traditional employment with regular paychecks, freelancers and creators experience income fluctuations that can be dramatic and unpredictable.

Let’s consider some of these hurdles –

1. Project-based nature

Many freelance projects are one-time engagements. This creates income gaps between projects, leaving you with periods of little to no earnings.

2. Client dependence

Reliance on a limited number of clients or projects can be precarious. If a major client withdraws a project or delays payment, it impacts your income stream and cash flow. This could hurt your ability to cover immediate expenses.

3. Seasonal fluctuations

Some industries, such as marketing or event planning, experience seasonal demand. This leads to periods of high income followed by periods of drought.

4. Negotiation challenges

Freelancers often negotiate their rates, which can be challenging for some and may result in underpricing their services.

5. Lack of benefits

Unlike salaried employees, you don’t enjoy structured benefits like provident funds, insurance, or fixed monthly salaries.

Addressing these challenges requires a budget planner and proactive strategies to build a strong financial foundation.

A 4-point budget planner for freelancers and creators

The key to overcoming these challenges lies in creating a flexible yet disciplined financial budget planner tailored to your needs. Let’s dive into a four-point strategy to help you manage your finances effectively.

1. Budgeting basics

Traditional budgeting often assumes a steady paycheck. For freelancers, this is a luxury, not a reality. Income fluctuates, making it challenging to stick to a rigid monthly budget. However, adaptable budgeting methods can bring order to chaos.

Here are some strategies –

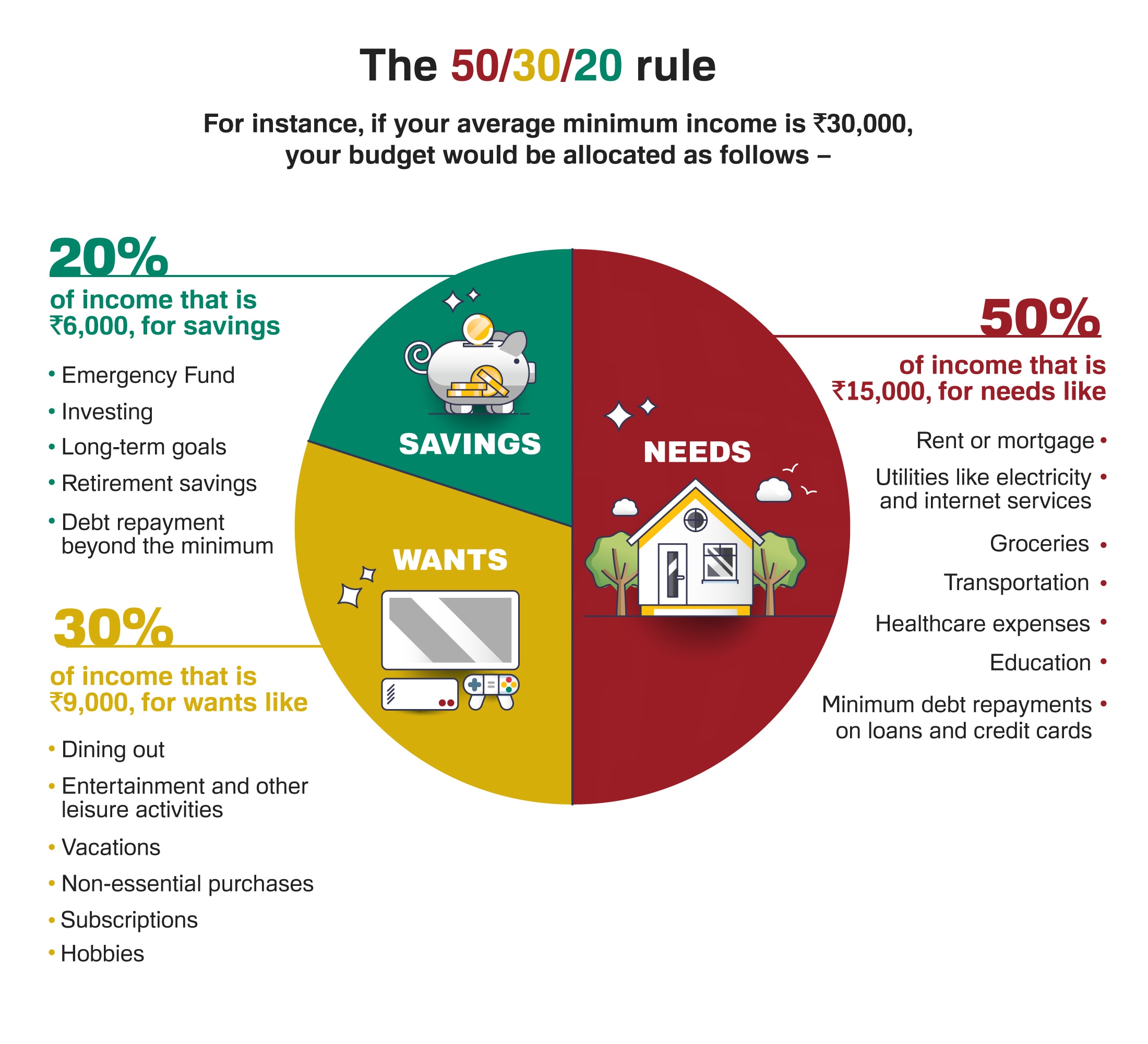

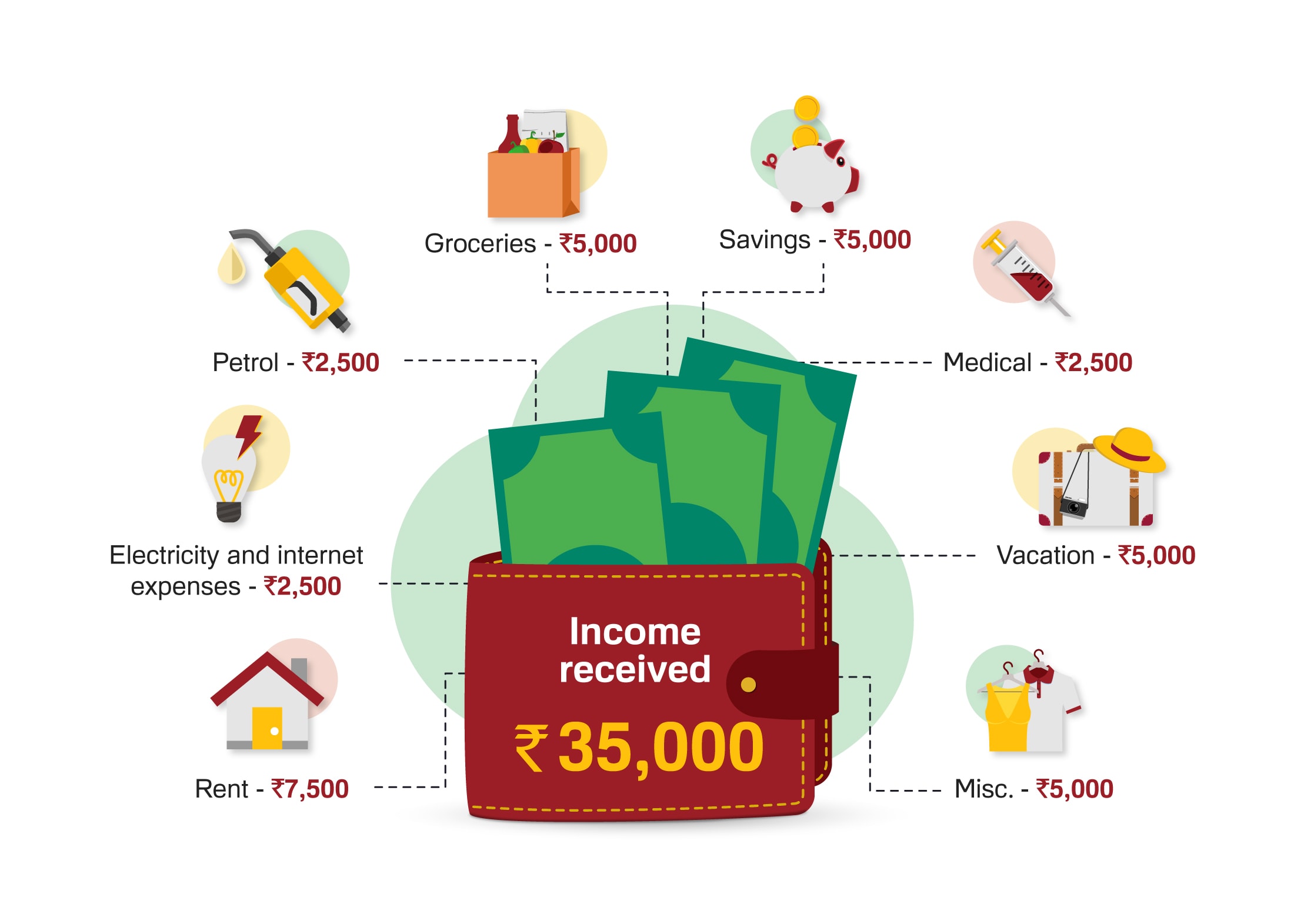

a. The 50/30/20 rule

This classic rule suggests allocating 50% of income to needs, 30% to wants, and 20% to savings. As a freelancer, you must adjust the ‘income’ as your lowest average monthly income instead of fluctuating earnings. This budget planner will provide a more realistic picture than relying on a single month’s earnings.

a. Envelope budgeting

Physically or digitally assign “envelopes” for different spending categories. Once an envelope is empty, adjust your spending rather than overspending. You could also top them up when funds allow and track spending diligently.

2. Emergency funds

You have 20% of your income set aside for savings. With these savings, you must first create an emergency fund. Life as a freelancer is unpredictable, and these funds will become your safety net for tough times. A well-structured budget planner makes this process smoother.

Your emergency fund should have at least 3–6 months’ worth of essential expenses. For instance, if your monthly needs cost ₹20,000, your emergency fund should ideally be ₹60,000–₹1,20,000. This money would help you tide over during those lean months or even unexpected expenses. Moreover, it also allows you peace of mind and focus on your work.

3. Savings and investments

Once your emergency fund is stored, you can focus on your long-term financial security. Here’s how to manage your savings and investments –

a. Set clear goals

Define short-term and long-term financial goals. Whether buying a new laptop, saving for a house, or planning for retirement, clarity helps you allocate funds wisely.

b. Diversify investments

Don’t let your money sit idle. Invest in mutual funds, fixed deposits, or even low-risk stocks. Use tools like the IDFC FIRST Bank mobile app to start investing with ease.

c. Consider retirement planning

Start investing early for retirement. Explore options like the National Pension System (NPS) and other pension plans or the Public Provident Fund (PPF).

d. Tax savings

Opt for tax-saving instruments like PPF and Equity-Linked Savings Schemes (ELSS) to reduce your tax burden while building wealth.

Prioritising savings and smart investments in your budget planner can not only help you secure your future but also create a buffer for irregular income months.

4. Tools and resources

Digital tools and budgeting apps can revolutionise how you manage your finances. Budgeting apps like Mint or Money View can track spending, categorise expenses, and create budgets. Some even provide investment advice and help you set financial goals. Online banks and fintech companies offer innovative accounts with features like automatic savings, round-up transfers, and bill negotiation tools.

Integrating these tools into your financial routine alongside a solid budget planner can help you –

a. Save time

b. Reduce the stress of manual tracking

c. Allow you to focus on your creative pursuits

d. Allow you to gain better control over your finances

e. Help you make informed decisions

f. Achieve your financial goals

Exclusive benefits of the FIRST Power Savings Account

The FIRST Power Women’s Savings Account from IDFC FIRST Bank is designed to empower women freelancers with various features that enhance financial management and provide comprehensive benefits. Here’s why it’s a standout choice –

1. High interest rates

Earn interest rates up to 7.00% per annum, which can help your savings grow faster. This can become an essential component of your budget planner.

2. Monthly interest credits

Unlike traditional savings accounts, this account credits interest to your account on a monthly basis, giving you the advantage of more frequent compounding to boost your savings.

3. Complimentary health benefits

Once you activate the mobile banking feature, you can gain access to a free one-year subscription to MediBuddy. It includes unlimited online general physician consultations for up to four family members, discounts of up to 15% at partner pharmacies, a free full-body health checkup, and ₹500 in wallet benefits.

4. Comprehensive insurance coverage

Enjoy peace of mind with free personal accident insurance worth ₹35 lakh and air accident insurance coverage up to ₹1 crore. This benefit is available with the IDFC FIRST Bank Savings Account having an average monthly balance (AMB) of ₹25,000 or more.

5. Unlimited ATM withdrawals

Make free and unlimited withdrawals from any bank’s ATM across India, ensuring seamless access to your funds when needed.

6. Enhanced debit card limits

With the ₹25,000 Average Monthly Balance variant, enjoy higher daily cash withdrawal and purchase limits (₹2 lakh and ₹6 lakh, respectively), perfect for managing larger transactions.

These exclusive benefits make the IDFC FIRST Bank Women’s Savings Account an invaluable tool for freelancers like you. By integrating this account into your monthly budget planner, you can ensure financial stability, even with an irregular income flow.

The takeaway

With a well-thought-out budget planner, emergency funds, smart investments, and the right tools, you can turn financial unpredictability into stability. Take charge of your finances today with the FIRST Power Women’s Savings Account. Click here to open an account and bring predictability to your budgeting!