Enjoy Zero Charges on All Commonly Used Savings Account Services

- About Us

- MD & CEO letter about the bank

- MD & CEO

- Our History

- Letter to Shareholders on the 1st Annual Report after Merger

- Letter to Shareholders on the 2nd Annual Report after Merger

- Letter to Shareholders on the 3rd Annual Report after Merger

- Letter to Shareholders on the 4th Annual Report after Merger

- Board of Directors

- Awards & Accolades

- News Room

- Investors

- Careers

- ESG

-

Customer care hotlineCall 1800 10 888

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Apply

Apply Now

Financial Calculators

Hassle-free financial planning with IDFC FIRST Bank

** Interest calculated on flat rate basis for other banks

In the spotlight

Quick actions for you

Activate UPI

Get the Power of UPI and earn cashback up to ₹200

FASTag

Upgrade to FASTag Max and enjoy benefits worth ₹5000*

Explore Bikes

and ride your dream bike with an instant loan

FIRST Rewards

Our exclusive Savings Account loyalty programme

Explore Cars

Shop, compare and choose your perfect car with the best financing options

Activate UPI

Get the Power of UPI and earn cashback up to ₹200

FASTag

Upgrade to FASTag Max and enjoy benefits worth ₹5000*

Explore Bikes

and ride your dream bike with an instant loan

First Rewards

Our exclusive Savings Account loyalty programme

Explore Cars

Shop, compare and choose your perfect car with the best financing options

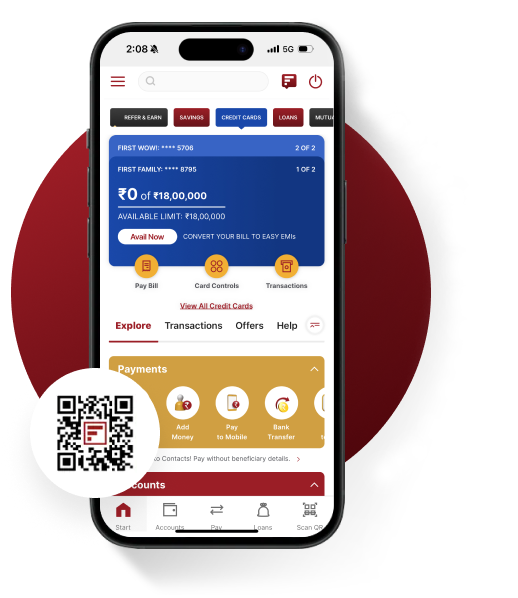

Award-winning digital banking platform

Recognised as the 'Best Digital Bank' for the year 2021-2022 by Financial Express India's Best Banks Awards 2023.

Now access all your accounts and cards from a single dashboard

Start banking with just a

WhatsApp message. Send

'Hi' to 95555 55555

Experience a secure way

to bank on the go with

our mobile banking app

Banking services now

at your fingertips

anytime, anywhere

Step inside the

world of smart

watch banking

But don’t take our word for it, Hear from our customers

"Dear Mitali, I just wanted to say a BIG thank you for the excellent customer service from you! I have been blown away by the speed, efficiency and commitment to time details by you! It has been nothing short of amazing. I definitely made the right choice when I walked into the Nariman point IdfcFirst bank branch 😊!!...." Rudra Ramchandran 3 April 2024

"I would like to callout the work of Mamta Singh from the Credit card inbound team. She has been very supportive and patient with my queries, and she resolved them with the utmost professionalism. This mail is not just to give Mamta a boost and appreciation but also an example of how the support from the customer care team can make a customer happy and trust the bank.." Abhishek N R 31 March 2024

"Dear Team, I am writing to express my thanks to Mr. Prasad Patil. I met him for one of my loan foreclosure with IDFC First Bank today. I was speechless the way he handled my loan foreclosure request today. I haven't came across the kind of instant action taken by Mr. Prasad Patil everything what he had done will be remembered for the ages...." Jayraj Jitendra Singh 30 March 2024

"Despite a holiday, you and your Bank Customer Care Department have acted swiftly in blocking payment for my lost cheque, thus preventing the disaster of encashing the same by unauthorized person. No word is sufficient to express my heartfelt appreciation to your dedication in serving the customer...." D K Ravi 24 March 2024

"Great bank, excellent customer service .My entire family banks here.There friendly efficient employees always greet you with a smile and makes you feel like you are the most important customer .Thank you for the service geetika mam.." Shikha Prakash 22 March 2024

"Some days ago I wanted to close my father 's two-wheeler loan, and I visited Aligarh branch for forclosure letter. The staff was very good, and the customer service executive was very humble and a good listener. All our resolutions were done properly and guided us through the process of loan closer. I am happy from Aligarh branch service executive and their staff . Thank you IDFC..." Uma Kant Saini 21 March 2024

"Hello there, I am writing this email to share the experience of my recent visit to the IDFC branch, Mr.Tarun Mudgal assisted me which I appreciate, and want to make sure that the bank knows that. Thank you Tarun for your prompt and resourceful assistance with my query about the loan closure procedure and for explaining it thoroughly...." Deepanshi Pal 21 March 2024

"Hi All, I would like to take a moment to express my utmost satisfaction with the service provided by Razia from IDFC Bank. As a Home Loan customer, navigating through various queries and processes can often be daunting, but Razia's professionalism and dedication made the entire experience seamless and stress-free..." Gaurav Sawhney 21 March 2024

"Hi Idfc, I am writing this mail to appreciate the service that I have received at the labbipet branch by the manager Ganduri Kamal Raj. I had a cheque bounce on the installment which was smoothly taken over and resolved,He needs a raise as he kept the service in the first priority...." Chagantipati Sirisha 21 March 2024

"Dear Chirag Vora Sir Social Media Team, IDFC First Bank I am writing to express my sincere gratitude for your assistance in canceling my personal loan with IDFC First Bank. Your prompt and efficient handling of my request through social media was truly commendable. Your professionalism and dedication made the entire process smooth and hassle-free for me..." Kunjan Kumar Patel 12 March 2024

Learn how to manage your finances effectively

Awards & Accolades

A glimpse of IDFC FIRST Bank's testament to excellence

Know more

Helping our communities grow with us

9.3 Million Beneficiaries

Supported since March 2023

70,000 Villages

Served across the country

9000 Residents

Impacted positively through our Swachh Worli Koliwada program

351 Students

Awarded post-graduate scholarships this year

9.3 Million Beneficiaries

Supported since March 2023

70,000 Villages

Served across the country

9000 Residents

Impacted positively through our Swachh Worli Koliwada program

351 Students

Awarded post-graduate scholarships this year

Disclaimer : With IDFC FIRST Bank Savings Accounts, enjoy Zero Charges on all commonly used Savings Account services w.e.f. 1st March 2024. For list of such services, charges and applicable T&Cs, visit: https://www.idfcfirstbank.com/personal-banking/accounts/savings-account/fees-and-charges. These services are being offered free in good faith, and in case of misuse of services, the Bank reserves the right to levy charges. T&Cs are subject to periodic changes. All rights reserved.

What's special about us

What's special about us

Savings Account

Savings Account

FIRST Select Credit Card

FIRST Select Credit Card

Personal Loan

Personal Loan

FIRST Wow! Credit Card

FIRST Wow! Credit Card  Home Loan

Home Loan

NRI Savings Account

NRI Savings Account

Fixed Deposit

Fixed Deposit

New Car Loan

New Car Loan

Pre-owned Car Loan

Pre-owned Car Loan

Consumer Durable Loan

Consumer Durable Loan