Are you ready for an upgrade?

Login to the new experience with best features and services

Notifications

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

Activate your Credit Card within minutes and enjoy unlimited benefits

Accounts

Deposits

Loans

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator

Wealth & Insure

Payments

Cards

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

Premium Metal

0% Forex & Travel

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

Lifetime Free

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

10X Rewards

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

UPI Cards

Fuel & Utility

Showstopper

Credit Builder

More

NRI Savings Account

NRI Fixed Deposit

FOREX Solutions

Transfer to NRE

Corporate Account

Cash Management Services

Corporate Lending

Treasury

MSME Accounts

Trade Services

MSME Loan

MSME Solutions

Offers

About Us

Investors

Careers

IDFC FIRST Academy

ESG

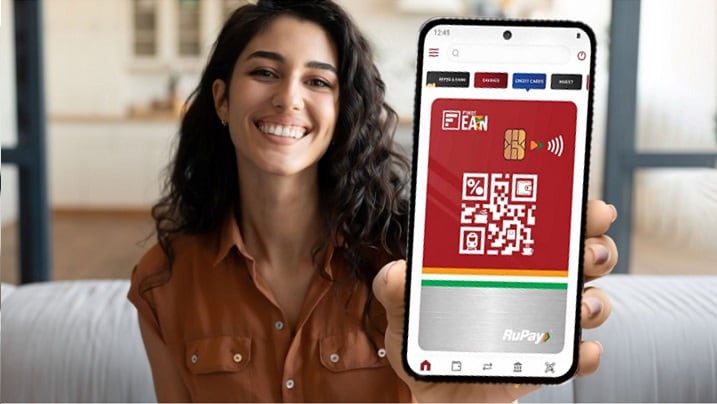

Meet Karan, a young professional who recently started his first job. Like many new earners, he’s looking to manage his finances better. Karan is comfortable using UPI for his daily payments, but he’s also interested in building his credit score and earning rewards for everyday spending. That’s when he discovered the FIRST EA₹N Credit Card from IDFC FIRST Bank.

Let’s explore why this UPI credit card could be a perfect fit for someone like Karan, who is just starting their financial journey.

Why the FIRST EA₹N Credit Card makes sense for new earners

Designed for beginners like Karan, this UPI credit card combines the following benefits –

1. Ease of use

The FIRST EA₹N Credit Card combines the simplicity of UPI with the benefits of a credit card, making it ideal for young earners. It offers –

a) The convenience of making UPI payments through a credit card, so you can pay for groceries, rent, or dining out effortlessly

b) The ability to scan QR codes at over 60 million merchants across India using your smartphone

c) Secure, PIN-protected transactions, ensuring reliability and peace of mind for first-time credit card users

As a RuPay UPI credit card, it’s uniquely designed to cater to the needs of young professionals, offering the perfect blend of convenience and security. With these features, the FIRST EA₹N Credit Card transforms everyday payments into a seamless and rewarding experience.

2. Credit-building opportunity

A strong credit score opens doors to better financial opportunities down the road. However, many young earners like Karan may not have any credit history yet. The FIRST EA₹N Credit Card is designed with them in mind.

The credit card is secured by a fixed deposit (FD), making it easier to qualify, even without a credit history. This FD-backed structure helps you build credit responsibly, minimising the risk of debt—a smart choice for new earners managing their finances.

Here are some tips to help you build your credit score with the FIRST EA₹N Credit Card –

a) Always clear the total due amount before the due date to avoid interest charges

b) Spend only what can be repaid comfortably. Experts recommend keeping utilisation below 30% of the available credit limit

c) Monitor your spending to avoid unnecessary purchases and ensure all transactions are without budget

3. Cashback system for essential spending

We all love getting rewarded for our purchases, and the FIRST EA₹N Credit Card delivers on this front. The bank’s credit card cashback system offers –

a) Up to 1% cash back on purchases made via the Mobile Banking App

b) Up to 0.5% cashback on UPI payments through credit cards on other apps

c) 25% discount up to ₹100 on movie tickets

Whether Karan is paying for groceries, dining out, or even booking a ride to work, this UPI credit card earns him cashback on essential spending and makes the most of his monthly budget.

4. Low barrier to entry

One of the major barriers for young professionals entering credit is the associated fees and eligibility criteria. However, the FIRST EA₹N Credit Card stands out with its accessible features. It charges a low joining and annual fee of just ₹499 + GST. Moreover, you can even get your joining fee back with the welcome offer that provides 100% cashback up to ₹500 on your first UPI transaction done within 15 days of card creation through any UPI app.

The eligibility criteria for the FIRST EA₹N Credit Card is pretty simple. You must be –

a) An Indian citizen

b) Above the age of 18

c) A minimum FD of ₹5,000 with the bank

With an interest rate starting from just 0.75% per month, this card is not only accessible but also a financially sound choice for those just beginning their careers.

Take charge of your financial future

For new earners like Karan, the FIRST EA₹N Credit Card is more than just a UPI credit card—it’s a smart tool for financial independence. Combining the ease of UPI payments with the perks of credit card rewards offers a unique blend of convenience, security, and benefits that align perfectly with the spending habits of young professionals.

So, if you’re starting your financial journey, why not take advantage of the FIRST EA₹N Credit Card? Apply today and unlock a world where credit meets convenience, all while building your financial future.

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject IDFC FIRST Bank or its affiliates to any licensing or registration requirements. IDFC FIRST Bank shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.