Enjoy Zero Charges on All Commonly Used Savings Account Services

- About Us

- MD & CEO letter about the bank

- MD & CEO

- Our History

- Letter to Shareholders on the 1st Annual Report after Merger

- Letter to Shareholders on the 2nd Annual Report after Merger

- Letter to Shareholders on the 3rd Annual Report after Merger

- Letter to Shareholders on the 4th Annual Report after Merger

- Board of Directors

- Awards & Accolades

- News Room

- Investors

- Careers

- ESG

-

Customer care hotlineCall 1800 10 888

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Future FIRST Savings Account

Take a step towards financial independence with up to 7% interest per annum on your zero balance savings account. Because for us your future is always FIRST.Read More

Future FIRST Account is a zero balance savings account with Visa Signature debit card. This account can be offered to students from premier/identified educational institutes of India. Enjoy up to 7% interest per annum with no minimum balance required, free fund transfers, free general banking services, and much more.Read Less

Future First account with Amazing benefits

Dining Deals

Enjoy exciting dining deals on delicious food and beverages with your IDFC FIRST Bank Debit Card - save up to ₹6,000/-

Free Personal Accidental Insurance

Free Personal Accidental Insurance Cover (death or permanent disability) of ₹35 lakhs - save ₹7,000 annually

Free airport lounge access

Free airport lounge access - 2 per quarter in major cities and save ₹12,000 annually

Monthly Interest Credit on your Savings Accounts

- Earning interest on interest with IDFC FIRST Bank

- Monthly interest credits versus the industry norm of quarterly interest credit

- Free and unlimited ATM transactions at any bank anywhere in India

- Industry best giveaways!

Future FIRST Account with VISA Signature Debit Card

Zero balance savings account

-

Personal accident cover is 35 Lakhs,

air accident insurance is 1 cr. -

Airport lounge access in major cities -

Twice every quarter

Experience a Mobile Banking revolution

Track spends, earn rewards, check your risk profile, invest in Mutual Funds in a click, experience Google-like search, cash flow analysisThe on-boarding vouchers/benefits offered in the first 30 days post Salary Account opening have been discontinued w.e.f .1st July'22

ELIGIBILITY

For Physical Bank Account Opening:

- Passport-size photograph

- If you have a PAN Card, it is mandatory to provide it while opening your account

- Any one of the following document:

- Aadhaar Card

- Passport

- Voter’s Identity Card (Election Card)

- Permanent and valid driving license with photograph

- Job Card issued by NREGA duly signed by an officer of the State Government

- Letter issued by the National Population Register containing details of name and address.

FREQUENTLY ASKED QUESTIONS

Who can open Future FIRST Savings Account?

Future FIRST Savings Account can be opened by graduate and postgraduate students from premier/identified educational institutes of India.

What is the initial pay-in amount required to open a Future FIRST Savings Account?

The IDFC FIRST Bank Future FIRST Savings Account is a Zero Balance Savings Account for students. No initial pay-in amount is required to open an account.

What benefits & features would I get on opening an IDFC FIRST Bank Future FIRST Savings Account?

You can enjoy a superior banking experience with IDFC FIRST Bank Future FIRST Savings Account with benefits such as:

- Attractive interest rates on your savings, so you can earn more

- Zero charges on 28 commonly used Savings Account services like IMPS, NEFT, RTGS, ATM transactions, cheque book issuance, SMS alerts, cash transactions, etc.

- Monthly Interest Credits, so you can earn 'interest on interest'

- Higher Personal Accident and Air Accident Cover with your Debit Card

- Exciting offers on food, shopping, travel, & more with your Debit Card

and much more

How does the Monthly Interest Credits feature work and how will I benefit from it?

With IDFC FIRST Bank Future FIRST Savings Account, experience the joy of earning Monthly Interest Credits on your Savings Account. You earn 'interest on interest' with the power of monthly compounding. IDFC FIRST Bank is the first universal bank in India to provide this feature, against the standard practice of crediting interest on your Savings Account every quarter.

Monthly compounding interest payout is better for you than Quarterly interest payout because when you get interest credit in Month 1, the interest for Month 2 is paid on your opening balance + interest received in Month 1 and so on. So, you earn more on your savings!

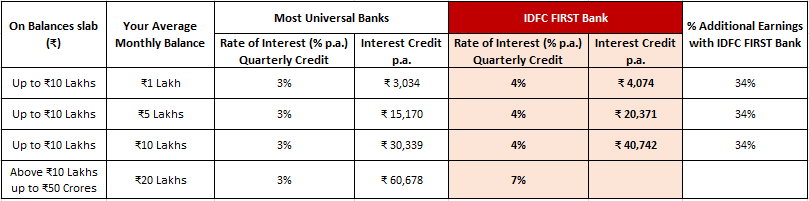

Interest will be calculated on progressive balances in each interest rate slab, as applicable. Please note, interest rates are subject to periodic change.

Can you afford to not have an IDFC FIRST Bank Future FIRST Savings Account?

What does the Zero Charges feature mean?

With IDFC FIRST Bank Future FIRST Savings Account you can enjoy ZERO Charges on 28 commonly used Savings Account services like IMPS, NEFT, RTGS, ATM transactions, Cash transactions, Cheque book issuance, SMS alerts and more. You can know more about services offered at Zero Charges here:

What are the documents required to open a Future FIRST Savings Account?

To open a Future FIRST Savings Account, you require Aadhar Card and PAN Card along with proof of enrollement universit/college which can be offer letter, College/unversit ID card.

What are the different ways I can add money/transfer funds to my account?

You can add funds to your Future FIRST Savings Account by one of the following ways:

- Via any other bank’s NetBanking/Mobile app. Simply add your IDFC FIRST Bank account details – Account number and IFSC code

- Through our Mobile app by clicking on “Add funds” option which lets you add transfer money from your other bank accounts

- Depositing a cheque at any of our branches

- Depositing a cheque at any IDFC FIRST Bank ATM

- Using any UPI app using your UPI ID

What are the modes through which I can access and keep a track on transactions in my IDFC FIRST Bank Future FIRST Savings Account?

We offer multiple methods to track your IDFC FIRST Bank Future FIRST Savings Account. Here are a few ways you can do it:

- NetBanking

- Mobile App

- WhatsApp Banking

- Monthly Account statements sent to your registered email ID

Can I add a nominee to my Future FIRST Savings Account? How many nominees can I add?

Yes, you can add 1 nominee to your Future FIRST Savings Account.

How can I add a nominee to my IDFC FIRST Bank Future FIRST Savings Account?

You can add a nominee to your Future FIRST Savings Account in one of the following ways:

- Via NetBanking or Mobile Banking App

- By visiting your nearest IDFC FIRST Bank branch

What's special about us

What's special about us