Are you ready for an upgrade?

Login to the new experience with best features and services

Notifications

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

Activate your Credit Card within minutes and enjoy unlimited benefits

Accounts

Deposits

Loans

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator -

EMI Calculator

-

Personal Loan Eligibility Calculator

Wealth & Insure

Payments

Cards

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

Premium Metal

0% Forex & Travel

- Best for travellers

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

Lifetime Free

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

10X Rewards

- Reward Multipliers

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

UPI Cards

Fuel & Utility

Showstopper

Credit Builder

More

NRI Savings Account

NRI Fixed Deposit

FOREX Solutions

Transfer to NRE

Corporate Account

Cash Management Services

Corporate Lending

Treasury

MSME Accounts

Trade Services

MSME Loan

MSME Solutions

Offers

About Us

Investors

Careers

IDFC FIRST Academy

ESG

Initial Public Offerings (IPOs) are becoming the investor-preferred buzzword in recent times. According to reports, India registered a 22% share of the global IPO activity in the first quarter of 2025 alone, with 62 IPOs raising $2.8 billion.

As a Non-Resident Indian (NRI), are you also looking to capitalise on the IPO trend in India? If you are, here’s some good news - You can add IPOs to the list of NRI investments in India!

The regulations specified under the Foreign Exchange Management Act allow NRIs to invest in IPOs in India.

Here is a complete breakdown of how to invest in IPOs and the rules for the same. But first, let’s start with the basics and understand the concept of IPOs.

What is the meaning of IPOs in the stock market?

IPOs are the way for unlisted companies to go public, offer their shares to common investors, and list on the stock exchange. IPOs allow companies to -

- Raise capital through the issue of fresh shares

- Enhance their brand visibility

- Garner investors’ trust

- Obtain funds for debt repayment and expansion

IPOs are a good way to invest in companies with good potential. If the companies grow after listing, you can make a good profit.

Things NRIs need for investing in IPOs

While you can invest in IPOs, you will need the following -

1. NRE/NRO account

A Non-Resident Ordinary (NRO) or Non-Resident External (NRE) account is a must to invest in the IPO through the Application Supported by Blocked Amount (ASBA) route.

2. NRI Demat account

A Non-Resident Ordinary (NRO) or Non-Resident External (NRE) Demat account is needed to store the shares that might get allocated to you if your IPO application is successful.

3. Trading account

While the Trading account is not mandatory for the IPO, it will be needed if you wish to sell the IPO-allocated shares in the future.

4. PIS account

While the PIS account in NRE/NRO is not mandatory for the IPO, it will be required if you wish to sell the IPO-allocated shares in the future to calculate the applicable TDS.

5. Sufficient funds in your account

You need sufficient funds in the NRO/NRE account, which will be blocked for the IPO. If your application is successful, the funds will be automatically debited from your account.

6. NRI investment provision

You would also have to check whether the company launching the IPO allows NRI investments. It can be checked from the company’s Red Herring Prospectus (RHP). Alternatively, you can invest through the NRO (non-repatriable) option.

With IDFC FIRST Bank, you can apply for IPOs, rights issues, call money, Non-Convertible Debentures (NCDs), Real Estate Investment Trusts (REITs), and Infrastructure Investment Trusts (InvITs) through IDFC FIRST Bank's Net banking or Mobile App in just three simple clicks.

How to invest in an IPO in India?

Now that the basics are covered, let’s jump to the ‘how’ part of investing in the IPO.

Here is a step-by-step guide on how to invest in an IPO in India with IDFCV FIRST Bank -

- Step 1 - Login to IDFC FIRST Bank Net Banking/Mobile App

- Step 2 – Go to ‘Accounts’ and choose ‘Investments’

- Step 3 – Choose ‘Apply in IPO’, select the IPO you want to invest in and apply online

The timings are as follows -

Channel |

Cut off timelines for IPO on the last day of issue |

|

HNI – Application >2L |

Retail – Application < 2L |

|

Online (Net banking/Mobile App) |

3:30 pm |

4:30 pm |

Paper-based application |

1:00 pm |

|

The amount required for your bid will be blocked in your NRI bank account through the ASBA process.

You will receive a confirmation of your application via email or SMS. On the IPO allotment date, you can find out whether your IPO application was successful or not. If the application is successful, the shares will be allotted to your NRI Demat Account, and the blocked amount will be used to pay for them. If the application is unsuccessful, the shares will not be allotted. The amount blocked would be released into your NRI account.

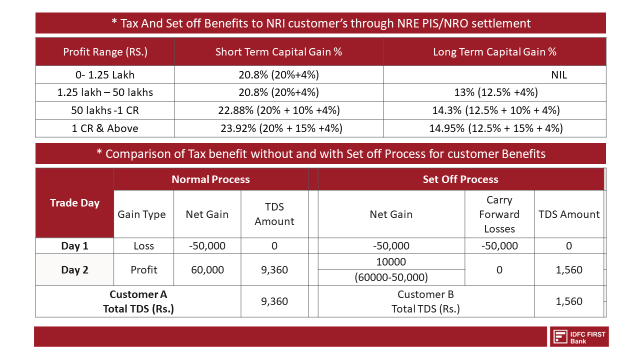

Taxation on capital gains for NRIs

Knowing how to buy an IPO in India is not sufficient. You also need to be aware of the tax implications of the profits you earn when you sell the shares after allotment. As a rule, profits earned from IPO investments are subject to capital gains tax. Here’s how -

- If you sell the shares within 12 months, you incur short-term capital gains, which are taxed at a rate of 20%

- If you sell the shares after 12 months, returns of up to ₹1.25 lakhs will be tax-free, and excess returns will be taxed at 12.5%

Tax implications

Why come to IDFC FIRST Bank for this specific investment

If you're eyeing the next IPO, consider using IDFC FIRST Bank's NRI Banking services to simplify the application process. With IDFC FIRST Bank, you can enjoy -

- A digital NRE/NRO account with interest going up to 7.25% per annum

- One-touch PIS account

- IDFC FIRST Bank mobile app for easy IPO investing

- A dedicated relationship manager for all your investment needs.

Open a tailored NRI account and invest in an IPO of your choice – start online in just a few steps.

What makes IDFC FIRST Bank NRI Banking stand out?

- A comprehensive suite of NRE, NRO, and Seafarer Savings Accounts tailored for global Indians

- Earn interest daily and enjoy monthly interest payouts on your savings

- Attractive interest rates up to 7.00% p.a. on NRE and NRO Savings Accounts

- Tax-free returns on NRE Savings and Fixed Deposits for optimised wealth growth

- Flexible and fully repatriable NRE and FCNR Deposit options with assured returns

- Open accounts instantly and manage them seamlessly via our top-rated mobile banking app

- Higher ATM withdrawal limits, cashback benefits, and a free VISA Signature Debit Card with no annual charges

- 24X7 seamless, zero-fee fund transfers and remittance solutions for convenient money management

- Access mutual funds, travel insurance, term insurance, and the FIRST WOW! Credit Card for a complete financial solution

- Recognised among the World’s Best Banks 2025 by Forbes in partnership with Statista

Frequently Asked Questions

The RHP is a detailed document which outlines -

- The company’s activities

- IPO details

- Intended usage of the funds, etc.

The dividend income is added to your total income and taxed at your applicable tax slab rates.

The repatriation limit for an NRO account is $1 million per financial year.

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject IDFC FIRST Bank or its affiliates to any licensing or registration requirements. IDFC FIRST Bank shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.